Tekcapital’s aim is clear. To find and invest in exciting new university technology with the potential to change people’s lives.

Tekcapital is listed on London’s AIM and has a portfolio of cutting-edge companies including Guident, an autonomous vehicle software company focused on vehicle safety, and Salarius, a producer of MicroSalt® a new low-sodium salt.

Across its portfolio, Tekcapital has built an attractive foundation of intellectual property that includes 70 patents within fast growing industries such as foodtech, autonomous vehicles, and smart eyewear.

Tekcapital targets companies setting out to deliver a solution with a large addressable market. For example, Tek’s 15% stake in Belluscura has a chance of helping 250 million prospective patients suffering from chronic obstructive pulmonary disease (COPD).

Their investment process is aided by a substantial network of science advisors who screen technologies for potential inclusion in their portfolio.

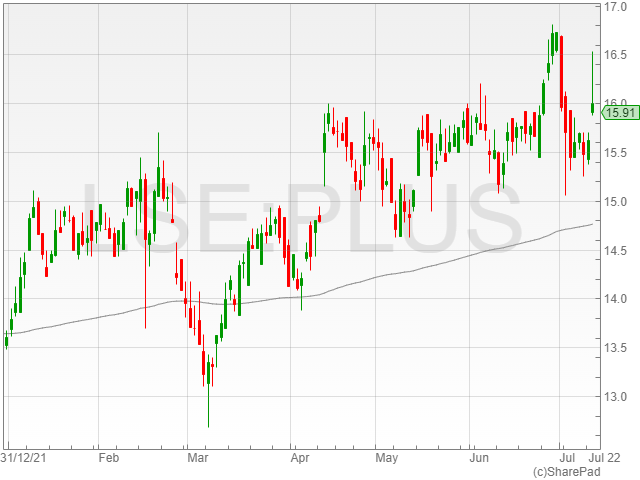

Tekcapital produced an operating profit of $26,368,670 in 2021, much of which was earned through unrealised gains of their portfolio companies.

This pays testament to their rigorous investment process and reinforces the progress towards their goal of crystalising gains through exits, and the distribution of cash to investors by special dividends.

Although no dividend was paid in 2021, Tekcapital are moving closer to a potential shareholder pay-out with the proposed IPO of Innovative Eyewear, subsidiary of Lucyd Ltd and MicroSalt Inc, subsidiary of Salarius as well as future monetisations of Belluscura.

Tekcapital recently announced they had received a large order for MicroSalt products and were confident enough in the progress at the company to begin thinking about a listing.

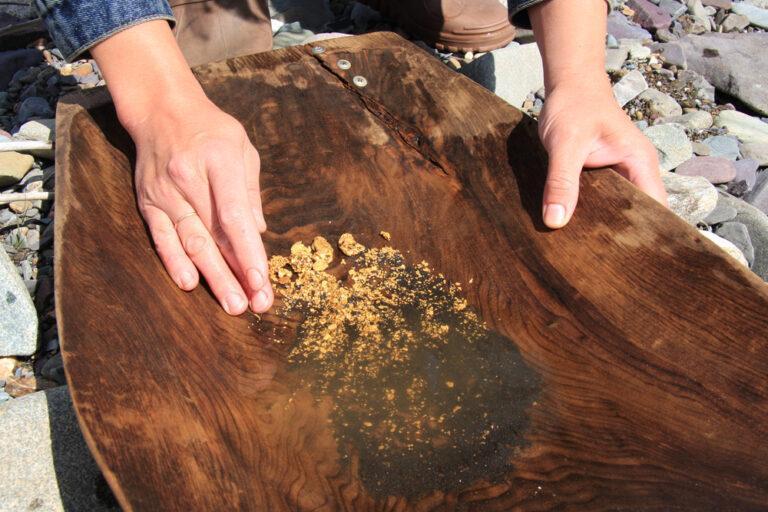

MicroSalt

MicroSalt is targeting improvements in the food industry by reducing the sodium content of salted snacks and other foods associated with high sodium.

According to as study noted by the American Heart Foundation, high-sodium diets were responsible for over 17 million deaths in 2016, a figure which is set to rise by 2030.

Having identified this worrying trend, the FDA is now committed to reducing sodium intake by 12%, providing a perfect backdrop for MicroSalt’s growth.

MicroSalt’s patent-backed technology has created a salt that has approximately 50% less sodium compared to existing salt options, and yet provides the same salty taste consumers enjoy. The improved taste is achieved by micro-particles that dissolve quicker and provide an intense salt flavour.

MicroSalt recently received a $400,000 equity investment from a Spanish venture fund, Tech Transfer Agrifood F.C.R. The stake valued MicroSalt at $9.27m post money meaning Tekcapital’s 73% stake is now worth $6.8m, considerably higher than last reported to the market in its 2021 results.

This would see Tekcapital’s portfolio value potentially increasing beyond the $62.5m reported in 2021, further emphasising the current disconnect between Tek’s market cap and the book value of its portfolio.

Tekcapital portfolio

With a $62.5m portfolio valuation, Tekcapital’s current £33m market cap provides a significant discount to net asset value. Yes, the portfolio is partially in unlisted companies which are yet to provide a liquidity event which may justify a discount – but any liquidity events are likely to transact at a much higher valuation than currently accounted for.

This provides an opportunity for investors seeking exposure to cutting-edge technologies usually reserved for private equity investors, at a major discount.

Analysts at SP Angel have recently attributed a minimum book value of circa 40p per share, compared to a current share price of 23p.

Whilst MicroSalt will capture much of Tekcapital investors’ attention in the short-term, the depth of the Tek portfolio ensures a sector balanced approach to the risk of investing in a selection of compelling technologies with demonstrable market traction.