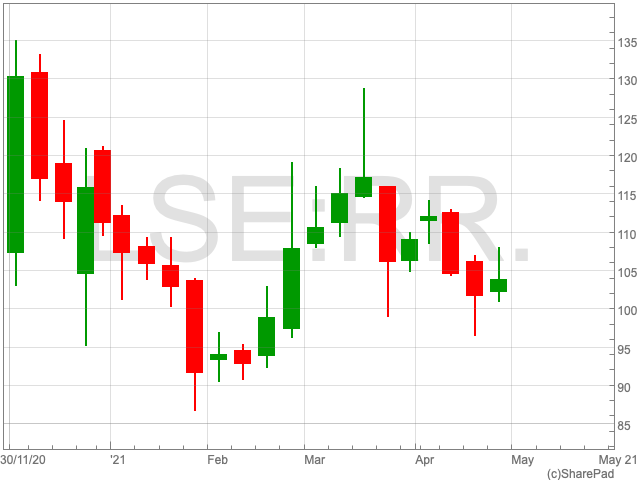

Rolls-Royce Share Price

The Rolls-Royce share price (LON:RR) is at the same level at which it began 2021, as it remains unclear what the immediate outlook is for the engineering company. Following a strong push from February through to March, shares in the FTSE 100 company have fallen back to 103.72p. As one of the largest aircraft manufacturers in the world, Rolls-Royce has been significantly impacted by the ongoing pandemic. While UK Investor Magazine reported two months ago that its outlook could depend on the airline industry, many questions remain unanswered, as despite a positive roll-out of vaccines in the UK, other parts of the world have not fared so well.

Finances

The Covid-19 pandemic had a severe impact on Rolls-Royce’s performance and near-term outlook. However, the company took solid measures to protect its balance sheet over the longer-term. The company strengthened its liquidity to £9bn and protected its financial position with £7.3bn of new debt and equity, while it launched a programme to raise at least £2bn from disposals.

Rolls-Royce has also made progress on its restructuring programme, removing 7,000 positions during 2020. Looking ahead, Rolls-Royce is aiming for its free cash flow to turn positive during H2 of 2021, and at least £750m during 2022, although these targets depend on the speed of the recovery, as well as the ongoing restructuring plan.

“The impact of the COVID-19 pandemic on the Group was felt most acutely by our Civil Aerospace business. In response, we took immediate actions to address our cost base, launching the largest restructuring in our recent history, consolidating our global manufacturing footprint and delivering significant cost reduction measures. We have taken decisive actions to enhance our financial resilience and permanently improve our operational efficiency, resulting in a regrettable, but unfortunately very necessary, reduction in the size of our workforce,” said chief executive Warren East.

Rolls-Royce has taken decisive action to tighten up its balance sheet to see the company through challenging market conditions, however, it could still do with some positive economic news.

Airline Industry

The slower pace of the vaccine rollout in the EU, a spike in infections in mainland Europe and the emergence of new variants has complicated the picture for Rolls-Royce. There is a real risk that the company will not get the summer it was hoping for, according to AJ Bell investment director Russ Mould.

“The risk, and one being increasingly acknowledged by Government ministers, is this summer is even worse than last for the travel space as the UK keeps restrictions in place to avoid undermining its hard-won success with the vaccine,” Mould said.

Nonetheless, governments across the world are doing their best to give hope into the airline industry. In Britan, proposals to permit travel to certain countries from May 17 received backlash for the caveat that travellers must undergo costly PCR Covid tests. The plans follow another week of uncertainty for a sector that lost $118.5bn in 2020, the worst year in aviation history, with downgraded passenger forecasts for a number of airlines.