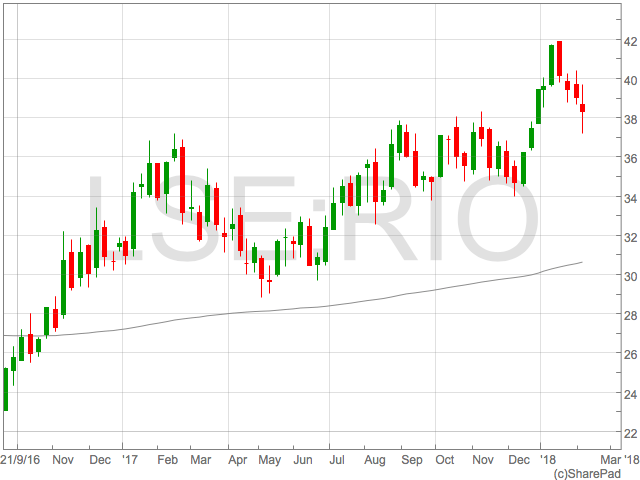

Rio Tinto (RIO:LON) announced the highest EBITDA margin for ten years helped by a jump in earnings.

The diversified miner also released details of a $1 billion share buy-back, a welcome return to shareholder which comes in addition to a full year dividend of 290 cents per share.

Rio Tinto have been helped by an upswing in commodity prices as demand for China remains robust and the global economic recovery stays on track.

“Today we have announced a strong set of results with operating cash flow of $13.9 billion, a record full year dividend of $5.2 billion and an additional $1 billion share buy-back. This brings total cash returns to shareholders to $9.7 billion declared for 2017.

“Today we have announced a strong set of results with operating cash flow of $13.9 billion, a record full year dividend of $5.2 billion and an additional $1 billion share buy-back. This brings total cash returns to shareholders to $9.7 billion declared for 2017.

“The strength of our cash flow is a result of resilient prices during the year coupled with a robust operational performance and a focus on mine to market productivity.

“Our strong balance sheet, world-class assets and disciplined allocation of capital puts us in the unique position of being able to invest in high-value growth through the cycle, and consistently deliver superior cash returns to shareholders.”