Aberdeen Investments has launched two actively managed ETFs targeting investment themes that the asset managers identify as reshaping the global economy: trade tensions, intensifying “tech wars,” and surging demand for new materials.

The abrdn Future Supply Chains UCITS ETF and abrdn Future Raw Materials UCITS ETF are designed to provide investors with exposure to Aberdeen’s highest conviction investment ideas in these areas through the low-cost, liquid structure of Active ETFs.

Active ETFs are becoming increasingly popular in the UK, with a raft of asset managers launching new products into the market after the storming success of the structure in the US.

Aberdeen has adopted a strategy of selecting clearly defined investment themes, as opposed to broad geographical mandates. This approach has enjoyed early success with one of the funds gaining by a third in just a few months.

The abrdn Future Supply Chains UCITS ETF focuses on companies positioned to benefit from the significant restructuring of global supply networks. The ETF is 6% higher since its launch in July.

Aberdeen identifies several key drivers behind this transformation:

Government policies have become increasingly focused on domestic production, with many nations implementing incentives and subsidies to encourage local manufacturing. This shift toward more insular economic policy represents a departure from decades of globalisation.

Companies are actively reducing their dependence on foreign suppliers as tariffs and fiscal policy changes take effect. The growing trends of reshoring—bringing production back to home countries—and nearshoring—moving production closer to end markets—are creating structural shifts across industries.

“Global supply chains are becoming more complex. With national security and trade becoming more closely aligned, geopolitics is changing the nature of trade flows,” said Lizzy Galbraith, Senior Political Economist at Aberdeen Investments.

“Some of the countries most exposed to tariffs will have the most to gain from reshoring – we believe that many of the economies at greatest risk of trade-related uncertainty are likely to be the long-run winners. Countries like Vietnam and Mexico for example have the greatest exposure to punitive action from Washington, and yet, Mexico’s integration with US supply chains and a strong manufacturing base in APAC countries including Vietnam make them likely winners of reshoring, given the ongoing structural geopolitical tensions with China.”

Raw materials for a new economy

The abrdn Future Raw Materials UCITS ETF targets companies involved in supplying the essential materials needed to build what Aberdeen describes as “a greener, smarter world.”

The fund, which has had a storming start to life, gaining 33% since launch, is positioned to capitalise on increasing demand for raw materials critical to renewable energy infrastructure, electric vehicles, advanced technology manufacturing, and other elements of the emerging low-carbon economy.

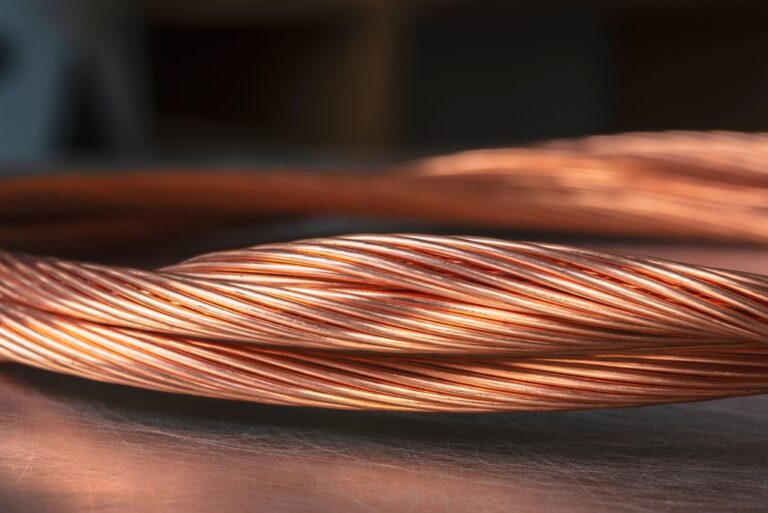

Managers have selected a range of metals they see as critical to the green transition. These include Copper, Nickel, Lithium, and Aluminium. In addition to these metals, the ETF currently focuses on three rare earths: Neodymium, Lanthanum, and Yttrium.

Speaking at a launch event at the London Stock Exchange, managers explained that the metals and materials the fund focuses on are constantly under review, and they are prepared to adjust the portfolio to capture emerging opportunities.

“The fundamentals are pointing towards the start of a new supercycle in raw materials. Technological advancements in batteries, EVs and semiconductors, combined with global policy support, increasing grid demand and rising renewable energy usage, are strong tailwinds underpinning long-term structural demand for certain raw materials,” said David Clancy, Research Director for Quantitative Index Solutions at Aberdeen.

“We see five strategic minerals in particular as key to supporting the green transition and technology revolution – copper, lithium, nickel, aluminium and rare earth elements. Demand for these materials looks set to increase significantly over the coming decades.”

Long-term investment thesis

Aberdeen emphasises that the themes they have selected for their Active ETFs aren’t temporary market dislocations, but rather sustained structural changes with “genuine duration” that will materially impact global equity markets over the long term.

“As with all major economic shifts, there will be winners and losers,” Abderdeen noted, suggesting that active management will be crucial in identifying which companies are best positioned to benefit from these transformations.

The launch of these ETFs reflects Aberdeen’s view that the intersection of geopolitical tensions, technological competition, and sustainability imperatives is creating compelling investment opportunities for those able to identify the companies most advantaged by these evolving trends.

Both funds are now listed on the London Stock Exchange, providing investors with access to Aberdeen’s thematic investment expertise in an exchange-traded format.