John Lewis sales rise 11% on Christmas Eve

The John Lewis Partnership has reported a rise in sales on Christmas eve – an 11% growth in sales compared to the year previous.

Sales at the partnership, which includes both John Lewis and Waitrose stores, saw sales rise not only on Chrismas Eve but also on Boxing day.

Barry Matheson, who is the group’s head of shop trade for Scotland and the north of England, said the stores had “very strong sales on Christmas Eve and a confident start to clearance sales both online and in shops”.

Beauty and leisure products at the department store rose by 25%, whilst a rise in technology products pushed sales up 3.1%. Fashion sales surged by 11%.

Waitrose provided a particular boost to sales, with a 19.2% rise on the same week a year ago.

“As always at this time of year, our sales figures are heavily distorted by the fall of Christmas and New Year. Both these weekly performances were in line with expectations,” said a spokesperson for the group.

Nicholas Carroll, who is a senior retail analyst at research group Mintel, said: “There has obviously been a big distortion by the way the last week has included Christmas Eve, and we will get a better picture in few days time when we get sales for the whole of the six week Christmas trading period.”

“Even so at a time when retailing is meant to be on its knees, the John Lewis figures that we can see look fairly good and they imply an increase in sales of about 4% over the two week period.”

Retailers including Marks & Spencer (LON: MKS), Debenhams (LON: DEB) and Tesco (LON: TSCO) will update investors next week.

Next will release an update on Thursday.

Sales at in the run-up to Christmas varied amongst retailers. Online fashion retailer Asos issued a profit warning.

Rise in rail fares met by protests across UK

Rail fares increased by 3.1% in England and Wales on Wednesday, leading to protests across stations.

The rise in rail prices is considerably more than the 2.6% rise in the average wage in 2018, increasing the cost of rail fares by hundreds of pounds to many commuters.

Despite the high number of strike action, cancellations and delayed trains the increase in fares has been defended by Transport Secretary Chris Grayling and the rail industry who have said that 98p on every pound spent on tickets is reinvested back into the rail.

The shadow transport secretary, Andy McDonald, has not defended the increase to price fares and said: “Today’s rail fare increases are an affront to everyone who has had to endure years of chaos on Britain’s railways.”

“Falling standards and rising fares are a national disgrace. The government must now step in to freeze fares on the worst-performing routes,” he added.

Prices in London will be frozen, thanks to London Mayor Sadiq Khan.

Anthony Smith, who is the chief executive of the independent watchdog TransportFocus, said: “Passengers now pour over £10 billion a year into the railway alongside significant government investment, so the rail industry cannot be short of funding. When will this translate into a more reliable services that are better value for money?”

Frances O’Grady, the TUC general secretary, said: “The most reliable thing about our railways is the cash that goes to private shareholders each year. But with the most expensive fares in Europe, that can’t be right. It’s rewarding failure and taking money away that should be invested in better services.”

“It’s time to take the railways back into public hands. Every penny from every fare should go back into the railways. The number one priority should be running a world-class railway service, not private profit.”

Footwear brand Mahabis falls into administration

The footwear brand Mahabis has entered administration.

The retail group, which was founded in 2014, called in administrators just days after Christmas.

“We are very sorry to report that Mahabis Limited entered administration late on the 27th December 2018,” said Mahabis in a statement.

“We have, for the moment, ceased trading as the administrators take over the business … We are all desperately disappointed at this outcome. Please bear with us as we do our best to work through the current circumstances,” the statement added.

The group had sold almost one million pairs of slippers in over 100 countries.

Whilst it is not yet clear what caused the downfall of the retailer, Mahabis was worth around £75 million – £100 million.

Customers who want to return recently bought footwear from Mahabis have been told not to expect a full refund.

“It is very likely that if you return goods you will not receive a full refund and any refund will take many months,” said the group. “We would recommend therefore that you consider carefully whether or not to actually return goods.”

Mahabis, where shoes cost around £70, targetted millennials through pop-up ads and email discount offers. The footwear company is thought to owe creditors £2.6 million to creditors in the 12 months to June 2017.

Staff at the firm worked a four-day week. The Mahabis boss, Ankur Shah, published a manifesto which encouraged ‘down-time’ for employees.

The brand is the latest to be hit by the UK’s difficult trading environment. Other brands that have collapsed over the past year include Toys R Us and Poundworld.

Mortgage approvals in 2018 hit 10-year high

A new analysis from the Yorkshire Building Society has revealed that first-time buyer mortgage approvals hit a record high in 2018.

Despite higher UK house prices, mortgage approvals hit a 10-year high allowing an increase of 362,800 first-time buyers to take out mortgages in 2018 compared to 2017.

The year 2018 saw 367,038 first-time buyers take out mortgages. This is compared to the 193,300 taken out following the financial crisis in 2008.

“Property prices have grown at a faster rate than wages over the past 12 years, which has created difficulties for first-time buyers,” said Nitesh Patel, a Yorkshire Building Society strategic economist.

“Various factors have helped to alleviate this challenging environment, although the market is still pretty tough for those wanting to become homeowners.”

“However, the figures indicate that government initiatives such as stamp duty relief, Help to Buy equity loans and Help to Buy ISAs may have made an impact. Over the past three or four years, we’ve also seen more mortgage lenders offering 96 per cent loan-to-value mortgages, as well as strong competition driving mortgage rates down,” he added.

“This combination of factors has made buying a home more accessible in recent years. But getting onto the housing ladder is still not an easy step for many young people, as demonstrated by the increasing numbers who have received help from the bank of Mum and Dad.”

“Despite these challenges, the first-time buyer market has bounced back following the financial crisis to outperform other sectors, such as the home moving and buy-to-let markets.”

“Buying your first home remains tough for many by it’s encouraging to see first-time buyer levels at a ten-year high and climbing.”

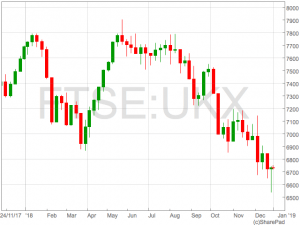

FTSE 100 starts 2019 in the red, down 1.6%

For the first day of trading in 2019, the FTSE 100 has opened in the red.

Wednesday morning saw the blue-chip stock index fell over 100 points, or 1.6%, to 6,620.71.

The bad start to the year follows the end to 2018, where the FTSE 100 tumbled over 12.5%, wiping over £240 billion off the value of companies listed on the London Stock Exchange.

Markets in Europe and Asia were both hit at the start of the year. Eurostoxx and stocks in Shanghai are down by over 1%, while Hong Kong’s Hang Seng fell by almost 3%.

“Global stock markets seem shaky on the first trading day of the year and still under the influence of the sell-off which we experienced in 2018,” said Naeem Aslam, who is the chief market analyst at Think Markets.

“Investors are clearly concerned about the growth in 2019 and the lack of confidence is keeping them on the sidelines or they are feeling safer by parking their capital in risk-off assets,” he added.

“The Chinese Caixin manufacturing number released today made investors more concerned about this as the number dipped below the critical point which differentiates the difference between contraction and expansion.”

“On the back of this number, investors followed one particular theme which spread from Hong Kong to Sydney- press the sell button only. Basically, for traders as long as the issues around the trade war between the US and China aren’t resolved, they cannot think of a situation which can promote growth.”

The tensions between the US and China are making a dent to global markets.

Christina Parthenidou, an investment analyst at XM, said: “With business conditions in China deteriorating and clarity missing over how Washington and Beijing will finally solve their trade dispute, despite both sides showing willingness to do so, some additional stimulus might be needed later in the year to prevent further economic weakness.”

Among the biggest fallers of the FTSE 100 on Wednesday are mining companies. BHP (LON: BHP) is currently trading down 4.01% and Glencore (LON: GLEN) shares are trading down 4.35% (1022GMT).

HMV falls into administration for a second time

Following tough trading over the Christmas period, HMV has fallen into administration.

The retailer is the latest to feel the bite of the difficult trading conditions and collapse, risking over 2,000 jobs.

KPMG has been appointed as the group’s administrators, who said they will keep all 125 stores trading whilst a buyer is found.

“Over the coming weeks, we will endeavour to continue to operate all stores as a going concern while we assess options for the business, including a possible sale,” said Will Wright, from KPMG.

“Customers with gift cards are advised that the cards will be honoured as usual, while the business continues to trade,” he added.

This is the second time that HMV has fallen into administration. The retailer last collapsed in 2013, where the group faced a backlash over gift cards that had become worthless overnight. It was soon bought by Hilco Capital in a £50 million deal.

Paul McGowan, who is the executive chairman of HMV and its owner Hilco Capital, said: “Even an exceptionally well-run and much-loved business such as HMV cannot withstand the tsunami of challenges facing UK retailers over the last 12 months on top of such a dramatic change in consumer behaviour in the entertainment market.”

“However, during the key Christmas trading period the market for DVD fell by over 30% compared to the previous year and, whilst HMV performed considerably better than that, such a deterioration in a key sector of the market is unsustainable,” he added.

The music retailer is among other big names to also fall into administration over the course of 2018. Retailers such as Toys R Us, Poundworld and Maplin have collapsed.

Many retailers, including Marks & Spencer (LON: MKS) and Carpetright (LON: CPR), have also suffered and closed stores using CVAs and issued profit warnings.

FTSE 100 finishes 2018 down 12%

The FTSE 100 has posted a 12% drop in 2018 after suffering set backs from Brexit, US/Sino trade wars and the global tightening of monetary policy.

Despite finishing 2018 in the red, the FTSE 100 reached all time record highs of 7,859 in May having enjoyed a strong rally on hopes of US fiscal stimulus from the Trump administration.

This proved to be short-lived with the second half of 2018 painting a dramatically different picture.

2018’s Winners

2018’s Winners

Ocado

For years called a ‘technology business with a food delivery service’, Ocado cashed in on their intellectual property with the licensing of their technology to Kroger in the United States. Analysts at Peel Hunt called the deal ‘transformational’ around the time of the announcement in May – and that it proved to be with shares in Ocado finishing 2018 off up just shy of 100%.Hikma Pharmaceuticals

After a torrid 2017 that saw shares in Hikma nearly half, the generics pharmaceutical business enjoyed significant sales growth as government seeks to take control of their healthcare budgets. The group announced a 54% jump in operating profit in the first half with the second half looking just as bright with a number of new drug launches promising additional revenue for the full year. Shares in Hikma closed 2018 up 50%.The Losers

British American Tobacco

The biggest casualty of the current constituents of the FTSE 100 is British American Tobacco. A long-time favourite of investors due to it’s reliable and consistent cash flows and dividend yield, the share BATS share price has fallen out of favour as the developed world enjoys lower smoking rates. In response to the lower outlook for tobacco sales the group have been pushing their new e-cigarette division to replace declining revenue from tobacco sales over the long-term. Shares in British American Tobacco shed circa 50% in 2018.Kingsfisher

Kingfisher have suffered a two pronged attack to their sales in 2018 with the general slowdown in high street retail spending in the UK and the failure to deliver a turn around in the European business. The rise of new build purchases for first time buyers has hit demand for DIY products which has compounded a broad based reduction in consumer spending, culminating in a 13.5% drop in H1 sales. The outlook for the second half isn’t inspiring. Shares are down 38% in 2018.Fine wine market 2018 review and 2019 outlook

Wine market performance for 2018

As we finish it is an ideal time for investors to reflect on the performance of the fine wine market over the past 12 months and use those findings to hone our strategy for the coming year.

A buoyant Liv-ex 1000

The big picture view for fine wine in 2018 is looking exceptionally positive. According to a recent report by Liv-ex the market has outperformed global equities with the Liv-ex 1000 reporting a 9% gain for the year. This is a welcome piece of news for investors nervous about the poor performance of the FTSE 100, S&P 500, DAX, and Hong Kong’s Hang Seng, and a reminder of how fine wine can weather stock market storms and provide an excellent option for portfolio diversification.

Bordeaux shrinks while Burgundy grows

Following the trends of recent years, 2018 has seen Bordeaux lose market share while Burgundy makes significant gains. Bordeaux accounted for 68% of the fine wine market in 2017, but this is down to 57% for 2018. Things are looking much rosier for Burgundy which has risen from 12.7% in 2017 to 15% of the fine wine market in 2018. Burgundy also claims all of the top 10 performers on the Liv-ex 1000 in terms of value thanks to the relative scarcity and high demand for these limited-production, rare wines from producers like Armand Rousseau and Domaine de la Romanée-Conti.

Italy and New World on the rise

This year has also witnessed the continued rising prominence of Italian and New World wines.

Of particular note is the Sassicaia 2015 which was revealed as Wine Spectator’s Wine of the Year. Following the announcement the wine became the top traded wine on Liv-ex both in terms of value and volume, giving Italian wine a 11.8% share of total trade.

For the New World the big news earlier in the year was the launch of California 50, the new index dedicated to wines from the United States. The California 50 will track the last 10 vintages for five of the state’stop fine wines; Dominus, Opus One, Screaming Eagle, Harlan Estate, and Ridge Monte Bello. According to Liv-ex, when tracked from 2003 these wines have offered impressive returns of 207% combined with very low volatility.

Interestingly, over the period July 2017 to July 2018 the California 50 is up 15.8% which puts it high above other Liv-ex indices. In comparison the second best performing index over that period is the Liv-ex 50 with a modest 5.2% increase. When combined with the US’s growing market share which has rocketed from 0.5% in 2013 to 3.7% in 2018, these dynamic performance figures suggest a very bright future for fine wine from the appropriately-named Golden State.

Looking forward to a prosperous 2019

2018 has undoubtedly been an exciting year for fine wine investors with Burgundy, Italy and the New World continuing to offer plenty of excitement. Although Bordeaux remains the cornerstone of the market, it is becoming increasingly evident that prudent investors should look beyond the traditional options. Going into 2019 market trends strongly suggest top wines from Italy, Burgundy and the New World are set to perform well and should offer a solid alternative to diversify portfolios hit by a yet another tumultuous year for the stock market.

Frontier IP announces roll out of water testing kit

Frontier IP Group has announced that subsidiary of FTSE 100 group Halma plc, Palintest, has begun commercial roll out of the rapid water testing kit named Siren. The technology used in the water testing kit is developed by the portfolio company Molendotech Ltd.

“It is a great achievement for the applications of our research to be commercialized with the launch of the first bathing water testing kit by Palintest that will allow a rapid assessment of bathing water quality. Molendotech researchers are working on further developments of the assay that will have many applications in a range of settings and benefit both industry and the public,” said Molendotech’s Chief Executive Officer, Professor Simon Jackson.

The group identifies strong intellectual property and accelerates its development through a variety of commercialisation services.

The commercial roll out of the water testing kit will focus on the UK and Ireland initially.

Currently, it can take over two days for local authorities and regulators to assess the quality of recreational water. This is because samples must be sent to a laboratory and undergo a complex analysis. But, with the new Siren kit, this process can now take place on location, producing results within 20 minutes.

Frontier IP owns a 14.1% stake in Molendotech.

Ian Leahy, Palintest’s open innovation manager, commented on the announcement: “It sounds strange to be discussing bathing water quality in the middle of a British winter but the fact is that people want to enjoy safe and high quality bathing water all year round – even on Boxing Day! By combining Palintest’s core competence of simplifying water safety validation with Molendotech’s technology we can finally deliver a screening tool that matches the behavior of recreational water users.” Additionally, Chief Executive Officer of Frontier IP Group, Neil Crabb, said: “We’re delighted with the rapid progress the agreement with Palintest is making. It has taken less than 18 months from when Molendotech was first incorporated to the full commercial roll out of the first product based on its novel intellectual property. We are confident the Company will continue to make strong progress.” Thursday’s stock market news also includes the FTSE 100 opening roughly 0.5% higher this morning following the Christmas break. Elsewhere, Visa will buy Earthport in a £198 million deal and the UK High Street’s £675 million fund will aim to create “community hubs”. At 16:30 GMT today, shares in Frontier IP Group plc (LON:FIPP) were trading at -0.66%. At 16:35 GMT today, shares in Halma plc (LON:HLMA) were trading at -0.52%.Visa to buy Earthport, shares surge 261%

Visa will be buying Earthport in a £198 million deal.

Shares in Earthport, the cross-border payment services group, surged after the announcement on Thursday.

The US-based payments group offered 30p for each Earthport share. This was four times the stock’s closing price on Monday of 7.45p.

“The Earthport board believes the offer by Bidco represents an opportunity for shareholders to realise an immediate and attractive cash value in Earthport today,” said Earthpot’s chairman, Sunil Sabharwal.

“Visa shares our vision of growth and expansion for Earthport and, as such, we believe it is a suitable and appropriate partner for our employees, partners, customers and other stakeholders.”

The group’s chief executive, Amanda Mesler, said on Thursday: “My focus, following a full strategic review, has been to rapidly implement a transformational growth strategy.”

“Whilst I believe Earthport is well positioned to deliver the potential it has always possessed, the all-cash offer from Visa represents a very attractive and immediate return for our shareholders.”

“Visa shares our commitment to operational and technological excellence in cross-border payments, and completion of the transaction would mean that Earthport and its customers will benefit from new opportunities arising from being part of a larger group with a shared vision,” she added.

Shares in Earthpot have fallen over 28% over the year.

Shares in Visa (NYSE: V) are trading +6.89% (1139GMT). Shares in Earthpot are trading +261.48% at 26.70 (1141GMT).