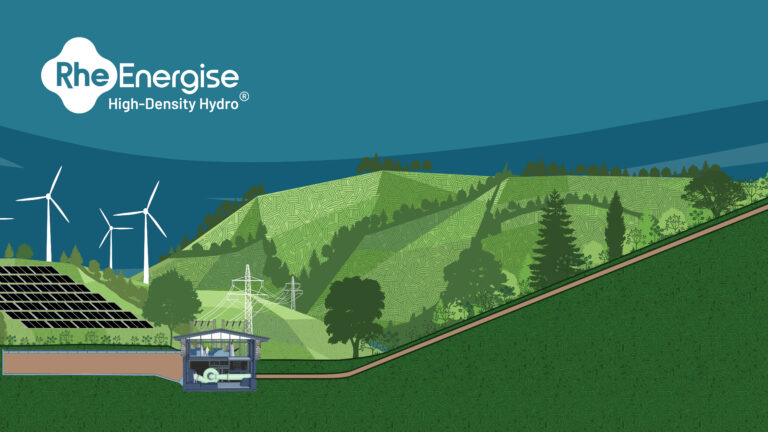

We are bringing innovation to pumped energy storage with our High-Density Hydro® solution, a -long duration energy storage technology that is low-cost, fast to build and globally scalable.

This century, we are witnessing the increasingly rapid transition from fossil-fuels to low carbon generation due to the critical tipping point we regularly face when dealing with climate change. Whilst this brings unapparelled opportunities, the race to deliver Net-Zero targets by 2030 is on. Power generation, that is now increasingly serving mobility, heat and industry, is becoming dominated by intermittent wind and solar power. This intermittency means that energy grids around the world require medium-long duration energy storage solutions to provide power grids with flexibility, reliability and stability. Our High-Density Hydro is a solution, that when deployed at scale, will support grid decarbonisation and the transition to Net Zero.

Drawing on the experience of hydropower systems that have been in use for a century or more, our engineers and scientists have devised HD Hydro to be low-cost, energy efficient, fast-to-build and environmentally benign. Rather than using water, we use a fluid that is 2½ times denser than water, and which can provide 2½ times the power when compared to a conventional low-density hydro-power system. It means that our system can be deployed beneath the surface of hills rather than mountains – so, turning small hills, found nearly everywhere, into batteries, and so opening up massive opportunities for its commercial deployment. HD Hydro is proven to outperform and outlast other similar types of energy storage solutions.

We are a young and ambitious company. The market pull for energy storage technologies is exceptionally strong as governments increasingly recognise the urgency to decarbonise over the next 30 years. We are assessing storage sites in the UK and Ireland, Spain and Chile for our first commercial-scale projects, with the USA, Canada and Australia firmly in our sights over the next 1-2 years. Our first phase of growth has benefited from significant support from the UK Government, with grants and contracts totalling over £1m in 2023 to add to the >£8.25m awarded in 2022 plus we have received incredible backing from private investors. We are now seeking new investors to take RheEnergise to the next level and realise the market opportunities that exist today and in the future.

Parallels between investment history of the wind industry and the investment opportunities in energy storage can be made. Vestas, the world’s largest manufacturer of wind turbines, made their first sale in 1979, by 2000 revenues were €858m and by 2021 revenues were €15,587m. Their growth is not expected to slow. We can expect that a handful of companies will dominate the short duration energy storage market, a further handful will dominate the inter-seasonal storage market, and lastly there will be a number of companies that dominate the medium duration energy storage space, such as RheEnergise.

BloombergNEF predict the global energy storage market to be worth US$620B by 2040, whilst Wood Mackenzie forecasts that 1TWh of medium-long duration energy storage will be needed by 2030.

As the world moves to a greater reliance on wind and solar power, help us to revolutionise energy storage. If you would like to know more about work and our investment opportunity, please register via this link or contact us via www.rheenergise.com

Visit Crowdcube for more information

Investment risk warning: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.