A softer start to equities trading on Monday saw the FTSE 100 give up 0.4% to 7,165.5 in mid afternoon trade, as the market was dragged down by commodities producers after the scramble to compensate for the impact of Russia’s invasion of Ukraine finally started to die down.

The FTSE 100 has been outperforming alternative markets across international borders on the back of its commodities-heavy stocks, however it appears the charm of these companies is starting to wear thin.

“The FTSE 100’s outperformance compared to other global markets has started to falter as the commodity stocks that helped support its relative strength begin to run out of steam,” said AJ Bell investment director Russ Mould.

“Metals prices had already turned and energy markets are starting to struggle too as attention turns to the pressures on demand now the initial supply shock associated with Russia’s invasion of Ukraine has begun to abate. Miners helped drag the FTSE 100 lower on Monday morning as a result.”

Anglo American shares fell 3.8% to 2,715p, Antofagasta dropped 3.2% to 1,077.2p, Endeavor slid 2.9% to 1,629p, Fresnillo decreased 2.3% to 667.4p, Rio Tinto dipped 1.1% to 4,780p, Croda declined 1.2% to 6,809p and Glencore dropped 1.2% to 426.1p.

The price of benchmark Brent Crude fell to $105 per barrel, marking a far cry from its heights of almost $130 per barrel in mid-March. Shell and BP shares fell 1.6% to 2,010.5p and 1.5% to 380.4p, respectively.

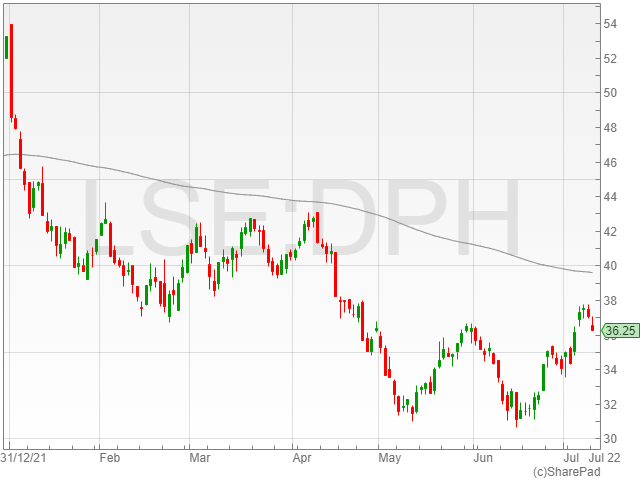

Meanwhile, Dechra Pharmaceuticals shares dropped 1.6% to 3,690p after the veterinary healthcare company reported a slowdown in revenue growth to 14% CER as the impact from Covid-19 started to unwind.

The group made a selection of minor acquisitions over the term, serving to boost its revenues, and the firm predicted a strong outlook for FY 2023.

“The complementary product acquisitions we made during the period strengthen our existing portfolio and are performing in line with initial expectations; there are a number of acquisition opportunities that we are assessing,” said Dechra Pharmaceuticals CEO Ian Page.

“We continue to believe in the ability of our people to execute our strategy and remain confident in our future prospects.”

Across international markets, all eyes are set to turn to China’s GDP figures later this week, as investors will use the new statistics to determine the direction of commodities consumption in the world’s largest consumer. The Hang Seng was down 2.7% to 21,124.2.

“In this context the latest Chinese growth figures will be closely watched, given it is one of the most commodity-hungry economies in the world, with the impact of Covid restrictions in particular focus,” said Mould.

The US Federal Reserve is also primed to release its latest interest rates decision this week, which will set the tone for international markets depending on the direction chair Jerome Powell settles on.

“There will be plenty of clue hunting going on as we await the latest decision from the US Federal Reserve at the end of this month,” said Mould.

“The key question is whether Jerome Powell and his colleagues will double up with another 75 basis points rise or if they’ll ease off to avoid the medicine for rampant inflation proving worse than the disease.”

The NASDAQ pre-open trading was down 0.6% to 12,072.2, the Dow Jones was down 0.3% to 31,206 and the S&P 500 was down 0.5% to 3,882.7.