Investors reluctant to take decisions ahead of General Election and Brexit negotiations

Trump biggest risk for investors, ahead of Chinese recession

Trading halted on Brazilian markets as President denies corruption allegations

RM Secured Direct Lending to issue further shares to raise funds to invest in UK businesses

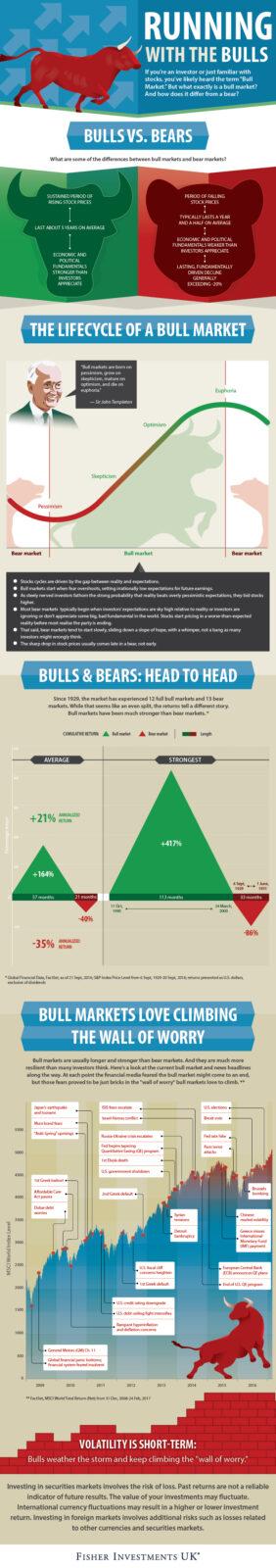

Bull or bear: the investor guide to market cycles

The infographic helps put the current market environment in historical context, shedding light on the evolution of bull markets and their tendency to overcome common fears. By differentiating bull and bear market lifecycles and identifying key points along with way, investors can see the important signs to watch along the way.

A core concept is sentiment’s evolution during a bull market. Many investors miss the fact stocks move on the gap between sentiment-based expectations and reality. For example, if the public is deeply pessimistic—as it was in early 2009—then anything less than catastrophically awful data can be the impetus for a nascent bull market. Conversely, if investors’ expectations are euphorically lofty, robust data that misses the mark may be the recipe for stocks to fall. Looking at data or sentiment alone is a common investor error.

The infographic helps put the current market environment in historical context, shedding light on the evolution of bull markets and their tendency to overcome common fears. By differentiating bull and bear market lifecycles and identifying key points along with way, investors can see the important signs to watch along the way.

A core concept is sentiment’s evolution during a bull market. Many investors miss the fact stocks move on the gap between sentiment-based expectations and reality. For example, if the public is deeply pessimistic—as it was in early 2009—then anything less than catastrophically awful data can be the impetus for a nascent bull market. Conversely, if investors’ expectations are euphorically lofty, robust data that misses the mark may be the recipe for stocks to fall. Looking at data or sentiment alone is a common investor error. Decrease in unemployment rate offset by rising levels of inflation – ONS

The UK unemployment has fallen to its lowest level in 42 years, with the unemployment rate falling to just 4.6 percent.

According to figures from the Office for National Statistics released on Wednesday, the number of people unemployed fell by 53,000 to 1.54 million in the three months to March.

This significant increase drove the employment rate to a new record high of 74.8 percent. However, the gap between inflation – at 2.7 percent in April – and basic pay growth – 2.1 percent between January and March – has widened, driving real wages down and creating difficulties for the average household consumer as Britain prepares to leave the European Union. Professor Geraint Johnes, Director of Research at the Work Foundation, told the Guardian that Wednesday’s figures constitute a “remarkably strong performance”, but added that the data was “less encouraging” concerning pay. “The pay data indicates a collapse in wage settlements in the construction industry, and this is significant because much of the employment growth in the last part of 2016 came from that sector. “While welcoming the strong employment growth evidenced in the first quarter’s figures, sustaining this into the longer term may therefore prove challenging,” he said.Labour to impose £48bn worth of tax rises in election manifesto

Greek economy sinks into recession for first time since 2012

Greece’s gross domestic product sunk by 0.1 percent in the first quarter of the year, falling back into recession for the first time sine 2012.

According to official figures from Eurostat released on Tuesday, the country’s GDP fell by a further 0.1 percent between January and March of this year, after shrinking by 1.2 percent in the final quarter of 2016.

The figures are set to worsen the Greek financial crisis, as the country struggles to secure a new bailout from international lenders almost two years on from a major crisis in 2015. Greek unions are set to begin two days of industrial action against cuts to pensions and tax rises insisted on by creditors, as the country continues to fight against increasing austerity. The Greek government are hoping a further loan payment will be approved by a meeting of eurozone finance ministers on 22 May.