Imagine gliding across the water, the only sound being the wind and the waves. No roaring engines, no vibrations, just pure, seamless movement.

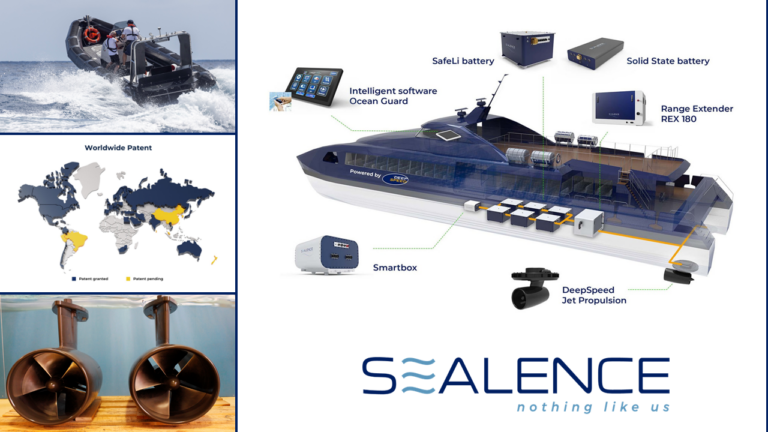

This vision is becoming reality thanks to Sealence, a company pioneering a new era in marine propulsion. By combining state-of-the-art solid-state battery technology with its patented DeepSpeed jets, Sealence is set to revolutionize the way boats move on water.

The technological approach to the problem is absolutely disruptive, Sealence has created a jet engine like the jets we see installed in aircraft, but redesigned to operate in water and driven by an electric motor.

The key to the proposition is greater efficiency – and therefore lower energy consumption – compared to propeller propulsion and the technological challenge has already been won. It is possible today to see the Sealence boats whizzing along at speeds of up to 60 knots.

But Sealence’s real challenge is not speed, it is getting commercial ships – both passengers and cargo – the same evolution that the aviation sector has made in past decades thanks to the introduction of jet propulsion. All in a sustainable way, without emissions into the environment.

The Challenge: A Sea of Change in Marine Mobility

The marine industry is undergoing a transformation. Traditional combustion engines are facing increasing scrutiny due to their emissions, noise pollution, and inefficiencies. While electric mobility is rapidly evolving on land, the transition on water has been slow. The challenge lies in the fact that existing electric solutions lack the power, range, and efficiency needed for real-world marine applications—until now.

Sealence’s Solution: Unmatched Innovation with DeepSpeed Jets

Sealence is not just following trends; it is setting new standards. Its DeepSpeed jet propulsion systems are more efficient, more powerful, and completely silent compared to traditional propellers. This is achieved through advanced hydro-jet technology, paired with an intelligent powertrain that maximizes energy efficiency.

- Unrivaled Performance – The propulsion systems offer today up to 230 kW (over 310 hp) and the company is now developing 600 kW (over 800 hp) jet power, with in future larger models to scale up to many megawatt levels.

- Solid-State Battery Innovation – The company utilizes cutting-edge solid-state battery technology, ensuring higher energy density, longer lifespan, and enhanced safety compared to conventional lithium-ion batteries.

- Scalability for All Vessels – While the current focus is on leisure and commercial vessels (12-24 meters) full-electric or hybrid with range-extender, Sealence is actively scaling towards larger passenger and cargo ships.

The Market Opportunity: A €10M+ Pipeline and Growing

The demand for sustainable marine solutions is accelerating. Governments worldwide are tightening emissions regulations, and yacht and commercial boat owners are seeking high-performance electric alternatives. Sealence’s order backlog (already sign or in final negotiation) is at the date for some million euros largely with large industries. Additionally, the pipeline of qualified commercial leads surpasses €10M, a figure that continues to rise as awareness of the technology grows.

Why Invest in Sealence?

Sealence is not just another startup; it is a proven and recognized leader in innovation:

- €32M+ in assets and a total funding of €18M through equity, grants, and debt.

- Awarded as one of the Top 50 Most Innovative Startups by the European Parliament.

- Its patented technology is recognized in 46 countries, with 5 additional patents pending.

- A highly skilled team: 70% of the 40 employees hold at least one university degree.

- A technological offering of a higher level than competitor’s products

A Clear Path to Growth and Profitability

Sealence has a well-defined roadmap for expansion, supported by a €30M funding round to be placed mainly with institutional investors, aimed at scaling its production and go-to-market strategy:

- 46% allocated to manufacturing facilities and assembly lines.

- 30% dedicated to the development of new products, including larger propulsion systems.

- 24% invested in market expansion and corporate growth.

The company’s industrial plan foresees reaching break-even by 2027, followed by positive cash flows that will drive further innovation and expansion. Its exit strategy, clearly defined in institutional agreements, is set for five years, either through a stock market listing or an M&A transaction.

Join the Future of Marine Mobility

This is an opportunity to be part of a ESG and B-Corp company that is not just making waves, but redefining the future of marine travel. Whether driven by a passion for technology, sustainability, or the thrill of investing in a groundbreaking movement, Sealence offers a unique and exciting prospect.

For more details on its technology, market potential, and investment opportunities, visit link or contact the company directly at investors@sealence.it.