The FTSE 250 was up 0.5% to 21,192.2 and the AIM was flat at 1,056.7 in late morning trading on Thursday.

Ibstock shares were up 9.5% to 182.2p after the group announced a Q1 2022 performance ahead of management expectations despite climbing inflation, with strong demand across all its end markets.

“Brickmaker Ibstock is plagued by soaring input costs and ballooning energy bills, but the group appears to be coping well,” said Hargreaves Lansdown equity analyst Laura Hoy.

“A focus on increasing capacity and efficiency at its factories has allowed it to jump on booming post-pandemic demand.”

Rank Group shares fell 8.8% to 117.1p after the gambling company cut its full year guidance on the back of poorer performance in March and climbing inflationary pressures.

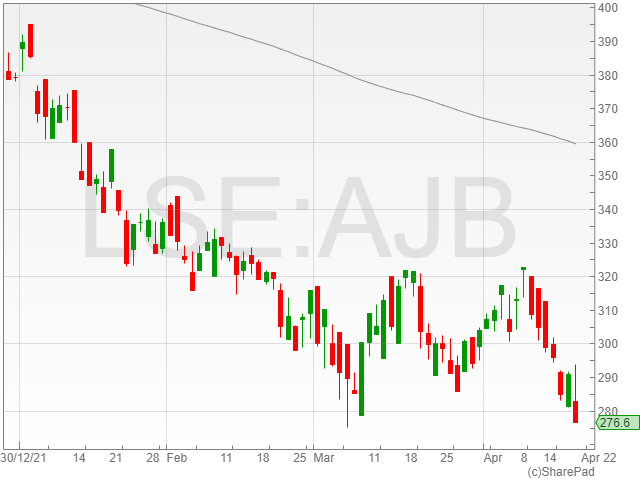

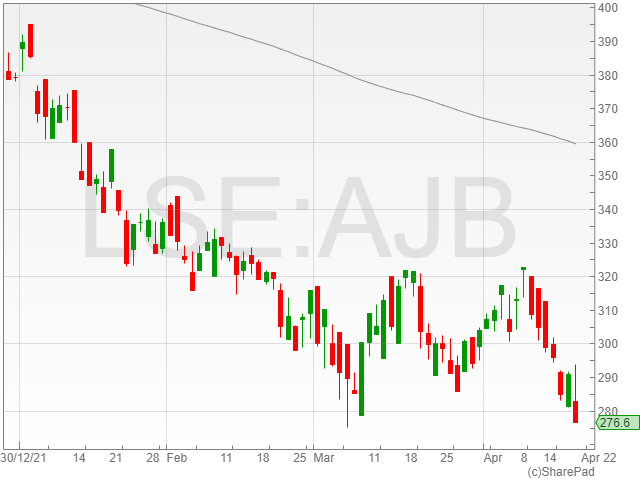

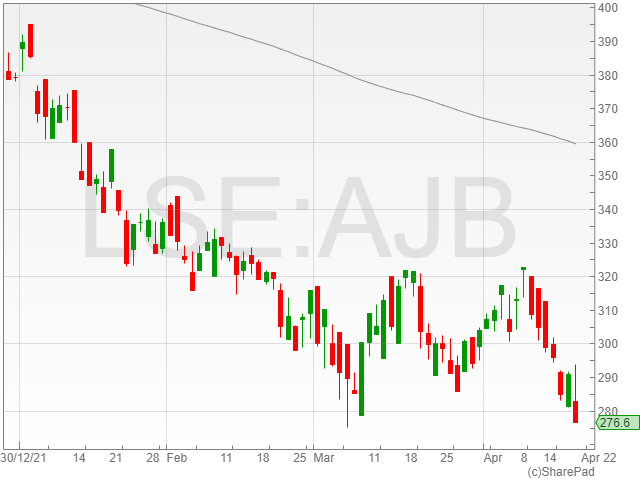

AJ Bell shares took a dip of 4.3% to 278.3p following lower customer investment reported in its trading update for Q2 2022.

Ferrexpo shares fell 2% to 176.1p as the company was pulled into the tide of falling commodities stocks today, despite its report of an increase to its humanitarian fund to $12.5 million in a move to assist relief efforts in Ukraine.

“Commodity producers have enjoyed soaring prices in the past year but their moment in the sun might be coming to an end,” said AJ Bell investment director Russ Mould.

“The cracks in the latest round of trading updates from the sector are a reminder that mining operations don’t always run smoothly, commodity prices rarely go up in a straight line on a sustained basis, and earnings are volatile.”

Solid State shares enjoyed an uptick of 13.3% to 11,500p, after the firm announced expected FY2022 results ahead of management expectations.

The company confirmed a 28% rise in revenue to £85 million compared to £66.3 million in 2021, alongside an adjusted pre-tax profit increase of 33% to £7.2 million against £5.4 million.

Churchill China share rose 8.9% to 15,250p following a strong slate of preliminary results for 2021, including an operating profit before exceptional items of £6.1 million, against £0.9 million in 2020.

The company also reported a re-instated final dividend of 17.3p per share after no dividends last year.

“The second half of 2021 saw a strong recovery in our sales to the Hospitality market such that the full year results are ahead of our expectations,” said Churchhill China CEO Alan McWalter.

GB Group shares were up 9.2% to 623p after the firm announced a pre-close trading statement with revenue ahead of management expectation at £242 million for FY2021.

Jangada Mines shares plummeted 27.8% to 7.4p following the release of an updated technical report for its Pitombeiras Vanadium Titano-Magnetite (VTM) project in Brazil, which provided and underwhelming $96.5m post-tax Net Present Value (NPV) and 9-year mine life.

Gear4music shares dropped 27.7% to 260p after the company announced a 6% decrease in total sales in its annual trading update, with higher inflation and weaker consumer demand across February and March predicted to impact the group’s HY1 2023 sales.

“Short-term inflation-linked overhead cost pressures and weaker consumer confidence across the broader retail landscape will mean the best opportunities for stronger growth during FY23 are likely to be in H2,” said Gear4music CEO Andrew Wass.

“We are, accordingly, moderating our overall growth expectations for the new financial year, which we believe is the prudent approach in the current environment.”

Tungsten West shares dropped 17.9% to 52.5p on the back of the group’s suspended operations across its Hemerdon Projects in light of adverse market conditions.

The company reported that it would continue to evaluate alternative approached to reigniting mining operations while it considers it next steps.

Osirium Technologies shares fell 16.6% to 12.5p after the firm reported a widened pre-tax loss of £3.43 million in its 2021 results against a loss of £3.10 million in 2020.