FTSE 100 hit by concerns over China

The FTSE 100 fell on Friday as concerns over China and Hong Kong finally played out in markets after a strong week in global equities.

The FTSE 100 was trading at 6,085, down over 2% just before 4.00pm on Friday.

“It took them a few sessions, but the markets are finally started to pay attention to this week’s China-Hong Kong developments – and what that means for the relationship between Beijing and Washington,” said Connor Campbell, an analyst at online trading company Spreadex.

“With China’s parliament rubber-stamping the new national security laws set to be imposed on Hong Kong, sending armed police to swarm the streets of the administrative region in an attempt to combat pro-democracy protests, Donald Trump has promised to hold a press conference this Friday,” Campbell added.

The real risk to markets is if Donald Trump moves to act against China and in the process reignites a trade war that could further derail a global economy that has been ravaged by COVID-19.

“It will potentially outline the actions the President is set to take against China, the said same vague actions he threatened if China passed the security laws earlier in the week,” Campbell said.

“This has been seen by investors as a step towards escalation, especially since the impending press conference was preceded on Wednesday by the House passing a bill condemning China’s detention and torture of Uighur Muslims.”

How efficiently can the UK Life Insurance industry breeze through the COVID-19 storm?

While the scourge of novel coronavirus continues unabated, creating havoc around world economies and financial markets, insurance markets have been under the scanner struggling to stay afloat amidst enhanced credit risk exposure, reputational risk, increased volatility, and risk of heightened life insurance claims.

Besides, UK insurers have been in the spotlight with the direction of European Insurance and Occupational Pensions Authority (EIOPA) on suspending non-discretionary dividend pay-outs and share buybacks. In view of the same, prominent players such as Aviva, RSA, Hiscox and Direct Line have already revealed their 2019 dividend suspension plan.

However, this seems to be in good faith positioning insurers in an apparently better position in near to mid-term keeping in mind regulatory risks, wider stakeholders’ interests and prudent risk management, with stress testing and capital projections playing an important role here considering their objective of policyholders’ protection.

Moreover, we cannot ignore the varied impact on different business lines, wherein although some heat has been felt on segments requiring medical practitioners’ inputs, other segments are experiencing heightened demand of policy protection amidst global health crisis.

As per the latest available data, the total worth of investments being managed by the UK insurance industry is pegged around £2.0 trillion, with the top five companies viz, Aviva, American International Group (AIG), AXA UK, Zurich Insurance Group and RSA Group, alone having around £30 billion of gross written premiums.

Fitch Ratings has recently affirmed the ratings for ten UK life insurance players, maintaining outlook for five life insurance groups, while revising for five others. This reinforces confidence in the positioning of UK life insurers, who seem to be strongly capitalised to breeze through the market crisis with although dented but reasonable solvency coverage ratios within target capital ranges.However, surging demand for life insurance claims amidst rising mortality and uncertainty could turn the wind in a jiffy.

With regulatory supervision, disruptive innovation and digitisation, and fierce competition driving the future face of UK general and life insurance space, a dedicated focus on improving customers’ financial well-being along with maintaining profitability and operational resilience is equally important. Some headwinds are expected amidst uncertainty around COVID-19 scenario and its impact on both the asset and underwriting side of the balance sheet.

by Kunal Sawhney, CEO of Kalkine.

Nationwide profits plunge 40%

Britain’s largest building society Nationwide said profits crashed to £469m in the year to April 4th, from £788m the year previously.

The company had already been seeing pressure on its profits from its investment in technology and payouts for payment protection insurance (PPI) before booking a £101m hit from Covid-19.

Nationwide said it would suspend repossessions of its mortgage customers in arrears for 12 months as part of its support measures for Covid-affected members.

Like all banks, it expects to see a surge in the numbers of people unable to make their interest payments.

Nationwide chief executive Joe Garner said: “In the last month of our financial year all our lives have been overshadowed by the coronavirus.

“We are helping members in financial difficulty with payment holidays on mortgages and loans and interest-free overdraft periods, and we have promised that no mortgage member will lose their home over the next 12 months due to the impact of the coronavirus.

“We’ve taken steps to protect our employees’ physical and mental health so we can maintain essential services to our members, and we’ve gone a step further and promised that everyone’s job is safe in 2020.”

The building society has also promised that no-one will lose their home in the next 12 months because of the impact of coronavirus.

Nationwide, one of the big players in the mortgage market, said total gross mortgage lending fell to £30.9m from £36.4bn last year, with its market share shrink to 11.4 percent from 13.4 percent last year.

Provisions for PPI increased to £56m from £15m last year due to higher-than-expected claims ahead of the deadline in August 2019.

Nationwide reported a core capital buffer of 31.9 percent, down slightly from 32.2 percent the previous year but still ahead of most major rivals.

Transformational cycle of Cadence Minerals

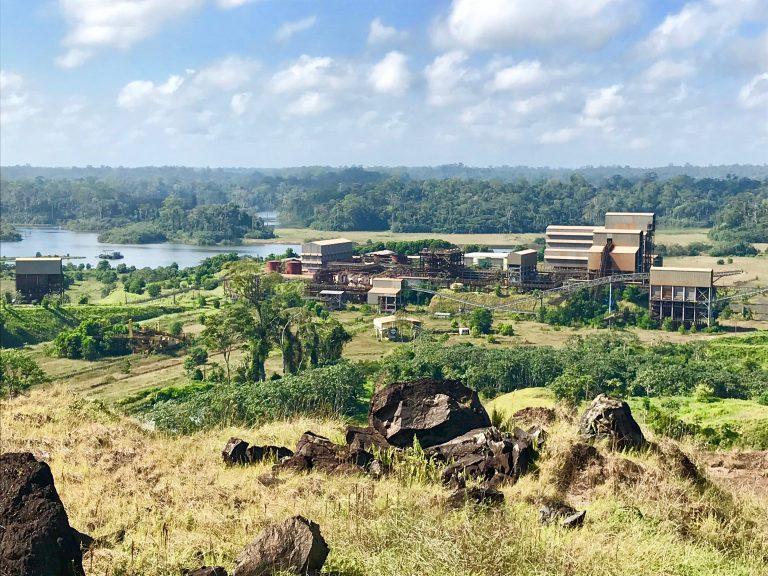

AIM listed Cadence Minerals (AIM: KDNC) continues to make substantial progress with the former Anglo American Iron Ore mine, railway and port at Amapá in Brazil.

Since September 2018, the board has conducted an exhaustive, ongoing round of due diligence and legal processes to bring the mine out of administration, into a recommissioning programme and ultimately back to production.

Back in April 2020, Brazil’s Commercial Court of São Paulo ruled that DEV Mineração S.A., owner of the Amapá iron ore project and 99% owned by Cadence, could commence shipment of the iron ore stockpiles situated at the wholly-owned port in Santana, Amapá, Brazil.

Independent surveys of these iron ore stockpiles indicate that some 1.39 Mt of iron ore in three stockpiles are available for immediate export with an average Fe grade of 62.12%.

Despite the impact of the Covid-19 lockdown in Brazil, shipment is still expected

to commence on schedule late Q2, early Q3 2020. The net proceeds will go to pay labour and small creditors, invest in the recommissioning of the assets and essential maintenance.

Currently rehabilitation of the mine, railway and port is expected to be completed in 2022. A production ramp up will see 5.3 million tonnes of iron ore produced per annum within 3 years of completion of the rehabilitation. The local economy will also see significant benefits, with hundreds of new jobs and employment opportunities.

The financials make impressive reading too.

Net revenues after shipping from the former Anglo American mine is forecast to be approximately $265m per annum, with EBITDA of approx $136m per annum based on a conservative iron ore price of $61 per tonne. Currently the iron ore price squeeze sees the commodity trading at up to $100 per tonne.

“This is a huge step change for Cadence,” says Cadence CEO Kiran Morzaria.

“Our range of lithium and iron ore investments continue to add value, but once

settlement is finalized with our creditors, Cadence will own 27% of Amapá, with options to acquire up to 49%. Our EBITDA forecasts will deliver a material change to current valuation metrics for our company.”

While the focus is certainly on Amapá, the rest of the Cadence portfolio is nonetheless impressive. Cornerstone stakes in projects such as the Cinovec Lithium and Tin Project in the Czech republic and Macarthur Minerals’ Lake Giles Iron Project in Western Australia has provided Cadence with opportunities to invest into assets such as Amapá.

Cinovec, 50% owned by European Metals Holdings (AIM: EMH) and Eastern European utility giant CEZ is set to become a major European and Global lithium supply hub to meet the boom in batteries and electric vehicles, with demand anticipated to grow some 800% by 2030. Cadence also has a range of other lithium and rare metal investments, plus a joint venture at the Yangibana Rare Earths project in Australia with Hastings Technology Metals (ASX: HAS).

Cadence Chairman Andrew Suckling is also a non-executive director of Macarthur Minerals (TSX-V: MMS, ASX: MIO) and chairman of the Audit Committee. Macarthur stated recently it was ‘encouraged by the robust iron ore market’, and also buoyed by the recent share price performance of Cadence Minerals, one of its largest shareholders.

City institutions are also waking up to Amapá’s potential, with broker WH Ireland noting that the “healthy margin from sales of the easy to ship iron-ore stockpile could be used to pay senior bank creditors, complete a feasibility study into the reopening of the mine and pay for some of the new infrastructure required.”

AIM listed Cadence currently trades on an asset backed market cap of just £7m, although with the current transformation cycle the company is undergoing, that

could be unlikely to last.

Bitcoin price hits $9,500, following turbulent weeks

$10,000 is within sight for Bitcoin, which has gained $800 this week after a series of highs and lows for the unpredictable investment.

March 2020 saw prices fall to $5000. By April, the value rectified to around $9000. The reason for the price increase? Many put it towards the Bitcoin Halving, an event that occurs once every four years.

Earlier this month, the number of bitcoin rewarded to those that maintain the bitcoin network was cut by half, dropping from 12.5 bitcoin to 6.25.

Some had warned the price could crash in the aftermath of the third halving but most analysts seem confident that the value will climb eventually.

In the days leading up to the Halving (11/05/2020), the price hit $10,000 – only to dramatically crash to $8500 in a matter of minutes.

Following the Halving, the price has seen a high of $9857 and lows of $8700.

“The recent much-hyped halving, while largely psychological in impact, could create a catalyst drawing new players into the market and contributing to the rise in the value of bitcoin,” said Gavin Smith, Chief Executive of Hong Kong-based BTC and cryptocurrency exchange and hedge fund Panxora.

He adds that he believes the cryptocurrency is at “the start of a multi-year bull phase” though there could be “a bumpy road ahead.”

“BTC has risen over 100% over the last few months and we believe most of that rise was driven by continued retail demand,” said Scott Freeman, co-founder of New Jersey-based bitcoin and crypto-focused institutional trading firm JST Capital.

Lennard Neo, head of research at Singapore-based institutional-grade bitcoin index fund Stack, wrote in a weekly analysis update: “The potential for BTC as an alternative hedging tool will only continue to grow.”

Neo believes that “short-term expectations of a huge potential drawdown have partially abated.”

“As bitcoin’s investment attributes become more prevalent, we expect to see a growing number of investors tactically allocating it to their portfolios in both the near and long term,” he added.

Boohoo acquires minority stake in PrettyLittleThing

Online fashion retailer, Boohoo, has seen a share increase of over 16% after purchasing a minority stake in its PrettyLittleThing brand.

Costing an initial £269.8m – potentially rising up to £323.8m for the 34% stake, the fashion retailer commented that the purchase would create “significant value for the group’s shareholders” and was an “important further step towards achieving its vision to lead the fashion e-commerce market globally by accelerating full ownership of a brand that is in high growth with enormous growth potential ahead of it”.

The stake Boohoo is buying is held by Umar Kamani, Chief Executive of PrettyLittleThing brand and son of Boohoo co-founder, Mahmud Kamani.

“Three years ago we wanted Umar focused on PLT . . . now is the right time to shift the emphasis,” said the Finance Director, Neil Catto.

The announcement comes shortly after criticism from hedge fund investor ShadowFall. Short sellers at the fund published a 54-page report accusing the fashion giant of misleading its investors in cashflow and profits.

The report saw share prices in Boohoo fall 12% but have since rebounded back in the deal welcomed by analysts.

Boohoo (LON: BOO) is currently trading at 390.60 (1420GMT).

In a statement issued on Wednesday, Boohoo refuting all the allegations made by Shadowfall. Boohoo said it gave “clear definitions” of how free cashflow was calculated and said its treatment of PrettyLittleThing in accounts was approved by auditors.

Boohoo is one of Britain’s highest-profile online fashion businesses. Founded in 2006, the company has become a stock market darling in recent years thanks to consistent sales growth. The business had sales of £1.2bn last year and is valued at £4 billion by the market.

Boohoo is the latest in a string of British businesses to be targeted by short-sellers, who make money when share prices decline. Other recent targets include Pets At Home (LON:PETS) and NMC Health (LON:NMCN), the former FTSE 100 healthcare business that ultimately collapsed earlier this year.

IWG shares soar following placing involving retail investors through PrimaryBid

IWG plc shares (LON:IWG) soared on Thursday following the successful raising of £320m to fund expansions and increase efficiency.

IWG placed shares at 239p representing a 8.1% discount to the mid price closing of 260.2p on 27th March

IWG shares were up over 14% to 298p at lunch time on Thursday, after touching highs of 320p earlier in the session.

Although the offer was largely met by institutions, IWG followed in the footsteps of Compass Group and made the offer open to retail investors through PrimaryBid.

Such offers had previously been reserved for institutional investors but PrimaryBid’s platform now allows retail clients to invest alongside larger investors.

The PrimaryBid retail offer accounted for roughly 15.4% of the overall offer.

PrimaryBid have traditionally been sole facilitators of smaller offers from listed companies but have recently provided retail investors with access to FTSE 350 secondary offerings.

IWG CEO Mark Dixon was heavily involved in the placing with a subscription of £91.3 million, representing approximately 28.53% of the total offer.

PrimaryBid

PrimaryBid

Such offers had previously been reserved for institutional investors but PrimaryBid’s platform now allows retail clients to invest alongside larger investors.

The PrimaryBid retail offer accounted for roughly 15.4% of the overall offer.

PrimaryBid have traditionally been sole facilitators of smaller offers from listed companies but have recently provided retail investors with access to FTSE 350 secondary offerings.

IWG CEO Mark Dixon was heavily involved in the placing with a subscription of £91.3 million, representing approximately 28.53% of the total offer.

Working from home

The fund raise set out to provide IWG with capital to pursue expansion in the social distancing environment and seek out M&A opportunities. IWG had rebranded from Regus in recent years to reflect their push into co-working and more flexible workspace environments. However, COVID-19 now throws up new challenge and opportunities for the company who are operating in a market that has seen capacity grow sharply in recent years but now has to contend with working from home. If the working from home trend takes hold after the COVID-19 social distance restrictions lift, IWG now has a war chest to target new opportunities in flexible working. As part of the expansion into new workplace trends, IWG are launching a specific working from home product. Investec, Barclays and HSBC Bank acted as joint global co-ordinators and joint bookrunners for the placing.Cineworld shares spike on cinema reopening and debt amendments

Cineworld shares (LON:CINE) jumped on Thursday as the cinema group announced favourable amendments to their debt covenants and said all their cinemas would reopen in July.

Cinworld shares had rose 24% by Thursday lunch time, with shares reaching the highest levels since March.

The cinema group said a release to the market:

“The Group has also agreed the terms of $110m of additional liquidity through an increase in its revolving credit facility. In addition, the Company has secured credit committee approval to apply for an additional $45m through the CLBILS loan scheme in the UK and expects shortly to commence a process to access $25m through the US government CARES Act. Cineworld expects that this additional liquidity, to the extent required, will provide it with sufficient headroom to support the Group even in the unlikely event cinemas remain closed until the end of the year.”

The market has flocked back into travel and leisure shares this week as the reopening of economies a relaxation of social distancing measures means companies in the sector will soon again be able to take paying customers.

Cineworld operates 787 cinemas across 10 countries, all of which were shut in early April.

The cinema group said a release to the market:

“The Group has also agreed the terms of $110m of additional liquidity through an increase in its revolving credit facility. In addition, the Company has secured credit committee approval to apply for an additional $45m through the CLBILS loan scheme in the UK and expects shortly to commence a process to access $25m through the US government CARES Act. Cineworld expects that this additional liquidity, to the extent required, will provide it with sufficient headroom to support the Group even in the unlikely event cinemas remain closed until the end of the year.”

The market has flocked back into travel and leisure shares this week as the reopening of economies a relaxation of social distancing measures means companies in the sector will soon again be able to take paying customers.

Cineworld operates 787 cinemas across 10 countries, all of which were shut in early April.

The cinema group said a release to the market:

“The Group has also agreed the terms of $110m of additional liquidity through an increase in its revolving credit facility. In addition, the Company has secured credit committee approval to apply for an additional $45m through the CLBILS loan scheme in the UK and expects shortly to commence a process to access $25m through the US government CARES Act. Cineworld expects that this additional liquidity, to the extent required, will provide it with sufficient headroom to support the Group even in the unlikely event cinemas remain closed until the end of the year.”

The market has flocked back into travel and leisure shares this week as the reopening of economies a relaxation of social distancing measures means companies in the sector will soon again be able to take paying customers.

Cineworld operates 787 cinemas across 10 countries, all of which were shut in early April.

The cinema group said a release to the market:

“The Group has also agreed the terms of $110m of additional liquidity through an increase in its revolving credit facility. In addition, the Company has secured credit committee approval to apply for an additional $45m through the CLBILS loan scheme in the UK and expects shortly to commence a process to access $25m through the US government CARES Act. Cineworld expects that this additional liquidity, to the extent required, will provide it with sufficient headroom to support the Group even in the unlikely event cinemas remain closed until the end of the year.”

The market has flocked back into travel and leisure shares this week as the reopening of economies a relaxation of social distancing measures means companies in the sector will soon again be able to take paying customers.

Cineworld operates 787 cinemas across 10 countries, all of which were shut in early April. EQTEC unveils 2020 progress in commercial update

EQTEC plc (LON:EQT), the waste-to-energy and gasification technology company, has outlined operational and commercial progress achieved in 2020.

The company has enjoyed in progress across their portfolio of projects including Billingham in the UK, North Fork in the US and their Greek Agrigas project.

EQTEC said they have received around enquires that could amount to £120 million in potential sales in Q1/ early Q2.

EQTEC shares were 7% stronger in early trade on Thursday following the update.

The standout out was the progression in the Billingham project where EQTEC have signed a finance terms sheet to provide funding for the project after design work was carried out for Northern Grid.

In terms of cash flow, EQTEC received a £770,000 payment for work completed at the North Fork project who ch included a detailed engineering plan. EQTEC said they expected equipment to be received at the site no later than August 2020.

There had also been steps forward in the financing of the Greek projects after due diligence reports were presented to a local bank, further updates are expected in early June. EQTEC’s technology is to be used in plants to utilise local farming waste in energy production.

The partnership with ewerGy had also identified 13 potential new projects in the Balkan region, which are now undergoing due diligence.

“I am pleased with the ongoing progress that EQTEC has made during this challenging time. As we approach H2 2020, we continue to focus on executing our strategy with special emphasis in seeking strategic partnerships to enhance our portfolio opportunities,” said David Palumbo, CEO of EQTEC

“We are already experiencing an increase in the number of large operators that are engaging in conversations with us regarding collaboration opportunities. We believe the coronavirus pandemic may influence the pace and nature of climate action positively and we will be ready to seize inspiring and fruitful new partnerships to apply our solutions.”

M&G Investments maintains dividend and invests in digital platform

Investment manager M&G Investments (LON:MNG) has maintained it’s dividend after the business displayed resilience throughout the COVID-19-induced market volatility.

Despite M&G Investments experiencing an 8% drop in Assets under Management, the manager said it Wass going to proceed with a £410m dividend payment, including both the ordinary dividend and special dividend related to the demerger from Prudential.

The move will please investors who have seen a large number of financial services shares cut or completely scrap their dividend in response to COVID-19.

M&G Investments shares rose over 9% on Wednesday following the news.

In addition to maintaining the dividend, the financial strength of M&G meant they felt confident enough to push forward with the acquisition of a platform digital from Royal London.

The wealth platform has 1,500 advisors and 90,000 individual clients and will increase M&G’s exposure to the advisor market to the tune of £14 billion in assets under management.

The company said it was also targeting £145m in cost savings before the end of 2022.

“I’ve been through a number of financial crises, but none has been like this terrible pandemic. It is testing all of us, in many different ways,” said John Foley, Chief Executive.

“Fortunately, M&G is a resilient business and I am proud of how my colleagues have risen to the challenge of continuing to serve, from their homes, the millions of customers we have around the world.”

“Our financial strength means we can also do the right thing by our shareholders, and make good on our announced intention to pay dividends totalling £410m. Many of our shareholders are income funds or individual savers who rely on these payments for part of their retirement income.”

“While markets have recovered from their March lows, I expect volatility to continue, but as an asset owner of scale we are well positioned to acquire assets at competitive prices. In the meantime, we will continue to manage the business in a prudent way, with our usual disciplined approach to capital management.”