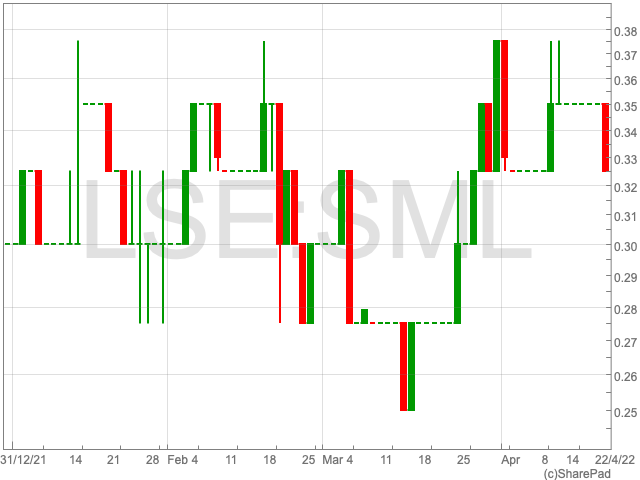

ITV shares gained the day after Netflix released its disappointing quarterly financial results, providing some reprieve to the stock which has been in a downwards spiral this year, giving up of 30% of their value year-to-date.

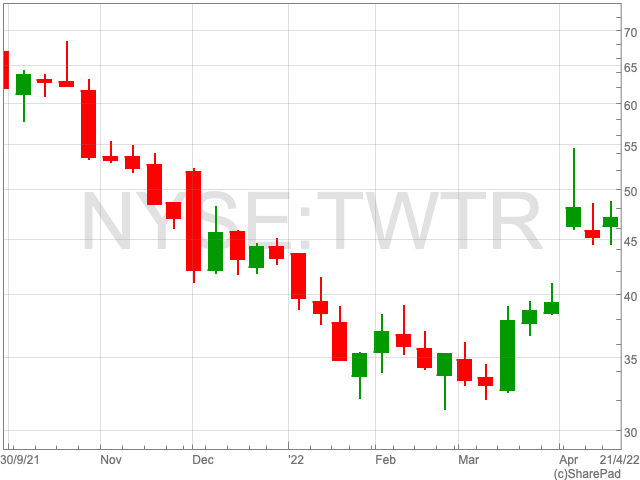

The sudden resurgence comes after streaming giant Netflix reported a loss in subscribers for the first time in a decade, with its shares consequently plummeting a heart-stopping 35% when the news broke on Wednesday.

However, as Netflix sank, the ITV share price soared, adding some 7% the day after Netflix posted their dismal update.

Streaming companies are aware that subscription-based entertainment is an increasingly fierce industry, and that most consumers have neither the financial capacity, nor the patience to sign up for every streaming competitor on the market. For one streaming company to succeed, another must suffer, making the market hyper-competitive and also making any new venture into the busy territory a risky gamble.

ITVX

ITV’s shares tumbled on the release of the company’s financial results after the group announced its intent to launch ITVX, a streaming replacement for its ITV Hub catch-up service.

Follow-up details revealed that ITVX would function as a streaming service for content before it aired live on conventional television, with thousands of hours of content for viewers to watch and 15,000 hours of material available upon the platform’s launch.

However, investors were critical of the company’s bid to break through into the heavily saturated ‘Squid Game’ of the streaming environment, and analysts sniped at the company’s attempt to jump into the ring with the established US heavyweights.

“ITVX is not as revolutionary as the company might like you to believe. It is effectively offering viewers a chance to see some of its programmes before they are broadcast on linear TV as well as its back catalogue of shows,” said AJ Bell investment director Russ Mould on ITVX’s unveiling in March.

“Viewers are increasingly switching on Netflix or Disney+ first and media groups like ITV need to find a way to make sure their brand also stays front of mind when someone is looking to put their feet up and choose something to watch.”

Analysts further cast doubt on the potential allure of ITVX’s slate of offerings, especially in light of smash hits including Netflix’s Bridgerton, Amazon Prime’s The Marvellous Mrs. Maisel or the entire catalogue of Marvel shows from WandaVision to Moon Knight on Disney+.

“Ultimately the proposition will only be as successful as its content, and here’s where ITV might have to dig deep to compete against the ever-growing number of rival streaming platforms. Yes, it has some classics, but will the lure of endless Carry On films be enough to get people to keep watching ITVX?”

The ITVX subscription would reportedly come with a tie-in subscription to Britbox, the streaming service which has proven popular in the US for its unfiltered access to UK content such as Doctor Who and Agatha Christie’s Poirot, which are in high demand across the Atlantic.

It was unlikely that the service would have made a great deal of headway against its juggernaut competitors such as Netflix, Disney+ and Amazon Prime without a major blow to the top tier streaming giants.

However, the gains this week were more likely attributed to the opportunity for ITV’s Studio business, as opposed to the hopes of gaining additional subscriptions at the expense of Netflix.

ITV’s Opportuntiy

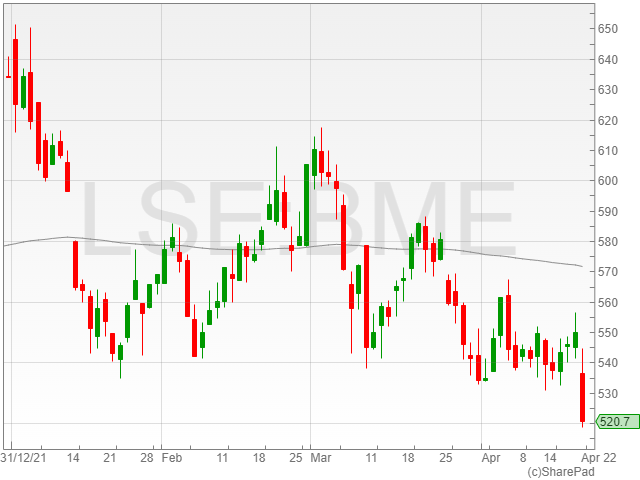

ITV’s studio business posted strong growth in 2021 with revenue jumping 28% to £1.7bn. ITV Studios external revenue increased 30% to £1.17bn.

The FTSE 100 broadcaster and content creator provides content to streaming services such as Disney+, Apple TV+, Netflix, Hulu and Amazon.

If Netflix are to reduce spending on original content, they may turn to studios such as ITV for series and films to provide to their users.

ITV Studios generated 13% of total revenues from streaming platforms in 2021, up from 10% in 2020.

ITV says they expect this to grow to 25% of ITV Studios revenue by 2026, which is more than achievable given revenue from original commissions sold to streamers was up 95% in 2021.

Netflix strategy shift

Netflix reportedly cut its production costs to $2 billion last quarter, coming in below management expectations, and the service said it expects to reduce its spending further with an additional cutdown to $1.7 billion in the next quarter.

The company’s spending slowdown might make room for ITV’s content to find a home on Netflix’s roster as it spends less on original content and potentially seeks out existing options to fill the gaps in its streaming offerings.

Shows co-produced by ITV Studios including The Good Witch, Queer Eye, Snowpiercer, Bodyguard and Poldark have all found a home on Netflix in recent years, with new original content from partnerships between the two companies such as Cowboy Bebop hitting the platform, too.

Netflix Originals

Netflix may have bitten off more than it can chew with its ambitious content, with shows from The Crown and Bridgerton to Stranger Things and the upcoming Sandman adaptation making headline news for their sky-high production budgets.

Stranger Things, one of the shows which put Netflix on the map as the original home of binge-watching, has reportedly cost $30 million per episode, while Neil Gaiman adaptation The Sandman is set to cost $15 per outing.

The service might need to fall back on licensed content agreements if it wants to compete in quantity and value-for-money, especially now that the company has raised its subscription prices in a time of record-high inflation levels of 7% for the UK and 8.5% for the US.

ITV Financials

ITV released a glowing slate of results for the last year on 3 March, with revenues increasing 28% to £1.76 billion against £1.37 billion in 2020

The company announced an operating profit of £519 million compared to £356 million in 2020, alongside an adjusted EBITDA of £813 million against £573 million the previous year.

ITV currently has a PE ratio of 5.1 and a forward PE ratio of 5.6, indicating analysts see largely earnings flat in the future. Nonetheless, a PE of 5.1 suggests significant value compared to historical averages.

The group also has a generous reported dividend cover of 4.6, meaning the broadcasting firm has the resources to pay out its dividend and potentially raise it over future shareholder payments.

ITV share price’s attractive valuation provided a solid base for investors to pick the stock up this week as they learned of the potential opportunity for ITV if Netflix, and other streamers, alter their content strategy and increase spending on ITV Studio’s productions.