by Alex Crooke, Co-Head of Equities – EMEA and Asia Pacific | Portfolio Manager

The old investment adage about not putting all your eggs in one basket is probably as old as investing itself. In fact, it would be no surprise to learn that the philosophy emerged at the same time as some of the earliest boom and bust cycles where particular investments went from zero to hero and back again in a very short space of time. Think money mania in the 1720s; tulip mania in the 1830s; railway mania in the 1840s. Unfortunately, it also seems that history has a habit of repeating itself. As an investing species, we don’t often learn much – what was the great financial crisis of 2008 if it wasn’t an ill-fated investment in a single asset class – the mortgage. In this article, we look at how the Bankers Investment Trust, has navigated the tricky market environment to deliver solid returns for investors.

However, one thing has changed since the dawn of investing in 1720. Crises no longer tend to be just parochial matters affecting a single or small number of countries. As the world has become ever more connected, more global, so have the crises. None more so than the recent and, sadly, ongoing global COVID pandemic. Markets around the globe were universally affected, with the effects of restrictions and lockdowns changing not only our movements but also our buying habits, with subsequent knock-on effects on the companies we buy from. Airlines and holiday companies were out, whilst pharmaceuticals and grocers either plummeted or soared.

What is also clear is that when the panic sets in, logic is thrown out of the window too. So, whilst portfolios exposed to these kinds of companies plummeted in late February/early March 2020, so too did non-correlated assets. Who would have thought the share prices of things like music rights, or the nuclear power industry would also have fallen? But fall they did – the sell-off was indiscriminate as investors scrambled to find ‘safe’ assets like cash and bonds.

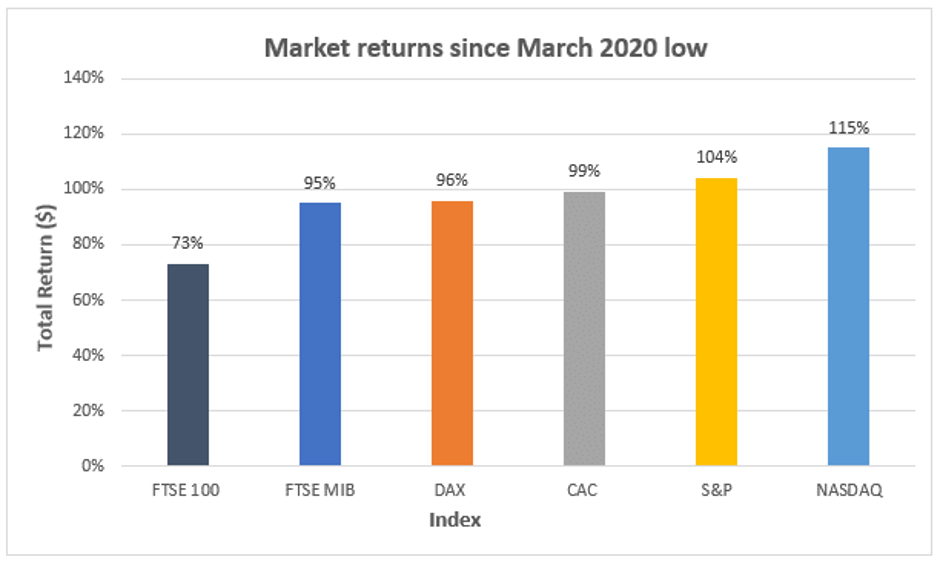

Source: Bloomberg 31/12/2021

So, what can the average investor take away from the chaos of 2020/1 as we look forward to a new year? Well, it’s hard to argue that in such extreme circumstances having a globally diversified portfolio would totally have shielded you from the volatility we saw at the beginning of 2020. However, what is also true, is that some countries have bounced back better than others. For example, in the UK, the FTSE 100 went from 7,674 on 3rd March 2020 to 4,994 just 20 days later – a fall of 36%. Since that low, the FTSE 100 has gone up by 73%, which sounds healthy until you compare the rebound in other countries – Italy and Germany are up over 95%, whilst France is closer to 100%. In the US, the numbers are staggering: the S&P 500 has grown 104% since its low in March 2020, and the NASDAQ is up a whopping 115%.

The same story of differing fortunes also applies when you look across the sectors. Some of the best performing sectors in the US in 2021, were those that saw negative results in 2020. For example, the energy and real estate sectors were the worst performing in 2020, but were the best performing 2021. Meanwhile, the tech sector bucked the trend performing strongly in both years as growth stocks remained in vogue due to the threat of renewed lockdowns. In the UK, the Travel and Leisure sector is still 25% lower than its pre-Covid peak2, whereas the Pharmaceuticals sector is basically back where it started. Meanwhile, the Electronics sector has surged ahead, up 31% over its pre-Covid level.

The reasons for these differences are harder to decipher in some cases than the numbers are to read. Clearly, the Travel and Leisure sector continues to be on its knees as we refrain from foreign holidays, and the airlines got hit with the double whammy of grounded planes and soaring fuel prices. But when it comes to country-level recoveries, it’s perhaps harder to fathom. Despite a largely successful vaccine rollout, the UK just hasn’t done well. Perhaps the lingering and persistent cough that is Brexit is still at play? Indeed, supply chain issues persist, driving inflation to over 5%, but that is not just a UK phenomenon. According to data from the Organization for Economic Co-operation and Development, the UK’s GDP is projected to be nearly 3.4% smaller in 2021 than in 2019, while Japan and Germany are projected to be 3% and 2% smaller, respectively3. In contrast, the Chinese economy is projected to have grown 10.6% larger for the whole of 2021, compared to 2019 – despite its own difficulties handling covid-19.

Whatever the reasons, markets are now in a more normal place – what some are calling the “new normal”. As such, the arguments for not having all your proverbial eggs in one basket seem as good as ever. One such solution is the Bankers Investment Trust, part of the Janus Henderson range of investment trusts. The Trust invests in large and medium-sized companies across the globe that offer attractive growth and income opportunities for shareholders looking for long term returns. It is managed by Alex Crooke, whose role is to decide where to allocate capital – to take advantage of some of those regional/sectorial differences we have discussed. Once the money is allocated globally, the Trust comprises of concentrated regional portfolios run by regional specialists whose sole role is stock selection across sectors.

2021 hasn’t been a year without challenges for the Trust. Inflation, supply chain issues, the tapering of central bank support for economies, combined with rising energy prices and labour shortages, have been headwinds for all global investment vehicles. However, Alex and the team have been expecting these headwinds and have continued to invest in line with the themes they identified over 12 months ago. For example, looking to find cyclical companies that will benefit from the global economic recovery as countries ease lockdown restrictions. In addition, Alex has been reducing exposure to overvalued companies where valuations may be at risk as volatility increases. A great example here is the technology sector in the US market, which is trading significantly higher than its 20-year average.

In Asia, China has proved a challenge too. Beijing has adopted a “Zero Covid” policy and is not only enforcing lockdowns but it is shutting down entire cities to try and eliminate the virus. This has disrupted activity within the services sector, especially contact intensive businesses such as hotels and restaurants. Meanwhile, major Chinese tech companies took a hit early on in the year after Beijing embarked on an unprecedented regulatory clampdown on the sector. Finally, sentiment towards China soured further as the property scandal revealed cracks in the country’s housing market – estimated to be around 29% of China’s GDP.4 This has led Alex to take a more measured approach to the country.

So how has this approach performed overall in a diversified portfolio since the start of 2020? Despite the challenging market environment, the Trust has returned 27% (including dividends) reinvested.5 At the same time, investors have also benefitted from a rising dividends, in fact, the Trust has increased its dividends every year for the past 55 years – making it an AIC Dividend Hero.

Regarding the outlook for 2022 and beyond, the team remains optimistic as economies continue to recover. This confidence is also reflected in announcements from central banks signalling their intentions to reduce their quantitative easing and raise interest rates. The recovery in corporate earnings is also encouraging with global dividends expected to return to their pre-pandemic levels in 2022. That being said, risks still remain with inflation the key concern. So far companies have managed to pass on costs to consumers; however, the question is how sustainable this is moving forward as prices continue to rise. In addition, there will be challenges around rising energy prices for both consumers and businesses and how this will affect energy usage – a critical component of the economy. The ongoing impact of Covid on economic activity and supply chain is also likely to restrict economic growth in the short term. Though growth is expected to be more moderate this year compared to last year Alex and the team believe that there is still further upside for markets this year. As such, they are hard at work figuring out which companies will benefit from the prevailing market environment.

| Discrete year performance % change (updated quarterly) | Share Price | NAV |

| 30/09/2020 to 30/09/2021 | 11.0 | 18.6 |

| 30/09/2019 to 30/09/2020 | 9.1 | 6.5 |

| 28/09/2018 to 30/09/2019 | 8.1 | 6.6 |

| 29/09/2017 to 28/09/2018 | 11.5 | 12.4 |

| 30/09/2016 to 29/09/2017 | 27.6 | 19.4 |

| All performance, cumulative growth and annual growth data is sourced from Morningstar. |

Glossary

Cyclical stock – A cyclical stock is a stock that’s price is affected by macroeconomic or systematic changes in the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery. Most cyclical stocks involve companies that sell consumer discretionary items that consumers buy more during a booming economy but spend less on during a recession.

Quantitative easing – An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system.

Disclaimer

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe, or purchase the security. Janus Henderson Investors, one of its affiliated advisors, or its employees, may have a position mentioned in the securities mentioned in the report.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Capital International Limited (reg no. 3594615), Henderson Global Investors Limited (reg. no. 906355), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

[Janus Henderson, Janus, Henderson, Intech, VelocityShares, Knowledge Shared, Knowledge. Shared and Knowledge Labs] are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.