FTSE 100 sinks

The announcement drove a sharp decline in the FTSE 100 as sterling rallied strongly against the dollar. Some of the biggest fallers in the FTSE 100 were again the house builders who were still reeling from a trading update from Berkeley Group suggesting the housing market was set for a lull which could see thier profits fall – something unlikely to be helped by rising rates.

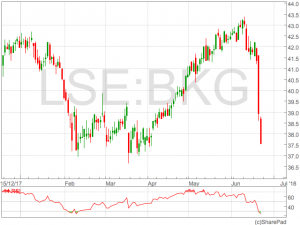

Taylor Wimpey (LON:TW), Persimmon (LON:PSN), Barratt Developments (LON:BDEV) and Berkeley Group (LON:BKG) were down between 2.9% and 3.7% on Thursday.

Some of the biggest fallers in the FTSE 100 were again the house builders who were still reeling from a trading update from Berkeley Group suggesting the housing market was set for a lull which could see thier profits fall – something unlikely to be helped by rising rates.

Taylor Wimpey (LON:TW), Persimmon (LON:PSN), Barratt Developments (LON:BDEV) and Berkeley Group (LON:BKG) were down between 2.9% and 3.7% on Thursday.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

Some analysts questioned the substance of the today’s balance sheet comments from the Bank of England suggesting any meaningful action was still some way.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

Some analysts questioned the substance of the today’s balance sheet comments from the Bank of England suggesting any meaningful action was still some way.

Today’s plans to bring in an unwind of QE from years and years away to merely years away could be seen as bid to remind investors that sterling can rise as well as fall.

— WorldFirst (@World_First) 21 June 2018