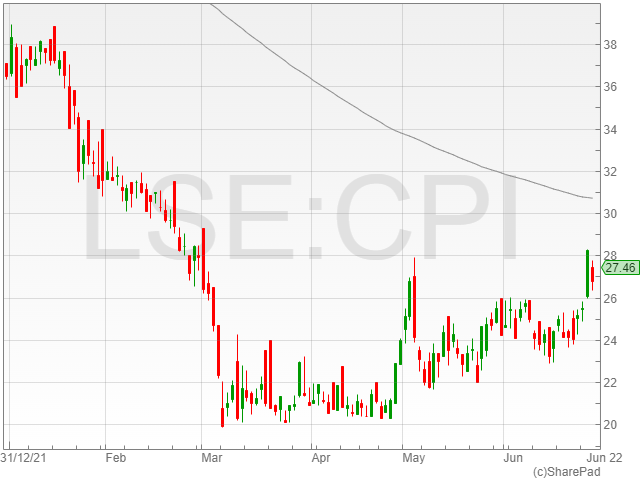

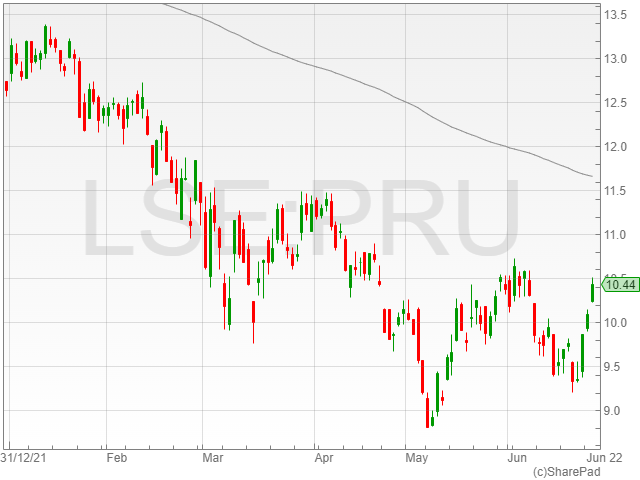

Moonpig shares were down 7.1% in late morning trading on Wednesday after the bespoke greetings cards group announced a 17.3% fall in revenue to £304.3 million in FY 2022 against £368.2 million in FY 2021.

The company suffered from the double-blow of Covid-19 restrictions lowering and the cost of living crisis driving consumers to cut back on the less essential purchases in life, with gift cards falling in demand as customers tightened their belts.

The company reported an adjusted EBITDA slide of 18.7% to £74.9 million compared to £92.1 million, alongside an adjusted EBITDA margin fall of 0.4% to 24.6% from 25% the last year.

Moonpig mentioned a pre-tax profit rise of 21.6% to £40 million from £32.9 million year-on-year, and an adjusted pre-tax profit drop of 30.9% to £51.5 million against £74.6 million.

The gifting products firm noted a 52.5% EPS surge to 9.3p compared to 6.1p.

The group further highlighted a net debt reduction of 27.2% to £83.8 from £115.1 million the year before.

Moonpig drew attention to its acquisition of Buyagift, which is set to deliver a step-change in its gifting proposition for a cash consideration of £124 million compared to a FY 2022 EBITDA of £14 million, and is expected to drive over 20% accretion to annualised adjusted EPS from acquisition.

The company is scheduled to close the transaction by the end of July 2022.

Moonpig commented it was confident in its FY 2023 outlook, and confirmed a strong start to the financial period with an expected revenue of £350 million for the coming year.

The firm mentioned an estimated medium-term mid-teens percentage in underlying revenue growth, with margin trends remaining resilient for the near-to-medium term.

Moonpig also raised its medium-term adjusted EBITDA margin rate to between 25% and 26%.

“Our first full year as a listed company has been another transformational period for Moonpig Group – financially, operationally and strategically. We have significantly outperformed the targets set out at IPO, and recently announced the proposed acquisition of Buyagift, which will accelerate our journey to becoming the ultimate gifting companion,” said Moonpig CEO Nickyl Raithatha.

“We remain confident in the outlook for the current year, with our loyal customers continuing to rely on Moonpig to connect with loved ones at moments that matter. The long-term opportunity remains vast and we have never been in a better position to capture it.”

Moonpig did not declare a dividend for FY 2022 due to its decision to reinvest its earnings in the company’s growth instead.