The Bank of England announced a 0.25% hike in interest rates to 1%, the highest rate in 13 years.

The Bank of England’s nine rate-setters voted six against three to raise interest rates to the projected 1% expected by the market, as a result of 30-year high rates of inflation sweeping the UK.

The three opposing rate setters pushed for a greater increase to 1.25% in a bid to curb the skyrocketing inflation, which is expected to soar to 10% in Q4 2022.

Households Suffering

Analyst pointed out that the bitter rates jump would cause the most damage to households already struggling with rising inflation, the Covid-19 pandemic and rising energy prices.

“The move by the Bank’s rate-setters to increase rates lumps even more pain on households struggling with the cost of living crisis,” said AJ Bell head of personal finance Laura Suter.

“With inflation at 7% and expected to hit double digits in October, when the energy price cap rises again, it might have seemed like the Bank’s hand was forced.”

“The global nature of the drivers of inflation means that this increase to 1% is very unlikely to beat inflation into a hasty retreat, but what it is certain to do is pile more misery on people already having to rely on debt just to pay their bills.”

Inflation is set to hit a 9% rate across April in light of the 54% energy price cap rise, with the rate predicted to peak in October as energy bills climb higher on the back of increased energy bills.

“We expect inflation to rise further to around 10% this year,” said the Bank of England in a statement.

“Prices are likely to rise faster than income for many people. That means that people will be able to buy less with their money.”

“The UK economy has been recovering from the effects of Covid, but we expect the increased cost of living to lead to slower growth overall.”

BoE Fighting Inflation

The Bank said it aimed to curb inflation back to its 2% goal, and added that it expected to fall back within its ideal rate in around two years.

“[We] do have tools to make sure inflation comes back down to our 2% target. The main tool we use to bring inflation down is to increase interest rates,” said the Bank.

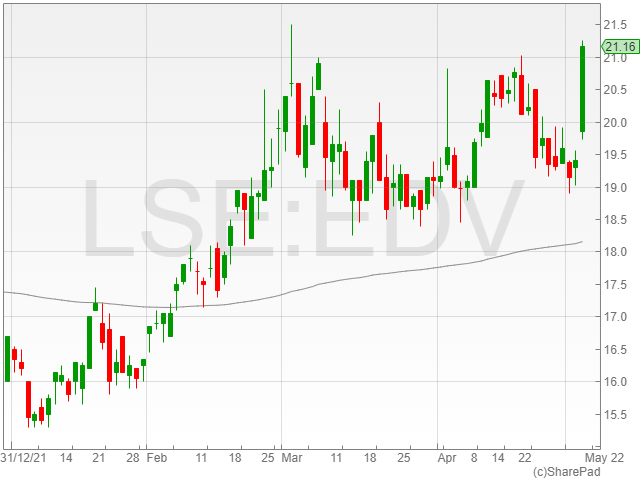

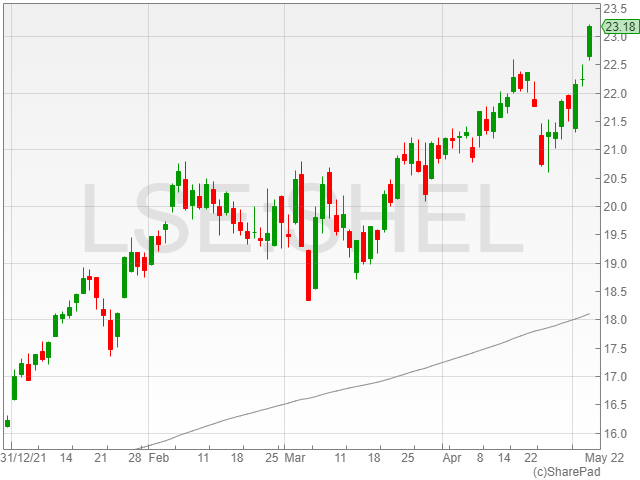

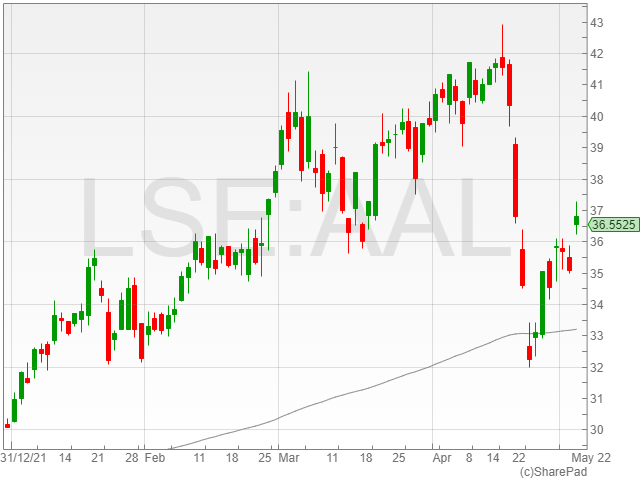

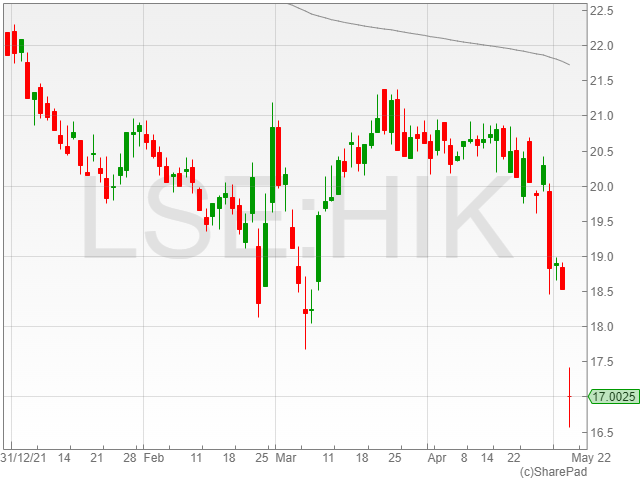

“We raised the UK’s most important interest rate (Bank Rate) from 0.1% to 0.25% in December 2021, to 0.5% in February 2022, and then again to 0.75% in March. This month we have raised Bank Rate to 1%.”

“We expect inflation to fall back next year and be close to our target in around two years.”

Recession Concerns

The looming prospect of a recession weighed on the announcement, with the Bank of England forecasting a potential GDP fall of close to 1% in Q4 2022 on the back of the rising energy price cap in October.

The institution reported a revised estimate to UK growth in 2023, anticipating a 0.25% contraction as opposed to its previous projection of 1.25% growth.

The outlook for 2024 appeared similarly grim, with a mere 0.25% growth predicted against its former 1% growth forecast.

Unemployment is also expected to hit 5.5% by 2025, as the UK suffers the second-largest hit to real household disposal income since 1964.

Further Interest Rate Hikes

The Bank of England confirmed that interest rates could continue to climb as high as 2.5% within a year, with many predicting that the Bank will hike rates to 1.25% at the next decision in June.

“Last time rates were at 1% they only sat there for less than a month, before being cut again to 0.5%. Anyone with borrowing will fear that the same will be true this time around, and that the Bank will increase rates again to 1.25% at the next meeting in June,” said Suter.

“That seems almost inevitable, with the Bank now predicting that rates will hit around 2.5% by this time next year.”

“This fourth increase in a row by the bank means that in the space of less than five months we’ve seen rates leap from 0.1% to 1%. And that means anyone with debt has seen a significant increase in their costs.”