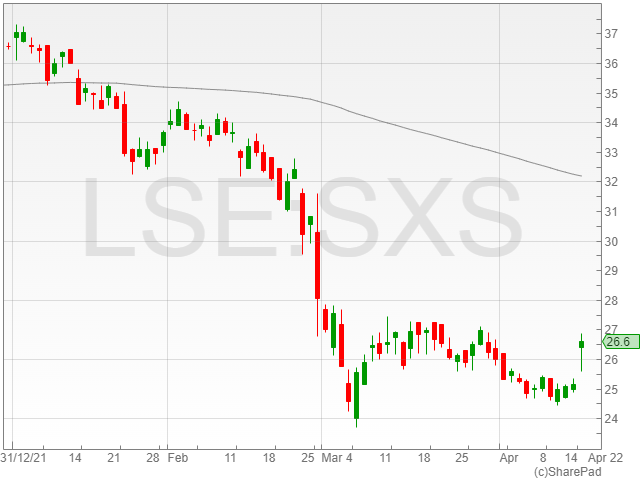

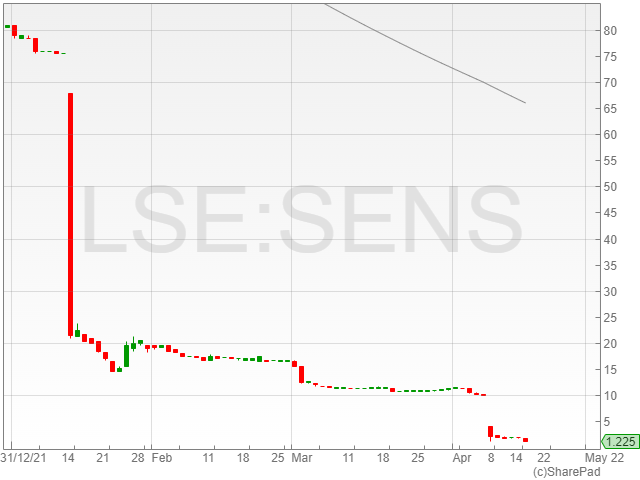

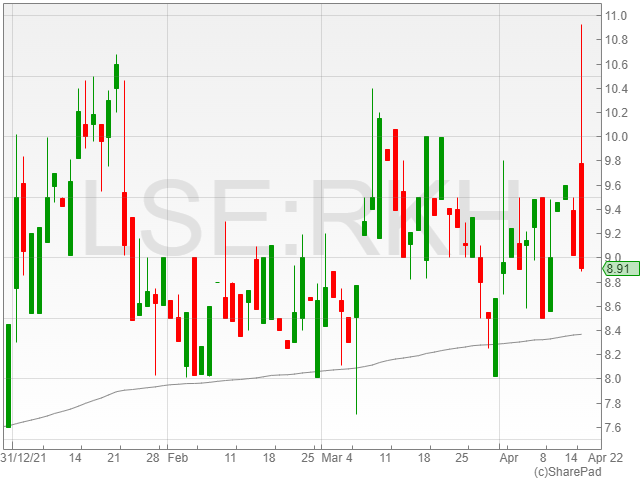

Rockhopper shares fell 4.1% to 9p in early afternoon trading on Tuesday, after the company agreed to assist Navitas’ entry into the North Falkland Basin.

Rockhopper and Navitas are set to partner in the Basin and develop a joint technical and financial deal to facilitate the development of the Sea Lion project to hit first oil on a lower cost, alongside an expedited basis post sanction.

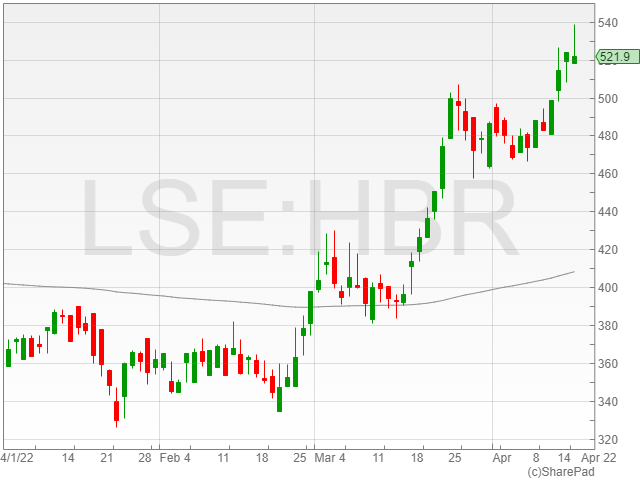

The agreement will see Rockhopper take on 35% of the jointly-held North Falkland Basin petroleum licenses, with Navitas securing 65% through its acquisition of Harbour Energy’s Premier Oil Exploration and Production Limited company.

Navitas has reportedly agreed to loan Rockhopper a sufficient sum of cash to fund the majority of the expenses linked to phase one of the Sea Lion project from Transaction Completion (TC) to Final Investment Decision (FID), with an 8% rate of interest per year, excluding certain expenses such as license costs.

The company confirmed that it would also provide Rockhopper with an interest-free loan to fund two-thirds of Rockhopper’s share of the Sea Lion phase one development costs, pending a positive FID.

Rockhopper said that funds drawn under the loans provided by Navitas would be repaid from 85% of Rockhopper’s working interest share of free cash flow.

The agreement stipulates that failure to acquire a positive FID within five years of the transaction leaves Rockhopper with the option to remove Navitas from the Falklands Island petroleum licenses by repaying the pre-FID loan.

However, if material progress has been made towards a positive FID, the parties can choose to extend the term for an additional 12 months, followed by a final extension of six months to provide extra time to secure the FID.

Navitas confirmed that it would become an operator of the Sea Lion project upon a successful completion.

“We are delighted to have signed definitive documentation to bring Navitas into the North Falkland Basin,” said Rockhopper CEO Samuel Moody.

“Subject to regulatory consents, we believe this marks the start of a new exciting chapter for the Falklands, and for the Sea Lion project in particular. Navitas’ US$1 billion Shenandoah financing in 2021 proved their ability to fund challenging offshore oil and gas developments.”

“Given this, coupled with a more positive oil price environment, we are very excited to have them as new partners and look forward to pushing ahead with Sea Lion, a world class resource.”