BP share price sinks on IEA demand outlook concern

The BP share price (LON:BP) fell sharply after a warning from the IEA the recent OPEC cuts will not be enough to reduce the over supply of oil.

The International Energy Agency said they saw oil demand falling 9% in 2020 due to the spread of coronavirus.

In the market reaction, the price of WTI oil fell beneath $20 to the lowest levels for 18 years, erasing the gains made due to the OPEC production cut.

OPEC confirmed 10 million in production cuts over the over the weekend in a historic move to reduce global oil supply.

However, the IEA has just poured cold water on the bullish impact of the OPEC supply cuts on the price of oil. Investors have seen the price of oil surpass the recent lows and take oil shares such as BP down with it.

The IEA see oil demand falling 9% in 2020 before recovering. Although the OPEC will remove some supply from the market it doesn’t go far enough to mitigate the declining demand.

The danger to the oil price is the over supply is quickly filling up storage facilities – something the IEA says could happen within weeks.

COVID-19: over £1.1 billion lent to SMEs

News emerged on Wednesday that the UK banking and finance sector has lent more than £1.1 billion to small and medium-sized businesses in order to help them survive during the COVID-19 crisis.

Support has been provided through the Coronavirus Business Interruption Loan Scheme (CBILS).

UK Finance said that total lending has increased by 150% to £700 million in the last week.

As the virus continues to spread, many have been financially hit by the economic implications of the illness.

UK Finance said on Wednesday that lenders have received 28,460 applications to the scheme from businesses. More than 6,000 of these have been approved so far and more are expected to be processed and approved over the next few days.

Total lending under the scheme has jumped from £453 million on 6 April to £1.115 billion just a week later, and the average value of a loan has increased to more than £185,000.

“The banking and finance sector recognises the challenging conditions faced by many businesses and the critical role we must play in helping the country get through this crisis,” Stephen Jones, Chief Executive of UK Finance, said in a statement.

“Frontline staff in local branches and call centres are working incredibly hard to help firms access finance as quickly as possible amid unprecedented demand. Like all businesses they are working at reduced capacity as many staff are self-isolating or looking after family,” the Chief Executive continued.

Meanwhile, the Chancellor of the Exchequer, Rishi Sunak, said: “Getting finance to businesses is a key part of our plan to support jobs and the economy during this crisis – and we’re working with lenders to ensure support reaches those in need as soon as physically possible.”

“Loan approvals have doubled in a week with more than 6,000 businesses benefiting from over £1.1 billion of loans – and it’s vital we continue this upward trajectory,” Rishi Sunak added.

FTSE 100 falls as attention shifts to earnings and warnings of sharp recession

The FTSE 100 fell on Wednesday as investors shifted their attention to upcoming earnings season and the damage coronavirus may have had on corporate earnings.

In addition, investors digested warnings from the IMF that the global economy was heading towards the worst recession since the Great Depression.

The IMF have predicted the global economy will shrink by 3% in 2020, with Europe particularly heavily hit contracting by 7.5%.

The projections did, however, limit the economic downturn to 2020 before sharp rebounds next year.

The UK’s economy is expected to shrink by 6.5% in 2020 before rebounding 4% in 2021.

Coming into the coronavirus crisis many investors and analysts had predicted a V-shaped recovery. This would have involved a sharp increase in activity as the economic opened up as quickly as it shutdown. This now looks very unlikely with Germany announcing measures would remain in place until early May. The UK is set to make an announcement on Thursday which is widely expected to detail an extension of current social distancing practises. Even Donald Trump, who previously said the economy would be back to normal by Easter, has conceded the reopening of the economy will be protracted with the release of a draft ‘phased reopening plan’.The #IMF says the “Great Lockdown” recession will likely be the worst since the Great Depression. Global economy projected to shrink by 3% in 2020. By contrast, in January, the IMF had forecast a global GDP expansion of 3.3% for this year. Details in chart below. Table: @IMFNews pic.twitter.com/Kg6oXUvJ4c

— 🚶🏻Curtis S. Chin (@CurtisSChin) April 14, 2020

Corporate earnings

The market received the first instalment of earning from US companies in JP Morgan and Wells Fargo who didn’t release spectacularly bad earnings figures but did miss estimates and caused concern with preparations for an economic downturn. JP Morgan CEO, Jamie Dimon said “in the first quarter, the underlying results of the company were extremely good, however given the likelihood of a fairly severe recession, it was necessary to build credit reserves of $6.8B, resulting in total credit costs of $8.3B for the quarter.” Bank of America reported on Wednesday and also bumped up provisions for bad debts in preparation of consumer defaults.Burger King “vegan” adverts banned

Burger King adverts promoting the fast food chain’s vegan burger were banned on Wednesday for misleading consumers.

Adverts for the Rebel Whopper were seen in January as part of the Veganuary campaign, which encourages consumers to follow a vegan diet for a month.

These advertisements described the product as a “plant-based burger” and “100% Whopper No Beef”.

However, the Advertising Standards Authority said on Tuesday that these adverts were “misleading”.

Though the patty itself was plant-based, it was cooked on the same grill as meat products.

Burger King’s complete burger also contained egg-based mayonnaise, which means the burger as-sold was not actually suitable for vegans.

Adverts included the “Vegetarian Butcher” logo and a green colour palette.

Burger King’s adverts were also timed to coincide with the Veganuary campaign, which further contributed to the impression that the product was suitable for vegans and vegetarians.

“Because the overall impression of the ads was that the burger was suitable for vegans and vegetarians when in fact it was not, we concluded that the ads were misleading,” the Advertising Standards Authority said in a statement on Wednesday.

Veganuary is a particularly popular campaign which occurs at the beginning of the year. Many decide to try following a vegan diet for reasons linked to health and environmentalism.

A growing number of restaurants in the UK have begun to cater for vegans as there is profit to be made, especially in the month of January.

Greggs (LON:GRG) offers vegan versions of its classic sausage roll and steak bake.

Cadence Minerals’ shares spike as “once in a lifetime” iron ore project receives approval

Since evolving from Rare Earth Minerals in early 2017, AIM listed Cadence

Minerals (LON:KDNC) has offered investors a proposition largely based on investments into selected lithium and base metal projects around the globe.

Taking cornerstone stakes in projects such as the Cinovec Lithium and Tin

Project in the Czech republic and Macarthur Minerals’ Lake Giles Iron Project in

Western Australia has provided Cadence with opportunities to invest into

acquiring assets directly.

The Company initially acquired lithium assets in Argentina and Australia, but when the iron ore supply squeeze in late 2018 threw up an opportunity to acquire the Amapá iron ore project in Brazil, Cadence management and its core investors jumped in with both feet.

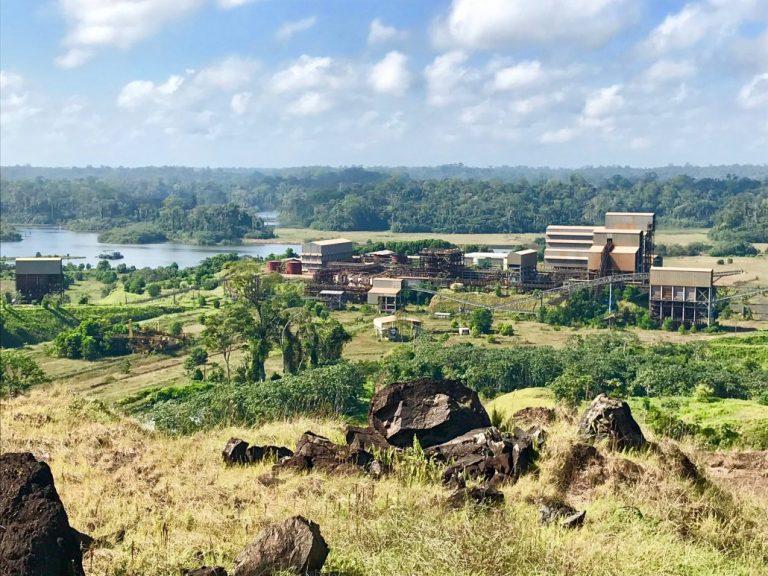

Formerly owned by Anglo American (AAL) and Cliffs Natural Resources, the Amapá iron ore project is a large-scale iron open pit ore mine with associated rail, port and beneficiation facilities. Based in Northern Brazil close to the Atlantic, Amapá commenced operations in December 2007, and prior to its sale in 2012 due to a collapse in iron ore prices, Anglo American valued its 70% stake at $462m. Back then the mine was selling ore globally to Europe, USA and China.

With approx 1.4 million tonnes of iron ore stockpile sitting ready for shipment at

the port, Cadence CEO Kiran Morzaria set up a joint venture company Pedra Branca Alliance Pte Ltd (PBA) with Singapore based commodities group IndoSino Pte Ltd to acquire DEV, the Amapá holding company.

A judicial restructuring plan submitted by PBA was approved, which saw Cadence, through PBA, acquire a 27% stake in the Amapá iron ore project for just $6m. And following extensive work with the judicial trustee and creditors committee, a landmark ruling was today delivered by the Commercial Court of São Paulo, approving the shipment of the iron ore stockpiles. The net proceeds of the iron ore sales will be used to pay labour and small creditors, and to bring the Amapá iron ore project back into production.

“Opportunities such as this come along once or twice in a lifetime,” says Morzaria.

“To start a project on the scale of Amapá would require little short of $1bn capex.

We (Cadence) will own 27% of a project, which when recommissioned should

generate over $136m EBITDA per annum for at least 14 years, plus we will have

the right and first refusal to acquire up to 49%.”

Rehabilitation of the mine, railway and port is expected to be completed by 2021,

with first new production in 2022. A production ramp up will see 5.3 million

tonnes of iron ore produced per annum by 2024.

More significantly, mine net revenues after shipping is forecast to be

approximately $265m per annum, with EBITDA of approx $136m per annum

based on a conservative iron ore price of $61 per tonne. Currently iron ore prices

are around $84 per tonne.

Of course there is another benefit in rehabilitating the Amapá mine. The local

economy will be rejuvenated, creating hundreds of jobs and employment opportunities, along with new funding for local schools and hospitals.

“Previously Amapá’s output amounted to a sizeable chunk of the local economy,”

adds Morzaria.

“Bringing the mine back to life will provide a huge boost to the region.”

AIM listed Cadence currently trades on an asset backed market cap of just £7m. Given this, the opportunity and the numbers are hugely impressive and will be completely transformational once the mine is close to re-opening.

To echo Morzaria’s words, for a micro cap mining company, Amapá surely is a once in a lifetime opportunity.

More than 1.2 million mortgage payment holidays offered amid COVID-19

New data revealed on Tuesday that lenders have offered over 1.2 million mortgage payment holidays in order to help support those struggling financially amid the COVID-19 crisis.

In the UK, one in nine mortgages are now subject to a payment holiday, according to UK Finance.

For the average mortgage holder, the payment holiday amounts to £260 per month of suspended interest payments, UK Finance said in a statement.

It was announced just under a month ago that mortgage lenders would provide support to those hit by the financial implications of the illness outbreak.

In the two weeks between 25 March and 8 April, the amount of mortgage payment holidays in place has more than tripled.

“Mortgage lenders have been working tirelessly to help homeowners get through this challenging period,” Stephen Jones, UK Finance CEO, commented.

“The industry has pulled out all the stops in recent weeks to give an unprecedented number of customers a payment holiday, and we stand ready to help more over the coming months,” the CEO added.

Stephen Jones continued: “We understand that the current crisis is having a significant impact on household finances for people across the country. Lenders have a number of options available to help, and payment holidays aren’t always the right solution for everyone. We would therefore encourage any mortgage customers concerned about their financial situation to check with their lender so they can find out more information on the support available and how to apply.”

Additionally, Robin Fieth, Building Societies Association CEO, also commented: “We know that this is a difficult time for many homeowners with a mortgage and building society staff have been working hard to offer individuals the right solution. For almost quarter of a million so far, that has been a three month payment holiday offering a much needed breathing space to families whose household income is under severe pressure during the current crisis.”

Heathrow passenger numbers fall

Heathrow saw its passenger numbers decline in March as the UK entered lockdown in order to help contain the spread of COVID-19.

Passenger numbers at the London airport dropped by 52% last month, when compared to the same period a year earlier.

Many nations have been placed under lockdown to help fight the spread of the illness, restricting travel and movement.

Stricter lockdown measures were introduced in the UK at the end of March to limit non-essential travel.

As there is little certainty over how long the crisis will last, Heathrow expects passenger demand in April to drop by more than 90%.

“Heathrow moved to single runway operations on April 6th, and over the coming weeks will consolidate operations into Terminals 2 and 5 only. The move will protect long-term jobs at the airport by reducing operating costs, helping Heathrow to remain financially resilient,” the airport said in a statement.

Heathrow is using any available capacity to prioritise cargo flights with the transportation of medical supplies.

“The airport is well-placed to receive time-critical and temperature-sensitive medical supplies, such as ventilators, medicines and COVID-19 testing kits,” it continued.

The airport donated 6,000 face masks last week to the NHS teams working at Thames Valley Air Ambulance and Hillingdon Hospital.

CEO John Holland-Kaye commented: “Heathrow continues to serve the nation by keeping vital supply lines open, and helping people get home.”

“Now is the time to agree a common international standard for healthcare screening in airports so that when this crisis recedes, people can travel with confidence and we can get the British economy moving again,” the CEO continued.

The aviation industry has been hit particularly hard by the virus as travel restrictions have been put in place in order to contain the outbreak of the illness.

Flybe (LON:FLYB) collapsed at the beginning of March, with the immediate crash of the airline blamed on COVID-19 related impacts.

Next reopens online business

Next (LON:NXT) announced on Tuesday that it has reopen its online business after putting measures in place to protect employees from COVID-19.

Shares in the British retailer were up during trading on Tuesday.

Next had temporarily closed its online business at the end of March, alongside its warehousing and distribution operations.

Next said on Tuesday that it has since put in place “very extensive additional safety measures”.

It will reopen its online businesses in a “very limited way,” Next announced.

The British retailer has prioritised which categories it will offer; only those most needed such as children’s clothing and selected small home items will be available.

“Other product ranges may be added at a later date,” Next said.

The decision was made after having consulted with colleagues and the company’s recognised union USDAW.

“Operations will start with support from colleagues who are willing and able to safely return to work,” the company commented.

“The idea is to begin selling in low volumes, so that we only need a small number of colleagues in each warehouse at any one time, helping to ensure rigorous social distancing is complied with.”

The British retailer continued: “To achieve these limited volumes, Next will only allow customers to order the number of items that it believes can be picked safely on any given day. At that point we will then stop taking orders and convert the website to ‘browse only’ until the following morning.”

Many nations have been put on lockdown in an attempt to contain the spread of the illness.

In the UK, the government announced strict social distancing rules in March in order to help the fight against the virus.

Shares in Next plc (LON:NXT) were up on Tuesday, trading at +0.15% as of 11:50 BST.

AstraZeneca share price jumps as COVID-19 drug testing begins and lung cancer trial yields positive results

Shares in UK-based AstraZeneca (LON:AZN) jumped on Tuesday morning after the drug company said it was to begin testing a treatment for COVID-19.

In further promising news, AstraZeneca said it progressed a lung cancer drug trial early due to high efficacy of the drug Tagrisso.

The AstraZeneca share price was up over 6% higher in early trade on Tuesday morning.

COVID-19 treatment

The Cambridge-based pharmaceutical giant said it was to begin clinical trials on Calquence to access effectiveness in treating patients with COVID-19. The drug is already approved for the treatment of chronic lymphocytic leukaemia which has helped AstraZeneca push forward with trials for COVID-19 patients in record time. It is thought Calquence will reduce the inflammation of the lungs caused by the body’s immune system response as it fights the COVID-19 infection. José Baselga, Executive Vice President, Oncology R&D at AstraZeneca said “with this trial we are responding to the novel insights of the scientific community and hope to demonstrate that adding Calquence to best supportive care reduces the need to place patients on ventilators and improves their chances of survival. This is the fastest launch of any clinical trial in the history of AstraZeneca.”Lung cancer trials

In addition to the commencement of COVID-19 trials, AstraZeneca announced encouraging results from a clinical trial of lung caner drug Tagrisso. The Phase 3 trial will be taken to the next stage of unblinded trials early due to strong levels of efficacy in a trial of Tagrisso in 682 patients. Patients in the study were given 80mg oral doses of Tagrisso once daily and the success of the trial means AstraZeneca can accelerate the trial by as much as two years. If successful, Tagrisso has the potential to become a multi-billion pound drug for AstraZeneca and will answer many questions about the strength of Astra’s drug pipeline. The AstraZeneca share price was up 5.2% to 7,502p on Tuesday morning following the results having faded from sessions highs.Gilead COVID-19 treatment improves two thirds of patients in study

Gilead’s drug Remdesivir has been found to produce positive effects in two thirds of patients involved in a compassionate study into the treatment of COVID-19.

Since the first reports of coronavirus spreading through China, pharmaceutical companies have been conducting trails for possible treatments and vaccines.

With the slim likelihood of a vaccine being found and tested to the degree it can be used on entire populations this year, drugs to treat infected patient are the next best option to fight COVID-19.

There are hundreds of tests ongoing currently ongoing globally, however over the weekend we have learnt of promising results from one of the first companies to beginning testing in China.

Gilead Sciences (NASDAQ:GILD) is a US-listed company that began its involvement with Coronavirus with a free shipment of the drug Remdesivir to China in January.

Remdesivir was initially developed by Gilead to treat Ebola and has been tested on other types of viral disease.

There were early reports of mildly positive results in patients with COVID-19 that received Remdesivir and further studies were commissioned, one of which we have just received results from.

Early results of this trial were reported over the easter weekend and highlighted a positive response in a two thirds of 53 patients involved in the trial.

The trial involved patients who were seriously ill with 30 of the patients on oxygen ventilators. 17 of these 30 came off ventilation after 10 days of Remdesivir treatment.

However, the results should be treated with caution due to the small sample size of the study that was conducted on a compassionate basis.

Remdesivir will now undergo further extensive clinical trials to test for efficacy and safety.

“Currently there is no proven treatment for COVID-19. We cannot draw definitive conclusions from these data, but the observations from this group of hospitalized patients who received remdesivir are hopeful,” said Jonathan D. Grein, MD, Director of Hospital Epidemiology, Cedars-Sinai Medical Centre.

“We look forward to the results of controlled clinical trials to potentially validate these findings.”

Gilead is among hundred of companies conducting trials of COVID-19 treatments, none of which have yet yielded a fully licensed and approved drug.