FTSE 100 outperforms Europe as oil jumps on OPEC production cut

The FTSE 100’s weighting towards natural resources helped London’s leading index outperform European peers on Monday.

Oil majors were behind the FTSE 100’s relative outperformance on Monday after OPEC announced a supply cut that sent oil prices soaring. WTI and Brent oil futures contracts were both trading over 5% higher at the time of writing.

While higher oil prices will be welcome news to oil and gas investors, higher energy prices are the last thing governments and central banks want to see.

Over the past six months, subdued hydrocarbon prices have been a significant factors in falling inflation.

Rising oil prices could now threaten all recent inflation and interest rate forecasts for the rest of this year. They may also push back expectations of when interest rates will eventually fall.

Concerns about the impact of oil prices were most evident in US futures. S&P 500 futures traded lower before rallying back to break even.

“The world needed a spike in oil prices like a hole in the head. Just as one of the pinch points in the global economy had started to ease, Saudi Arabia and its counterparts in OPEC have unveiled a surprise output cut,” said Danni Hewson, head of financial analysis at AJ Bell.

“The decision by the oil producers’ cartel, unusually taken outside of any officially scheduled meeting, represents a flexing of its muscles and potentially a pre-emptive move as it anticipates a drop-off in crude demand relating to the collapse of SVB and ensuing banking crisis.

“It is this crisis which has helped box central banks in when it comes to their ability to control inflation as they have to think about their role in preserving financial stability too.”

Although OPEC’s surprise cut in production will cause a major headache for central banks and governments, Hewson spelled out the benefits of higher oil prices for the FTSE 100 index.

“Rising oil prices imply higher costs of energy, transportation and other areas like plastic. The heavy exposure of the FTSE 100 to energy and resources stocks is looking like an attribute again as index heavyweights BP and Shell help lift the index. It is telling that the more domestic focused and diversified FTSE 250 is down a smidge on Monday.”

BP and Shell were both in excess of 4% higher and added a significant number of points to the FTSE 100 on Monday. Centrica was up 2%.

The prospect of higher interest rates for a longer period provided support for the FTSE 100’s banks as Barclays, Lloyds and Standard Chartered and HSBC all added more than 1%.

AIM movers: Record order for Saietta and Tungsten West cuts costs

Saietta Group (LON: SED) has gained its largest order for its eDrive systems. The £5m order is for 3,000 bespoke systems based on the AFT140 motor from Nasdaq-listed urban delivery vehicles manufacturer AYRO. Saietta is exclusive supplier for the Vanish vehicle launched in February. First deliveries will be in the autumn and the full number delivered by the end of 2024. Forecast revenues for the year to March 2024 are £12.1m. The share price jumped 45.6% to 64.5p. The July 2021 placing price was 120p.

Litigation finance provider Burford Capital (LON: BUR) has secured a positive ruling from a New York court on the Petersen and Eton Park cases against the Republic of Argentina and YPF. The court decided that Argentina was liable for failing to make a tender offer for YPF shares. The damages could be between $2bn and $3bn, plus interest. Burford will take a large share of this payout. Peel Hunt has increased its previous estimate of book value for Burford Capital from 1046p a share to 1268p a share. The share price increased 27.4% to 961.25p.

Block Energy (LON: BLOE) says that the WR-BO1Za well produced 269 barrels of oil equivalent/day in an extended well test over 12 days. Further wells are planned for the Krtsansi field, onshore Georgia. Cash generation will be spent on the drilling and workover programme. The share price improved 24.3% to 1.15p.

Oil and gas company 88 Energy Ltd (LON: 88E) says the Hickory-1 well in Alaska has revealed a new upper slope fan system reservoir, which had not been intersected by previous wells. There are multiple indicated pay zones, which will be assessed over one week. This will be used to design the flow test for the well. The share price rose by one-fifth to 0.6p.

Tungsten West (LON: TUN) is restructuring the operations of its Hemerdon tungsten and tin project in Devon. Costs will be cut and surplus assets sold. Concentrate at the site will be sold. Project funding is being discussed. A convertible not issue will raise at least £5m and an open offer could raise up to £2m. The share price slumped 48.8% to 5.5p.

Data analytics services provider D4T4 Solutions (LON: D4T4) will not achieve expectations in the year to March 2023 because of delays to contracts. Revenues are likely to be 23% lower than previous expectations at £21.5m, while pre-tax profit will be one-third below estimates at £3.5m. Profit is falling by a lower percentage because low margin hardware sales are mainly responsible for the revenue shortfall. The share price declined 13.3% to 180p.

Oil and gas company Serinus Energy (LON: SENX) has suspended workover operations on the rig programme to install a submersible pump into the W-1 well on the Sabria field, onshore Tunisia, in which it has a 45% working interest. There are problems removing the coiled tubing. The rig will move to the Sabria N-2 well to remove wellbore restrictions and recomplete the well. The share price fell 8.7% to 5.25p.

ECR Minerals (LON: ECR) released its accounts for the year to September 2022 just in time to avoid a share suspension. There was a £2.6m cash outflow before financing during the year. There is positive news from the three exploration targets in the Lolworth Range area in Australia. There have been some significant results for niobium and tantalum from samples taken. The share price slipped 8.33% to 0.55p.

Cineworld share sink on restructuring plan developments

Cineworld shares sank on Monday as equity holder value destruction ratcheted up with developments in their restructuring plans.

New equity will be issued to lenders as part of a restructuring deal. Cineworld also announced a rights issue to raise additional capital. The rights issue will be offered to existing lenders and seeks to raise $800m.

Cineworld said their restructuring plans do “not provide for any recovery for holders of Cineworld’s existing equity interests.”

Cineworld shares were down over 22% at the time of writing.

“Cineworld’s shareholders had been given plenty of warning their investment in the business could be wiped out by a debt restructuring and this looks like it will soon happen. The company’s lenders are going to gain control through a debt for equity swap and a rights issue, giving Cineworld yet another throw of the dice to try and sort out its finances,” said Danni Hewson, head of financial analysis at AJ Bell.

“Keeping the US and UK operations and only potentially selling its Eastern European and Israeli sites will streamline the group and put it in a better position to ride the recovery in the cinema industry – if it comes.”

Hewson continued to explain the deep issues facing cinemas with the rise of streaming platforms.

“That’s a big ‘if’ as competition from streaming platforms has become intense and film-lovers are increasingly happy to watch new releases at home. It helps that gigantic flatscreen TVs are much more affordable these days, as are speakers, so it is easy to create a good cinema experience in the home.”

North America propels Gaming Realms

Growth in North America propelled Gaming Realms (LON: GMR) during 2022 and it is continuing into this year. Newer markets are yet to make a significant contribution.

AIM-quoted Gaming Realms develops online real money-based and social games, which are licenced to partners around the world. The focus is slots and bingo games. The growth is coming from real-money games.

In 2022, revenues grew from £14.7m to £18.8m, while underlying pre-tax profit increased from £2.5m to £2.8m. Even though social gaming revenues were flat, the profit contribution increased because of lower marketing spending.

Cash generation is strong and more than covers capitalised development costs. Net cash is £2.92m.

North American revenues more than doubled last year. The North American online casino market is set to grow significantly, and Gaming Realms can also gain market share. Revenues are growing quarter on quarter. There is also plenty of growth to come from other countries.

It can take around three years for a new market to mature. Gaming Realms entered three new markets in Europe last year and it is set to enter even more markets this year – depending on the timing of regulatory approvals.

Future

This year has got off to a strong start with a 53% increase in revenues in the first two months. Peel Hunt is forecasting 22% growth in revenues for 2022, but it points out that the first half tends to be a weaker period. Even so, there could be scope for upgrades later in the year.

A 2023 pre-tax profit of £7.4m is forecast. At 26.9p, the shares are trading on less than eleven times prospective 2023 earnings and the multiple could fall to eight next year.

The cash pile will continue to build up – it could reach £15m by the end of 2024 – and acquisitions may be considered to enhance growth. For now, there is plenty of organic growth to go for. Good value.

Burford Capital wins major case

Litigation finance provider Burford Capital (LON: BUR) has secured a positive ruling in a major case. Trading in the shares was suspended on Friday afternoon when the verdict was announce and when trading recommenced this morning the share price jumped 25.2% to 944.5p, having been above 1000p early in the morning.

This case has been described as one of AIM-quoted Burford Capital’s four pillars of value. The damages could be between $2bn and $3bn, plus interest. Burford will take a large share of this payout. The size differs by case.

Peel Hunt has increased its previous estimate of book value for Burford Capital from 1046p a share to 1268p a share.

The New York court published an Opinion and Order on the Petersen and Eton Park cases against the Republic of Argentina and YPF. This case has been going on since 2015.

The court decided that Argentina was liable for failing to make a tender offer for YPF shares and the arguments made by Argentina to reduce damages were unavailing. YPF was found not to be liable.

The next step is a hearing to resolve two factual issues and then the level of damages can be calculated. However, Argentina is likely to appeal and that could take 12-18 months.

The case can be found at http://investors.burfordcapital.com.

Belluscura shares jump after starting manufacturing in China

Tekcapital portfolio company, Belluscura, has started manufacturing its X-PLORTM portable oxygen concentrator in China.

The agreement to begin manufacturing in China was made with InnoMax Medical Technology in 2022 and the move is hoped to accelerate Belluscura’s overseas expansion.

The Asian Pacific medical oxygen concentrator market expected to reach $1bn by 2027.

Belluscura shares were 15% higher after the announcement in early trade on Monday.

“We continue to make good progress, with manufacturing in China commencing, increased orders for X-PLOR and the tremendous reception of DISCOV-R by the industry at Medtrade,” said Robert Rauker, Chief Executive Officer, Belluscura.

Award

In addition to announcing Chinese manufacturing, Belluscura announced their DISCOV-R had received the Silver Award in the Best New Product category at Medtrade.

Medtrade is the largest home medical equipment trade show in the US and participants said Belluscura’s technology was ‘transformational’ for the oxygen supply industry.

Aquis weekly movers: Good Energy returns to profit

Marula Mining (LON: MARU) continues its rise ahead of the proposed move to AIM. The share price was 40.8% higher on the week at 12.5p, having reached a high of 12.875p during Friday.

Ananda Developments (LON: ANA) rose 17.3% to 0.475p after it published a medicinal cannabis research round-up. The sublingual spray shows promising results in diabetes type 2 patients. There has also been progress in explaining the mechanisms of action of CBD alleviating bladder pain syndrome.

Good Energy (LON: GOOD) recovered 13.3% to 212.5p after reporting full year figures. Revenues jumped from £146m to £248.7m as energy prices increased, while the energy supplier returned to profit. There was net cash of £19m at the end of 2022. The book value of Zap-Map is £13m. Management is seeking to expand its energy efficiency services operations.

Western Selection (LON: WESP) shares are 12.5% higher at 45p. The investment company reported an interim pre-tax profit of £200,000. Following the subsequent sale of treasury investments and the £4m received after the takeover of Crestchic, there is cash of £11.6m – equivalent to 64.6p a share. The remaining core investment is in AIM-quoted Kinovo. NAV has risen to 80p a share.

Wine maker Chapel Down Group (LON: CDGP) increased underlying pre-tax profit by 22% to £1.7m in 2022. Singer expects this profit level to be maintained in 2023 before more than doubling to £4m by 2026. Net cash is £3.3m. NAV is 38p a share. The shares are 9.09% ahead at 36p.

Capital for Colleagues (LON: CFCP) had net assets of 77.78p a share at the end of February 2023. There are 13 companies in the investment portfolio. Castlefield Investment Partners has reduced its stake from 45.9% to 42.1%.

Invinity Energy Systems (LON: IES) has made a sale of a 1.5MWh energy storage system to STS Group for a solar storage project in Hungary. The share price rose 5% to 31.5p.

RentGuarantor Holdings (LON: RGG) has entered into an agreement with Vorensys for the use of the RentGuarantor services. Vorensys provides tenant referencing services. The share price improved 4.08% to 255p.

Arbuthnot Banking Group (LON: ARBB) reported better than expected 2022 results. Pre-tax profit jumped from £4.6m to £20m and the dividend was raised by 11% to 42p a share. The loan book increased by 11% to £2.2bn. NAV is 1411p a share. The share price improved 2.15% to 950p.

==========

Fallers

Visum Technologies (LON: VIS) made an interim loss of £457,000 on revenues of £120,000. The first US location for its theme park video technology was opened in November. Debt financing has been secured for rides and attractions. Existing sites in Europa Park and Linnanmaki will reopen in April. The financial position is expected to improve. The share price slumped 35.3% to 5.5p.

Valereum (LON: VLRM) has sold shares in subsidiary Valereum Collections raising £70,500 at 625p a share. Valereum retains a 99.8% stake in the company, which will operate the group’s NFT programme. The Valereum share price dived 23.6% to 5.25p, which is a new low for the year.

Shares in Asimilar (LON: ASLR) fell ahead of the trading suspension on 3 April due to the accounts not being published in time. The share price slipped by 21.1% to 1.875p.

KR1 (LON: KR1) has invested $500,000 in Hydra Ventures, which supports and incubates decentralised autonomous organisations, in return for 5,000 HYDRA tokens. This is part of a $10m fundraising. The share price was 5.43% to 43.5p.

AIM weekly movers: ECSC takeover

Daisy Group is making an agreed bid for ECSC (LON: ECSC), which values the cyber security services provider at £5.4m. The bid is 54.02p for each share in cash. The share price jumped 144% to 50p. A few days prior to the bid, ECSC was trading at an all-time low. ECSC joined AIM at the end of 2016, when it raised £5m at 167p a share. ECSC fits well with business technology and communications services provider Daisy and there is cross-selling potential.

Footwear retailer Unbound Group (LON: UBG) has received a 10.5p a share potential offer from WoolOvers Group. There would also be a contingent value right that would give shareholders the proceeds of any insurance claim related to business interruptions due to Covid lockdowns. Unbound management says it would be likely to accept this offer. The share price recovered 113% to 8.5p.

Verici Dx (LON: VRCI) continued rise following the previous week’s operational update. The developer of clinical diagnostics for organ transplants has recovered from 4.75p on 20 March to 13.5p, up 92.9% on the week. Post kidney transplant rejection assessment product Tutiva has been launched and pre-transplant product Clarava should be launched before the end of 2023. The Medicare reimbursement pricing for Tutiva should be secured by the end of June.

Energy-as-a-Service provider eEnergy Group (LON: EAAS) reported a 58% rise in interim revenues to £15.1m and it underlying pre-tax profit improved from £200,000 to £700,000. Cash generation should start to improve in the second half with net debt of £6m forecast for the end of June 2023. Full year revenues expectations are 93% underpinned by contracts. A pre-tax profit of £3.6m is forecast for 2022-23. The share price improved by 85.9% to 5.02p, which is six times forecast earnings.

Biodexa Pharmaceuticals (LON: BDRX) was previously known as Midatech Pharma and at the beginning of the week there was a 20-for-one share consolidation. That led to a 60.5% decline in the share price to 7.5p. Trading on AIM is set to be cancelled on 26 April with the Nasdaq listing being retained.

Scottish gold producer Scotgold Resources (LON: SGZ) has been hit by falling ore grades at the Cononish gold mine. The average gold grade in January was 5.65g/t. compared with an estimated grade of 7.35g/t. A different part of the mine is being developed and the production process is being changed. Shore has its forecasts under review because of concerns about the financial position of the company. The share price has slumped 60.5% to 15p.

On the same day as the bid for ECSC was announced and the last day of its financial year, rival cyber security consultancy and services provider Shearwater Group (LON: SWG) admitted that its 2022-23 results will be below expectations. Cenkos slashed its revenues forecast for the year to March 2023 from £37.7m to £27m and suspended 2023-24 forecasts. There is still £3.4m in cash after the expected full year loss. The share price fell 42.5% to 50p.

There are more delays for the electric vehicle contract due to redesigns and that means that Trackwise Designs (LON: TWD) will run out of cash more quickly than expected. Delayed payments mean that the current cash may only last until May, and not August, unless the problem is sorted out quickly. There will be an impairment charge on assets with the 2022 figures. The share price dived 37.2% to 0.675p, compared with the recent fundraising price of 1p.

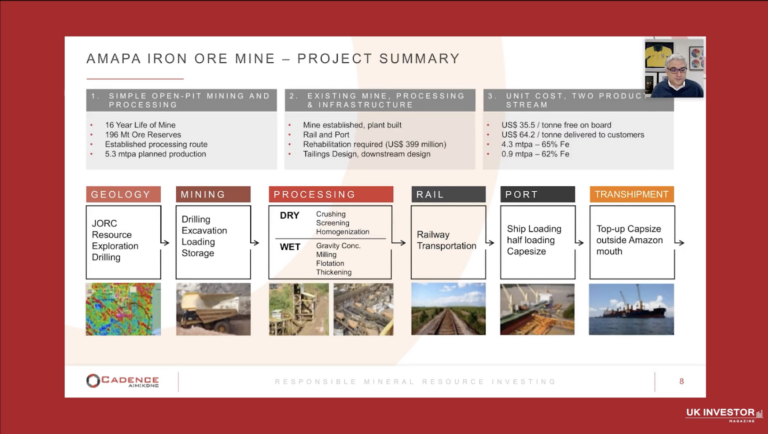

Cadence Minerals Investor Presentation March 2023

Download Presentation Slides Here

Cadence Minerals is an early stage investment and development company within the mineral resource sector and is listed as an investment company on the London Stock Exchange AIM market and the Aquis Stock Exchange, also based in London.

Their strategy is to identify undervalued assets, with irreplaceable strategic advantages that will deliver capital growth to our shareholders. They invest in these assets and where required help deliver capital growth.