Helen Steers, Pantheon Partner and lead manager of Pantheon International Plc (ticker code: PIN), discusses the growth of the global private equity market and how investors can access it through one of the longest established private equity investment trusts.

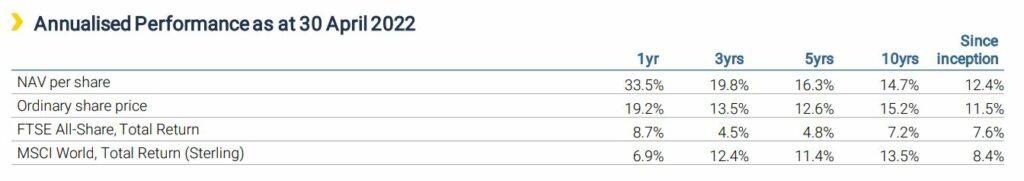

Investors may be asking themselves how to allocate their capital in these uncertain and inflationary times. Pantheon International Plc (“PIP”), a FTSE 250 listed private equity company managed by Pantheon, a leading global private markets investor, is worth considering for investors that are looking for an investment trust that has delivered consistent returns through previous economic cycles. The trust, which provides exposure to many of the best private equity managers in the world, has demonstrated over the course of its 35-year life that it can perform in different economic environments and its NAV has outperformed its benchmark, the MSCI World index, by c.4% per annum while its share price has outperformed by c.3% per annum (as at 30 April 2022). In other words, a £1,000 investment in PIP at its inception in 1987 would have returned £26,968 more than the same initial investment in the MSCI World index.

PIP has a track record of strong long-term performance

Inception date is September 1987. Past performance is not indicative of future results. Future performance is not guaranteed and a loss of principal may occur.

Private equity is a growing market that is very difficult for ordinary investors to access; private equity funds often require a minimum investment of $10m, investors are expected to lock up their capital for at least 10 years and the funds of the most successful private equity managers are oversubscribed and impossible to access without deep, longstanding relationships. But this is an area of the market that has been growing at an extraordinary rate. Since 2011, the number of US and European private equity backed companies has been increasing by over 12% per annum[1], while the number of publicly listed companies has been stagnant. According to Preqin, the assets under management in the global private equity market has increased from $1.7tn in Dec 2010 to nearly $5.3tn in 2021. Preqin predicts that the private equity market will more than double in size by 2026.

Investors can access this growth through PIP. Pantheon has a nearly 40-year history of partnering with the very best private equity managers and a share in PIP offers exposure to managers that are otherwise impossible to access.

Download PIP’s latest Factsheet

Investing responsibly in high-growth companies in resilient sectors

PIP’s portfolio has been deliberately positioned to take advantage of high growth and resilient sectors such as Healthcare, Information Technology and Consumer staples and services, and we are backing private equity managers who are able to identify long-term structural trends. The Consumer businesses we own are generally recession-resilient and an example would be Affinity Education Group which provides educational services and daycare centres in Australia.

In the Healthcare sector, our private equity managers have long recognised the opportunities emerging from trends such as ageing demographics in developed countries and the increasing demand for better healthcare services in the developing economies. One of our portfolio companies, RAYUS, is a leading provider of high-quality diagnostic imaging and interventional radiology in the USA, while another of our portfolio companies, Appliance Heath Technology, is the leader in the provision of children’s orthodontic aligners in China.

We have continued to invest in Information Technology companies that are cash-generative and are supporting the digitalisation and automation that we have seen occurring in many sectors. One of our portfolio companies, Riskalayze, is a strong example of this. They are a US-based provider of risk tolerance tools for financial advisers, which provide a highly differentiated offering to their peers. This is in part due to the superior software functionality and its ability to map thousands of different financial products.

Download PIP’s latest Factsheet

PIP’s portfolio is diversified across the different types and stages of private equity investments, though we have a preference for growth and small/mid buyouts as this offers private equity managers more levers to pull to grow the businesses and provides a greater array of exit opportunities. PIP’s managers do not rely on the IPO market to exit their investments, in fact most of the exits are typically to strategic trade buyers or to other private equity managers that can take the businesses into their next stage of growth. PIP’s portfolio is global, offering access to exciting private companies around the world, with a weighting towards the USA, which has the deepest most developed private equity market. We pay close attention to the liquidity of PIP, ensuring that significant levels of cash can be generated from the investments when they are exited in order both to meet PIP’s outstanding commitments and to invest in the exciting deals in PIP’s full deal pipeline.

Pantheon takes its commitment to Environmental, Social and Governance matters extremely seriously and has deeply embedded ESG policies in its entire investment process when investing on behalf of PIP. Pantheon was one of the early signatories to the UN Principles of Responsible Investment (UNPRI) in 2007 and it has consistently received high ratings for its approach and industry engagement.

Investors must assess carefully what is suitable for them and their investment objectives and tolerance/appetite for risk, but through a share in PIP, they can easily participate in a proactively and responsibly managed portfolio offering access to an exciting and growing asset class.

Important Information

This article and the information contained herein may not be reproduced, amended, or used for any other purpose, without the prior written permission of PIP. This article is distributed by Pantheon Ventures (UK) LLP (“Pantheon”), PIP’s manager and a firm that is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom, FCA Reference Number 520240.

The information and any views contained in this article are provided for general information only. Nothing in this article constitutes an offer, recommendation, invitation, inducement or solicitation to invest in PIP. Nothing in this article is intended to constitute legal, tax, securities or investment advice. You should seek individual advice from an appropriate independent financial and/or other professional adviser before making any investment or financial decision. Investors should always consider the risks and remember that past performance does not indicate future results. PIP’s share price can go down as well as up, loss of principal invested may occur and the price at which PIP’s shares trade may not reflect its prevailing net asset value per share.

This article is intended only for persons in the UK. This article is not directed at and is not for use by any other person. Pantheon has taken reasonable care to ensure that the information contained in this article is accurate at the date of publication. However, no warranty or guarantee (express or implied) is given by Pantheon as to the accuracy of the information in this article, and to the extent permitted by applicable law, Pantheon specifically disclaims any liability for errors, inaccuracies or omissions in this article and for any loss or damage resulting from its use. All rights reserved.

[1] Source: PitchBook, as at March 2021 reflecting YE 2020 data.