UK retail investors unphased by AI bubble fears – eToro

UK retail investors are heading into 2026 upbeat on technology stocks, particularly AI-related firms, despite ongoing concerns about market valuations, according to eToro’s latest Retail Investor Beat survey.

The trading platform’s poll of 1,000 UK retail investors revealed that 53% expect the bull market to continue through 2026, with the US remaining the preferred destination for long-term returns.

A third of respondents (33%) believe American markets will deliver the strongest performance. This has been echoed by surveys by other brokers.

Remarkably, months of market commentary about a potential AI bubble have done little to dampen respondents’ enthusiasm for shares. An overwhelming 81% of investors feel confident about their holdings heading into the new year, whilst just 12% anticipate a decline in AI stocks.

The so-called ‘Magnificent Seven’ tech giants remain investor favourites, with 83% expecting them to outperform or match broader market returns.

“Retail investors clearly aren’t buying the ‘AI bubble’ narrative”, said Dan Moczulski, UK Managing Director at eToro.

“Retail investors holding their nerve has been a key theme of 2025. Staying invested, buying the dip, investing consistently: many investors have been handsomely rewarded this year by blocking out the market noise and sticking to these golden rules.”

When asked about potential threats to the bull run, investors pointed to political uncertainty (40%), economic slowdown or recession (39%), and geopolitical instability (34%) as primary concerns. Notably, high market valuations and asset bubbles ranked lower at just 23%, suggesting investors are more focused on macroeconomic and political risks than valuation concerns.

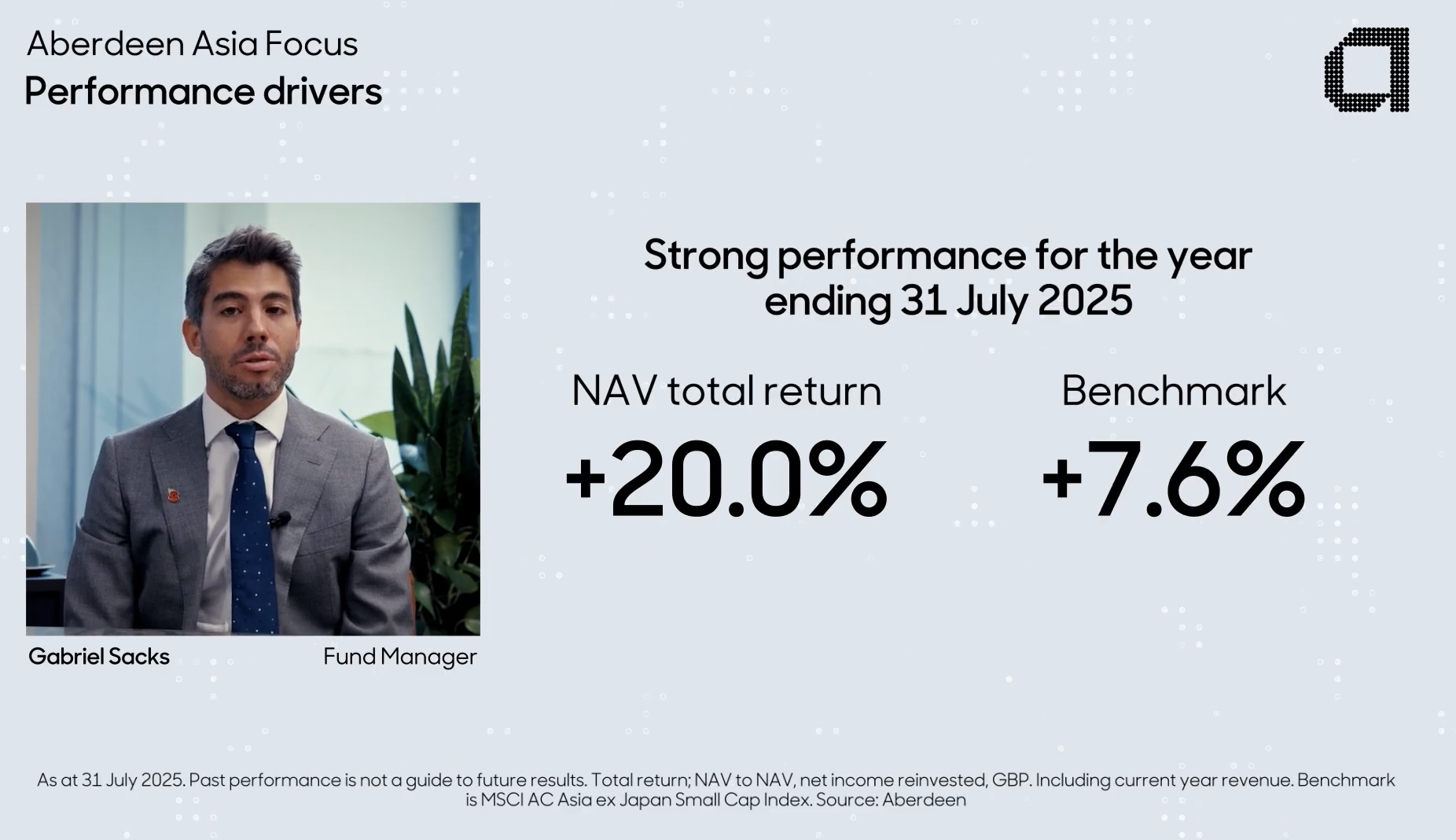

What’s driving growth in Asian smaller companies

Watch the latest manager update video for Aberdeen Asia Focus, featuring Lead Manager, Gabriel Sacks.

AIM movers: Everyman hit by poor box office and Made Tech grows

Digital transformation business Made Tech (LON: MTEC) increased interim revenues 27% to £27.7m and the full year will be better than expected. The contacted backlog slipped 8% to £74m, from what was a very strong level. Net cash was £11.9m at the end of November 2025. Full year pre-tax profit is expected to improve from £2.9m to £3.9m. The share price jumped 25.5% to 33.25p.

Oracle Power (LON: ORCP) says drilling at the Northern Zone gold project in Western Australia has identified gold mineralisation in the previously undrilled ‘saddle’ between the eastern and northwestern mineralised zones. The share price rebounded 23.5% to 0.04p.

Dekel Agri-Vision (LON: DKL) maintained cashew production at 700 tonnes in November. Higher palm oil prices are offsetting lower oil palm harvests. Dekel Agi-Vision is on course to be profitable in 2026. The share price improved 5.26% to 0.5p.

Customer engagement systems provider Netcall (LON: NET) is acquiring digital experience platform Jadu for an initial £15.2m in cash and shares. This will bring cloud-based technology and 76% of annual revenues of £7.4m are recurring. The deal should be earnings enhancing within one year. Canaccord Genuity has raised its 2025-26 pre-tax profit forecast from £9.4m to £9.7m, while next year’s has been increased from £10.7m to £11.9m. The share price is 4.13% higher at 113.5p.

Following yesterday’s trading statement by digital signage supplier Mediazest (LON: MDZ) showing annual revenues are estimated to be 30% higher at £4m in the year to September 2025, the share price has risen a further 2.78% to 0.0925p. Long-term incentive plans have been announced for directors. The related options have an exercise price of 0.09p. There are a total of 180 million shares under option.

FALLERS

Cinemas operator Everyman Media Group (LON: EMAN) has been hit by disappointing box office for films in the second half of the year. UK admissions have declined in recent months. Forecast revenues have been reduced to £114.5m, while EBITDA has been cut to £16.8m, which is slightly higher than last year. The share price slumped 23.9% to 27p.

Chemotherapy drug delivery technology developer CRISM Therapeutics (LON: CRTX) has raised £1m at 9p/share. The cash will be spent on progressing the MHRA approved phase 2 open label clinical trial of irinotecan-ChemoSeed in patients with surgically resectable glioblastoma. A retail offer is planned. The share price slipped 13.6% to 9.5p.

Blue Star Capital (LON: BLU) investee company SatoshiPay has onboarded its first customers to its fiat-to-crypto infrastructure platform. They include laCrypto in Brazil. Blue Star Capital shares slipped. The share price fell 6.98% to 10p.

Defence equipment and services supplier Cohort (LON: CHRT) reported interim revenues 9% higher at £128.8m, but pre-tax profit dipped from £9.8m to £8.8m. This was due to sales of lower margin products. The order book is worth £604.5m. The share price declined 5.89% to 1039p.

FTSE 100 steady as Scottish Mortgage gains on SpaceX IPO plans

The FTSE 100 carved out minor gains on Wednesday as the Scottish Mortgage Investment Trust rose on reports of SpaceX IPO plans.

London’s leading index was 0.1% at the time of writing, with investors’ attention firmly on this evening’s Federal Reserve interest rate decision.

“Happy Fed Day global markets – after much speculation and market-moving narrative, today the Federal Reserve Open Market Committee is expected to cut interest rates by 25bps,” said Emma Wall, Chief Investment Strategist, Hargreaves Lansdown.

“This cut is fully baked into markets, and any deviation will cause considerable upset. Global markets had a mixed session yesterday awaiting the news, with the S&P 500 falling slightly and NASDAQ up marginally. Futures look more positive across the Pond, with both indices looking to open up later today. Asian markets have had a negative session, while the FTSE 100 has opened up this morning in London.”

The UK will have to wait a little longer to learn the Bank of England’s interest rate decision, which will be released next week and is the last major event on the UK economic calendar for 2025.

Although markets are pricing in a UK interest rate cut to 0.25%, a reduction in UK borrowing costs is far less certain than in the US, with inflation proving a thorn in the side of BoE voting members. This has been reflected in tepid trade in UK-centric assets this week.

FTSE 100 movers

The Scottish Mortgage Investment Trust was among the top risers on Wednesday, on reports that SpaceX – its largest holding – was preparing for an IPO as early as 2026. SpaceX, a space exploration company founded by Elon Musk, is thought to be eyeing a $30bn fundraise as part of the IPO.

Scottish Mortgage Investment Trust shares rose 3% as investors saw the Baillie Gifford-managed trust as a way to get early access to the SpaceX IPO, which could value the company at $1.5 trillion.

Pearson was the top riser, adding over 3%, as the publishing and education group continued to recover from a selloff following a trading statement in October.

Berkeley Group enjoyed a solid session as investors looked to the future and overlooked interim results showing revenues and profits falling amid a slowing housing market.

“At least the company’s communication remains refreshingly clear. It is fully committed to its 10-year strategy out to 2035 which provides a roadmap to see it through any turbulence in the wider market. It also continues to be effusive about the strong dynamics behind the London property market,” said Dan Coatsworth, head of markets at AJ Bell.

“Berkeley has managed to keep a tight lid on costs, despite some inflationary pressures in labour and materials and this, coupled with the strength of its balance sheet, could help it to handle the ups and downs of the housing market.”

Berkeley Group shares were 2% higher at the time of writing.

Kingfisher shares fell following a broker downgrade by Deutsche Bank Research who now rates the DIY specialist as a ‘sell’.

Oracle Power shares surge on fresh gold discovery

Oracle Power shares jumped on Wednesday after announcing encouraging assay results from six drillholes at its Northern Zone Gold Project, situated 25 kilometres east of Kalgoorlie in Western Australia.

The latest batch reveals the highest grade of 11.0 g/t gold over one metre at 46 metres depth in drillhole NZAC153. Other notable intercepts include five metres at 3.09 g/t gold from 47 metres and seven metres at 1.58 g/t gold from 42 metres.

Oracle noted that gold mineralisation has now been identified in a previously undrilled “saddle” area between the eastern and northwestern mineralised zones, extending the project’s footprint.

The company’s partnership with Riversgold continues to encounter shallow gold mineralisation across the project area. Drilling for 2025 has concluded, with samples from 28 air core drillholes submitted for assay. Results from the remaining 37 drillholes are expected to arrive in batches over the next six weeks.

All in all, it’s been a positive campaign for Oracle and its shareholders, with shares up around 85% on the year.

A further nine grade control drillholes are anticipated shortly, which will provide additional detail on the deposit’s characteristics.

“Intersecting these gold grades in the previously undrilled saddle area between the eastern and the northwestern shallow gold zones is highly significant as it demonstrates the potential for these two zones to join together,” explained Naheed Memon, CEO of Oracle.

“Our modelling suggests that this could constitute a ~600m wide zone of shallow oxide mineralisation overlying the Northern Zone porphyry system.

“The two recently completed drill programs were designed to add to the gold footprint in the top 50-60m at the Northern Zone Project, and to enhance the MEGA Resources mining scenario for 2026. Results continue to expand the lateral footprint of Northern Zone and we are achieving the goal of making the Project bigger in the oxide zone. I look forward to updating shareholders as we progress the Project.”

Berkeley Group shares rise as guidance maintained

Berkeley Group shares rose on Wednesday after announcing revenue of £1,179.5 million in the six months to 31 October 2025, down from £1,278.9 million in the prior year, whilst maintaining an improved operating margin of 20.8% (2024: 20.2%).

The housebuilder sold 2,022 new homes across London and the South-East at an average price of £570,000, with the gross margin rising to 27.0% from 26.5%.

Sales reservations in the period were approximately 4% lower than last year, impacted by Budget-related uncertainty in the final two months. Forward sales stood at £1,137 million at period-end, down from £1,403 million in April, though Berkeley achieved values slightly ahead of business plan assumptions whilst maintaining pricing discipline.

Despite the softer sales performance, the group said pre-tax profit guidance for FY26 and FY27 remains on track.

“Berkeley’s near-8% slide in first-half profits is a wobble investors are not used to from the South East’s most reliable housebuilder. A drop to £254mn may not sound catastrophic, but for a house builder viewed by some as the sector’s cornerstone, it’s enough to make the sector sit up and take notice,” said Mark Crouch, market analyst for eToro.

“Berkeley insists it remains on track to deliver £450mn this year and a similar figure in FY27, supported by a strong net-cash position, but the update will be a significant body blow, especially after faint signs that the sector might finally be turning.

Crouch continued to explain that there are deep-seated constraints in the UK housing market that will act as a headwind for all UK housebuilders for the foreseeable future.

“Perhaps the inconvenient truth is that the strain UK housebuilders are facing isn’t really about supply at all, it’s about affordability. Mortgage rates hovering around 5% are historically unremarkable, but after a decade and a half of ultra-cheap credit they’ve reset the entire economics of buying a home. Add stubborn inflation, record high taxes and wages that refuse to catch up, and the average buyer simply cannot bridge the gap. Westminster’s new housing initiatives may help sentiment at the margins, but they don’t fix the maths.”

The question investors have is how much of this bad news is already baked into the price. A 2% rise in Berkeley shares on Wednesday suggests much of the negativity is factored in and investors are prepared to buy on any signs of positivity. Berkeley’s maintenance of guidance provided that today.

Everyman Media lowers full-year outlook amid weak Q4 Box Office

Everyman Media shares sank on Wednesday after the cinema group blamed a poor Q4 box office for falling revenues that will impact its full-year performance.

The premium cinema operator now expects revenue of no less than £114.5m for the year ended 1 January 2026, down from previous guidance, though still ahead of last year’s £107.2m. EBITDA is forecast at a minimum of £16.8m, marginally above the prior year’s £16.2m.

In September, the group had outlined forecasts for the year ended 1 January 2026 of revenue of £121.6m and EBITDA of £20.0m.

Everyman Media shares were down 18% at the open on Wednesday.

The downgrade comes as the company is hit by challenging economic conditions and disappointing Q4 box office takings across the broader UK cinema market. Net debt is now expected to reach approximately £24.0m at year-end, up from £18.1m in 2024.

Despite the reduced outlook, Everyman said it remains on track to achieve growth across all key metrics, including food and beverage spend per head, average ticket prices, and market share.

The company noted that 2024 was a 53-week trading period, meaning on a like-for-like 52-week basis, revenue would have been £103.8m and EBITDA £15.4m, representing stronger year-on-year growth.

“Notwithstanding the industry-wide challenges, to date this has been a year of progress in which we have achieved growth across our core operating metrics, delivering increased revenue, EBITDA and customer spend per head, as well as strong membership growth and expanding market share,” said Alex Scrimgeour, CEO of Everyman Media Group.

“The continued growth in customer satisfaction reflects our commitment to delivering the premium experience across our estate, and with our market leading position, we remain confident in the long-term growth opportunity in the premium cinema sector”.