IG Group full year earnings ahead of expectations

Classlist nears £550k crowdfunding target

Hostelworld sinks 25%

FTSE rallies for second day

M&S show growth, but warns on near-term profit

25/05/2016

Morning Round-Up: Greece/Eurozone deal, Monsanto rejects Bayer, last minute for BHS

Monsanto has rejected a bid from Bayer just days after a potential deal was announced, calling the $62 billion offer was “financially inadequate”.

German chemical group Bayer offered $122 a share in cash for Monsanto – the largest all-cash offer, ahead of InBev’s $60.4 billion offer for Anheuser-Busch. However, Monsanto’s CEO Hugh Grant said the bid undervalued the company, but remained open to anything higher.

Monsanto shares rose 3.1 percent on the news, with Bayer similarly rising on the German market. BHS in emergency bidding process Last-minute bidding has begun to save retail chain BHS, with a consortium led by former Mothercare boss thought to be the frontrunner.Richess Group, a newly formed consortium headed by Greg Tufnell and backed by a wealthy Portuguese family, is looking the likely winner so far after other bidders, including Matalan founder John Hargreaves, dropped out.

According to sources, if no deal is made by Friday BHS is likely to enter liquidation, risking 11,000 jobs.25/05/2016

Big Yellow Group posts revenue growth, notes slow economic acitivity

Special Report: Investment In The Financial Technology Sector

Financial Technology, also known as FinTech, has become a buzz word for investors searching for early stage innovative companies which have the potential for substantial long-term returns.

Due to the relatively recent emergence of the sector, many FinTech companies are still in the start-up and early stage of the business cycle meaning it can be difficult for investors to gain exposure to the sector. In this report, we have detailed a number of companies listed on London’s main market, easily accessible to investors seeking exposure to this rapidly expanding area of finance through established companies.

Request this report now to discover:

-

UK-listed stocks leading the way in financial technology

-

Areas of finance set to be developed by ‘disruptor companies’

-

How your finances could be impacted by changes driven by FinTech

This report is now publicly available, you can download your copy below:

A copy of this report will be sent to you immediately

By submitting my details I consent for information to be sent to me via the above contact details by Charles Hanover Investments Ltd. Contact may be made by email, post or telephone call. Any information provided is not an offer to enter into any transaction and Charles Hanover Investments Ltd will accept no responsibility for any loss incurred by acting on this information. By ticking the box below I confirm I have read and agree to the Research Terms,Terms of Business and have read and understood the Disclaimer, Privacy and Order Execution Policy.

Disclaimer: This report is for your information only. The information included is general in nature and is not in any form a recommendation to enter into any transaction nor does it constitute an offer. Depending on specific objectives and financial position the research may be unsuitable for certain investors. Charles Hanover Investments or Equitrade Markets will not accept any responsibility for any losses, including, without limitation, any consequential loss, which may be incurred by acting upon the contents of this report. Although the upmost care is taken to ensure the accuracy of this report information contained may not be entirely complete and accurate and Charles Hanover Investments or Equitrade Markets will not be held liable for any inaccuracies.

Risk Warning: Trading Contracts for Differences (CFDs), Futures and spread betting carries a high level of risk to your capital, and is not suitable for all investors. Only speculate with money you can afford to lose. Trading or placing any bets can result in consumers incurring liabilities in excess of their initial stake. Please ensure you fully understand the risks, and seek independent advice if necessary. Charles Hanover Investments is a trading name of Equitrade Markets Ltd, a company authorised and regulated by the Financial Conduct Authority for the conduct of investment business in Shares, Spread Betting, CFDs, Futures, Options and Rolling Spot Foreign Exchange.

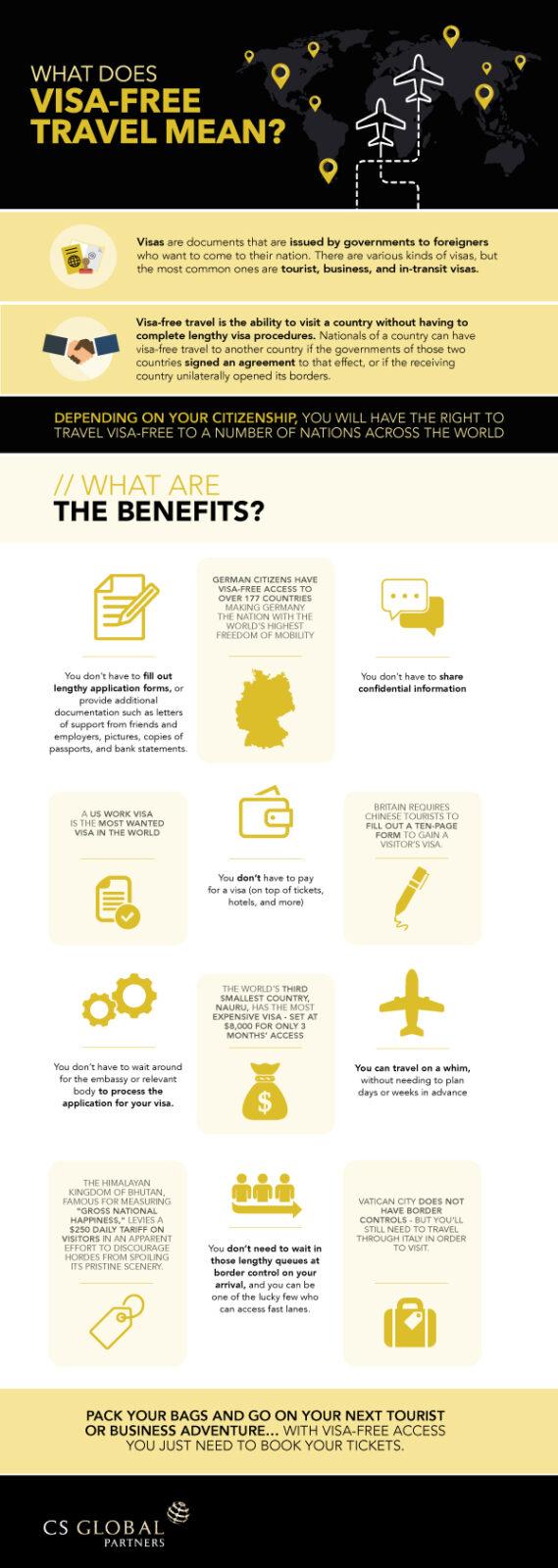

Brexit: could you benefit from visa-free travel?

Morning Round-Up: German GDP up, Nationwide soars, Spotify mixed

Revenue for the past financial year hit €1.95 billion, an increase of over 80 percent, but was weighed down by a 7 percent increase in net loss. The company offers music online, either free or by monthly subscription, but has high outgoings in the form of royalties paid to artists. Of its 89 million monthly active users, only 28 million are paying through subscription.

The group said they are prioritising investment in the face of increasing competition from Apple, Tidal and Deezer.

24/05/2016