Aquis weekly movers: Zentra switches from Main Market

Manchester-based Zentra (LON: ZNT) switched from the Main Market to the Access Segment of Aquis with the help of Hybridan on Wednesday. The former One Heritage Group has discontinued its co-living and in-house construction services. The focus is high quality apartments and housing, as well as work for local authorities and housing associations. A portfolio of properties was sold for £7m after the end of June 2024. There is a conditional contract to sell land for £400,000. So far, £3m has been reinvested in a 30% stake in One Victoria, a residential and commercial development, in Manchester. It is scheduled for completion in the summer. Prior to the move the share price rose 60% to 4p. It has been unchanged since then.

AI software developer IntelliAM (LON: INT) has signed a letter of intent with SKF Lubrication System so the two companies can sell each other’s products. IntelliAM’s machine learning platform will be included in the latter’s products. If the acquisition of 53 Degrees North Engineering had been made at the beginning of the six months to September 2024, revenues would have been £1.61m and EBITDA £140,000. Annualised recurring revenues are £149,000. Chairman David Richards bought 7,142 shares at 70p each. The share price jumped 22.2% to 82.5p.

SulNOx Group (LON: SNOX) has raised a further £300,000 at 52.5p/share with a warrant attached. Unicorn AIM VCT has taken its stake to 5.39%. The share price improved 12.2% to 69p.

Marula Mining (LON: MARU) is withdrawing from planned projects in Zimbabwe. It is also relinquishing its interest in the Nkombwa Hill project in Zambia. This enables focus to be placed on the Blesberg lithium and tantalum project and other core interests. The share price increased 11.8% to 4.75p.

Ananda Developments (LON: ANA) has raised £150,000 at 0.35p/share following positive results for cannabis-based treatment MRX1. There was a significant reduction in blood plasma levels of NT-proBNP (N-terminal pro-B-type natriuretic peptide) levels. This biomarker is used in diagnosis and management of heart failure. The share price is 10.4% higher at 0.425p.

Igraine (LON: KING) has formalised its investment rights with GEM and its battery storage project development subsidiary BES3. The first site has been chosen. The share price rose 6.67% to 0.4p.

Vinanz Ltd (LON: BTC) has received commitments totalling £1.5m at 14.5p/share conditional on a move to the London Stock Exchange. This will fund the purchase of more Bitcoin mining machines. The share price edged up 0.82% to 15.375p.

FALLERS

Wishbone Gold (LON: WSBN) has raised £250,000 at 0.2p/share. The share price slumped 42.2% to 0.185p.

Mendell Helium (LON: MDH) says M3 Helium, which it has an option to acquire, has increased production to 100Mcf/day and is rising by 2Mcf each day. This enhances the potential value of the farm-in to Scout Energy’s acreage in the Hugoton field. The option has been extended to the end of March 2025. The share price fell 14.3% to 3p.

In the year to April 2024, Helium Ventures (LON: HEV) had net assets of £24,000, including £56,000 in cash plus £250,000 long-term investment and £30,000 in short-term investments. Since then, the company has been issued a 19.4% stake in Trackimo following the £250,000 subscription. Creditors include deferred payments to directors of £130,000. The share price slipped 6.67% to 3.5p.

AIM weekly movers: Positive news for Orosur Mining from drilling at Anza project

Sancus Lending (LON: LEND) chairman John Whittle acquired two million shares at 0.39p each and chief executive Rory Mepham bought three million share at an average price of 3.6p/share. Sancus Lending spent £2m on buying back ZDP shares funded by an issue of bonds for the same amount. That leaves 16.3 million ZDP shares, and their quotation will be cancelled. The ordinary share price recovered 50% to 0.45p.

Orosur Mining Inc (LON: OMI) has received assays from the second and third holes of the current drill programme at the Anza project in Colombia. There was a composite intersection of 77.3 metres @ 7.68g/t gold from surface at the second hole and 75 metres at 5.6g/t from surface at the third hole. This shows a continuing trend to the North West. The fourth hole is completed. The share price increased 48.7% to 8p.

Orcadian Energy (LON: ORCA) has revealed heads of agreement for a farm out deal for the 145bcf Earlham/Orwell project in the North Sea. A joint venture led by Independent Power Corporation is earning a 50% stake and Orcadian Energy is fully carried to first gas. The joint venture, which has also acquired the $1.5m Shell loan, will be repaid this free carry spending through an additional 30% share of project revenues until the cost is covered. Orcadian Energy is also selling 50% of HALO Offshore UK to Independent Power Corporation, which is securing £5m of acquisition finance for gas field buy outs. Orcadian Energy has a 50% interest in the P2634 licence in the North Sea that has been acquired by Serica Energy (LON: SQZ) from Parkmead (LON: PMG). The Orcadian Energy share price rebounded 48.6% to 13p.

Kazera Global (LON: KZG) 70%-owned subsidiary Whale Head Minerals has secured an offtake agreement with Fujax South Africa for an initial 100,000 dry tonnes of heavy mineral sands from the Walviskop project in return for 80% of the anticipated final sales price less certain costs. Production recently started. Fujax will make a prepayment of $600,000 in two tranches in December and January. The share price improved 47.6% to 1.55p.

FALLERS

ValiRx (LON: VAL) has raised £1.57m at 0.65p/share. The share price dipped by 48.3% to 0.775p. The cancer treatments developer will be spending the money on R&D for CytoLytix and new evaluation projects. Chief executive Mark Eccleston has subscribed for 17.7 million shares and intends to buy a further 3.08 million shares in the broker offer. There are warrants attached to each new share and they are exercisable at 1.3p each.

Data analysis software provider Cirata (LON: CRTA) says Marvell Semiconductor has renewed its existing contract for 12 months, which will generate $401,000. There were 358,000 shares issued to settle consultancy fees. The share price declined by one-third to 24.5p.

Impax Asset Management (LON: IPX) has lost the mandate from St James’s Place for its Sustainable & Responsible Equity Fund. It will end in February. There are £5.2bn of assets under management and annualised revenues will be reduced by £12.7m. In 2023-24, group revenues were £170.1m and underlying pre-tax profit was £49.4m. The share price dived 23.8% to 252p. That is the lowest it has been since 2020.

Industrial monitoring and maintenance systems supplier Tan Delta Systems (LON: TAND) says delays in orders mean that 2024 revenues will be lower than expected at £1.2m, down from £1.5m last year. The loss will be £1.2m. Net cash will be £3m. The share price slipped 23.4% to 18p. Tan Delta Systems joined AIM in August 2023 and raised £6m at 26p/share.

FTSE 100 set to finish week on a high

The FTSE 100 looked set to close the week out with a very marginal high despite the disappointing news the UK economy shrank in news in October.

“The UK economy has failed to deliver an early Christmas present for Sir Keir Starmer and Rachel Reeves, after it unexpectedly contracted 0.1% in October with construction and manufacturing both showing weakness, and services stagnating,” said Derren Nathan, head of equity research, Hargreaves Lansdown.

“On a brighter note, consumers are feeling more optimistic than they have for a while with the GfK consumer confidence index reaching a four-month high in December of minus 16. But with the major purchase index unmoved since last month, it may be more mince pies than new TVs that feel the benefit this Christmas. That reflects ongoing concerns around the prospects for growth in 2025. Confidence levels for the economy over the next 12 months remained unchanged at minus 26.”

Thankfully, the FTSE 100 does not reflect the UK’s soggy and slow economy, and stocks were little changed by the news of the economic decline that was attributed to the decisions made by the Labour government.

“The Budget continued to be blamed for the UK’s fragile economic performance as official figures showed GDP unexpectedly contracted in October, having also done so in September. This led to weakness in the pound, which can be helpful to the FTSE 100 given the relative boost it affords its dominant overseas earners,” said Dan Coatsworth, investment analyst at AJ Bell.

While US indices rocket to record highs, investors in London’s leading index must make do with a paltry gain of less than 1% on the week after the index rose 0.1% on Friday.

There was little conviction in the market moves on Friday with few FTSE 100 stocks moving over 1%.

Rentokil Initial was the top FTSE 100 gainer after announcing that an activist investor had increased their stake in the company. Rentokil shares were 3% higher at the time of writing.

Diageo was still feeling the positive impact of a broker upgrade with another 2% gain.

All eyes will be on the Federal Reserve and their interest rate decision next week.

AIM movers: Kazera Global offtake agreement and weak sales at Portmeirion

Kazera Global (LON: KZG) 70%-owned subsidiary Whale Head Minerals has secured an offtake agreement with Fujax South Africa for an initial 100,000 dry tonnes of heavy mineral sands from the Walviskop project in return for 80% of the anticipated final sales price less certain costs. Production recently started. Fujax will make a prepayment of $600,000 in two tranches in December and January. The share price increased 28.9% to 1.45p.

Versarien (LON: VRS) subsidiary Gnanomat has ben awarded a grant of approximately £663,000 for a project relating to next generation energy storage services. That covers 70% of anticipated costs of the 24-month project. The share price rose 16.4% to 0.0355p.

Orcadian Energy (LON: ORCA) is selling 50% of HALO Offshore UK to Independent Power Corporation, which is also securing £5m of acquisition finance for gas field buy outs. Orcadian Energy has a 50% increase in the P2634 licence in the North Sea that has been acquired by Serica Energy (LON: SQZ) from Parkmead (LON: PMG). This is a heavy oil prospect. The Orcadian Energy share price improved 14.4% to 12.875p.

GCM Resources (LON: GCM) has agreed an extension of the memorandum of understanding with Power Corporation of China over the Phulbari coal mine development. It lasts until 6 December 2025. The original prospective deal was announced in 2018. The share price is 14.3% higher at 2p.

FALLERS

Impax Asset Management (LON: IPX) has lost the mandate from St James’s Place for its Sustainable & Responsible Equity Fund. It will end in February. There are £5.2bn of assets under management and annualised revenues will be reduced by £12.7m. In 2023-24, group revenues were £170.1m and underlying pre-tax profit was £49.4m. The share price slumped 25.1% to 245.25p.

Portmeirion (LON: PMP) trading has been weaker than expected and the 2024 pre-tax profit forecast has been cut from £4.5m to £1m. South Korea and the US have been weak markets. Christmas stock was delivered late to the US and there were order withdrawals. Net debt is expected to be £7.4m. An unchanged divided of 5.5p/share is anticipated. The fragrance business is the bright spot. The share price slipped 14.6%to 175p.

Ongoing interim wealth management revenues at WH Ireland (LON: WHI) fell from £6.3m to £5.3m. The broking business was sold during the six months to September 2024. The underlying loss was reduced from £1.81m to £1.32m and cost reductions are underway to help to reach breakeven. Assets under management declined from $1.2bn to $1.1bn. The share price declined 8.06% to 2.85p.

Trading in Aura Energy (LON: AURA) shares has been halted pending a capital raising. An assessment of future capacity expansion at the Tiris uranium project in Mauritania. The production target update in September increased the mine life from 17 to 25 years. Options to expand production capacity in the third year of operations from the initial plan to produce to produce 2MIbspa U3O8 to produce up to 4MIbspa U3O8. At 3MIbspa U3O8 NPV8 would be $544m, while at 4MIbspa U3O8 it is $521m. Tamesis has been AIM appointed broker. The share price fell 6.45% to 7.25p.

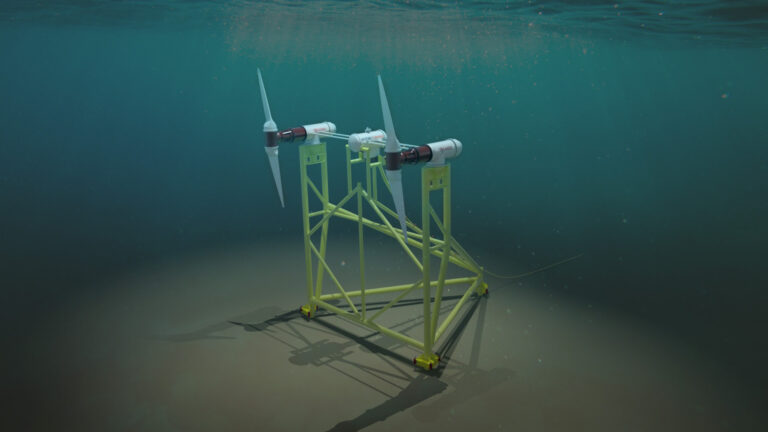

Inyanga offers investors exposure to the €53bn ocean energy market and its HydroWing technology

Inyanga Marine Energy Group, a pioneer in tidal energy technology, is raising funds to accelerate its innovative HydroWing technology rollout, capturing a share of the ocean energy market estimated to be worth €53bn by 2050.

The company is significantly expanding its global footprint with HydroWing projects earmarked for the UK, Europe and Indonesia.

The HydroWing technology, protected by eight international patents, represents a significant advancement in tidal energy generation. The system utilises next-generation T3 Turbines, each capable of producing 2x600kW, building upon the proven success of their T1 and T2 predecessors, which have accumulated 55 years of operational experience.

In Europe, Inyanga has achieved a notable breakthrough with its inclusion in the Interreg North-West Europe SHINES project, approved for funding on December 11, 2024. The project, which brings together 13 project partners and 4 associated partners from 6 countries, aims to accelerate the adoption of tidal and river energy across Northwest Europe.

The company’s flagship project at Morlais in Wales, scheduled for deployment in 2028, has secured a 20MW capacity allocation through the UK government’s Contracts for Difference scheme. A full-scale demonstration project is planned for 2025, preceding a more extensive deployment in the coming years. Investors participating in this funding round will secure exposure to Inyanga as it begins to deploy its innovative tidal technology.

Inyanga’s growth has been supported by funding from a mix of private investors and funds, including a £1.8 million capital raise in 2021 and a £0.9 million equity investment from the Cornwall and Isles of Scilly Investment Fund.

The company recently welcomed a delegation from Indonesia’s state power company PLN, marking a significant milestone in its international expansion.

The company has secured a binding agreement with a PLN subsidiary to develop a 10 MW tidal project in East Nusa Tengarra, Indonesia, which will be the country’s first tidal energy installation. This follows Inyanga’s recent contract win to construct Southeast Asia’s first tidal energy plant in Capul, Philippines.

CEO Richard Parkinson emphasised the technology’s particular relevance for island communities: “Tidal energy is the perfect solution for remote island communities such as in the Indonesian archipelago, as it can replace expensive and polluting diesel generators and provide base load energy, fuelled by the perpetual tides that surrounds these islands.”

Although Inyanga has identified an opportunity in the islands of Indonesia, the total technology can be deployed anywhere, as demonstrated by projects in Wales and Europe.

The global ocean energy market is projected to reach 350GW and be worth €53bn by 2050, with tidal energy installations having grown by 30.2 MW since 2010. Inyanga’s HydroWing technology aims to address traditional barriers to tidal energy adoption through reduced capital expenditure and maintenance costs, positioning the company to capitalise on this growing market

Inyanga is currently crowdfunding on Crowdcube, find out more here.

Impax Asset Management shares sink after St. James’s Place cancels underperforming mandate

Impax Asset Management Group announced today that St. James’s Place (SJP) will terminate its mandate to manage the Sustainable & Responsible Equity Fund, worth approximately £5.2 billion in assets under management.

Impax Asset Management shaes were down 20% at the time of writing and were London’s biggest decliner on the day.

The termination, expected to take effect in February 2025, is subject to approval by the fund’s unitholders at an Extraordinary General Meeting scheduled for January 9, 2025. The move will impact Impax’s annual revenue by an estimated £12.7 million.

According to Impax, SJP’s decision stems from a desire to diversify the fund across different investment styles. However, looking at the fund’s performance, SJP is probably tired of the poor performance.

Trustnet data shows the SJP Sustainable & Responsible Equity fund has consistently underperformed the benchmark having returned only 5% over three years compared to 17.7% for the benchmark.

The mandate represents Impax’s only partnership with St. James’s Place.

St. James’s Place themselves have been the subject of scrutiny in recent months amid accusations of poor service and customer support that is likely to lead to significant redress.

FTSE 100 rises after the NASDAQ storms to record high

The FTSE 100 jumped on the coattails of a US rally on Thursday after the NASDAQ broke through the milestone 20,000 mark to fresh record highs.

US tech shares have proved they still have the power to lift global investor sentiment. Strong sessions for Tesla and Google’s parent company, Alphabet, helped propel the NASDAQ to record levels, sending a wave of optimism through equity markets.

Alphabet shares rose after the tech giant announced its latest AI development.

“Alphabet unveiled Gemini 2.0 yesterday, its shiny new family of AI models that promises to be faster and smarter,” said Matt Britzman, senior equity analyst, Hargreaves Lansdown.

“Alphabet sees these models as a step toward the next chapter in language models where they handle tasks on your behalf, with highlights like better multitasking, complex reasoning, and tool use. While it’s still early days for this tech, investors liked what they saw from a name that’s sometimes seen as being behind in the AI race.”

Although the FTSE 100 has next to no exposure to technology, hopes the US tech rally could continue helped lift sentiment.

“The FTSE 100 ticked higher on Thursday after US stocks chalked up another landmark. The Nasdaq index yesterday smashed through the 20,000 barrier for the first time,” said Dan Coatsworth, investment analyst at AJ Bell.

“The catalyst for the tech-driven rally was a benign inflation reading. This fuelled expectations for an interest rate cut when the Federal Reserve meets next week.

“The Fed is in tricky position given the uncertainty over the incoming Trump administration’s agenda and the scope for tariffs to revive inflationary pressures.”

A rate cut next week is far from nailed on, but it is the most likely scenario. However, the Federal Reserve’s approach to interest rates in 2025 will drive trade the accompanying commentary next week will have the power to move the dial for global stocks.

Positive developments in the US overnight provided a welcome distraction from the China headline-to-headline trade that has dominated the week so far.

At the time of writing, around half of the FTSE 100’s constituents were trading positively, with banks and utilities helping to support the index.

Diageo was the FTSE 100’s top riser after UBS switched its sell rating to buy with a price target of 2,920p. Diageo shares were 3.4% higher at the time of writing.

IAG continued its rip-roaring rally with another 2% rise, extending its 2024 gains to 89%.