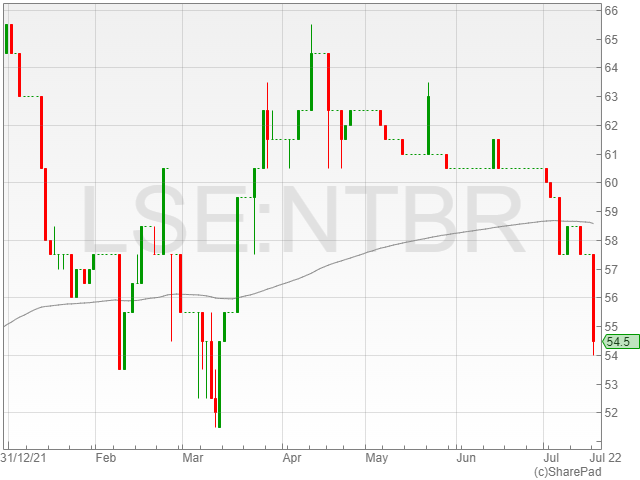

Northern Bear shares fell 9.2% to 53.2p in late afternoon trading following a reported cautious outlook on rising costs for construction materials going forward.

The company announced a narrowed pre-tax loss of £879,000 against £1.6 million the year before, alongside a 24% revenue increase to £61.1 million compared to £49.2 million.

Northern Bear highlighted an EBITDA rise to £3.6 million from £2.3 million and an adjusted operating profit of £2.6 million against £1.4 million the last year.

The construction firm noted a net cash position of £2.2 million at year end compared to £2.1 million.

The group confirmed an impairment charge linked to A1 Industrial Trucks goodwill of £2.6 million and a legal claim against Springs Roofing settled for £600,000 in July this year.

“We are pleased to announce strong operating results for the year ended 31 March 2022, despite the ongoing challenges facing our industry,” said Northern Bear non-executive chairman Jeff Baryshnik.

“It is a testament to the executive team and the subsidiary operating teams that FY22 operating results exceed those of the comparable pre-pandemic year ended 31 March 2020.”

Northern Bear chose not to declare a dividend for FY 2022 after two potentially accretive acquisitions did not come to pass. The company said it was exploring options for additional shareholder value.