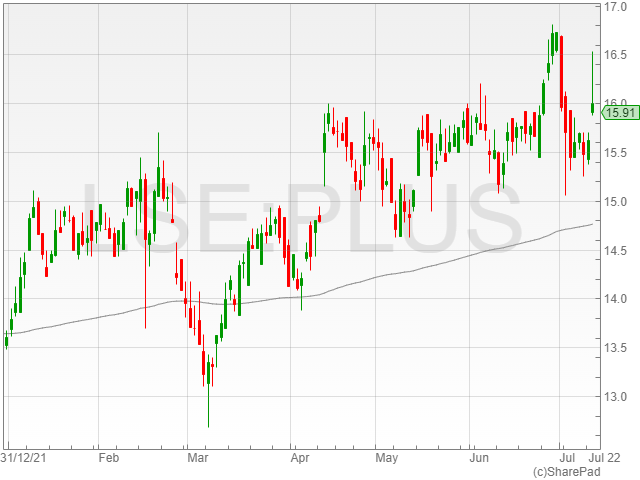

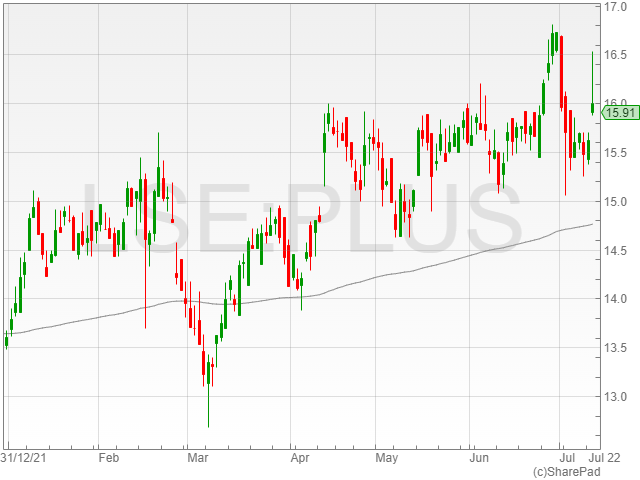

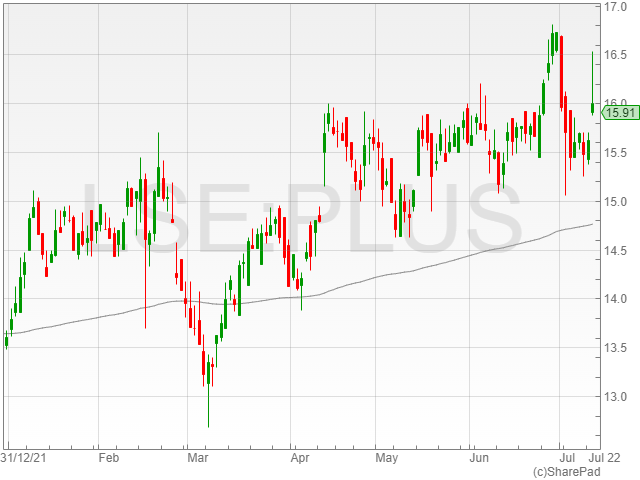

Plus500 shares rose 2% to 1,594p in early morning trading on Tuesday after the firm reported its revenue and EBITDA for FY 2022 were projected to exceed market expectations.

Plus500 mentioned a revenue growth of 48% to $511.4 million in HY1 2022 from $346.2 million the year before, with an EBITDA rise of 63% to $305.3 million compared to $187.6 million and an EBITDA margin increase of 11% to 60% against 54% year-on-year.

The company announced a series of highlights over the HY1 period, including the launch of new US operations supported by its positive momentum in recent years, alongside the success of its proprietary technology in accessing market opportunities.

Its US developments are set to launch a new trading platform for the US retail futures market in HY2 2022 in a move to capitalise on widened market accessibility to the applicable retail audience.

The group confirmed a customer income level of $339.8 million over the term compared to $379.2 in HY1 2021.

The fintech company also noted its higher group revenue reflected customer trading performance of $171.6 million from $33 million the last year.

Plus500 pointed out 57,275 new customers taken on across HY1 against 136,980 in the previous year, with an active customer base of 216,928 compared to 333,940.

The firm said its global advertising campaign launched over the term served to drive brand awareness and attract a higher level of customers over the medium to long term.

Plus500 added it was debt free and held cash balances in excess of $950 million on 30 June 2022, with consistently high levels of cash generation.

As a result, the company confirmed a share buyback scheduled totally approximately $105 million since the start of FY 2022, with 2.6 million shares repurchased at an average price of £14.98 for a total consideration of $51.7 million.

The company is set to expand into new territories in the coming months through organic investments and planned acquisitions, including entry into the Japanese retail market.

Plus500 confirmed it was in a positive position for growth after its strong HY1 over the medium to long term as a multi-asset fintech firm.

“Plus500 continued to outperform in the first half of 2022, supported by positive momentum achieved in recent years and by the power of our market-leading proprietary technology. We made significant progress in delivering against our strategic priorities, in particular the major growth opportunities in the U.S., where we continue to make substantial investment,” said Plus500 CEO David Zruia.

“In addition, the Group continued to deliver outstanding levels of returns to shareholders during the period, through both recent $60.0m dividend payments and our most recent $105.0m aggregate share buyback programmes, which emphasise the Board’s view of the current value of the Company’s shares.”

“Our continued strategic, operational and financial momentum will ensure Plus500 delivers sustainable growth in the medium to long term, enabling the Group to deliver further shareholder value in the future.”