The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.”

The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.” Flutter Entertainment shares complete V-shaped recovery

Shares in the owner of Betfair and Paddy Power, Flutter Entertainment (LON:FLTR), have completed a remarkable V-shaped recovery following the sharp selloff due to coronavirus.

With the heavily touted V-shaped recovery in the global economy looking increasingly unlikely, the FTSE 100 gambling company has at least provided its investors with a strong recovery.

The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.”

The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.”

The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.”

The recovery has completed with a 13% increase on Friday as a reaction to the betting group’s Q1 trading update.

Flutter’s Q1 revenue grew 29% to £547m from £478m in 2019, helped by strong performance in the gaming division.

With sporting events being heavily disrupted due to coronavirus lockdowns, Flutter’s strong performance was a surprise to markets and shares hit a 5-week high on the back of the announcement.

The rally took shares back above 85p and completed a sharp recovery from the selloff that started in early May.

Flutter Entertainment CEO, Peter Jackson, commented on the results.

“The Group performed very well in the period prior to the disruption to sporting events in mid-March. We delivered strong customer growth across each of our brands and benefitted from favourable sports results across our sportsbooks. Following the widespread cancellation of sporting events, Group revenues have been more resilient than we initially expected, helped by the continuation of horse racing in Australia and the US. Gaming continues to perform well across the Group.”

“During this unprecedented time, we are keenly aware of our heightened responsibility to ensure that we do all we can to promote responsible gambling. We have stepped up our own practices and are collaborating with our peers within the Betting and Gaming Council to continue to raise standards across the sector. We are also working hard to provide all the support we can to our employees and I would like to thank them for their ongoing commitment and support for each other during this difficult period.”

“While the current disruption is truly exceptional, it underlines the importance of product and geographic diversification. As such, the strategic logic of our combination with The Stars Group remains compelling. Following approval of the deal yesterday by the Irish Competition and Consumer Protection Commission, we look forward to completing the transaction in Q2 upon receipt of outstanding shareholder and regulatory approvals.” FTSE 100 jumps following encouraging COVID-19 drug trial results

The FTSE 100 surged on Friday after US drug company Gilead announced positive results from a trial of the antiviral drug Remdesivir.

A trial at the University of Chicago found the large majority of 125 patients with COVID-19 who undertook the experimental course of Remdesivir showed dramatic signs of improvement. Two of the 125 sadly died.

The study at the University of Chicago was a phase 3 trial and involved 113 patients that were classed as seriously ill, many of whom were on ventilation.

Reports from researchers highlighted significant improvement in patients with changes noticable almost immediately after the patients began taking Remdesivir.

Over the weekend, the UK Investor Magazine reported Gilead had seen an improvement in two thirds of seriously ill patients with COVID-19 who had received a course of Remdesivir.

The latest set of results build on these positive findings, but further trials are needed to make broad assumptions on Remdesivir efficacy, and test the safety of the drug for use against COVID-19.

Such trials are currently underway with around 4,000 COVID-19 patients trialing Remdesivir at multiple locations around the world.

The trials have been ongoing since March and are expected to yield results in May.

Remdesivir had originally been developed for treatment of patients with Ebola but Gilead sent a free shipment to China in January to test on COVID-19 patients and initial positive findings sparked wider testing.

Gilead shares surged in after-hours trading last night and triggered a global rally in equities.

If the early signs of Remdesivir trials are backed up with more comprehensive results, it could provide the most important breakthrough in reducing the death rate in patients who are seriously ill with COVID-19.

In this scenario, government leaders may have the confidence to speed up the reopening of their economies, safe in the knowledge there is a drug that can dramatically reduce the death rate of the most severely ill patients with COVID-19.

The prospect of economies reopening drove a wave of optimism through equity markets with the FTSE 100 rising over 3% in Friday morning trade.

The German DAX was also much better bid and US futures were pointing to further gains.

Latour 1982? Why Authenticity Matters In The Fine Wine Market

OenoFuture’s Chief Wine Analyst and Master of Wine Justin Knock explains why authenticity matters in the fine wine market.

For anyone interested in fine wine the documentary film Sour Grapesis a must-watch. This is the story of Rudy Kurniawan, the most notorious name in the world of fine wine over the past decade, who lured in high-end collectors and sold them tens of millions of dollars of fake wine. Kurniawan has been in jail since 2013, but his actions are of course not unique and there are several lessons we should learn from his tale.

One is that eliminating fake wines out of the system has proven difficult for numerous reasons. Perhaps the most obvious is in the taste. Sampling in this way is not only destructive; who of us can claim they know what ’45 Mouton tastes like, or rather, what it should taste like at 50, 60, 70 or 80 years of age? More insidiously, what about ’62 Lafite?

Kurniawan’s genius was to routinely take a very good shoulder vintage like ’62, blend it with a little young Cabernet from the New World, and produce the acclaimed ’61 – thereby instantly multiplying the cost of his still high-quality components many times over.

In the case of the collectors in the film it was clear that many of them were willing to suspend disbelief to fulfil dreams of tasting exquisitely rare wine, an all-too-familiar example of investor emotions getting the better of rational thought. Despite concerns about where and how Kurniawan was finding these wonder wines, the victims wanted to believe that what he was bringing them was real. A seminal line in the film is after Kurniawan has gone to prison, they ask a collector what they thought of him now. The reply, ‘yeah I know he ripped us off, but … Rudy was such a great taster’.

While Kurniawan was convicted as a rogue hand, it’s clear that his actions were enabled by others who bankrolled his acquisitions, aided in producing huge quantities of fake wine, and bolstered his credibility by offering lots at auction. Whilst never convicted on charges, one very famous New York auction house settled out of court with American billionaire Bill Koch for selling him hundreds of Kurniawan fakes (Koch had prior experience buying fakes from another infamous fraud, Hardy Rodenstock, and was not to be shaken down twice). What’s happened to these known fakes? A tiny quantity was destroyed but the vast majority remain in the fine wine market today.

The high ascribed value of fake wine can thus be a barrier to ridding it from the system – in a high stakes game of pass-the-parcel who is ultimately going to bear the loss? In a showdown for the lawyers it’s one thing to assert that within the limits of probability a wine is not genuine. It is something else altogether to guarantee that it is fake. Taking all these things into consideration its therefore a better approach to have extremely robust acquisition protocols and avoid bringing fake wines into the system in the first place.

Prevention rather than cure

Central to Kurniawan’s conviction was the testimony of Maureen Downey, founder of Chai Consulting and WineFraud.com. Amongst the world of fine wine, Maureen and her team of authenticators are a legendary force. They have placed accused fraudsters on trial (Kurniawan, for example) and under the microscope with their approach to authenticating wine. One element is forensic; bottles can be examined under high magnification or alternative light sources to sort the genuine from the fake. This can be aligned to historical research on a domaine or château to understand the exact details of production from a particular vintage. It is research like this that led to Sotheby’s Serena Sutcliffe MW to once quip, ‘There is more ’45 Mouton in the market than was ever made’. OenoFuture’s method of sourcing stock ex-cellars, that is directly from the producing estate, is the single most important step we can take to guarantee the provenance of the wines in which clients invest, and this covers more than 95% of our inventory purchases. OenoFuture has now taken steps to partner with UK certified authenticator Siobhan Turner (former EGM of the Institute of Masters of Wine), Chai Consulting and Winefraud.com to enhance our sourcing protocols and train the Oeno wine team on authentication measures for the small portion of our acquisitions that are not ex-cellars.Fraud is good

Can there be a positive outcome from wine fraud? No industry wants to talk about its dark side, especially when the very foundations upon which the industry is built are challenged. Fraudulent wine has been with us since time immemorial, but many may not know that it is also responsible for completely shaping the structure of the 20thcentury wine industry and has made wine the safe and respected beverage it is today. It may surprise many to know that the first control systems that featured audit trails and production legislation only appeared in the 1930s. Prior to that nothing was available to establish the veracity of a wine’s origin or status. While there were informal quality hierarchy systems in places like Burgundy, and also in Bordeaux with the famous 1855 classification, there were no means of assessing origin forensically or legislatively. Everything was based on trust. The importance of having ‘a reliable merchant’ is short-hand today for one with judicious taste in quality, but back in the day it really was about trust in authenticity. Fraud became a major problem in wine in the 1870s and 1880s thanks to the advance of phylloxera, the vine louse that devastated European vineyards without discrimination. Over the course of two decades the production of wine in Europe plummeted. With wine being part of the staple diet of both peasants and the gentry, it created chaos in markets and incredible opportunities for the nefarious. The resulting shortage encouraged numerous creative and illegal solutions. Importation of raisins from the eastern Mediterranean to western Europe rose ten-fold within a decade. The desiccated grapes were steeped in water to rehydrate and leach their sugars and fermented. The nascent German chemical industry supplied colour and other additives thanks to their recent discovery of heavy-metal based inks and dyes. Carcinogenic Fuchsine, thanks to its rich, magenta hue, was a popular additive, while it is said that by 1885 more wine was being ‘made’ on the docks of London, Brussels and Hamburg than in the vineyards of France. Simpler still was the rebadging of wine in cask that had arrived in Bordeaux from Rioja or the Languedoc and passing it off as Claret. As vineyards died in Europe, so they rose in the New World. Phylloxera was a boon to California, South America, Australia and South Africa as they multiplied plantings and enjoyed export success in a thirsty Europe. Eventually production recovered across Europe as grafting to American rootstock proved successful in nullifying the louse, but by then the world faced a glut from recovering European production, the New World and man-made wines. Collapses in prices led to civil unrest and riots in France in the early 1900s sowing the seeds for major reform. And thus, over a period of several decades the French AOC system (Appellation d’Origin Contrôlée) was born. Interesting, the AOC system was originally devised to eliminate fraudulent wine production, specifically the passing-off of French regional names with wines from some other origin. It’s actually a trademarking exercise that protects the name of wine from a place, not the quality of the product. Many things we take for granted today were born in this turbulently fraudulent period. Fine wine once shipped in bulk is now almost exclusively estate bottled – a practice started by Mouton-Rothschild in 1924. Chateauneuf du Pape became the first AOC in 1933, nominating 13 different varieties as the only ones permitted. And yet Grenache, Syrah and Mourvèdre (those of dark colour and rich body) were planted in almost total exclusion to the rest because the Burgundian négociants would buy the production and ship it north for blending. We accept today that Burgundy can be finer than Bordeaux, but back in the 50s and 60s Burgundy was known to be much richer than Claret. The laying down of strict regulations controlling production in France have propagated into Spain, Italy and the rest of Europe. With names like Champagne, Barolo and Pomerol now synonymous with luxury, high quality and high prices it’s impossible to deny the success of the AOC system as one of the greatest marketing exercises in history. Controlled production has encouraged exclusivity which in turn has generated winery profits, much of which has been re-invested improving vineyard quality, winemaking sophistication and international marketing. It’s hard to argue that nearly one hundred years on we are living through the Golden Age of wine. Or to paraphrase Gordon Gecko, ‘Fraud is good’. More recently, producers themselves have taken further steps to combat fraud by much more sophisticated players. This includes incorporating technology into their products with things like proof-tags, hidden DNA in the label, ultra-violet printing and many others that remain secret to the producers only. Simpler steps such as serial numbers, bottle numbers and strong database management can help wineries trace every bottle through to the end user. Blockchain technology also offers plenty of potential to securely trace the entire history of a bottle, recording where and how it has been stored and under what conditions. There are also other non-invasive techniques that verify the contents and their age through the measurement of chemical isotopes. Wine fingerprinting is surely an anti-fraud technique for the 21stcentury. Investors and collectors need to be aware of fraud, not afraid of it. The well-educated and well-tooled are also the well-armed in combating fraud in wine which can bring trust and credibility to the market, freeing participants to invest and trade on solid ground.Volkswagen scraps full year outlook

Volkswagen AG (ETR:VOW3) said on Thursday that the outbreak of COVID-19 has had a “significant” impact on its business.

Shares in the German company were up during trading on Thursday.

Based on preliminary figures, Volkswagen now expects first quarter sales revenue to amount to roughly €55 billion.

Meanwhile, operating profit is expected to plunge to €0.9 billion, an 81% decline compared to the figure recorded for the first quarter of 2019.

The company scrapped its full year outlook for 2020 and is unable to determine when predictions for the full year can be made.

Many sectors have faced financial challenges as a result of the virus and the measures to contain it.

Stricter lockdown measures were introduced in the UK at the end of March in order to help contain the spread of the illness, closing all non-essential shops.

“The automobile retail network has largely came to a standstill,” Volkswagen said in a statement.

“The Volkswagen Group has already implemented extensive counter measures to reduce costs. Securing liquidity has the highest priority and optimising working capital and prioritising investments are key focus areas,” the company continued.

“The Volkwagen Group is planning the phased restart of production with enhanced safety standards for the workforce. As can be seen from the positive developments in China, economic recovery during the course of the year appears possible,” the company added.

Looking ahead, the company warned that the effects of the illness on consumer demand, the supply chain and production cannot be “accurately forecasted” right now.

Indeed, there is much uncertainty surrounding the pandemic, including its duration.

Shares in Volkswagen AG (ETR:VOW3) were up on Thursday, trading at +1.10% as of 15:33 CEST.

COVID-19: retail sales plunge as high streets remain empty

Retail sales in the UK took a hit in March as measures to contain the spread of COVID-19 were introduced by the British government.

UK Head of Retail at KPMG, Paul Martin, said that the illness has changed the consumer landscape “significantly”.

Data from the British Retail Consortium revealed that, on a total basis, sales decreased by 4.3% in March, compared to a decrease of 1.8% in March 2019.

In the last two weeks of the period, sales crashed by 27%.

The British government introduced stricter lockdown rules at the end of March in order to help stop the illness from spreading.

People have been encouraged to stay at home and practice social distancing, with all non-essential shops being made to close.

“Lockdown has prompted a fundamental rethink of what is deemed essential,” Paul Martin continued.

“The UK’s closure of non-essential stores only started at the backend of the month, so it’s likely worse data is yet to emerge,” Paul Martin said.

Many have been hit financially by the economic implications of the illness.

Paul Martin added that staying at home has seen a rise in sales of food and drink, computing equipment, children’s toys and health-related goods.

“Yet our high streets are completely void of footfall, and non-food categories like fashion have been forced into hibernation,” Paul Martin said.

The Chief Executive of the British Retail Consortium, Helen Dickinson OBE, described the March data as “the worst decline in retail sales on record”.

Helen Dickinson OBE said: “The crisis continues; the retail industry is at the epicentre and the tremors will be felt for a long while yet. Many physical non-food retailers have been forced to shut down entirely or to limit themselves to online only to protect customers and staff. Consequently, hundreds of thousands of jobs at are risk within these companies and their supply chains.”

“At the same time, supermarkets brace themselves for lower sales, while still spending huge sums on protective measures, donating to food banks and hiring tens of thousands of temporary staff. We welcome the Government’s actions to date, yet millions of livelihoods rely on their continued support.”

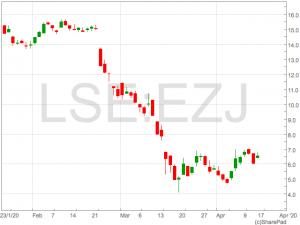

easyJet share price gains in broad travel sector rally

The easyJet share price (LON:EZJ) rose over 9% in early trade on Thursday in a broad travel sector rally that also saw Carnival and IAG up over 6% and 4% respectively.

The jump in easyJet shares came as the airline released their trading update for the six months ending 31st March. easyJet said it saw a loss of between £185m to £205m for the winter trading period. This is a material improvement on 2019 when the company posted a loss of £275m.

The company said swift cost cutting measures in the last few weeks of the period when coronavirus began to ground flights has helped to minimise losses in the first half.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

“Our first half trading performance was very strong prior to the impact of coronavirus, which shows the strength of easyJet’s business model,” said Johan Lundgren, easyJet CEO.

Airlines typically post losses across the Autumn and Winter months and make up for it in the Summer months. However, this year’s Summer trading period is going to be severely disrupted by the coronavirus lockdown. Much of the period is likely to be blighted by grounded flights or a severely reduced schedule. To combat these measures easyJet brought forward the release of winter 2020/2021 tickets and have enjoyed a significant increases in sales as passengers plan trips for when coronavirus lockdowns may have eased. The airline also said it had deferred the delivery of 24 aircraft and raised finance to ensure to financial strength of the group through the grounding of flights. easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date. Bitcoin – Investing in the 4th Industrial Revolution

Bitcoin is one of today’s most misunderstood technologies. While Bitcoin is commonly touted as a speculative asset, its monetary token is the least exciting aspect of the technology. Far more promising is Bitcoin’s potential to serve as infrastructure for the Fourth Industrial Revolution: a data-based economy.

An Immutable and Transparent Infrastructure

Right now, the data we emit becomes the property of dubious organisations (e.g. Cambridge Analytica data scandal), and there’s no way to ensure the integrity of the data we record intentionally (e.g. Novartis data manipulation scandal).

The Bitcoin blockchain solves the issues of data ownership and data integrity, making it the ideal infrastructure for a data-based economy.

Bitcoin has the potential to transform existing business applications and infrastructure like EDI, accounting, banking, supply chain management, healthcare and many more. But, beyond these improvements lies a massive explosion of entirely novel business applications and enterprise models.

Interested to learn more? Pre-order your (free) copy of our new eBook, What is Bitcoin?

Webinar: Before Investing, Educate Yourself

The first step to identifying Bitcoin and blockchain investment opportunities should be to educate yourself thoroughly.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you. Aquis Exchange revenue jumps as trading activity increases

Aquis Exchange (LON:AQX) has reported a 73% increase in revenue for the year ended 31st December as trading activity picked up among its members.

Revenue grew by 73% to £6.9m, up from 4m in the same period a year prior.

Aquis Exchange has three main revenue channels in Subscription Fees, License Fees and Market Data.

The most significant of these channels the Subscription Fees business which relates to the trading activities of its members and accounted for £5.3m, up 71% in 2019.

The introduction of new order types including the ‘Market at Close’ or ‘MaC’ order attracted higher trading volumes on the Aquis Platform.

The ‘Market at Close’ order allows traders to take the price at the close of the a market based on a broad range of trading facilities including dark pools.

In addition to strong growth in its trading facilities business, Aquis made the exciting acquisition of the NEX Exchange, a junior London exchange which has 90 companies listed on it with a combined market capitalisation of over $2 billion.

Aquis entered the primary market with the acquisition of the NEX Exchange with the aim of turning the exchange around. The NEX Exchange made a loss of £2.1 million in the year to 31st March 2019 but has huge potential to facilitate the IPOs of companies that may not be ready for the London’s main exchanges.

Alasdair Haynes, Chief Executive Officer of Aquis, commented on the results:

“Against a challenging market backdrop, Aquis delivered substantial operational and financial progress during 2019. It is very pleasing to see our adjusted EBITDA figure reaching near break-even, as revenues continue to grow across all business divisions and the MaC leads the field among closing auction alternatives in the market.

“Last month we were delighted to complete our acquisition of NEX Exchange, now renamed the Aquis Stock Exchange, and to list our first company on to it a few weeks later. Developing this market into a future-facing, disruptive home for quality growth businesses will be a key focus for us during the year ahead.

“Notwithstanding the impact of the COVID-19 pandemic, our aim is to take the Group to the next level of operational, financial and strategic success in 2020. We look forward to continuing to build value for all our stakeholders.”

COVID-19: 66% of businesses have furloughed staff

New data revealed on Wednesday that 66% of businesses have furloughed a proportion of their staff under the British government’s coronavirus Job Retention Scheme.

As the illness continues to spread, many are struggling to overcome the financial challenges caused by the measures to contain the virus.

Indeed, stricter lockdown measures in the UK have caused many non-essential shops to close, such as restaurants, pubs and bars.

Data from the British Chambers of Commerce’s Coronavirus Business Impact Tracker shows that 31% of businesses have furloughed between 75 to 100% of their workforce.

Meanwhile, very few firms have been able to successfully access government support schemes.

Indeed, the British Chambers of Commerce said that only 2% have been able to access the Coronavirus Business Interruption Loan Scheme this week, whilst 9% of survey respondents were unsuccessful.

For those who were unsuccessful, slow or no response from lenders has been cited as the main reason.

“Businesses on the frontline need cash to start flowing from support schemes fast.With April’s payday coming up, we are fast approaching a crunch point, and both the furlough scheme and CBILS facilities need to be accelerated,” British Chambers of Commerce Director General Dr Adam Marshall said in a statement.

“While we’ve seen a high number of firms furloughing staff in anticipation of the Job Retention Scheme coming online, it is still unclear whether they will start receiving funds before their payroll date, which could exacerbate the cash crisis many businesses are facing.”

“It is essential that the Job Retention Scheme makes payments to businesses as soon as possible. Any delay could mean more livelihoods under threat, more business failures, and more hardship in our communities.”