The FTSE 100 powered to record highs on Wednesday, with precious metals miners and Lloyds helping the index shake off a poor session in the US overnight.

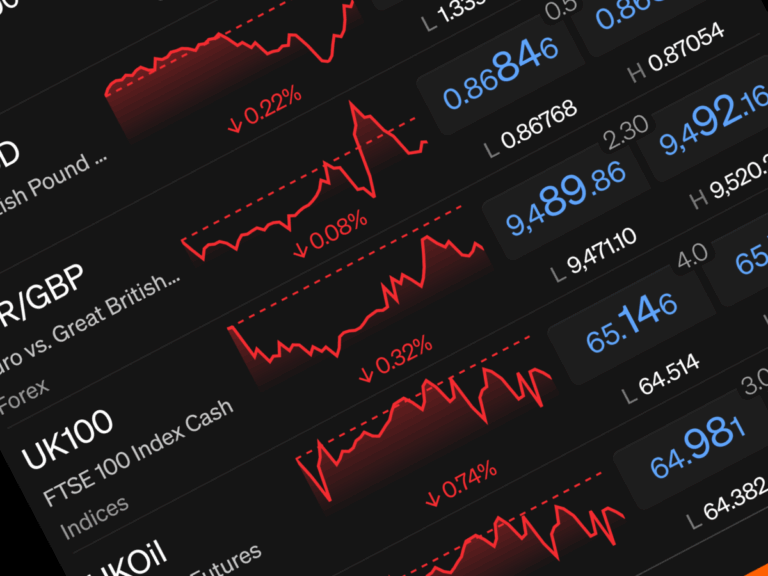

London’s leading index was trading at 9,532 at the time of writing.

“After a miserable day on Wall Street yesterday, European markets opened with a spring in their step,” said Russ Mould, investment director at AJ Bell.

“The FTSE 100 was propelled by Lloyds enjoying a relief rally amid relatively positive news on the motor finance scandal, while Endeavour Mining continued to shine off the back of gold surpassing $4,000 an ounce for the first time.

“While stock markets have generally done well this year, gold has been a superstar. Traditionally, investors would load up on the shiny stuff when markets look gloomy, not when they’re motoring ahead. It shows that investors are hedging their bets, particularly as there are growing concerns that euphoria around AI has gone too far and the bubble could burst at some point.”

Precious metals miners have been a core driving force in the FTSE 100’s gains so far this year, and Endeavour Mining and Fresnillo were again among the top risers as gold took out yet another key level on Wednesday

And the rally could be set to continue. The latest gains in gold are being attributed to the US government shutdown, which shows little sign of being resolved in the short term.

“This latest high marks the latest stage in what has been a meteoric rise in the gold price, which has now doubled in the last two years,” said Steve Clayton, head of equity funds, Hargreaves Lansdown.

“Some are pointing to the ongoing US government shutdown, where Federal workers have been sent home, possibly with no pay, if overnight reports of President Trump’s intentions prove accurate.”

Endeavour Mining was the top FTSE 100 riser with gains of 2.7%.

Lloyds was also among the top risers as investors cheered an FCA proposal that could mean the financial impact of the motor finance scandal for Lloyds is less than previously feared.

“The motor finance scandal is proving to be less dramatic than thought. Lloyds’ shares jumped after the regulator proposed that motorists would get £700 on average in compensation, lower than the previous indicated amount of £950,” Russ Mould said.

“Lloyds has already taken a £1.2 billion provision to cover the cost, which now looks like a reasonable assumption. The fact its share price jumped means the market is comfortable with the outcome and that a big uncertainty factor will soon be removed.

“Lloyds’ management will be keen to shift the market’s focus to the bank’s growth opportunities in the future, not what it has done in the past.”

Lloyds shares were 2% higher at the time of writing.