Investing in UK Build-to-Rent with FTSE 250 Grainger

The UK Investor Magazine was thrilled to be welcomed by Robert Hudson, Chief Financial Officer of Grainger PLC, to explore recent developments at the FTSE 250 build-to-rent specialist.

We start by looking at the group’s transition from a trading company to a REIT and the tax benefits for investors. Taking a broad view of Grainger’s proposition to investors, Rob notes the ability of retail investors to gain exposure to the UK rental market through an ISA by buying Grainger shares.

Grainger’s total rental income is up 15% in the early stage of their financial year. We look at the factors driving growth and the momentum the company is building in the build-to-rent sector.

We explore Grainger’s 5,000 property pipeline and the expected uplift in earnings.

Rob outlines the technological capabilities of the business and how the company’s CONNECT platform is designed to facilitate future growth and improved margins.

We discuss Grainger’s dividend track record and how the dividend will evolve as Grainger transitions to a REIT.

Rob finishes by detailing what excites him the most about the year ahead.

FTSE 100 surges on US-UK trade deal hopes

The FTSE 100 jumped again on Tuesday on optimism that the UK would be in the running to strike a favourable trade deal with the United States.

London’s leading index was 0.9% higher at 8,210 at the time of writing and is now over 2% higher on the year compared to a 8% decline for the S&P 500. The German DAX is 6% higher for the year.

Investors tiptoed back into the market after a relatively benign Monday for global equities. There were no major fresh developments in the global trade war yesterday, and traders were happy to mull over electronics exemptions announced over the weekend.

However, analysts cautioned that the lull should be treated with caution, with the next development in the trade likely to be just around the corner.

“The eye of a hurricane is said to be unnaturally still, characterised by calmer conditions, and bright skies. The eye is also the most dangerous part of a storm, often lulling people into a false sense of security, only to then be caught off guard by violent winds, and tempestuous conditions, once the eye passes,” said Michael Brown, Senior Research Strategist at Pepperstone.

“Don’t worry, this isn’t a weather report, though I feel the analogy is a rather apt summation of where markets stood as the new, holiday-shortened, trading week got underway. News on the tariff front was eerily lacking, despite an hour or so of idle waffling from President Trump in the Oval Office.”

Despite ongoing uncertainty resulting from Trump’s tariffs, UK investors were happy to focus on UK-centric news flow and stepped back in to pick up FTSE 100 bargains on Tuesday.

“The FTSE 100 made a strong start to proceedings on Tuesday after comments from US Vice President JD Vance that there’s a ‘good chance’ of a UK-US trade deal,” said AJ Bell investment director Russ Mould.

“Suggestions there might also be a softening of tariffs on the motoring sector also helped lift the mood – with names which have sold off most heavily on US trade policy like Rolls-Royce bouncing back. Housebuilders were in demand as slowing UK wage growth raised hopes for a cut to interest rates, which would in turn boost the affordability of mortgages.”

Taylor Wimpey and Barratt Redrow were both over 2% higher at the time of writing.

3i Group was the top riser after analysts at Citigroup bumped up its price target to 4,850p from 4,670p. 3i shares were 4% higher at 4,060p at the time of writing.

Silver miner Fresnillo was among the gainers as investors bought into the stock ahead of the ex-dividend date for an ordinary dividend of 26.1c per share and a one-off special dividend of 41.8c per share. The combined dividend would yield investors around 6%.

At the time of writing, 95 of the FTSE 100’s constituents were gaining, with just 5 in the red.

MHA raises £98m in successful AIM IPO

Accountancy firm MHA has raised £98m in a successful AIM IPO, providing a much-needed boost to London’s junior market.

The company raised £98m at 100p, valuing the company at around £271m on listing. MHA shares were steady at 101p at the time of writing.

MHA, the 13th largest accountancy firm in the UK, has established itself as the joint fastest-growing among the top 20 firms in 2023.

The group has set an ambitious medium-term goal to break into the top 10 UK accounting and professional services businesses, with targeted annual revenues exceeding £500 million.

The firm has demonstrated a strong track record of acquisitions, most notably completing its largest deal to date in April 2024 with Moore and Smalley, which contributed £30.4 million in revenue and approximately 400 new employees.

MHA is targeting a fragmented UK accountancy market and eyes further strategic acquisitions as a listed company.

Over the past decade, MHA has recorded a compound annual revenue growth rate of 13.7%, while maintaining 87% recurring revenue in FY24, helped by an increasingly complex regulatory environment.

“Against a backdrop of rising demand for high-quality advisory services and increasing regulatory complexity, we believe we are well placed to build on the strong momentum we have established in recent years,” said Geoff Barnes, Chair of MHA

“Admission gives us the ideal platform to strengthen our market position and broaden our capabilities, enabling us to scale at pace and drive further innovation while continuing to deliver the high standards our clients expect. Importantly, it also allows us to offer equity participation to future partners and leaders, ensuring they share directly in the firm’s ongoing success.”

As the UK and Ireland representative of the Baker Tilly International Network, MHA benefits from connections to independent firms across 143 territories generating approximately $5.62bn in annual revenue, whilst maintaining its own brand identity in the UK market.

Greatland Gold looks forward to ‘significant cash flow’ from Telfer and self-funding Havieron expansion

Greatland Gold has provided investors with a clear path to ‘significant cash flow’ from its Telfer gold mine and confirmed plans to expand its flagship Havieron assets with cash generated from production, which is set to commence in 2028.

The company released an in-depth outlook for production and expansion plans for both Telfer and Havieron on Tuesday.

Greatland Gold unveiled its initial ore reserve at the Telfer gold-copper mine, delivering 712K ounces of gold and 23K tonnes of copper, alongside a two-year production outlook that extends operations through to FY27.

Recently acquired Telfer has had a strong start to production, and the company sees ‘continued high volume gold production from Telfer into a strong gold price environment is expected to generate significant cash flow.’

The updated Telfer outlook, announced less than five months after Greatland’s acquisition of the mine, extends the pre-acquisition plan by a further 18 months.

According to the company’s projections, dual train production will continue with an annual average output of 280,000 to 320,000 ounces of gold and 7,000 to 11,000 tonnes of copper.

For 2026, production is expected to reach up to 340,000 ounces of gold at an all-in sustaining cost (AISC) of A$2,400 to A$2,600 per ounce, while FY27 is projected to yield 260,000 to 300,000 ounces at an AISC of A$2,750 to A$2,950 per ounce. Telfer is now a serious gold extraction operation.

“Greatland has made a tremendous start to our ownership of Telfer, producing over 90,000 ounces of gold and generating over A$250 million in free cash flow in the March 2025 quarter,” said Greatland Managing Director, Shaun Day.

Investors will be encouraged that the company is locking in higher gold prices by securing downside protection through gold put options for a significant portion of its anticipated production over the next couple of years, with a weighted average strike price of A$4,071 per ounce across 266,008 ounces of gold.

Greatland also provided an upbeat assessment of the outlook for its flagship Havieron asset. The company highlighted that the Feasibility Study will target an expanded mining rate of 4.0 to 4.5 million tonnes per annum, representing an increase of 43% to 60% from the initial 2.8 million tonnes per annum.

The first gold production from Havieron is expected to be in 2028.

Havieron has ore reserve grades of 3.0g/t gold and 0.44% copper across 25 million tonnes, with indicated resource grades of 2.6g/t gold and 0.33% copper across 50 million tonnes.

Greatland Gold anticipates that the integration of high-grade Havieron ore will dramatically reduce the overall cost of production while sustaining higher volume production.

“Augmenting production with high grade Havieron ore feed, expected to begin during FY28, is expected to result in a step change reduction in AISC and sustained higher volume annual production. Havieron is a world-class ore body with exceptional ounces per vertical metre, resulting in excellent cost efficiency,” Shaun Day said.

Future expansion of Havieron is expected to be largely self-funded from future Havieron cash flows, with the Feasibility Study targeted for completion in the second half of 2025.

Greatland Gold shares were 2% higher at the time of writing and are 120% higher on the year.

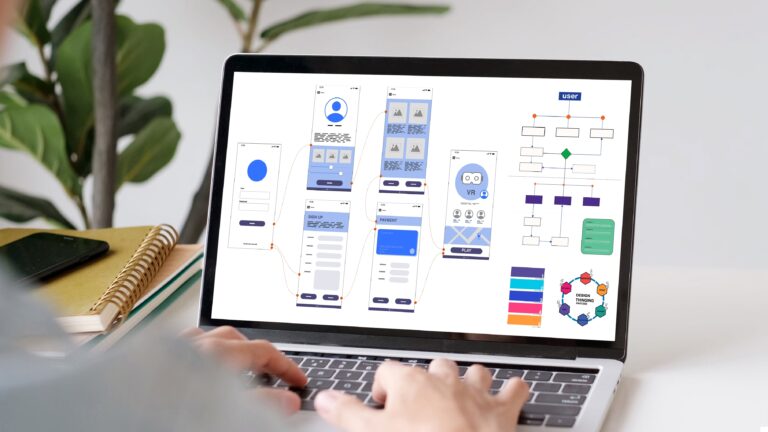

How UK Application Development Companies Innovate

In the world of technology, at every step and turn, innovation is not merely a catchphrase but more of a survival tool. The different application development companies across the UK also set trends for the rest of the world, revolutionizing industries and rewriting new rules of business-consumer interaction in the digital age. Innovation, however, does not happen in a void. It strikes when talent gels well with daring experimentation and an everlasting feel of the changing market imperatives.

These companies don’t just write code or design sleek interfaces; they craft ecosystems. Their work crosses industries, mending gaps between companies and consumers, turning ideas into working tools that change everything from convenience to productivity to entertainment. So, how exactly is it done? Let’s peel back the layers and take a closer look at what drives this relentless pursuit of progress.

What Sets an Application Development Company Apart?

When people think about a company for app development, the image of teams hunched over keyboards, bringing apps to life, might come to mind. While this captures part of the story, it barely scratches the surface. These UK companies are more than just coding factories—they are vibrant hubs where creativity and technical expertise converge, blending the precision of engineering with the flair of artistry.

In the UK, the best firms know how to work together. Their teams are composed of developers, designers, strategists, and project managers, each with their own unique insights. It’s not a linear process where tasks move neatly from one person to the next; instead, it’s a dynamic interplay of ideas. From brainstorming solutions to real-world problems to perfecting prototypes through countless iterations, every step reflects a shared commitment to excellence.

The distinguishing factor behind such companies is the fact that they can stay ahead of the curve. App development happens at a fast pace, and what was considered revolutionary today becomes totally irrelevant the next day. In this continuous investment in research and development, these firms not only move with the tide but create it. Be it integrating artificial intelligence into their applications or leveraging blockchain for better security, their futuristic approach makes them always ahead of the edge.

And then, of course, there’s this relentless focus on user experience. These companies never stop at functionality but go really deep into how people use their applications, testing and iterating designs until they get the perfect balance of practicality and elegance. They don’t want to make a tool; they want to make an experience touching a chord on a human level.

Pushing Boundaries in Application Development

The UK is not an accident as the hotbed of innovation; this is the result of a technology ecosystem that drives creativity and pays off for audacious ideas. It was this environment that allowed application development firms to thrive and strive beyond their wildest dreams-to transform industries and create new ones.

Probably one of the most dramatic changes in recent years has been the low-and no-code platforms. While this democratization enables non-developers to build apps, it challenges the traditional developer to up their game. The UK companies have embraced this challenge: reaping the efficiency dividends of low-code solutions while applying more energies to solve complex problems that call for bespoke development.

Another area in which these companies really excel is in integration: the applications of today do not exist within a vacuum but part of an integral ecosystem that comprises all manner of things, from IoT devices and cloud services. UK developers make sure the applications they have developed will meld seamlessly with other technologies in such a fashion that users will move across different platforms very easily.

Their approach to data is something else that is worth mentioning. In a time when privacy concerns are at an all-time high, UK application development companies make sure their way to data is pretty transparent and secure. By following stringency like GDPR and other regulations, they make their apps not only law-compliant but also trustworthy for end-users. Simultaneously, they use big data to offer personalized experiences, proving that security and innovation can coexist.

The Evolution of Mobile Application Development

One cannot even think of innovation in the UK’s tech landscape without talking about mobile application development. Mobile applications are no longer a luxury but a necessity. From banking to shopping, education to entertainment, the use of mobile phones shapes our way of living, working, and having fun.

The only thing that keeps UK companies one step ahead in this field is the way they manage to mix creativity and functionality together. Mobile apps today need to be fast, responsive, and user-friendly, but at the same time distinctive enough in this over-saturated market. UK developers achieve it with three guiding lights: personalization, performance, and adaptability.

Personalization is everything. Those applications that may adjust according to diverse tastes, preferences, and requirements of behavior tend to flourish more. High analytics and ML algorithms are those which are mainstays leaned on by developers for building a nearly personal experience. Be it video-on-demand services curating playlists according to the viewer’s history or some fitness application automatically calibrating the workout regime based on a person’s physical activity in reality, personalization sits at the center of most popular mobile applications.

Meanwhile, performance is not open to discussion. People want apps to load instantly, work perfectly, and never crash, which pushed companies in the UK to adopt state-of-the-art technologies such as progressive web apps and accelerated mobile pages that offer great performance.

Last but not least, there is flexibility. The mobile landscape is pretty broad, and it involves a lot of different devices, screen sizes, and operating systems. Developers in the UK make sure that the applications they are working on will be able to function seamlessly in this environment without any lag, so that no user gets left behind.

Conclusion

Equally exciting as it is challenging, the world of app development holds some pretty interesting sights that UK-based companies are churning out-a path the entire world needs to take seriously. From intuitively developing a user experience to the integration of technologies never experienced before, they’re showing just what is possible in the digital realm.

What makes them really great is not just their technical capabilities but the vision. They don’t just develop applications; they build bridges between ideas and realization, problems and solutions, businesses and their audiences.

In an environment that is in continuous evolution, one has no other choice but to move along with it. The most successful companies realize this and accept change as an opportunity, not a threat. Their work not only reflects the present but also shapes the future, ushering in advancements that are yet unimaginable.

But one thing is for certain moving forward: the UK is going to remain a beacon of innovation regarding application development. For businesses looking to make their presence felt in the digital space, finding a partner based in the UK could prove to be the smartest move they ever make.

B&M shares gain on positive guidance revision following strength in France

B&M European Value Retail, the UK’s leading discount goods value retailer, has announced respectable results for the 52-week period ending 29 March 2025, with revenues rising to £5.6 billion.

The company is an obvious choice for investors when the economic going gets tough due to their focus on the more thrifty consumer. Today’s results validate his thesis.

B&M said that adjusted EBITDA is expected to exceed the midpoint of its previously stated guidance range of £605m-£625m, helping to send shares over 7% higher in very early trade on Tuesday.

Over the year, group revenues increased by 3.7%, driven primarily by new store openings and positive LFL sales in France, which helped offset negative LFL performance in both B&M UK and Heron Foods.

B&M UK recorded a 3.8% year-on-year revenue increase to £4,483m, although this was accompanied by a negative LFL of 3.1% for the full year.

The fourth quarter may cause some mild concern with UK LFL at -1.8% for the 12-week period to 22 March 2025, and -2.4% for the full 13-week quarter. It appears even the budget shopper is tightening their spending habits. B&M will also not be immune to increased competition from other discounters Lidl and Aldi.

French operations were much stronger with a 7.8% revenue increase and positive LFL growth of 2.6% for the full year. B&M France saw revenue growth of 9.1% for the quarter.

B&M UK volumes were encouraging. General merchandise sales values and unit volumes increased in Q4, both on a like-for-like and total basis. Growth was particularly strong across Garden, Toys, Paint and Stationery categories, which underpinned the overall performance.

However, Fast-Moving Consumer Goods (FMCG) delivered negative LFL results, despite achieving positive total sales value and volume growth. The company stated that “actions are underway to improve FMCG LFL performance,” suggesting targeted strategies to bolster the category.

In line with previous guidance, B&M opened 45 gross new UK stores during the year, which the company reports are “performing in line with our expectations and are generating strong returns.” The Group maintains a robust pipeline for the coming year, with plans for another 45 gross new store openings.

Despite like-for-like softness, new store openings are driving growth, and B&M investors are evidently pleased with the company addressing poor performance in the UK.

B&M European Value Retail shares rose on Tuesday, but are still worth around half of their 2023 peak.