Shearwater gaining cyber contracts

Cyber security services provider Shearwater Group (LON: SWG) is growing rapidly on the back of increased demand for cyber security. New contracts worth £25m were won in the fourth quarter of the year.

In the year to March 2022, Shearwater revenues increased from £31.8m to £35.9m. Two customers account for more than two-thirds of those revenues. The overall growth was held back by a decline in software sales, while the products are re-engineered so that they are part of one integrated platform. The main growth was in security solutions. US revenues grew 26% to £1.5m.

Shearwater moved from breakeven to an underlying pre-tax profit of £900,000. Higher depreciation and amortisation charges mean that pre-tax profit is expected to fall to £500,000 this year, although EBITDA should be higher. Historically, there tend to be upgrades later in the financial year.

There are already £14m of revenues secured for this year, which is 37% of the forecast of £37.7m. There is potential for software contracts, although there may be more SaaS-based revenues meaning that it will take time for these revenues to build up.

There are increasing numbers of cyber attacks and they can be highly costly to corporates. This is making them more aware of the requirement for good cyber security services and software to be in place.

AIM weekly movers: Tintra platform progress and Ince discounted fundraising

Tintra (LON: TNT) has fast-tracked development of its banking platform and is six months ahead of the roadmap. Tintra intends to raise $25m to fund further development and it believes that it can be done for no more than 10% of the company. It is not clear how this will be done. The shares jumped 78.9% to 170p at the end of the week and they are more than treble the level at the beginning of the year.

Gas and electrical services provider Kinovo (LON: KINO) shares have risen on the back of Jersey-based Tipacs2 Ltd increasing its stake from 13.9% to 25.7%. The company is related to Thomas and Nikolaus Wilheim. The stake first went above 3% in September 2020. MI Sterling Select Companies Fund sold its 9.93% stake. Kinovo is growing its revenues, but it has potential liabilities relating to the DCB business it sold and subsequently got into financial difficulties.

John Selaschi has acquired a 5.13% stake in Active Energy Group (LON: AEG) and the share price rose 62.7% to 6.8p on the week. He also owns an 8.34% stake in Verditek (LON: VDTK).

Coal miner MC Mining (LON: MCM) shares rose 61.3% to 12.5p. MC Mining is finalising a debt and equity funding package for the hard coking coal Makhado project. The bankable feasibility study is being extended to include alternative development plans to enhance th4e value of the project. Performance improvement initiatives are underway at the Uitkomst colliery.

The share price of battery technology developer Ilika (LON: IKA) continues to recover following the recent results. It is 40.5% higher on the week at 78p.

==========

Fallers

Professional services provider Ince (LON: INCE) is the worst performer in the past week after it raised £7m at 5p a share, which was a 58% discount to the previous market price. The share price fell 65% on the week to 5.3p. Ince is also taking on an additional £1.6m loan. Ince has been operating at the limit of its debt facilities following the recent acquisition of broker Arden Partners. There was a cyber attack which management estimates cost £4.9m in cash. An insurance claim has been lodged for this amount, but that could take 12 months to settle. Insurance proceeds would be used to pay off loans. Annual cost savings of up to £5m are being targeted. Revenues are recovering, although Arden had a quieter than expected first half.

Parsley Box (LON: MEAL) floated at 200p at the end of March 2021 and it has fallen to a new low of 11.25p, down 37.5% on the week. Trading is poor and marketing spend is being reduced due to low response rates. First half revenues slumped from £14m to £9.6m. finnCap has reduced its full year revenues forecast to £19m and the expected loss increased to £4.6m. The loss could continue for at least two years and cash could be run out by the end of 2024.

Payment services provider Cornerstone FS (LON: CSFS) continues to decline following the exit of chief executive Julian Wheatland. The share price fell a further 21.4% to 8.25p.

FTSE 100 rallies with global equities as investors look past US recession

The FTSE 100 was buoyed by shining corporate results from several companies in a busy week for the market, with the blue chip index closing 1.1% higher at 7,428 at close of trading on Friday.

US markets enjoyed a boost with Amazon and Apple reporting sales ahead of market expectations and hopes that the US Federal Reserve might ease back on interest rate hikes, given the US has already entered a technical recession.

The Dow Jones was 0.1% higher at 32,586.1, with the S&P 500 rising 0.5% to 4,093.5 and the NASDAQ up 0.5% to 12,233.5.

“The FTSE 100 continued to grind upwards on [Friday], putting it on course to end a pivotal week in positive territory,” said AJ Bell investment director Russ Mould.

“Also helping sentiment was good news from Amazon and Apple, with both managing to deliver better-than-expected sales despite rising prices and a weakening consumer outlook.”

“It says something about the looking glass nature of investing right now that seemingly bad news in the shape of the US meeting the technical conditions for a recession – even if the ultimate arbiter the National Bureau of Economic Research is still to deliver its verdict – is seen as a positive development as it might lead the Fed to ease back on rate hikes.”

NatWest

NatWest shares gained 8.2% to 248.9p as the banking giant exceeded market expectations with a £2.6 billion operating profit in the interim.

The firm announced a 13.1% return on tangible equity and a cost:income ratio of 58.3% from 67.6% in the previous year.

NatWest reported a total dividend of 20.3p for the HY1 2022 period.

“In a mixed UK bank reporting season so far, there’s no question who is getting the gold star,” said Mould.

“Natwest has knocked it out of the park with its latest results. It’s hard to see what more it could have done to impress the market.”

Croda

Croda shares increased 5% to 7,498p on the back of a tripled HY1 profit linked to high demand in its Consumer Care business.

The company saw a pre-tax profit spike to £636.5 million against £204.1 million the last year.

Croda reported an 8% rise in its interim dividend to 47p from 43.5p in the previous year.

Rightmove

Rightmove shares fell 0.5% to 639.6p, despite a 9% revenue growth to £162.7 million in HY1 2022 from £149.9 million the last year as a result of increased digital products used by customers.

The property site confirmed a 6% operating profit rise to £121.3 million compared to £114.9 million year-on-year.

“This is another decent set of results from Rightmove, helped by a housing market that has remained robust,” said Wealth Club head of equities Charlie Huggins.

“How long can that last with interest rates rising and inflation at a 40-year high? Only time will tell. However, even if the housing market stalls, there are reasons to think Rightmove could prove resilient.”

AstraZeneca

AstraZeneca shares dipped 0.2% to 10,844p after HY1 2022 revenues climbed to 48% to $22.2 billion, reflecting growth in all divisions, except for Other Medicines.

The pharmaceutical giant saw a 71% spike in operating profits to £1.4 billion, excluding the impact of its Alexion acquisition, exchange rates and one-off expenses.

“Drug maker AstraZeneca is something of a stock market rarity right now – a company trading at fresh record highs in 2022,” said Mould.

“But it appeared to fall victim to profit taking this morning as it beat expectations for the second quarter and raised its full-year guidance, yet got only raspberries in response from investors.”

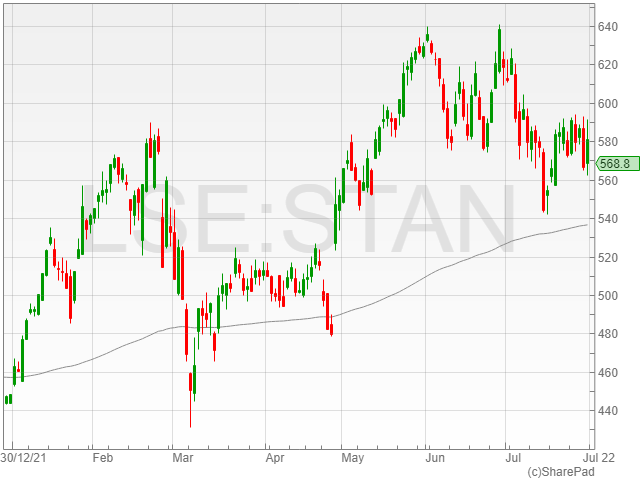

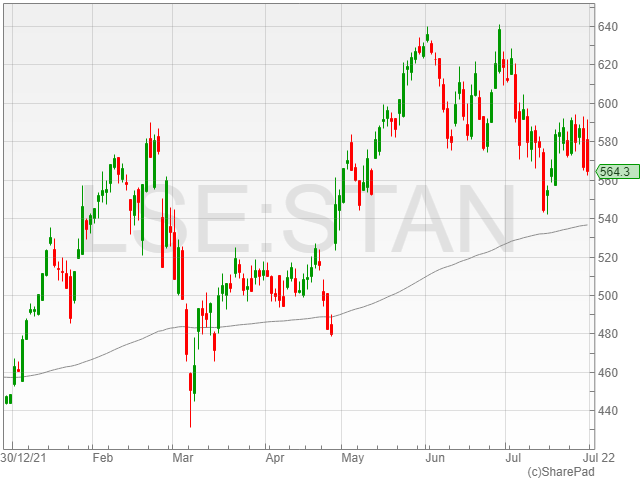

Standard Chartered

Standard Chartered shares fell 0.4%% to 564.2p as its pre-tax profits grew 8.2% to $2.7 billion against $2.5 billion year-on-year in HY1 2022.

The banking firm reported an operating income climb of 7.7% to $8.2 billion compared to $7.6 billion the last year.

The group mentioned a dividend of 4c per share in the period.

Standard Charted also announced the launch of a $5 billion share buyback over the next three years, after its recent $750 million buyback in the interim term.

Glencore

Glencore shares climbed 2.7% to 461.8p following a mixed bag of production results, with rising output of cobalt, nickel and ferrochrome and coal.

However, the mining group announced falling copper production as a result of geotechnical constraints in Katanga, the basis change from its Ernest Henry sale in January 2022, Collahuasi mine sequencing and lower copper units produced from the miner’s zinc sector.

Glencore further mentioned falling zinc, gold, silver and lead production across the interim term.

The company reported its unchanged FY production guidance remained unaltered, with the exception of a lowered copper production expectation.

“Our full year production guidance remains unchanged with the exception of copper, where the ongoing geotechnical constraints relating to Katanga’s open pit and continued management of higher levels of acid-consuming ore, largely account for the reduced guidance of 1,060kt (previously 1,110kt),” said Glencore CEO Gary Nagle.

Standard Chartered HY1 profits hit $2.8bn, $500m share buyback announced

Standard Charted shares fell 0.5% to 563.7p in late afternoon trading on Friday following an announced HY1 2022 pre-tax profit growth of 19% to $2.8 billion, beating market expectations.

The banking firm benefited from rising interest rates, with the latest Bank of England meeting hiking rates 1.25% in a move to tackle soaring inflation.

Analysts projected a $2.4 billion profit for the group in the interim term, along with a CET1 ration of 13.9%.

Standard Chartered confirmed it was on track to reach a 10% return on tangible equity by 2024 at the latest.

Meanwhile, the banking giant reported a higher dividend of $119 million, representing 4c per share.

Standard Charted also announced the launch of a $500 million share buyback, which is scheduled to kick off imminently.

“We remain disciplined on expenses, with significant savings delivered and maintained a strong capital position, with a CET1 ratio of 13.9%,” said Standard Chartered CEO Bill Winters.

“We are also announcing today a new $500 million share buy-back to start imminently. We remain confident in the delivery of the financial targets we set out in February.”

Octopus Renewables Infrastructure Trust NAV rises £40m to £627.5m

Octopus Renewables Infrastructure Trust shares rose 0.9% to 114.1p in late morning trading on Friday after the group announced an unaudited NAV rise of £40 million to £627.5 at 30 June 2022, representing a growth of 7.1p to 111.1p per share.

Octopus Renewables attributed the rise to increases in short-term wholesale energy price forecasts, especially across the UK, Sweden, Poland and Finland.

The valuation reportedly includes an increased discount to baseload forward prices on revenue not fixed in each market of 30% for 2022 and 2023, and 20% for 2024 and 2025.

The company confirmed a 20% discount for 2022 and 2023 for Nordic markets only at 31 March 2022.

Octopus Renewables commented the impact of updating wholesale energy price forecasts was over £17.2 million.

The group said it had a fixed pricing on a substantial portion of output for the rest of 2022 and 2023 at the Saunamaa and Suolakangas wind farms in Sweden and Finland, and the Penhale solar farm in the UK.

The company added its fixed power price agreements were secured at prices over forecast, resulting in a valuation climb of £1.8 million.

Meanwhile, 60% of ORIT’s forecast revenue at 30 June 2022 to 30 June 2024 was fixed, with approximately 51% of Octopus Renewable’s forecast revenues to be received by its current asset portfolio was confirmed to be explicitly inflation linked.

The firm noted a gain of £3.9 million recognised on the completed construction at the Kuslin wind farm in Poland, along with the completion of civil works and the installation of seven out of eight turbines at the Cerisou French wind farm.

Octopus Renewables announced all its assets under construction were scheduled to achieve operational status by the end of Q2 2023.

The group said it continued to see strong appetite for renewable energy assets in its target regions and no alterations to market discount rates made over Q2.

AIM movers: ThinkSmart offer and Tintra funding

A company controlled by ThinkSmart Ltd (LON: TSL) executive chairman and 29.4% shareholder Ned Montarello has entered into a scheme of arrangement to acquire the AIM company. The independent shareholders will be offered their share of the sale of 618,750 shares in NYSE-listed credit provider Block, after expenses. At the current Block share price of $74.76, shareholders would receive 36p a share. The Block share price has fallen by two-thirds in the past year and could fall further, although it has recovered in the past few weeks. The ThinkSmart share price has taken a similar trajectory. It recovered 26.3% to 30p on the news of the offer.

Tintra (LON: TNT) has fast-tracked development of its banking platform and is six months ahead of the roadmap. Tintra intends to raise $25m to fund further development and it believes that it can be done for no more than 10% of the company. That seems a tall order. The shares have jumped 60.9% to 185p and they are 252% higher than at the beginning of the year.

Ormonde Mining (LON: ORM) has agreed to sell the La Zarza copper gold project in Spain to Tharsis Mining for €2.3m. The assets were valued at €2m. There will be €800,000 paid on the sale and then three annual amounts of €500,000 each on the anniversary of the deal. Ormonde Mining still has the Salamanca and Zamora gold projects. The share price is 17.4% higher at 0.675p.

Pantheon Resources (LON: PANR) says that the Alkaid #2 well has reached a total depth of 8,950 feet and the oil bearing reservoir is thicker than expected and could be deeper than thought. The data is still being analysed. The Pantheon Resources share price rose 22.5% to 125.45p.

Antibody discovery company Fusion Antibodies (LON: FAB) has risen again after yesterday’s appointment of Dr Adrian Kinkaid as chief executive. The share price is up 20.6% to 61.5p. It is more than 50% ahead of the level two days ago. He joins from NetScientific (LON: NSCI) investee company Vortex Biotech.

A production concession has been granted for the Podere Maiar gas field, where Prospex Energy (LON: PXEN) has a 37% interest. First gas should be produced next year. Prospex Energy has to pay €280,000 towards the connection to the gas grid. The shares are 13.9% ahead at 4.5p.

Bradda Head Lithium Ltd (LON: BHL) reported its maiden full year figures and the share price dipped 4.88% to 7.8p. There was still $7.33m in cash at the end of February 2022. The North America-focused lithium explorer has completed the drilling of Basin East project in Arizona. Metallurgical testing shows 99% lithium extraction into leach, while 85% of lithium mineralisation sits in the 11-micron fraction. Since Bradda Head joined AIM, the lithium price has risen from $12,000/t to $70,000/t, although the price is expected to fall back.

Frederick & Oliver bullish on Bitcoin and Ethereum outlook

Bitcoin, Ethereum, and the entire crypto universe faced cataclysmic declines earlier this year as a tightening of monetary policy stopped the rally in digital assets in its tracks, and spurred a sharp selloff.

Although the mainstream media were largely hysterical at the scale of the declines, long-term crypto investors, as well as the analysts at Frederick & Oliver, were unperturbed by the move.

Having traded as high as $64,400 in the second half of 2021, Bitcoin slid and eventually capitulated to trade below $18,000 as the broader crypto complex crashed.

Download Bitcoin & Ethereum Special Report and Outlook

In the previous so-called ‘Bitcoin winter’ in 2018, Bitcoin then also fell by over 80% before breaking to new highs. Such volatility has conditioned crypto traders to expect volatility and looks for such opportunities for entries.

“Bitcoin and Ethereum had fallen more than 70%, discounts of this magnitude must be explored regardless of asset class. Major coins had previously registered sizeable rallies following steep declines, we felt this opportunity was too good to pass up,” said Marc Kimsey, trader at Frederick & Oliver.

Bitcoin has displayed a high correlation with US Tech stocks. The same factors driving the downside in Bitcoin also impacted tech stocks – and just same they moved down in tandem, the two have bounced from lows hand in hand.

Download Bitcoin & Ethereum Special Report and Outlook

With the US recording a technical recession yesterday, investors have taken the opportunity to buy into tech shares, and Bitcoin, on hopes the worst is now behind us.

AstraZeneca revenue grows to $22.2bn, raises FY guidance on Covid-19 treatments

AstraZeneca shares decreased 1.7% to 10,676.4p in late morning trading on Friday, despite a 48% growth in revenue to $22.2 billion, reflecting expansion in all divisions except for Other Medicines.

The pharmaceutical giant announced a 71% surge in operating profit to £1.4 billion, excluding the impact of its Alexion acquisition, exchange rates and additional one-time costs.

AstraZeneca noted its operating profits were boosted by higher-margin treatments, which contributed a higher level of sales.

The company reported its higher operating profit helped to offset a 33% climb in operating costs year-on-year.

FY 2022 guidance

Meanwhile, AstraZeneca confirmed an optimistic outlook for Covid-19 medicines caused the firm to revise its guidance, including a low-20s percentage revenue growth from a previous expectation of high-teens percentage increase.

“AstraZeneca’s doing better than expected, and it’s taking this opportunity to set itself up for the future. The group’s in the process of signing new contracts for its Covid-treatments as the pandemic subsides in a step away from its pledge to sell vaccines at-cost,” said Hargreaves Lansdown equity analyst Laura Hoy.

“While the group’s said it’s covid medicines will carry a lower margin, they’ll finally start contributing to the bottom line. For now it seems AZN is in good shape to weather the economic storm, exchange rate tailwinds adding a welcome boost.”

“Healthcare falls firmly into the essentials bucket, and that’s a good place to be during a downturn. However it’s worth noting that lawmakers could turn their attention back to the drug price debate in a bid to ease the cost of living crisis.”

“While Astra racked up some brownie points for its role in combatting the pandemic, that won’t insulate it if big pharma ends up in the crosshairs.”

The pharmaceutical group said it expected an EPS rise in the mid-to-high teens percentage.

AstraZeneca announced a 93c HY1 2022 dividend.

NatWest sparkles as £2.6bn profits exceed market expectations

NatWest shares flew 6.8% to 245.8p in early morning trading on Friday in light of a pre-tax operating profit ahead of management expectations of £2.6 billion in HY1 2022.

The banking firm reported a return on tangible equity of 13.1% and a cost:income ratio of 58.3% compared to 67.6% the last year.

NatWest highlighted a Go-forward group income rise of £819 million, representing a 16.2% growth against HY1 2021, as a result of base rate increases and volume growth.

The company announced a bank net interest margin climb of 0.26% to 2.72% on the back of base rate rises.

Meanwhile, the group mentioned a 1.5% dip in other operating expenses in the Go-forward group to £50 million, alongside a HY1 operating profit before impairments rise of 53.5% to £2.7 billion.

NatWest further mentioned a net impairment release of £46 million in the Go-forward group, linked to low levels of realised losses across the company portfolio.

However, the banking giant said it continued to keep a wary eye on the volatile market outlook going forward in FY 2022.

“In a mixed UK bank reporting season so far, there’s no question who is getting the gold star,” said AJ Bell investment director Russ Mould.

“Natwest has knocked it out of the park with its latest results. It’s hard to see what more it could have done to impress the market.”

FY 2022-2023 guidance

The company noted an expected FY 2022 income excluding notable items of £12.5 billion in the Go-forward group, with a NIM greater than 2.7%.

The firm highlighted its £3 billion investment over 2021 to 2023 as it intends to reduce Go-forward group operating expenses by 3% in 2022 and maintain broad stability in 2023.

The group said it expected to reach a return on tangible equity between 14% to 16% in FY 2023.

“Profit ahead of expectations: check. Big shareholder returns: check. Raised guidance: check. It all adds up to suggest that rising rates are helping to boost the profitability of the group,” said Mould.

“If Natwest can keep this sort of momentum up, the Government will be glad it extended the deadline for the final sale of its shareholding by 12 months to August 2023.”

“There will likely be significant obstacles along the way given the clouds hanging over the UK economy, but the business at least looks in decent shape to take on these challenges.”

NatWest confirmed a total dividend of 20.3p for the HY1 financial term, consisting of a dividend of 3.5p and a special dividend of 16.8p per share.