Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households.

Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households. House builders demolished by Summer Budget

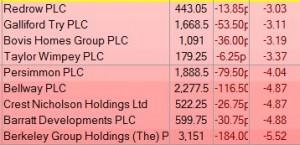

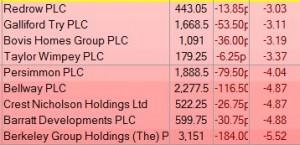

UK house builders bore the brunt of the Chancellors budget after he removed tax relief for buy-to-let investors – potential reducing the amount of homes that are purchased for investment purposes.

The UK’s leading homebuilders typically sell many new homes off plan, often to those that are making an investment.

Osborne said his desire to create a fairer housing market was the motive for introducing the changes.

Barratt Developments, Persimmon and Taylor Wimpey were the FTSE 100’s top fallers and The FTSE 350 House builder’s index was the biggest sector faller.

Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households.

Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households.

Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households.

Home builders have enjoyed significant support from the government in the last few years and this is the first major negative intervention to the house builders the Tories have made.

The Tories have said they would like more people to own a home but there may be the unintended consequence of higher rents for lower income households. Osborne reforms dividends

In today’s Budget George Obsorne further supported savers by reforming dividends meaning 85% of investors will pay less tax.

George Osborne said of his reforms: “I am today undertaking a major and long overdue reform to simplify the taxation of dividends. The dividend tax credit will be replaced with a new tax-free allowance of £5,000 of dividend income for all taxpayers”

The announcement came among many changes to the tax system that were aimed at reducing tax bills for working people. Corporation tax was also slashed, Osborne said by 2020 corporation tax would be reduced to 18%.

The FTSE 100 rallied on the news and was trading up around 1% in the wake of the announcement, however much of this can be attributed to a rebound from yesterday’s selloff.

Ruroc eyes up expansion through crowdfunding campaign

Ruroc, creators of the world’s first fully integrated ski helmet, goggle and mask are seeking to crowdfund through online platform Crowd2Fund. They are seeking a £150,000 revenue loan, with 10% APR.

The company, first established in 2010, has already proven itself in the marketplace; Ruroc’s helmets are used by over 20,000 people worldwide and are frequently seen in the Formula One Pit lanes on Sky Sports. The company are hoping to use the loan to introducing a new range of products, including an updated version of the RG-1.

The business currently turns over more than £1 million and has been experiencing double digit revenue growth year on year. The company’s flagship product, the RG-1, is fully patented and permanently prevents goggles fogging without the use of electronics.

One of Ruroc’s strengths is having a strong following online. They have a number of celebrity fans, such as Simon Pegg, close to 2,500 followers on Twitter and over half a million likes on Facebook. This has resulted in a brand following, who have helped fuel sales internationally; currently 88% of sales are from international customers. The company feel that crowdfunding is the best source of finance, giving their existing customers the chance to invest and grow the company.

Daniel Rees, the MD of Ruroc, says: “The new helmet will help to alleviate the problem that we have with seasonality as it will be certified across a number of sports including road and mountain biking, as well as a selection of other action sports.”

Rees believes that the revenue loan suits businesses such as Ruroc which are seasonal.

Rees says, “Crowd2Fund’s revenue loan was a massive attraction for us as we are a seasonal business and this offers a much easier solution than making fixed monthly repayments.”

Crowd2Fund are the only UK-based crowdfunding platform to offer the revenue loan model.

For more information on this investment opportunity, visit Ruroc’s page on the Crowd2Fund website.

Chinese stock market crash snowballs

It was only a couple of months ago analysts were touting the economic recovery in China as reason to pile into Chinese equities to benefit from corporate earnings and central bank easing.

That trade would have been very successful for a nimble trader who exited near the top, however those inexperienced Chinese individuals, who account for roughly 85% of the market, are now running for the hills as the crash in Chinese stocks snowballs.

“I’ve never seen this kind of slump before. I don’t think anyone has. Liquidity is totally depleted,” said Du Changchun, an analyst at Northeast Securities to Reuters.

Panic is contagious and China has an epidemic. Around half of the stock market has been halted and those who piled in on margin are in a huge amount of trouble.

The selloff continues despite intervention from authorities who are doing there best to contain the market volatility.

“It’s just a matter of whether it will fall more slowly, or continue to slump in freefall,” said Qi Yifeng, analyst at CEBM. If this is the sentiment shared by the masses, the Chinese stock market could have a lot further to fall.

Hiring pace slows further in June

Permanent staff placements by recruiters have continued to slow in June, according to a survey published on Wednesday.

This continues the trend set in May, where the number of job vacancies made available also fell to their slowest in 2015.

The report cited a lack of skilled candidates as the reason for the slow growth.

“Recruiters are struggling to fill vacancies for everything from software engineers to sales,” Bernard Brown, a partner at KPMG, said.

Job data will be watched closely by the Bank of England, who are predicted to raise interest rates from its record low of 0.5% in the near future. The market predicts the first rise in the UK Bank Rate around May or June 2016, with the conensus of economist views pointing to March.

Anthony Jenkins sacked as Barclays CEO

Barclay’s CEO Anthony Jenkins has been sacked over the lack of cost cuts and changes to the investment bank.

Chairman John McFarlane will step in as caretaker CEO until a suitable replacement is found.

“Whilst it is unfortunate that I have had little time to work with Antony, I respect and endorse the position of the board in deciding that a change in leadership is required at this time,” said Mr. McFarlane

Jenkins’ exit follows a number of changes at the top of major investment banks whose boards and investors felt the man at the top wasn’t the most appropriate person to navigate changes in regulations and deliver cost synergies.

“The board recognizes the contribution made by Antony Jenkins as chief executive over the past three years in incredibly difficult circumstances for the group, and is extremely grateful to him in bringing the company to a much stronger position,” Barclays said in statement.

Shares in Barclays traded up 3.3% in early London trade.

Apprentice star Lauren Riley crowdfunding for ‘The Link’ app

Apprentice star Lauren Riley is crowdfunding for The Link, her new app designed to revolutionise methods of communicating between professional firms and their clients.

Initially, the app has been created for those working across private client legal sectors. Riley, who is a family law solicitor, saw the need for a way to save time and money and increase productivity by replacing multiple daily calls, emails and letters into one easy to use channel. In an increasingly competitive market, an app that claims to potentially increase firms’ profit by £84,000 per year, per solicitor is an invaluable addition to the workplace.

The Link App are crowdfunding on Crowd2Fund, with a funding target of £150,000 for 15% equity. The funding will enable them to release their product on the general market.

Riley says: “Crowd2Fund offers a simple and quick platform for investors to gain insight into the business with much of the usual due diligence work done for them. My investors also become my clients, product testers and invest in future rounds so crowdfunding was clearly the best way to raise funds.”

“I have always loved being in business. As an entrepreneur I was convinced there must be a better way for lawyers to communicate with their clients. After all, this is the twenty first century. After listening to the continued grumblings of my colleagues who work in law, I had my eureka moment and The Link App was born. We’ve seen phenomenal interest in the app so far, using the crowd is a modern way to raise funds for a modern company.”

The basic version of the app has launched and 80 law firms have already expressed their interest in using the product. Although initially focused on law firms and their clients in the UK, many professional sectors have the same needs and in the future the app could be developed to target these sectors and globally.

For further information on investing in The Link, visit www.crowd2fund.com/thelinkapp. As an added incentive, investors will also receive £1,000 of usage credit on the app if they contribute £5,000 or more of the £150,000 target.

Fevertree Drinks up 8%

Fevertree Drinks are up 8% this morning after issuing a pre-close trading statement.

The company stated: “The Board is pleased to announce that Fever-Tree has continued to perform strongly in the first six months of 2015. It is anticipated that sales in the first half of 2015 will be approximately GBP24 million, 61 per cent. ahead of the prior year period. June was a particularly strong sales month, although it was accentuated by certain customers and importers building inventory in advance of the summer season.

Given the strong sales in the first half of the year and in particular in June, the Board anticipates that the results for the full year will be materially ahead of board expectations.”

UK-based Fevertree is a leading supply of premium carbonated mixers for alcoholic spirits.

Red Rock Resources down 23%

Red Rock Resources (AIM:RRR) is one of the biggest movers on the AIM market this morning, falling 23.08% after announcing investment in Elephant Oil.

The company have issued a total of 689,473,706 ordinary shares of 0.01p each, representing proceeds of £327,500. 421,052,632 of the new Shares represent a £200,000 subscription by Elephant Oil Limited.

Elephant Oil is a privately held independent oil and gas exploration company focused on West Africa. Elephant holds an 100% interest in the production-sharing contract on Block B, onshore Benin, on the prolific West Africa Transform Margin. The block covers 4,500 km2 and is one of only two onshore blocks to have been made available by the government of Benin.

Andrew Bell, Chairman, states: “Following continuing discussions with Elephant, Red Rock has determined to press forward with its investment in Elephant’s oil exploration activities in West Africa, and consequently to undertake the current funding exercise. We consider that the Elephant team is making rapid progress in working to expand its footprint and add further oil opportunities in West Africa and our own exploration activities in Ivory Coast have given us a strong conviction of the economic prospects and investment merits of the region, as well as of its geological prospectivity.”

Thursday set for Greece deadline

The Eurozone has given Greece until Thursday to come to an agreement with their creditors.

European Council President Donald Tusk confirmed that “the final deadline is this week,” after emergency talks in Brussels. He stated that it was the “most critical moment in the history of the eurozone”.

Whilst there were expectations that Greece would present new proposals on Tuesday, however none were forthcoming.

On Sunday, a meeting of all 28 members of the EU will be held and Greece’s future will be decided. In comments to French TV on Wednesday morning, the EU’s Economy Commissioner, Pierre Moscovici, said agreement with Greece was “indispensible” and a Greek exit from the Eurozone must be avoided.