14/01/2016

Oil drops to 12 year lows

Oil fell to 12 year lows on Thursday, briefly trading below $30 a barrel before recovering, as oversupply concerns continue to affect the market.

The global benchmark LCOc1 dropped as far as $29.73, the lowest since February 2004 and down more than 1.5 percent.

Analysts now expect the oil glut to persist throughout 2016 and on into 2017, with increased tensions between oil giants in the Middle East making it more and more unlikely that an OPEC deal on oversupply will be reached. To exacerbate the problem, United Nations’ nuclear watchdog is expected to confirm on Friday that Iran has curtailed its nuclear programme, and enabling sanctions against Tehran to be lifted – and allowing Iranian oil to flood the already crowded market.

WTI Crude is currently trading up 0.13 percent at $30.48 a barrel, with Brent Crude down 1.81 percent at $30.21 (1049GMT).

The Psychological Rollercoaster of Investing

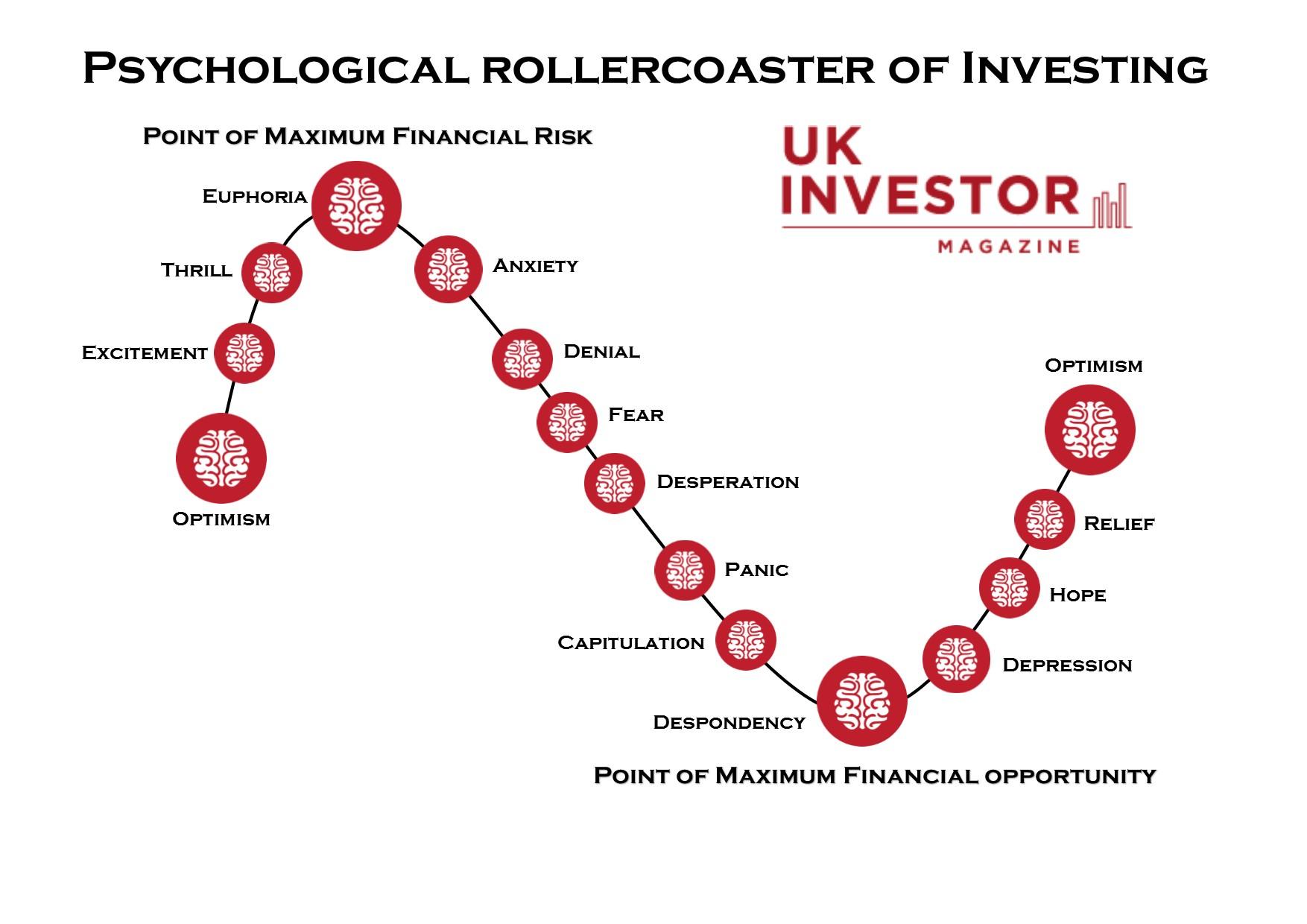

Understanding the varying emotions that you or another investor might experience can really help explain the relationship between feelings and judgements towards the market.

The below diagram shows the well known expression of the emotional roller-coaster experienced when investing, so next time you are investing, bear the chart in mind and ask yourself: “Where am I right now?”

Optimism to Euphoria

Whether the market is picking up, or it just starts with a positive hunch, the entering of the market is always backed by a feeling of optimism. With excitement and thrill, there is confidence in trading until euphoria is reached. At this stage in the cycle, maximum financial gain is reached. However, buying at the top will increase the chance of compounding costs with emotionally driven decisions.

Anxiety to Panic

As reality starts to set in, investors try to ignore bad news and move onto denial. At this point investors are reluctant to sell at a loss and volumes dry up. Sooner or later, investors are forced to sell moving through feelings of fear, desperation and panic.

Capitulation to Optimism

Forced by a lack of liquidity, investors often sell at a loss and remove themselves from the market due to reasons of despondency and depression. At the end of the cycle, it is not easy to start again at optimism, however, take too long and you might miss out on the recover, which can be fast and powerful.

Safiya Bashir on 14/01/2016

Bid target Home Retail releases disappointing Christmas figures

Home Retail (LON:HOME), the subject of a high-profile takeover bid from Sainsbury’s, saw sales fall by more than expected in the 18 weeks to January.

The Group reported a 2.2 percent drop in like-for-like sales at its biggest chain Argos, which suffere a 13 percent reduction in traditional store sales in December, and a 10 percent increase in digital sales was not enough to make up the numbers. The Group announced that profit before tax for the 2015 financial year would be around the bottom of analysts’ expectations, which range from £92 million to £118 million.

Supermarket chain Sainsbury’s made a secret bid for Home Retail back in November, which has since been rejected, in an effort to expand its customer base by acquiring the Argos chain. Home Retail have also since announced that they are in talks to sell the Homebase arm of the company to an Australian home chain for £340 million. These disappointing results will no doubt be taken into consideration by both companies.

However, the news appears not to have affected investor sentiment, with Home Retail currently trading up 0.13 percent at 149.60 pence per share. (1021GMT)

14/01/2016

Tesco shares soar on “strong Christmas” results

Tesco (LON:TSCO) reported a “strong Christmas”, with sales rising 1.3 percent making the Group one of the best performers of the Big Four supermarkets.

Transactions rise by 3.4 percent as customers flocked to the long-standing store, and sales were well above the negative figures predicted by analysts. Tesco’s share price rose over 7 percent in early morning trade, before settling down to up 4.86 percent at 166 pence per share. (1100GMT)

Chief executive Dave Lewis praised the Group’s performance, saying in a statement:

“Our Christmas performance was strong… There is plenty more to do, but we are making progress and are trading in line with profit expectations for the full year.

“International sales have also continued to strengthen, driven once again by improvements across the offer. We continued our strong positive sales momentum in both Europe and Asia, with our Thai business reaching its highest ever market share.”

14/01/2016

Cyprus to successfully complete bailout programme

Cyprus is likely to successfully complete its three-year bailout programme by the end of March, according to a source inside the EU.

In 2013 a £10 billion bailout was agreed from the European Commission, the European Central Bank and the International Monetary Fund after the country’s economy collapsed. Changes to the running of the economy had to be made in order to receive the bailout funds, most of which have been completed; however, one final reform needs to be finalised in order to receive the last 400 million euro pay-out.

The European Commission, the European Central Bank and the International Monetary Fund agreed in 2013 a three-year rescue plan of 10 billion euros (7.63 billion pound) for the Mediterranean island after its financial sector collapsed because of its exposure to the Greek economy.

“I am quite confident that prior actions will be fulfilled before the end of the programme and that therefore the disbursement will actually take place,” an official told Reuters.

In other economic news from the region, Greece has exited 33 months of deflation, finally seeing a light at the end of the tunnel after months of economic decline. Greece has had to implement strict cuts to public services and benefits in order to comply with conditions for an EU bail-out.

13/01/2016

3 reasons why Sainsbury’s-Home Retail deal could be good for investors

Sainsbury’s (LON:SBRY) shares dropped dramatically last week after it emerged that a secret offer for Home Retail (LON:HOME), made back in November, had been rejected. But investors are a little baffled – why are Sainsbury’s so keen on getting hold of the home and DIY group?

Fortunately, Sainsbury’s released a presentation today designed to make their thought process a little clearer. It all boils down to three main reasons:

1) Safety in a declining sector

It’s no secret that supermarkets have having a tough time at the moment, and all of the Big Four are pursing strategies in order to stay afloat. Sainsbury’s strategy is to branch out into other areas, becoming a ‘one-stop shop’ for items other than groceries – as CEO Mike Coupe says, Sainsbury’s aspiration going forward is to serve customers “whenever and wherever they want to shop”. As a result, Sainsbury’s has already tried to boost its presence in non-food, which has higher profit margins, by growing its Tu clothing range and selling homewares.

Acquiring a company such as Home Retail, who own the Argos and Homebase brands, is the next logical step in that process.

2) Increasing customer base

Shoppers continue flock to cheaper stores such as Lidl and Aldi, and the price war between the Big Four supermarkets isn’t drawing them back – so Sainsbury’s plan is to capitalise on shoppers laziness, and offer them everything they need in one place. Sainsbury’s estimate that 2/3 of households shopped at their supermarket last year, with 2/3 also shopping at Argos. By selling both products in one place, less shoppers need to go to two different stores and, ergo, Sainsury’s customer base has expanded. Whilst investors may have been confused by the match up between the two Groups – Argos has been called a “working-class brand” while Sainsbury’s appeals to the middle classes – this strategy only serves to encourage both sets of shoppers into one store.

“We know that there is a benefit in bringing the two companies together and there are more opportunities combined than separate,” Mike Coupe commented.

3) Streamline costs

Sainsbury’s plan is, when the lease runs out on Argos stores, relocate them into large existing Sainsbury’s. 40 percent of Argos leases expire within the next four years, meaning the opportunity to streamline costs and cut rent is an immediate option.

As for Home Retail’s DIY chain Homebase, suspiciously little has been said about it in either the 22 page presentation or their 30 minute call to investors – given this, it seems likely that the Homebase arm will be sold if the deal goes through. Sainsbury’s originally sold Homebase in 2000 to Schroder Ventures for £969 million, and sources have said that there is no desire to own it again.

Under British takeover rules the supermarket now has until February 2nd to make a firm offer or walk away.

Miranda Wadham on 13/02/2016

Pay expectations for 2016 revealed – and don’t expect a pay rise

Chancellor George Osborne warned last week that the UK faces a ‘cocktail’ of threats from a slowing global economy, something that is likely to have a knock-on effect on the British public – recent figures have confirmed that pay increases are likely to drop in 2016.

A recent payroll survey by reward consultants Paydata has revealed that employers setting their 2016 budget will offer few – if any – pay increases to staff this year. Contributing factors include the influence of inflation, CPI sitting at zero and RPI sticking at one percent, but also a new and more controversial issue raised by businesses – the introduction of Gender Pay Gap Reporting due to be implemented in April. Employers feel that they need to address any potential equal pay concerns before they reward pay increases.

Whilst the trend over the years has been for businesses to pay individually determined increases rather than an across-the-board bonus to all staff, the new legislation puts the current system on stand-by until companies are equipped with guidelines on pay rewards by the government. Like previous industry trends, sectors will vary in their pay increases; Professional Associations and Institutes pay marginally below the overall figures, and those located in London will generally increase due to recruitment and retention pressures.

A number of commentators, including the CBI, predicted last year that inflation would increase this year towards the governments two percent target, however these forecasts now need to be reviewed as it’s estimated that wage inflation will not pick up. Further reward surveys are expected to be released in the Spring, which could reveal some interesting details on the adoption of equal pay reporting.

13/01/2016

High Street Christmas results: the good, the bad and the ugly

The Good:

Morrisons Shares in the troubled supermarket chain rose over 10 percent on Wednesday, after a Christmas trading statement showed a 0.2 percent rise in sales in the nine weeks to 3 January. Morrisons have issued several profit warnings over the last year, slashing prices and selling off 140 of their M convenience stores in as all of the Big Four supermarkets struggle to compete with discount stores. However, Wednesday’s Christmas results are the first positive figures from the chain since the new chief executive David Potts was appointed – perhaps a sign that there is light at the end of the tunnel for Morrisons. John Lewis John Lewis disclosed excellent Christmas figures on Monday, seeing a 7 percent rise in sales for the six weeks to January 2nd – despite spending a whopping £7 million on their famous Christmas advert. A big drive in online sales led the growth, with 40 percent of sales made through their website, with John Lewis confirming that its overall festive performance has kept it on track with full-year profit expectations for between £270 million and £320 million. Game Struggling gaming chain Game announced better than expected Christmas figures this morning, down just 0.4 percent in the three weeks to January 9th – a vast improvement on the 6.7 percent drop in the first 21 weeks of the year. Despite adjusting its full-year profit expectation down to £30 million, shares in the company rose over 10 percent in early trading as investors saw the figures as a positive start to the year.The Bad:

Waitrose In comparison to its parent company John Lewis, grocery chain Waitrose suffered at the hands of a competitive market and saw a 1.4 percent drop in sales over the Christmas period. CEO Mark Price remained positive however, saying that he believed the market share of the company had increased. Whilst Waitrose’s emphasis on quality over price usually sets them in good store for Christmas shopping habits, the lure of discounters Aldi and Lidl proved too much for the brand and, unfortunately, disappointing figures reflected that. Marks and Spencer Marks and Spencer had a mixed Christmas, seeing clothing and general merchandise sales fall by 5.8 percent in the three months to January, but its grocery arm defying tough market conditions and rising 3.7 percent. The company cited the unseasonable weather as the main reason for the disappointing clothing sales, and its share price remained largely unaffected. It could be that investors were calmed by the announcement made t the same time – the retirement of Marc Bolland from the role of CEO, to be succeeded by Steve Rowe. Greggs Budget national bakery Greggs saw a sharp drop in share price on Tuesday after below-par Christmas sales. Sales rose by 2.3 percent in the final quarter of 2015, a big slowdown from the 5.6 percent in the rest of the year.And the Ugly…

Next Blue chip clothing chain Next surprised investors last week with a dramatic fall in sales over the Christmas period. A usually reliable company, Next’s poor results caused shares to plunge over 5 percent. The chain was the first in a series of companies to blame the unseasonably warm weather in November and December as a reason for falling sales, but added that their limited stock availability also contributed. Poundland After acquiring the 99p Store chain earlier in the year, their first set of Christmas results since that were highly anticipated by investors as a signal as to the long-term benefits of the acquisition. Unfortunately, shares dropped 10 percent as the company re-adjusted their full-year profit downwards to take into account the restructuring and conversion of 99p Stores to Poundlands. A quiet Christmas also contributed to the fall in figures.Miranda Wadham on 13/02/2015

A promising year ahead sees Shoe Zone shares soar

Footwear retailers Shoe Zone (LON:SHOE) saw shares soar over 10 percent this morning, as upgrading of its stores and international expansion increase investor sentiment.

The company’s revenue fell by 3.5 percent to £166.8 million, with profit before tax also falling by 2.4 percent. The company cited “difficult trading conditions” as a reason for the lower performance.

However, Shoe Zone have restructured their manufacturing and are in the process of upgrading stores in order to boost future sales – the company are opening 12 new stores and currently refitting 40 of their existing. The launch of a new website has increased online traffic conversion rates to 66 percent, as well as starting to sell internationally through Amazon and eBay.

Shoe Zone’s CEO Anthony Smith said the group had seen a “solid performance”, commenting:

“There is extensive work underway to increase the Grade 1 store portfolio and we are targeting an additional 56 stores to be operational by the beginning of February.

“We are also excited to be trialling “Project Big Box” in August 2016 which will involve three stores that will be twice the average size of a Grade 1 store. The trial stores will benefit from an extended product range, higher priced footwear and will allow us to benefit from the out of town market.”

Shoe Zone are currently trading up 11.71 percent at 186 pence per share. (1056GMT)

13/01/2016

Sports Direct shares rise after taking stakes in US sports brands

Sports Direct (LON:SPD) saw shares rise this morning, after announcing the acquisition of stakes in two US sports companies, Iconix and Dick’s Sporting Goods.

Sports Direct said in a statement that the deals would allow them to “build relationships with key suppliers and brands”, as well as expanding their presence in the US.

The company now hold an 11.5 percent stake in Iconix, which owns the Umbro and Lee Cooper brands, 2.3 percent of Dick’s Sporting Goods, one of the US’s largest sports retail brands.

The announcement saw shares rise a much-needed 3.37 percent, after the release of poor Christmas trading figures at the beginning of this week. The company blamed the unusually mild weather for “deterioration of trading conditions on the high street”, and issued a profit warning, sending shares tumbling.

Sports Direct are currently trading up 3.37 percent at 425.50 pence per share. (1039GMT)

13/01/2016