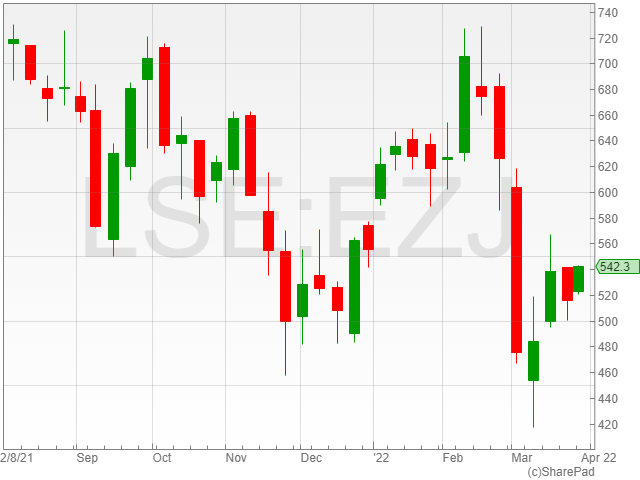

Rio Tinto shares have gained 1% to 5,922p in early morning trade on Tuesday after completing the acquisition of the Rincon lithium project.

The Argentinian Rincon lithium project was acquired for $825m by Rio Tinto once the Australian mining group received approval from Australia’s Foreign Investment Review Board (FIRB).

Rincon is located in the Salta Province of Argentina and is an undeveloped lithium brine project. The project has scalable capabilities for battery-grade lithium carbonate, earning the region a reputation as an ’emerging hub for greenfield projects’.

When compared to solar evaporation ponds, the direct lithium extraction technology proposed for the project has the potential to substantially improve lithium recoveries.

Currently, a pilot plant is operating on the site, and future development will concentrate on further refining the method and recovery rates.

Rincon Mining, owned by Sentient Equity Partners, entered into a binding agreement with Rio Tinto in December 2021 for the acquisition of their Rincon lithium project.

Jakob Stausholm, Chief Executive Officer, Rio Tinto, said “Rincon strengthens our battery materials business and positions Rio Tinto to meet the double-digit growth in demand for lithium over the next decade, at a time when supply is constrained.”

“We will be working with local communities, the Province of Salta and the Government of Argentina as we develop this project to the highest ESG standards.”

The second half of the next decade is expected to see a supply-demand deficit due to the expected demand increase of 25-35% for battery-grade lithium carbonate.