The UK’s small and mid caps rebounded on Friday as equities clawed back some of the losses incurred this week caused by concerns over growth and tightening monetary policy.

Bridgepoint shares jumped 10% to 281p after the group reported that all motions were passed with majority votes in its latest annual general meeting.

ConvaTec shares gained 3% to 219p as momentum continued from Thursday when the group announced its exit from the hospital care segment and reported expected revenue for 2022 to be around $20m to $30m and adjusted EBITDA of around $5m.

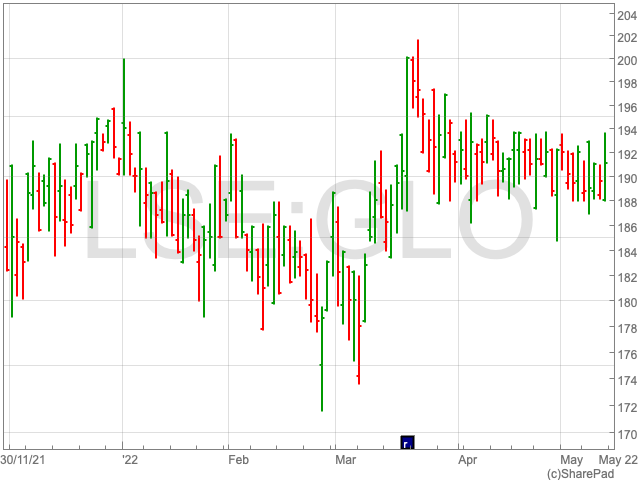

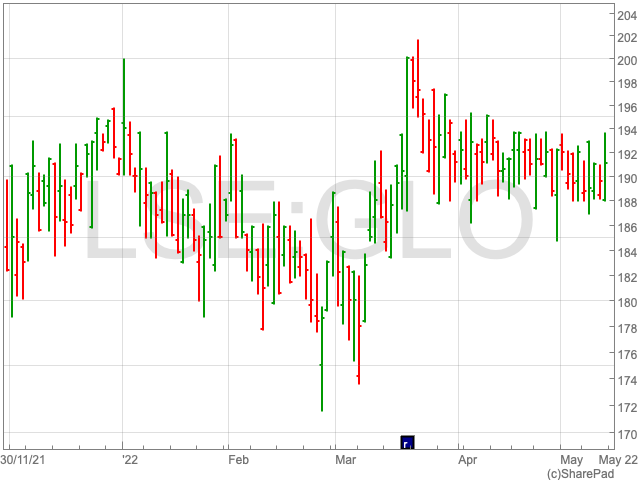

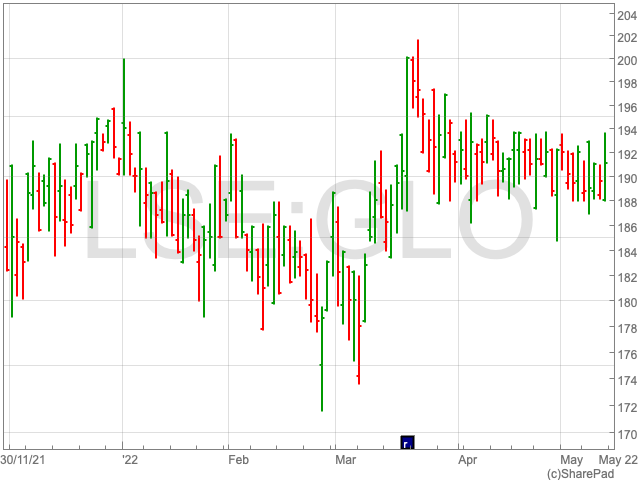

ContourGlobal shares gained 0.7% to 191p after the group noted a 53% jump in revenue from $427m to $652m in its first quarter of 2022 as the year started positively with resilient trading. However, net profit fell 10% to $8m from $9m.

Vietnam Enterprise Investments shares dropped 4.3% to 645p after the group reported a drop of 5.9% in its NAV and said the NAV per share performance was down 5.6% over three months.

Mitchells and Butlers’ shares rose 2.1% to 209p as the group announced May 18 as the date for its Half Year Results.

AIM Index

The AIM index was at 950, up 1.2% on Friday with strong gains after investors returned from the “recession rout” as described by Russ Mould, Investment Director at AJ Bell.

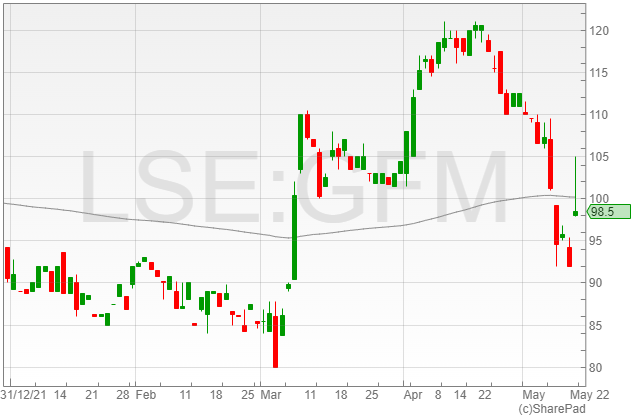

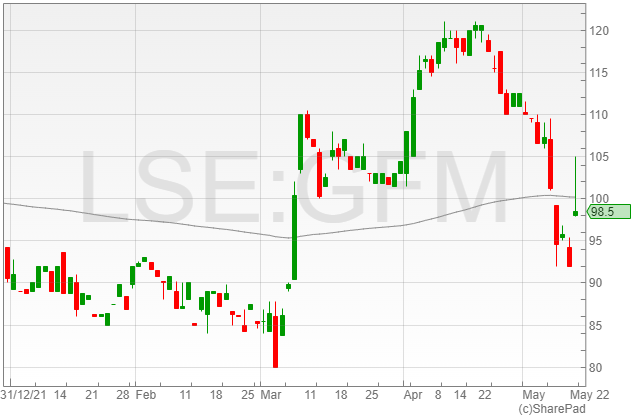

Griffin Mining shares were up 7% to 98.5p after the miner reported a pretax profit of $36.5m in 2021, which was more than double 2020s $14.5m due to higher volumes of zinc and other metals sold. The sale of higher tonnes of zinc metal in concentrate in 2021 rose 83% to $43.9m and the amount sold rose 30% to 41,949 tonnes in 2021.

ThinkSmart shares increased 10% to 24.5p following the company’s latest business update in which the digital payments platform company said it intends to return roughly £2.5m to its shareholders, subject to approval.

One Media IP Group shares rose 1.8% to 7p after the group said it placed a bid of £3.5m to own a 1% stake in the back catalogue of UK rock band Pink Floyd. Pink Floyd has put up the entire back catalogue of music for sale for around £350m.

President Energy shares were up 4.8% to 1.7p following the group’s first-quarter results where it records a pretax profit of $5.3m, a revenue of $8.7m and forecasts revenue to be around $40m from Argentina subsidiaries.

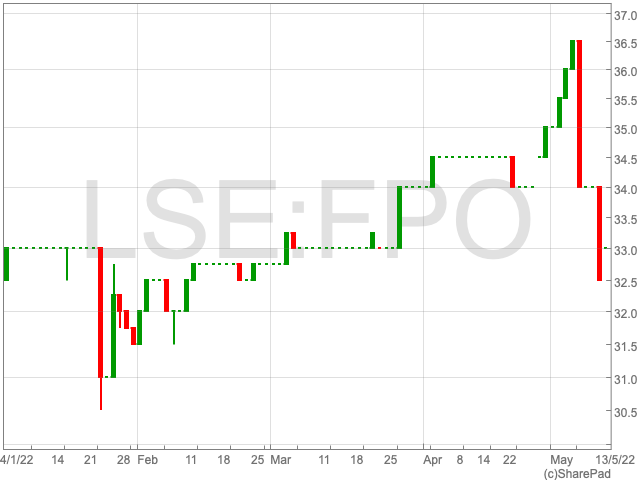

First Property Group shares gained 1.5% to 33p after the property fund manager announced that it has signed leases for 20% of the net internal area in its office building located in Gdynia, Poland which was 98% vacant due to covid lockdowns.

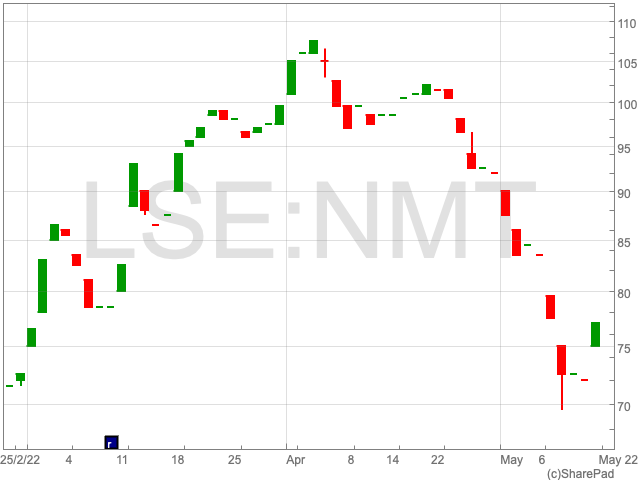

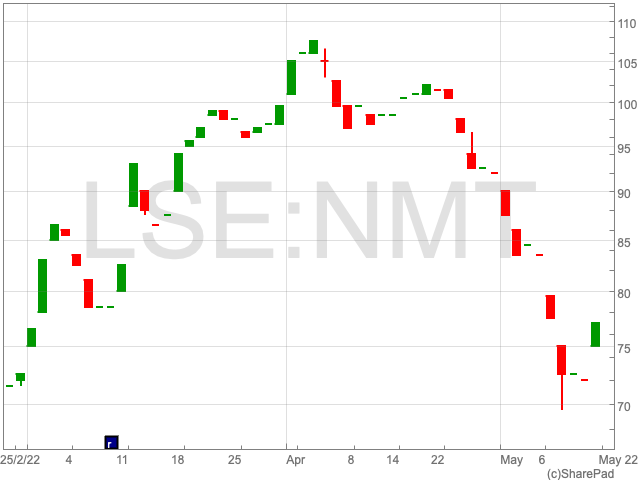

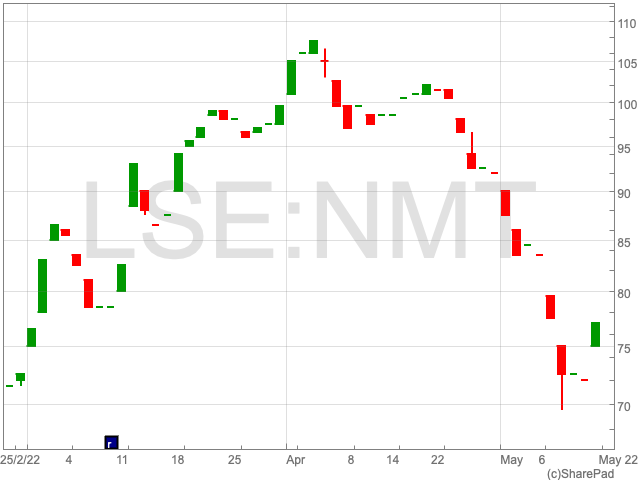

Neometals shares were trading up 6.3% to 76.5p after the group reported that its battery recycling joint venture has made a deal with Mercedes-Benz AG’s recycling subsidiary Licular, where Primorbius, which is a joint venture between Neometals and SMS Group, will design and construct a 2,500 tonnes per annum lithium-ion battery recycling plant

Sabien Technology shares rose 5.5% to 24p when the group confirmed that the UK and Welsh governments will fund the construction of a new freeport in Wales that the b.grn Group aims to do. Sabien holds a 33% stake in b.grn.

Vast Resources shares plummeted 37% to 0.85p after the group Atlas Special Opportunities converted bonds amounting to $500,000. The explorer was traded as high as 2.22p this week.

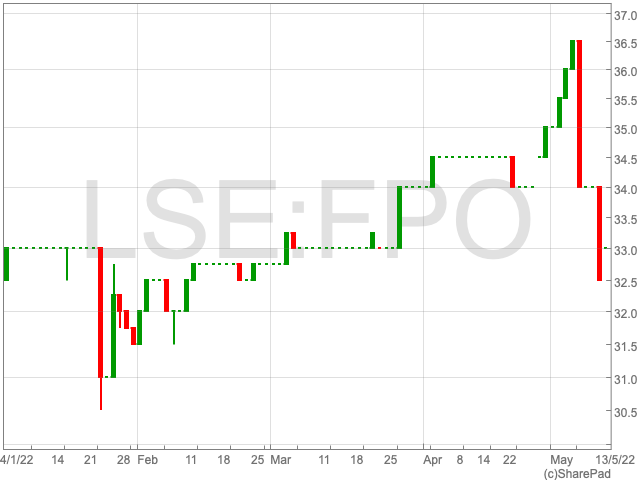

Condor Gold shares dropped 6.8% to 34.5p after the group reported a widening pretax loss of £668,000 compared to £513,000 in 2021 and noted no revenue, the same as a year ago. However, the group drew focus to a feasibility study for its La India project in Nicaragua.

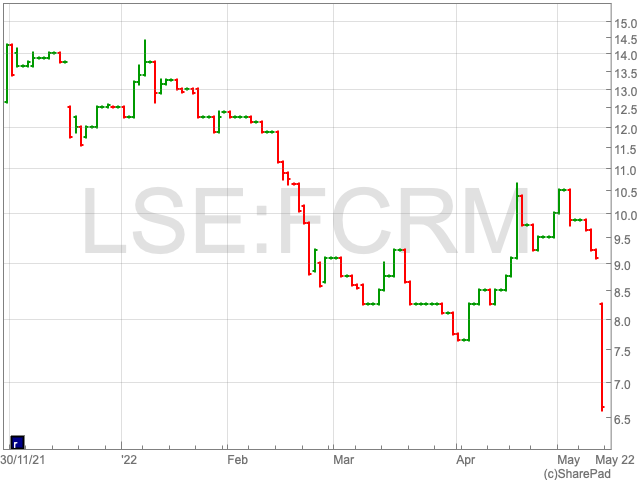

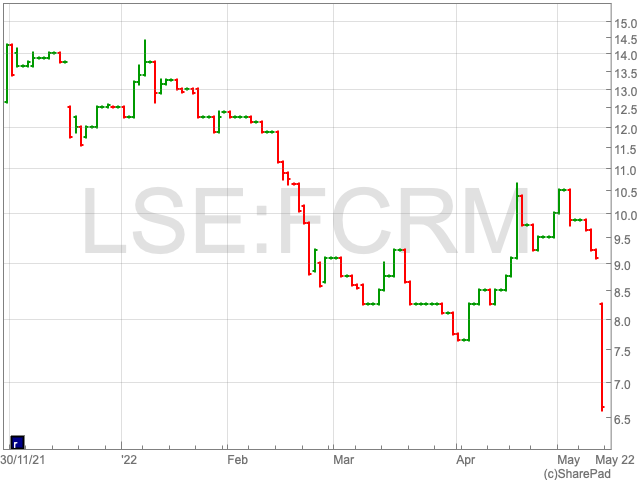

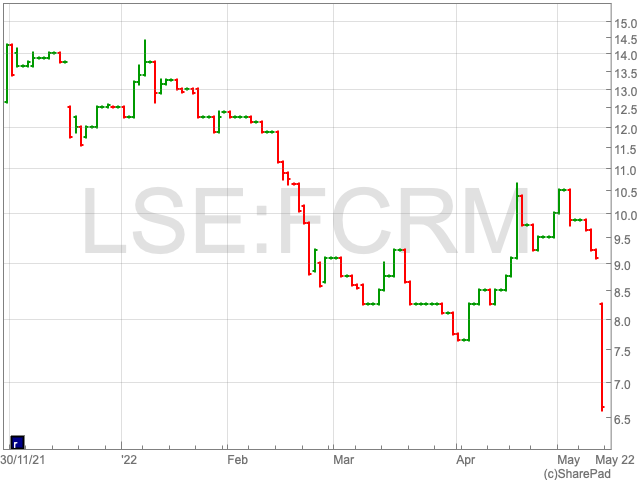

Fulcrum Utility Services shares sank 20% to 7.2p after the group said UK energy market conditions hurt its profits. The impact of inflationary pressure hurt the group’s financial position resulting in the group predicting a 21.8% YoY growth to £57.4m in report adjusted revenue for FY22 and expects adjusted EBITDA to be around £0.5m.

UK Oil and Gas shares fell 0.8% to 0.12p following the group’s announcement of being granted a one-year extension to the “Retention Area work programme” of the group’s PEDL137 licence encompassing the operating Horse Hill oil field and its underlying Kimmeridge oil pool by the North Sea Transition Authority.