Patagonia Gold shares edge up on output figures

Patagonia Gold (LON:PGD) shares moved up in early trading on Friday, after releasing output figures for its Cap Oeste operation in Argentina.

Cap Oeste is Patagonia Gold’s only producing asset and the group released no comparative figures. In the first quarter the mine produced 10,662 ounces of gold equivalent, with the average cash cost of production coming in at $693 per ounce, or $756 per ounce including depreciation and amortisation.

“The team at Cap Oeste continue with efforts to optimise the production process, while the installation of the new crushing circuit to reprocess the material already stacked on the leach pad is completed,” the company said.

“The production guidance for the year is currently being reviewed and the market will be updated once this exercise is complete”.

Patagonia Gold said it was using the proceeds from gold sales from Cap Oeste to complete the payment of the new crushing circuit, as well as reducing its net debt position.

Shares in Patagonia Gold are currently up 0.86 percent at 117.50 (0946GMT).

Fuller Smith & Turner shares drop on weak beer sales

Fuller Smith & Turner (LON:FSTA) saw shares sink nearly 3 percent in early trading on Friday, after flat sales in beer and cider pointed to uncertainty in the future.

The group reported a strong set of results despite the flat sales, with profit before tax increasing by 9 percent in the year to the end of March to £43.6 million. Revenue grew 5 percent to £403.6 million, despite the “challenging” market.

“While we are still in a time of national and global uncertainty – and we do not underestimate the related wider market and economic issues that we will have to navigate over the months ahead – we believe we are in a strong position,” said Chief Executive Simon Emeny.

Like-for-like sales in the the managed pubs & hotels division performed better, up 2.9 percent for the period, while like-for-like profit in the Tenanted Inns division rose 3 percent. Adjusted profit before tax rose 3 percent to £43.2 million, from £42.1 million.

Shares in Fuller, Smith & Turner are currently trading down 2.89 percent at 942.00 (0930GMT).

European markets down ahead of G7 meeting

The FTSE 100 opened down on Friday morning, with nearly every share trading down an hour after market open.

The FTSE is currently down 0.74 percent at 7,647.73, with the DAX also down 1.27 percent. Other European markets have followed suit, seeing the CAC40 fall 0.23 percent and the IBEX35 down 0.73 percent.

The impending G7 meeting has spooked investors globally, with Canada set to host the world meeting starting today. America is likely to face criticism over its trade policies from the UK, Germany, France, Japan, Italy and Canada, causing uncertainty.

The economic calendar is fairly quiet at this time of year, meaning G7 speculation is likely to have a bigger effect.

Jasper Lawler ofLondon Capital Group told The Guardian that investors were starting to show “unease” over the potential climate at the G7 Summit, culminating in a softer session for Asia and the weaker start in Europe.

BT shares rise as CEO steps down

BT shares soared on Friday morning, after the group’s CEO Gavin Patterson announced his departure from the company.

Investors cheered the news of Patterson’s decision, which came about after shareholders made it clear they had little confidence in his ability to implement BT’s turnaround plan.

The new plan was unveiled just four weeks ago, designed to breathe new life into the company after it missed both profit and revenue guidance in March. The strategy includes 13,000 job cuts and a move out of BT’s central London headquarters, in order to cut costs amid growing competition.

BT’s chairman, Jan Du Plessis, said:

“The board is fully supportive of the strategy recently set out by Gavin and his team. The broader reaction to our recent results announcement has, though, demonstrated to Gavin and me that there is a need for a change of leadership to deliver this strategy.”

Patterson, who has been the group’s CEO since 2013, said it had “been an honour to lead BT since 2013 and serve as a member of the board for the last 10 years”.

Shares in BT rose by around 2 percent following the announcement.

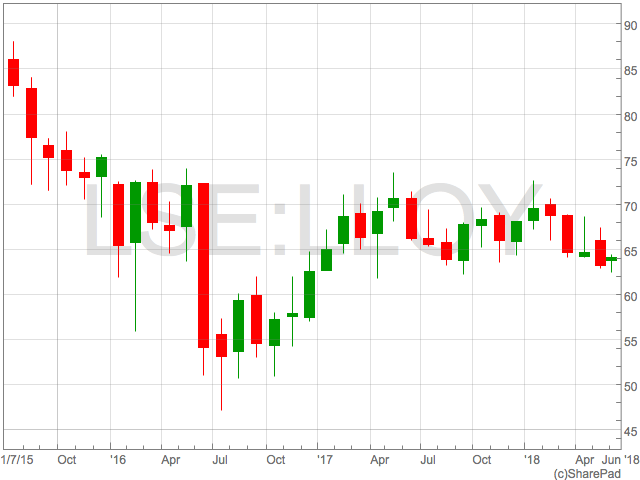

Lloyds share price bounces off strong support

Lloyds share price has remained in a tight range since the beginning of 2017, finding strong support in the 62p – 62.50p and resistance at 73p-74p.

The 200 day moving at 66.7p represents a potential magnet for the price in the short term, sitting neatly in the middle of the 2018 trading range. Technical traders will also be aware 14-day RSI has recently touched 30, signalling oversold, and has rebounded.

Strong results

The group boosted investor sentiment by raising its 2017 dividend by 20 percent at the start of the year, and announcing a £1 billion share buyback. In February the group reported relatively strong results, with statutory profit before tax up significantly to £5.3 billion, an increase of 24 percent on the year before. Underlying profit also increased by 8 percent to £8.5 billion, leading the group to boost its ordinary dividend per share by 20 percent. The banking group may also be set to benefit from a rising UK interest rate over the next couple of years. Despite it being expected to rise to just 2 percent by 2020, this would be an improvement on its current level and offer a boost to Lloyds.Contract tender

Lloyds has also gained the interest of several of the big investment management groups, after putting an investment contract up for tender. Goldman Sachs Asset Management joined rivals in the battle to win the £109 billion investment contract earlier this week, with BlackRock, JPMorgan Asset Management and Schroders all having already been selected to take part in a second round of bids in April. The contract is one of the largest ever to be put up for tender in Europe and has been managed by Standard Life Aberdeen since 2014.

Appscatter shares rise on maiden revenue report

App distribution platform Appscatter (LON:APPS) reported its maiden earnings on Thursday, after generating its first annual revenue.

The group, whose SaaS platform integrates with app stores to allow apps to maximise their distribution, reported full year revenues of £1.9 million. Its cash balance rose from £3.8 million to £226 million.

Net losses also narrowed throughout the year, dropping to £5.8 million in the year to the end of December, from £8.8 million the year previously. This comes after the group secured its first paying customers during the period, obtaining 16,835 registered users, by the end of May.

“Alongside investing in our core platform, we have also been successful in agreeing important partnerships with Airpush and IronSource, leaders in our industry who will broaden our horizons and increase our brand-awareness as we continue to focus on expanding our user base,” Philip Marcella, appScatter CEO.

Shares in Appscatter are currently trading up 2.56 percent at 60.00 (1059GMT).

How Reid Green & co generated a 75% return on Citigroup Inc

Sponsored by Reid Green & co

Citigroup Inc is a case study of an investment opportunity Reid Green & co highlighted to our subscribers. Over an 18 months period this idea generated a 75% return.

In this case study we will cover why we found the company attractive, what happened after we covered the stock and how Reid Green & Co approaches the investment problem.

What was it about Citigroup Inc that made Reid Green & Co rate it a buy a $43.15 per share and a sell at $74.05 per share?

What was it about Citigroup Inc that made Reid Green & Co rate it a buy a $43.15 per share and a sell at $74.05 per share?

Citigroup Inc. (Citi) is a financial services holding company. The Company’s whose businesses provide consumers, corporations, governments and institutions with a range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, trade and securities services and wealth management. In 2016 due to a negative sentiment in the banking sector related to banks’ exposure to commodities which were in the doldrums at the time, Citigroup found itself trading at a 30% discount to its tangible equity and at more than a 40% discount to its reported book value. Some of the discount was also part of a punishment for Citigroup appearing to generate a meagre 8% return on its equity, meanwhile Reid Green & Co thought the correct to look at Citigroup equity was the same way the banking regulators look at their equity. Upon looking at the company’s regulatory equity, which as must lower than its stated equity, we concluded than compared to Citigroup’s earnings it was actually earning closer to 11% of its true equity and factoring the discount this set up an attractive investment situation. An excerpt of what we told our subscribers can be seen below: “However, we think Citigroup’s compliance with US GAAP accounting standards is masking the banks much higher return on equity, as items such preferred stock, deferred tax assets, goodwill and intangible assets bloats the banks equity. When you deduct the $16 billion in outstanding preferred stock and $25.5 billion in intangible assets from the company’s equity, you realise that the bank’s tangible equity is actually $179.5billion or $60.77 per share, which would indicate a return on tangible equity of 9.4%. In spite of the above, the regulators actually have an even more nuanced view on the banks equity, one that we think gets closer to revealing the banks true economic performance. In assessing the banks regulatory equity, not only do the regulators deduct the preferred equity and intangibles, but they also subtract $32 billion of the Citi’s deferred tax assets. This results in $147 billion in regulatory equity or $50per share and when compared to its 2015 net income results in an 11.5% return on equity. This is 50% higher than the headline numbers would suggest. In summary our basic valuation takes into account the fact that the bank generates an 11% return on equity, is well capitalised with 12% in regulatory equity, is growing its core lending business, has $30 billion deferred tax assets which allows it to earn $100 billion of tax-free profits, and its excess earnings either gets returned to shareholder via buybacks or increases the company’s tangible equity.What happen after Reid Green & Co covered the stock?

During October 2017 Citigroup announced: In the first three quarters of the 2017 financial year ended 30 sept Citigroup Inc:- Increased its tangible book value to $68 per share up 13% from $60 in 2015.

- Increased its common equity from 8.7% in 2012 to 13%

- Repurchased 140 million common shares and returned $10.8 billion to shareholders

- Maintained a 9% return on tangible capital and 11% return on regulatory capital

Reid Green & Co looks for situations that have created large mis-pricings.

Although Citigroup Inc was much larger than the typical company we cover today, the investment thesis was a textbook example of what we look for in an investment opportunity. Reid Green & Co seeks out high quality companies, whose stocks prices for one reason or another do not reflect the true value of the business. More often than not we look for situations where there are multiple possible but highly likely catalysts for realising the underlying value. As in Citigroup’s case as long as the company generated earnings the profit would either be added to the company’s balance sheet and thus increase its book value per share or it would be distributed back to shareholders in accretive stock buybacks. Both of which would increase or realise intrinsic value. On behalf of our subscribers Reid Green & Co will continue to look for such opportunities. Claim your 30-Day Free Trial With our no risk 30-day free trial you can experience our investment research service up-front without paying for it During the free trial on top of being able to examine the quality and nature of our reports you will receive at least 1 actionable investment idea you can take advantage of right now. At any point in the free trial you can cancel your subscription. No questions asked. No payment required. Click Here to learn more about the 30-Day Free TrialMorning Round-Up: FTSE delayed, European markets up

The FTSE 100 had a delayed start to Thursday morning, after a technical issue prevented it from opening at its usual time of 8am.

After opening at around 9am, it moved to trade up 0.05 percent. The biggest risers were Auto Trader (LON:AUTO), up 5pc after a strong set of full year results, and Mitie (LON:MTO) and Capita Group (LON:CPI), both up 4.5 percent.

The biggest news on the markets this morning is House of Fraser’s decision to close 31 of its stores, including its London Oxford Street Store. The decision puts 6,000 jobs at risk and follows a period of poor performance for the department store chain.

Fallers included Princess Private Equity (LON:PEYS), down 6 percent, and Puretech (LON:PRTC), trading down 5.5 percent.

The German DAX also rose on Thursday morning, trading up 0.34 percent, with France’s CAC40 up 0.61 percent.

Joules beats high street gloom with strong results

Country clothing brand Joules (LON:JOUL) defied the high street’s doom and gloom with its full year results on Thursday, doing “marginally” better than expected.

Revenues increased by 18.4 percent in the 52-week period to the 27th May, with performance starting strong and continuing on into the Christmas period.

Retail revenue increased by approximately 15.9 percent on the year before, with the group opening 15 new stores in the UK and Republic of Ireland and e-commerce sales flourished.

“Our multichannel approach and ‘buy now, wear now’ product proposition has enabled the Group to deliver a performance ahead of our initial expectations, despite the widely reported challenges in the sector,” said Colin Porter, Chief Executive Officer.

The group, famous for its colourfully printed country clothing, said pre-tax profit was likely to be “marginally” ahead of the prior year of analyst expectations of £12.6 million.

“This performance is testament to the strength and appeal of the Joules brand and our distinctive products,” Porter said.

Shares in Joules are currently up 4.79 percent at 344.75 (0921GMT).

House of Fraser set to close 31 stores

House of Fraser shocked investors and consumers on Thursday by announcing the closure of 31 stores, including its flagship Oxford Street store in London, putting 6,000 jobs at risk.

Frank Slevin, Chairman of House of Fraser said: “Our legacy store estate has created an unsustainable cost base, which without restructuring, presents an existential threat to the business.

“So whilst closing stores is a very difficult decision, especially given the length of relationship House of Fraser has with all its locations, there should be no doubt that it is absolutely necessary if we are to continue to trade and be competitive.”

The company also wants a 25 percent cut in rent at ten stores, with the 31 stores closing set to pay a rent at 30 percent of the current level for seven months.

House of Fraser identified the stores set for closure in a CVA proposal as:

Altrincham, Aylesbury, Birkenhead, Birmingham, Bournemouth, Camberley, Cardiff, Carlisle, Chichester, Cirencester, Cwmbran, Darlington, Doncaster, Edinburgh Frasers, Epsom, Grimsby, High Wycombe, Hull, Leamington Spa, Lincoln, London Oxford Street, London King William Street, Middlesbrough, Milton Keynes, Plymouth, Shrewsbury, Skipton, Swindon, Telford, Wolverhampton, Worcester.

The CVA proposal is still subject to approval.

House of Fraser have been struggling for several months, reporting Q1 results that sounded warning bells for investors. It stands alongside many other high street retailers having a tough time at the moment, including Marks and Spencer and Carpetright.