Victrex reported a mixed slate of results in its HY 2022 update, including an 8% increase in group sales volume to 2,264 tonnes compared to 2,087 tonnes year-on-year, as a result of double-digit growth in electronics, energy and industrial and VAR.

The company also highlighted a recent improvement in its automotive sector, despite disruptions in its semiconductor chip supply chain, and a 12% uptick in medical revenue with the return of elective surgeries, with a 6% increase in the firm’s core application growth pipeline.

The polymer solutions group announced a 6% growth in revenue to £160.1 million against £150.9 million, alongside a 4% uptick in gross profit to £85 million from £81.4 million.

Victrex mentioned an 80 bps decline to 53.1% compared to 53.9% in the company’s gross margin, with a reported pre-tax profit fall of 6% to £43.6 million against 46.6 million, reflecting a one-off expensed ERP software implementation.

The firm’s earnings per share fell 7% to 43.5p compared to 46.9p since HY1 2021, with an announced dividend per share remaining flat at 13.4p.

Victrex highlighted advances in its polyether ether ketone (PEEK) business for its HY2 2022 outlook, alongside a projected increase in volume growth and a focus on year-on-year revenue growth.

The high performance materials firm added that its gross margin was estimated to decline in the next half year, as a result of currency movements.

The company said its mitigation plans for recovering additional inflation were making good progress, however it caveated that the group remained mindful of the changing global environment going into the remainder of 2022.

“Our attractive and differentiated portfolio includes sustainable products which bring environmental and societal benefit and, reflecting the value PEEK brings to customers, our core application growth pipeline increased by 6%,” said Victrex CEO Jakob Sigurdsson.

“Whilst volumes were strongly ahead and our initial price recovery programme is delivering on plan, we have faced further unprecedented energy, raw material and distribution inflation, as well as FX headwinds.”

“Thanks to significant improvement in operating efficiency and better asset utilisation, first half margin was broadly stable, despite the additional cost inflation, which we are well placed to recover. Without these additional cost headwinds, margin would otherwise have improved closer to our target level.”

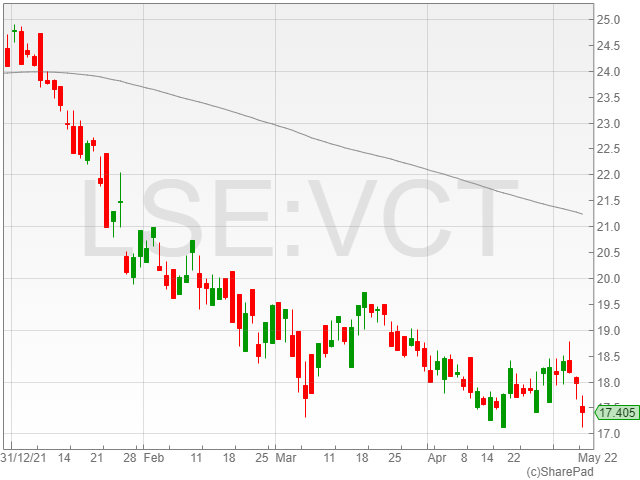

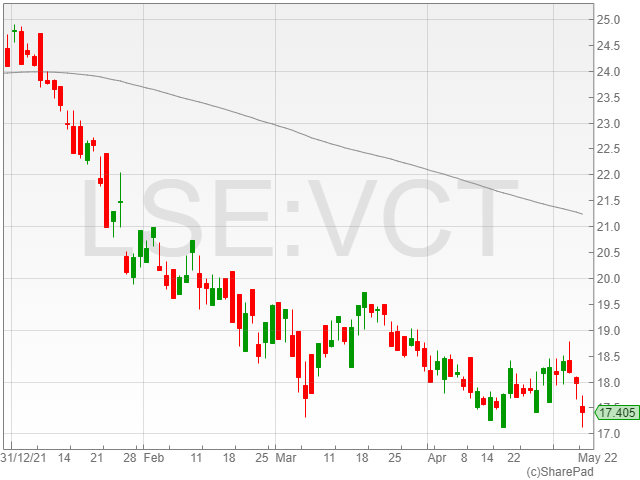

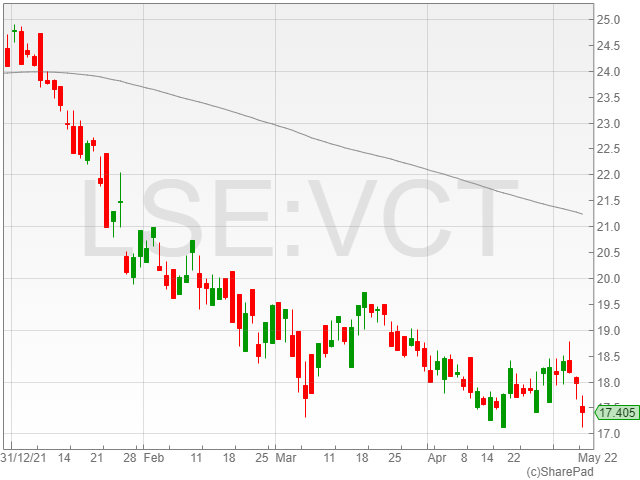

Victrex shares were down 3.8% to 1,728p in early morning trading on Monday.