Shaftesbury and Capital & Counties Properties’ (Capco) Boards of directors have taken note of recent news speculation and confirmed that they are in advanced talks over a possible all-share merger on Monday.

Shaftesbury and Capital & Counties’ potential merger would result in a REIT centred on London’s West End, with a portfolio of 2.9m sqft of lettable space in high-profile locations such as Covent Garden, Carnaby, Chinatown, and Soho.

The combined ownership would include 1.8m sqft of retail and hospitality space, as well as 1.1m sqft of commercial and residential space.

They groups did not give a value for the deal, however, Sky News reported the merged businesses would have a valuation of £3.5bn.

According to the proposed terms of the probable merger, Shaftesbury shareholders will own 53% of the new firm, minus the Shaftesbury shares acquired by Capco, and Capco shareholders will own 47% of the combined company.

Capco now owns 97m shares in Shaftesbury, or about 25.2% of the company’s existing share capital, including 38m shares held as security for Capco’s exchangeable bond.

Jonathan Nicholls, Chairman, and Ian Hawksworth, CEO, will oversee the united firm with a defined governance and leadership structure. The CFO will be Situl Jobanputra, while the COO will be Chris Ward.

Norges Bank, a substantial shareholder in both Shaftesbury and Capco, recognises the strategic reason and has expressed its willingness to support a merger in the future, subject to a review of the final terms and conditions of any transaction.

The talks are still underway, and the terms of a potential merger have not been settled. It is impossible to predict whether or not a bid will be received.

The proposed merger is currently planned to be structured as a Capco acquisition of Shaftesbury, subject to terms being finalised.

As a result, the Takeover Panel have agreed that Shaftesbury will be considered as the offeree and Capco will be treated as the offeror for the purposes of the code until further notice.

In connection with the potential merger, Evercore and Blackdown Partners are giving financial assistance to the Shaftesbury Board and Liberum Capital is serving as Shaftesbury’s corporate broker.

In accordance with the potential merger, Rothschild & Co is offering financial guidance to the Capco Board and Capco’s corporate brokers include UBS, Jefferies, and Peel Hunt.

Capco must either announce a firm intention to make an offer for the company or that it does not intend to make an offer by 5.00p.m. on 4 June 2022.

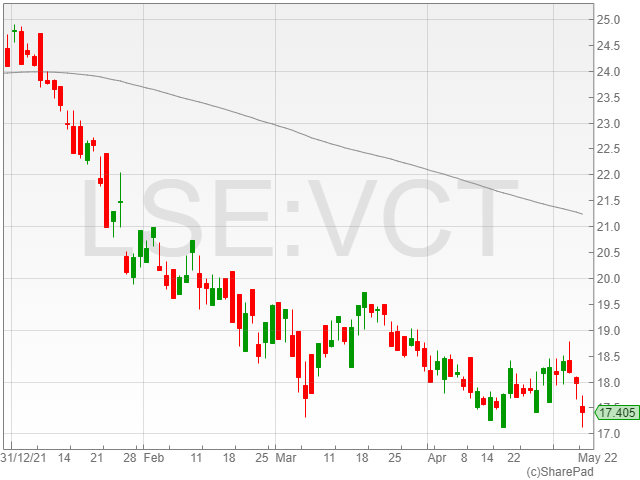

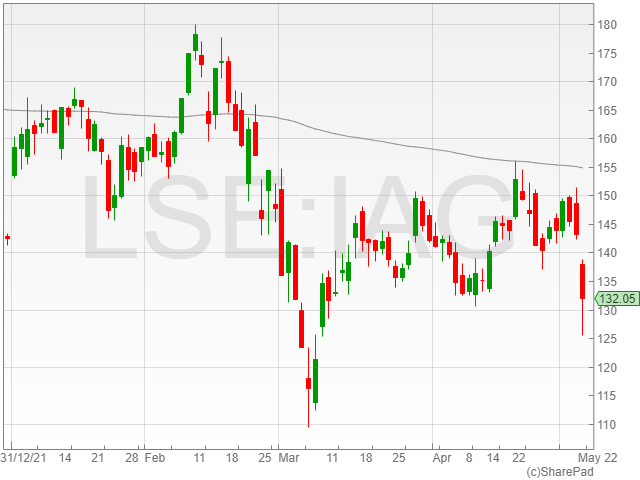

Shaftesbury shares fell 3.9% to 555p and Capital & Counties Properties shares dropped 6% to 155p on news of the possible merger.