GlaxoSmithKline reported a 32% rise in revenue in Q1 and noted higher quarterly profit as it announced it is on track to demerge and list its consumer healthcare arm Haleon on Wednesday.

In the first quarter of 2022, GlaxoSmithKline recorded a 32% increase in revenue to £9.7bn with Commercial Operations contributing £7.1bn.

Specialty Medicines recorded £3.1bn which made up almost half of the Commercial Operations £7bn contribution. The segment saw a 98% rise which was driven by consistent growth in all therapy areas including sales of Xevudy. The sale of Xevudy amounted to £1.3bn for GlaxoSmithKline.

Vaccine turnover increased by 36% to £1.66bn, led by Shingrix which is a shingles vaccine for adults aged 50 and over, in the US and Europe, reflecting robust performance and the advantage of a favourable comparative in Q1 2021, when sales were hit by COVID-19-related disruptions in numerous markets and decreased Centers for Disease Control purchases.

GlaxoSmithKline’s General Medicines generated £2.34bn, up 2%, thanks to Trelegy’s growth in all regions, the antibiotics market’s recovery, and the benefit of a favourable prior period returns and rebates adjustment, which helped to offset the impact of generic competition in the US, Europe, and Japan.

The remaining £2.6bn of the group’s revenue came from Consumer Healthcare which rose 14%.

GSK consumer healthcare will become Haleon in July, leaving a biopharma-focused ‘New GSK,’ according to the company’s demerging plans. Since early 2020, the separation has been in the works.

Sensodyne toothpaste, Panadol & Advil pain relievers, and Centrum vitamins will all be available at Haleon.

GlaxoSmithKline’s total operating profit rose 65% to £2.8bn compared to £1.69bn in Q1 2021 which included an upfront settlement from Gilead of £924m.

GlaxoSmithKline’s total EPS increase 67% to 35.9p compared to 21.5p in Q1 2021 due to leverage from significant sales growth during the quarter such as Gilead.

GlaxoSmithKline will propose a 14p quarterly dividend, down from 19p in the first quarter of 2021.

GSK aims to announce a 27p dividend for the first half-year under its new dividend policy, with 22p going to the new GSK and 5p going to consumer healthcare, soon to be Haleon.

GlaxoSmithKline 2022 Outlook

In 2022, GlaxoSmithKline estimates adjusted operating profit growth of 12% to 14%, excluding any contribution from Covid-19 solutions. GSK stated that the company intends to continue delivering on its strategic priorities.

Covid-19 solutions will generate similar sales in 2021, “but at a substantially reduced profit contribution due to the increased proportion of lower margin Xevudy sales,” according to the pharmaceutical company.

Xevudy is a Covid-19 antibody medication developed by GSK in collaboration with Vir Biotechnology, a San Francisco-based immunology business, however, it is no longer allowed for Covid-treatment in any US region due to the surge of the Omicron BA.2 sub-variant.

Emma Walmsley, Chief Executive Officer, GSK said, “We have delivered strong first quarter results in this landmark year for GSK, as we separate Consumer Healthcare and start a new period of sustained growth.”

“Our results reflect further good momentum across specialty medicines and vaccines, including the return to strong sales growth for Shingrix and continuing pipeline progress. We also continue to see very good momentum in Consumer Healthcare, demonstrating strong potential of this business ahead of its proposed demerger in July, to become Haleon.”

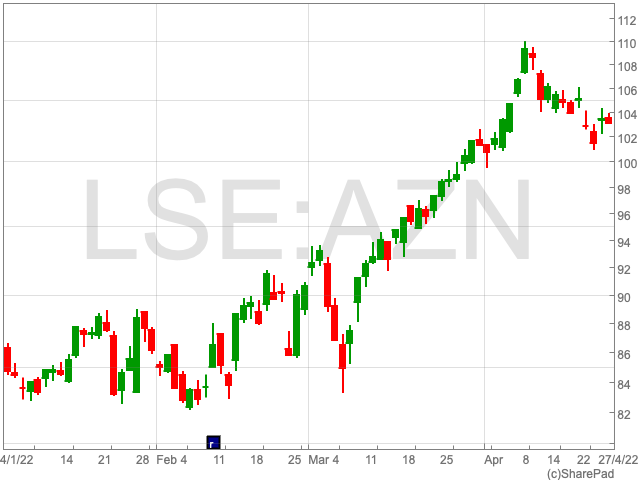

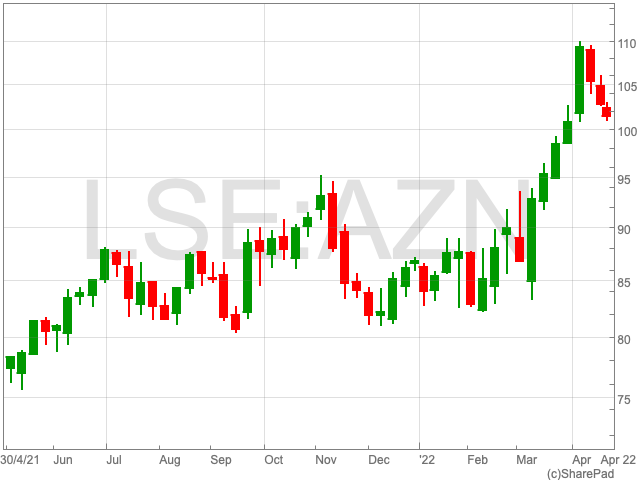

GlaxoSmithKline shares gained 1.15% to 1,774 after the company reported strong financials in its Q1 results.

Sebastian Skeet, Senior Analyst for healthcare sector companies at Third Bridge said, “With a consumer division split off set for July, GSK’s biggest task is to restore investor confidence in their pipeline.”

“All eyes will be on the guidance GSK will issue alongside Q2 results, and how the post-Hal Barron pipeline will tackle the patent cliff edges set for 2028.”

“Key revenue driver Shingrix’s performance was encouraging, with management seemingly upbeat on its prospects, although recent data points to prescription levels still significantly below pre-pandemic volumes. Longer term, mRNA vaccines pose a threat following Pfizer and BioNtech announcing a shingles collaboration earlier in the year.”