Next Tuesday morning, 11th March, will see the Costain Group (LON:COST), the UK infrastructure engineering business, declare its annual results for the year to end-December 2024.

We already know that the group’s revenues will show up slightly lower, while it will have increased its profits for the year.

The company, which is capitalised at £282m, which last year could have made £46.5m of profits, also had around £134m of cash in its group bank accounts.

What is more its shares, which are currently around 105p each, are trading on just 8.5 times historic and 7.4 times current ...

Three investment trusts for income

Investment Trusts are a great vehicle to include in an income portfolio. Many have steadily increasing dividends that are well covered by the trust’s current income and reserves from prior years.

In this article, we highlight three income investment trusts that are ideal pillars for investors seeking long-term investments that provide a blend of capital appreciation and stable dividend income.

Income Investment Trusts:

- abrdn Equity Income Trust

- CT Private Equity Trust

- JPMorgan Global Emerging Markets Income Investment Trust

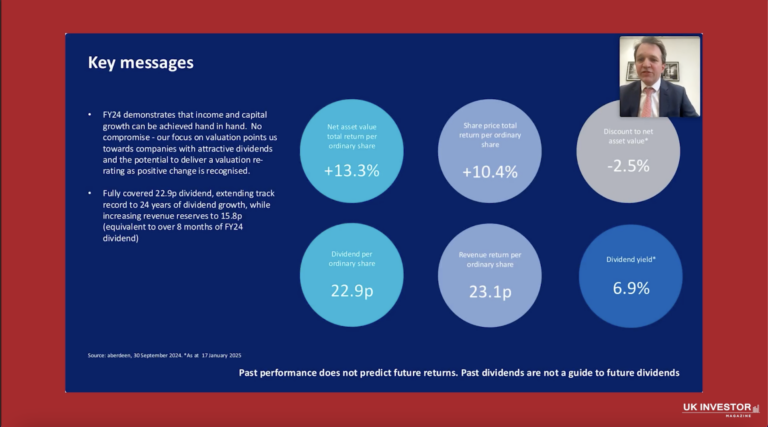

abrdn Equity Income Trust – 6.3% yield

The abrdn Equity Income Trust has notched up 24 years of continuous dividend per share growth and even increased dividends during the pandemic when many companies slashed their payouts.

Perhaps the most interesting observation is that the dividend has been covered by earnings each year of the manager’s tenure, apart from two years during the pandemic.

The trust’s dividend yield is 6.3%, which is far higher than the FTSE All-share benchmark yield and the FTSE 100.

Around 50% of the trust’s portfolio is weighted to the FTSE 100, so you’d expect to see stalwarts such as Imperial Brands, BP, HSBC, and Barclays in the top holdings. But the trust is index-agnostic and is actually underweight the FTSE 100 compared to the All-share index. This means it is overweight the midcap FTSE 250 index and small-cap index. It even has a very small proportion of the portfolio in AIM.

An unconstrained approach means the managers led by Thomas Moore are free to seek out high-yielding companies across the UK equity universe to secure benchmark-beating yields. This gives the abrdn Equity Income Trust an edge and means it is one of the highest-yielding UK equity income investment trusts available to investors.

The consistency of this trust’s dividend growth is difficult to beat, and the stability of the NAV makes it a compelling income play.

abrdn Equity Income Trust Investor Presentation:

CT Private Equity Trust – 5.9%

There’s quiet optimism that 2025 could be a good year for private equity managers. Interest rates are set to fall, and the market is ripe for a wave of M&A. This would create perfect conditions for private equity investment trusts such as CT Private Equity Trusts to realise positions and improve their cash positions.

It is estimated that in Europe and the US there are over 400,000 companies with over £10 million compared to just 11,000 public companies. This is a huge untapped pool of companies that private equity investment trusts, such as the CT Private Equity Trust, provide investors with access to companies that may otherwise be out of reach.

CT Private Equity boasts 25 years of outperformance of the FTSE Share total return and has even outperformed Berkshire Hathaway over this period. Indeed, CTPE has returned 4.1x the returns of the FTSE All Share over this period.

The trust focuses on the smaller end of the private equity market, allowing the managers to build a portfolio of over 500 underlying companies to provide diversification and flexibility.

Private equity trusts have the option to invest directly into to underlying companies or invest via other specialist private equity funds. The CTPE trust is comprised of 50% direct investments into private companies and 50% into funds allowing the managers to harness their own deep expertise as well as a wide network of private equity managers.

Not only does the trust offer an eye-catching yield, but investors buying at this point can secure deep value through the trust’s 30% discount to NAV. An improving economic outlook will likely see this narrow and provide material capital gains.

CT Private Equity Trust Investor Presentation

JPMorgan Global Emerging Markets Income Investment Trust – 4.1%

The JPMorgan Global Emerging Markets Income Investment Trust focuses on quality emerging markets companies that provide both a respectable yield and opportunity for growth.

The trust includes names such as Tencent, Samsung, Alibaba, and Infosys.

One of the pitfalls of an income strategy is selecting high-yielding stocks that turn out to be value traps. High yields often come with high risks. To mitigate this, the managers of the trust employ a stock selection strategy that largely avoids the highest-yielding stocks in the emerging market universe.

The trust targets a dividend yield of between 3% and 6% for any given company. Around 60% of the portfolio companies fall into this range, while around 20% have a yield lower than 3%, and 20% have a yield higher than 6%.

Regarding geographical breakdown, the trust is weighted to markets with a culture of paying dividends and, importantly, attractive yields. The low-yield, highly valued Indian stock market means the trust is less exposed to China, which is not only better valued on an earnings basis but it is a better place to find quality companies ramping up their shareholder distributions. Tencent and Alibaba are great examples of this.

The trust yields around 4% currently, and the opportunity for capital growth from leading emerging markets stocks over the long term makes this trust an interesting choice for those seeking exposure to EM and a blend of growth and income.

JPMorgan Global Emerging Markets Income Investment Trust Investor Presentation:

JPMorgan Global Emerging Markets Income Investment Trust Investor Presentation March 2025

Download the presentation slides.

JPMorgan Global Emerging Markets Income Investment Trust plc provides a diversified income-oriented way to tap into the growth potential of global emerging markets.

The trust primarily seeks a dividend yield which is higher than the average emerging market company but also growth companies in this exciting equity sector. This gives the fund attractive total return qualities which may help investors to look through the associated volatility on a more strategic basis.

abrdn Equity Income Trust Investor Presentation March 2025

Download the presentation slides.

abrdn Equity Income Trust plc is an investment trust with a premium listing on the London Stock Exchange. Established on 14 November 1991, it offers investors access to an actively managed portfolio of UK quoted companies.

The trust employs an index-agnostic investment approach, focusing on identifying and capitalising on opportunities across the full spectrum of the UK market cap. Its strategy is centred around ‘Focus on Change’, which involves evaluating evolving corporate situations to uncover insights not fully recognised by the market. The trust is committed to delivering sustainable dividend growth and is managed by a team with extensive investment experience.

Rights and Issues Investment Trust Investor Presentation March 2025

Download the presentation slides.

Rights and Issues Investment Trust PLC managed by Jupiter, is a London listed closed ended investment company which invests in a portfolio of primarily UK Small and Mid-cap companies.

Waymo and Uber accelerate autonomous vehicle deployment on Tesla’s doorstep

Uber and Waymo officially launched their autonomous vehicle partnership in Austin this week. Through the Uber app, riders can be matched with Waymo’s self-driving cars.

The collaboration between Uber and Waymo brings together Waymo’s autonomous driving technology with Uber’s established ride-hailing platform to create a formidable AV offering.

The location is notable because it is right on the doorstep of competitor Tesla’s global headquarters.

Austin riders requesting UberX, Uber Green, Comfort, or Comfort Electric rides may be matched with a Waymo fully autonomous all-electric Jaguar I-PACE vehicle at no additional cost. Riders will have the option to accept the autonomous vehicle or switch to a traditional driver.

The user experience remains largely unchanged within the familiar Uber app. Riders can unlock the vehicle, access the trunk, and start their trip directly through the application. To meet safety requirements, 24/7 customer support is available both in the Uber app and inside Waymo vehicles.

The launch of Uber and Waymo’s partnership in Austin is the latest development in the rapidly expanding autonomous vehicle industry that promises to revolutionise urban mobility in a way that hasn’t been seen since the invention of the steam engine.

Elon Musk’s new role in the US administration has intensified investor interest in the sector because, as we’ve already seen from some of his early actions, he’s likely to push for policies that benefit his own companies. And Tesla is in desperate need of some positivity.

Tesla sales are plummeting amid backlash at Musk’s political interference in Europe, and much rides on the successful deployment of Tesla’s robotaxi.

However, Musk is far from the dominant player in this area, as demonstrated by Uber and Waymo’s fleet in Austin.

Several early-stage companies are also doing exciting things in the space. Tekcapital’s Guident has developed teleoperation AV safety systems required by many US states, and UK-based Wayve has just set up an AV testing centre in Germany.

The sheer potential in terms of total addressable market and future revenue means there will be many winners from the AV revolution. In the meantime, Watching Musk battle it out with Uber and Waymo will certainly be interesting.

Murray Income Trust: Meet the manager

Murray Income Trust is an investment trust founded in 1923 aiming for high and growing income with capital growth.

The income defender: proven to enable risk-averse income seekers to tap into the income growth potential of equities, with a long track record of raising dividends every year since 1973.

The active diversifier: manages equity risk through careful stock and sector diversification, with up to 20% of the portfolio invested overseas.

The fundamental investor: uses abrdn’s equity research capabilities to identify high-quality large-cap companies with robust earnings potential and also small and mid-cap companies with strong growth potential.

Nativo Resources tailings option in Peru

Nativo Resources (LON: NTVO) has secured an option to evaluate the potential to reprocess the Toma la Mano tailing deposit and there are other potential tailings projects in Peru. The share price continues to decline following the share consolidation.

The agreement is via the local, 50%-owned partner Boku Resources, which has three-years to produce a technical evaluation. The nearby mine produced silver, copper, lead and zinc. Nativo Resources would process the tailings and help to remove the environmental liability

The Toma la Mano tailing deposit is in central Peru. Records suggest that the tailings deposit has 1.8Mt of tailings with 0.1g/t-1.7g/t of gold and 10g/t-37g/t of silver. These will have to be verified before a resource estimate can be calculated.

AIM-quoted Nativo Resources could do further deals for other tailings deposits in Peru, where the local communities can generate income and get rid of a potentially costly environmental liability. The processing will be much lower cost than mining the metals.

Via Boku Resources, Nativo Resources is already involved in the Bonanza gold mine in Peru, and it has produced its first gold.

The share price continues to decline following the consolidation of 1,500 existing shares into one new share. The board believed that this would help to make the share price less volatile. They may still be true in the longer-term, but it was always likely to lead to a short-term dip in the price.

The consolidated share price on the day before the consolidation was 2.25p and it has declined since then. Today, the share price has fallen a further 6.94% to 1.675p. That means that the share price has fallen by one-quarter over the past six days.

The share price may take a little longer to settle down, but the shares are worth keeping an eye on because of the potential for further progress with deals in Peru.

AIM movers: Northern Bear raises guidance and ex-dividends

Building and roofing services provider Northern Bear (LON: NTBR) has benefited from relatively mild and dry weather during the winter. There has also been growth in the fire protection business and new contracts won. This means that operating profit for the year to March 2025 will exceed previous forecasts and be in the range of £3.15m-£3.45m. The cost of closing the company’s fit-out business is included in the guidance. The share price increased 9.52% to 57.5p.

Xtract Resources (LON: XTR) says drilling has started at the Silverking copper prospect in Zambia, where Xtract Resources is earning a 70% interest. This will test the depth extension of the main high-grade pipe and establishing its width. It will also evaluate a second pipe structure and another anomaly. A phase 2 exploration programme is commencing at the end of the rainy season at the Western Foreland project in Zambia. The share price is 10% higher at 0.55p.

Helium One Global (LON: HE1) says new samples from the State-16 well at the Galactica project in Colorado, where it has a 50% working interest, show helium concentration of 2.17%, which is higher than previously. The well head pressure was also higher than previously. That indicates long-term flow potential. The share price improved 3% to 1.03p.

Battery technology developer Ilika (LON: IKA) has produced a successful prototype of a 50Ah Goliath electric vehicle battery. This is the minimum viable product for electric vehicles. The Goliath should reduce battery costs and increase range. Production for pilot testing should start later this year. The share price continued its upward trend with a 3.57% to gain to 43.5p.

FALLERS

Petrel Resources (LON: PET) has raised £250,000 at 1.05p/share and each share has a warrant exercisable at 2p/share. This will be used as working capital while new oil and gas projects in Iraq. Petrel Resources may be invited to enter into pre-qualification discussions with the Ministry of Oil. The share price slumped 34.2% to 1.25p.

Trading in Celsius Resources Ltd (LON: CLA) has been halted on the ASX, but trading continues on AIM. This is ahead of a fundraising. The share price declined 14.3% to 0.45p.

Shares in floorcoverings manufacturer Victoria (LON: VCP) fell 13.6% to 80.6p even though yesterday it was announced that Saqib Karim raised his stake from 6.12% to 7%.

Premier African Minerals (LON: PREM) is still seeking funding for the Zulu lithium and tantalum project, including talks with the offtake partner. A direct investment or sale of the project may be required if funds are not raised. Cash is required for operations to resume. At the end of January 2025, the group’s net liabilities were $64.3m, including the offtake prepayment of $46.4m from Canmax Technologies. The share price slipped 11.9% to 0.0185p.

Interim figures from pharma mathematical modelling provider Physiomics (LON: PYC) show a dip in revenues from £374,000 to £329,000, while the pre-tax loss edged up from £235,000 to £249,000. Full year revenues should be in line with expectations. There is a pipeline of new contracts, but they may not be signed in this financial year. The share price dipped 8.6% to 0.425p, which is a new low.

Ex-dividends

Colefax Group (LON: CFX) is paying a dividend of 2.8p/share and the share price fell 2.5p to 872.5p.

Nexus Infrastructure (LON: NEXS) is paying a dividend of 2p/share and the share price is unchanged at 177.5p.