House price growth in the UK has fallen to its lowest level since 2013, with London prices leading the drop.

Nationwide reported their house price figures on Wednesday, with the annual rate of growth falling by 2 percent this month. London was again the region reporting the weakest growth, with prices across the rest of the UK generally witnessing a rise.

The East Midlands was the fastest growing region, up 4.4 per cent on an annual basis to an average of £181,549 in the second quarter. This was followed by the West Midlands, which rose 4.3 per cent to an average £188,516.

Robert Gardner, Nationwide’s chief economist, said:

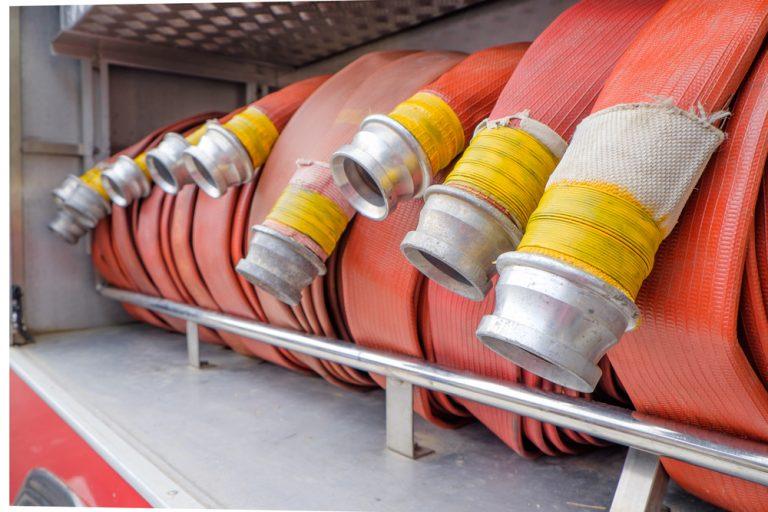

“Surveyors continue to report subdued levels of new buyer enquiries, while the supply of properties on the market remains more of a trickle than a torrent.

“Looking further ahead, much will depend on how broader economic conditions evolve, especially in the labour market, but also with respect to interest rates.

“Subdued economic activity and ongoing pressure on household budgets is likely to continue to exert a modest drag on housing market activity and house price growth this year, though borrowing costs are likely to remain low.”