“I grew up eating healthy, affordable burritos in California and I just couldn’t find anything like it over here. As the concept evolved, it became evident that there was a strong market for fresh, affordable burritos and tacos.”

That quote was made by Brandon Stephens, who moved to London from California in 2003 to pursue his MBA at London Business School.

Whilst there he prepared his business plan for Tortilla.

Find a hole then fill it

What became the Tortilla Mexican Grill (LON:MEX), was the brainchild of Stephens and his wife Jen, who were brought together by their shared interests and love of good quality street-food.

They quickly noticed the lack of exciting, yet healthy fast-food options in London, as well as a gap in the market for fast, fresh and affordable burritos and tacos, the Mexican street-food that they enjoyed so much in California.

That was the turning point that transformed their passion into a business.

The pair went on to establish the first Tortilla ‘Real California Burritos & Tacos’ outlet in Islington, London 2007.

Today it is the UK’s largest fast-casual Mexican restaurant brand with a fully customisable and authentic California-style Mexican menu.

A tortilla is a flatbread, a burrito is what you do with it

A burrito is a dish in Mexican cuisine that took form in California, consisting of a flour tortilla wrapped into a sealed cylindrical shape packed around various ingredients.

The tortilla is sometimes lightly grilled or steamed to soften it, to make it more pliable, and allow it to adhere to itself.

These thin, pliable flatbreads are used as a wrap in Mexican cuisine. They are typically made using corn or wheat flour.

The standard burrito includes seasoned ground beef, refried beans, shredded lettuce, diced tomatoes, sour cream, and chili sauce.

The California Burrito begins with a huge flour tortilla topped with juicy, marinated and spice rubbed, grilled steak, then piled high with baked Mexican Street Fries, loads of cheese, guacamole, and sour cream

Fast-expanding group with a simple business model

Since its start in 2007 the group has grown to over 68 restaurants today, 52 of which are group-owned, three are operated by SSP, four by Compass Foods and nine are owned by Eathos.

The group’s restaurants are situated 29 within the M25 area and 23 outside of the M25 elsewhere in the UK.

Global food travel experts Select Service Partner UK (SSP) has franchises from the group to operate at Gatwick Airport, Euston Station, and Bristol Airport.

Compass, which is one of the largest food businesses in the world, has also taken out franchises from the company. Alongside such stores as Greggs, Starbucks etc Compass has four opened sites alongside University campus areas, it has plans for another ten sites over the next five years.

Eathos opened the group’s first franchise in Dubai in the UAE in August 2016 and is now up to nine such outlets. It is a highly specialised restaurant operator, which is headquartered in Dubai, offers local and international owners and franchisors unrivalled access to patrons across the growing population markets of the Middle East, North Africa and Turkey.

Through a partnership arrangement with Merlin Entertainments, in May last year the company opened a site in the Chessington World of Adventures Resort. Located in the Mexicana Land, Tortilla Chessington is centrally run and staffed by Tortilla and its employees.

The Group Offer

The brand fits in well with an energetic, vibrant culture, by providing a great value-for-money proposition.

It is ideally-suited to the fast-growing sector trends, which include eating out, healthy eating, provenance, ethnic cuisine, and delivery across a variety of locations.

Its product offering is popular with a broad customer base, and it operates upon a clearly defined multi-channel marketing strategy.

The brand benefits from flexible site locations and formats, and it has a scalable central infrastructure.

The company’s product range includes burritos, tacos and salads. Its menu includes burrito, tres tacos, naked burrito, salad, quesadilla, nachos queso, chips & salsa, and drinks.

Its multi-channel offering includes dine-in, self-serve, take-away, click and collect and delivery options for its customers.

Since 2015 it has an exclusive contract with Deliveroo.

In addition, it also offers do-it-yourself meal kits, allowing customers to build their own quesadilla and nacho meals to make at home.

Ease of operation

There are just six key menu items – it is the toppings that add the massive variation.

The group delivers what they call a ‘phenomenal product at a keen price’.

Its main dishes are priced £6 to £8 each.

They are customisable – offering its consumers indulgent, healthy, vegan and vegetarian choices.

In the Covid-hit restaurant sector Tortilla is resilient. It has a tight menu and does not fry, so it has no oil price problems and does not need chefs to prepare what can easily be handled by 17/18-year-olds.

It is able to employ a young unskilled workforce with short training timescales, which enables it to offset the pressured labour market.

Its operational simplicity supports its training and career development, while avoiding the recent chef shortage issues.

Cost pressures have been minimised by the simplicity of its operation, while the global supply chain impact has been mitigated by the group’s limited menu and, importantly, by having very close relations with its two main suppliers.

The CPU and ‘cloud kitchens’

The group has a 5,500 sq.ft. central production unit based in Tottenham Hale, in North London.

From there its commercial kitchen is used by the group to prepare food and ingredients for supply to its restaurants.

It supplies all of the menu items sold in the restaurants, apart from the toppings whose flavour profiles benefit from freshness, like guacamole and pico de gallo salsa.

As a side note the group ‘smashes’ well over 200 tonnes of guacamole each year.

The company also has plans to see a number of ‘cloud kitchens’ being opened.

These professional commercial kitchens are only used to produce food for delivery.

Growth Kitchens, based in Balham, South London, is looking to open three such kitchens to help the group to handle its geographic deliveries.

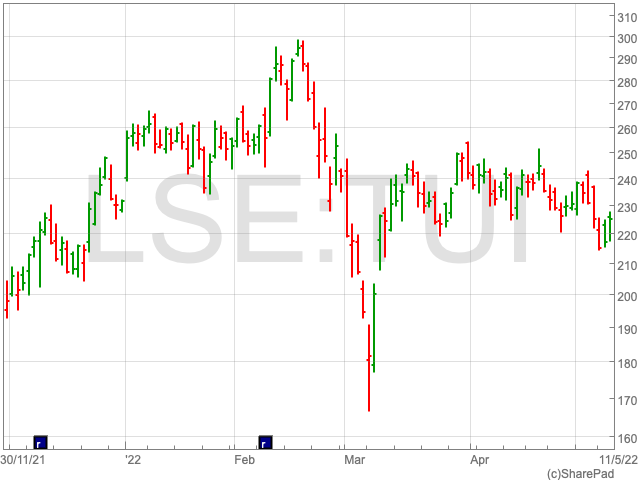

Went onto AIM late last Autumn

The group only went public last October when it Placed 15.48m shares, of which 12.72m were through selling shareholders and 2.76m were issued by the company.

The Placing price was 181p, valuing the group at £69.98m.

Subsequent to that Placing the group has 38.66m shares in issue.

The largest holder is Quilvest with 20.4% of the equity.

Other larger holders include Canaccord Genuity with 14.7%, Quantum Partners 11.6%, Brandon Stephens 8.3%, the Patel family 6.9%, Gresham House Asset Management 5.5%, Schroder Investment Management 4.4%, Nadine Benchaffai 3.98%, and CEO Richard Morris with 3.6% of the equity.

What is Quilvest?

Quilvest Capital Partners were an early investor in the company, supporting its financing way back in 2011.

It is a US-based equity investment group with some $6bn of assets under management.

It has various holdings in scattered sectors. However, it has had a lot of experience in the fast-food and restaurant business.

It was a holder of Yo Sushi and sold out, it holds a stake in American Franchise (Taco Bell and Applebee restaurants), in Luke’s Seafood (restaurant and seafood products), it is an investor in Metro Franchising (Donkin’ Donuts), also in Anthony’s Coal Fire Pizzas (part sold) and was invested in Hill & Valley (bakery products) before selling out.

Although it is subject to a ‘lock-in’ agreement it must be expected that Quilvest will look to dispose some or all of its remaining stake in due course – but I would guess that it will be there for some years yet.

Strategy going forward

Since the IPO fund-raising last year, the group has been able to pursue, at quite a pace, its declared strategy of opening nine new sites and three kitchens in the current year.

Its total aim is to deliver 45 new sites over the next five years.

It has been extremely well-placed to take advantage of the badly-hit property sector, with landlords delighted to grab new tenants, especially quoted ones.

Planning permissions to turn retail units into restaurants has become so much simpler since Covid-19, with local planners hating to see empty premises on their High Streets.

The company has a target set of achieving a 35% return on capital employed as it opens its new branches.

It is already building up its new site pipeline for 2023. As it opens new locations it is also planning to open more delivery kitchens, as well as seeking out additional franchise and licence opportunities.

Still very early-stage in the group’s development

The group is the market leader in offering South American cuisine. The demand for Mexican food is fast-growing.

Its expansion plans and business strategy are impressive, as too are its targets over the next few years. It is flexible in its site locations, and it is totally scalable.

Revenues are expected to carry on growing from last year’s £48.1m, to £57.3m this year, £67.3m next year and with £78.2m for 2024 already pencilled-in by its broker Liberum Capital.

Estimates for pre-tax profits rise from this year’s £3.8m, up to £5m by 2024.

On the face of it the group’s earnings per share progression to 7.9p in 2024, makes the shares look to be out on a pretty fancy 21 times future earnings.

However, this company is so clearly growth-focussed that its current rating should allow for its still early-stage development status.

Its advisers must have considered the future prospects, when they pitched the market price at 181p a share last October.

They touched 200p within days of floating, and that was before the Covid restrictions were lifted and well before the impact of the Ukraine conflict.

The company will be holding its AGM on 15 June, when there could well be another Trading Update.

I now take the view that further expansion news will incite more interest in the company and that its shares, now at 162p, will very soon rise above their previous peak.