ECR Minerals, the exploration and development company focused on gold in Australia, has received the final rock chip sample results from its Hurricane Project in North Queensland.

ECR Minerals shares rose in the immediate reaction on Thursday.

The highlights include grab samples up to 45.7 g/t gold at Hurricane North and 43.2% antimony at Holmes South, equivalent to 83.38 g/t gold grade.

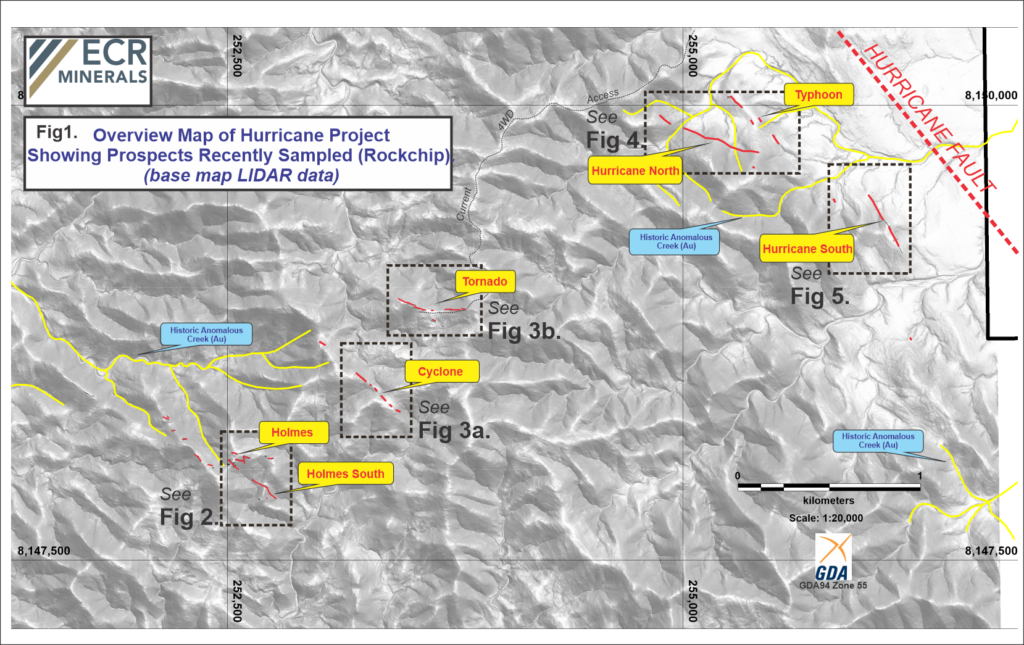

In total, assays were received for 224 rock chip samples collected across the project area. This sampling aimed to test the mineralised vein systems at prospects such as Holmes, Tornado, Cyclone and Hurricane North and South.

Mapping by ECR has confirmed quartz stockwork zones up to 20m wide at the Holmes prospect. The sampling results will help determine the size and extent of these mapped visible outcrops.

“As I have said previously, the Hurricane Project has been a key part of ECR’s strategic planning over the past year. The overall results package is extremely encouraging, and our thanks go to Adam Jones and the field team for an exceptionally comprehensive piece of field work,” said ECR Managing Director Nick Tulloch.

“It is clear that some of the grades and ‘drill ready’ zones indicate that ECR now has a potentially commercial proposition at Hurricane, but these conclusions have to be balanced against any cost of any option purchase agreed at the end of the extended time period, coupled with the capex required to progress the project to the next level. Along with Mike Whitlow, Adam Jones and the field team, we will now spend time assessing these results and how we can maximise the regional potential taking the wider Hodgkinson Province and our potential new Kondaparinga exploration license into account. I look forward to reporting back to you with our proposed course of action.”