The FTSE 250 saw a 0.5% increase to 21,060 and the AIM market enjoyed a rise of 0.1% to 1,037 in late morning trading on Monday.

Travel companies pulled the FTSE 250 higher as customers prepared for Spring and Easter travel following a bleak winter.

The more domestic facing small and medium cap indices overlooked developments in China and pushed higher, despite weakness in oil companies.

FTSE 250 Risers

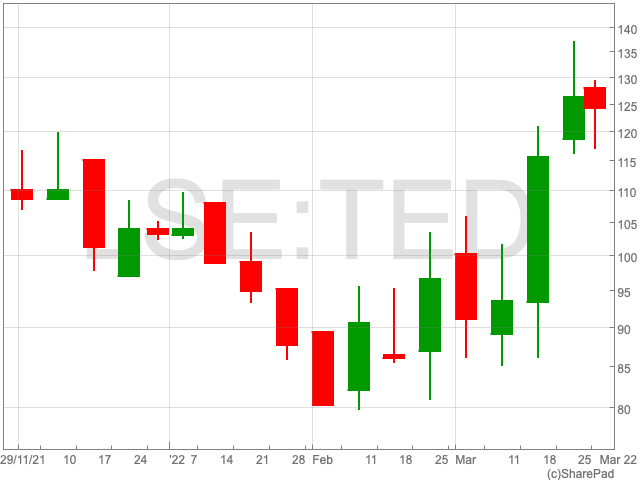

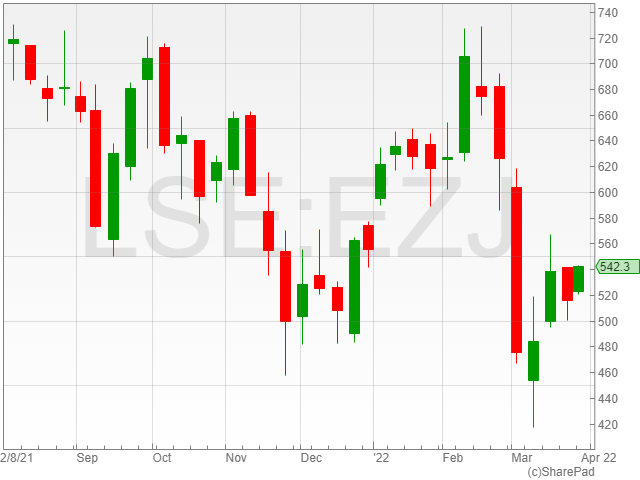

EasyJet shares rose 4.3% to 538p on hopes of a boost in international travel as winter ends and consumers make plans for Spring holidays.

Airline Wizz Air Holdings enjoyed a rise of 3.7% to 2,647p and travel booking group TUI rose 3.4% to 231p following the same pretext of EasyJet’s gains.

RHI Magnesita shares gained 0.9% to 2524p after the announcement of joining a joint venture with Horn & Co.

FTSE 250 Fallers

The FTSE 250 fallers were topped by Lancashire Holdings with a drop of 3% to 392.8p contradicting the trend of FTSE 100 listed insurance companies.

The Kainos Group fell 2.4% to 1,328p and the Volution Group saw a decline of 2.4% to 404.5p.

Tullow Oil shares dropped 2.6% to 52p following the closing of its Azinam Acquisition deal and a drop in oil prices.

AIM Top Risers

The Minoan Group led the AIM risers with a 12.7% increase to 1.3p per share after the appointment of George Mergos to its Loyalward subsidiary allowing projects to progress.

Cambridge Cognition Holdings saw a rise of 12.7% to 137p after the company announced a £1 million contract for an autoimmune trial.

Phoenix Copper rose 12.5% to 58.5p on the back of a positive growth outlook for 2022 as the price of copper and precious metals is expected to increase.

AIM Fallers

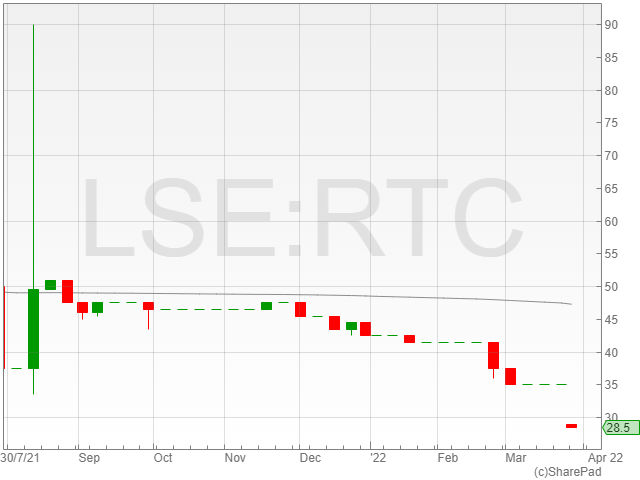

The RTC Group led the fallers with an 18.5% decrease to 28.5p following a reported profit reduction to £0.3 million against £1.1 million in 2020.

The Tandem Group fell 14% to 430p on the back of a bleak outlook for 2022 following cancelled holidays and a weak order book for the year ahead.

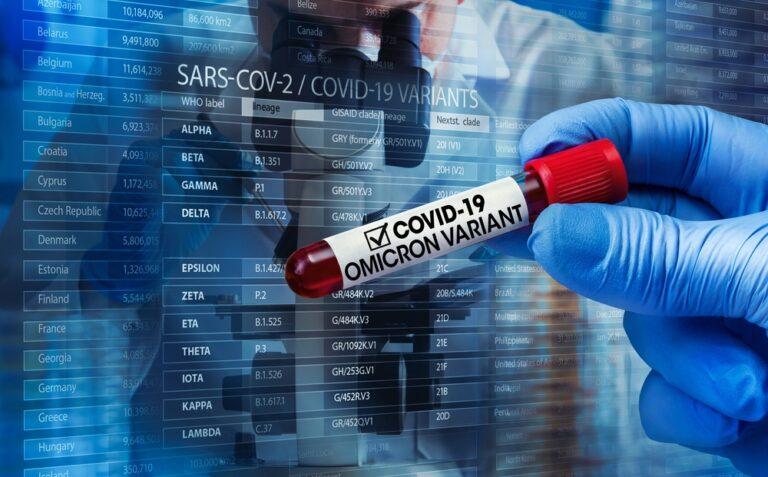

Origo Partners saw a 10.7% decline to 0.1p per share after the Chinese-oriented investment company took a hit in China’s latest Covid-19 lockdown as companies in the region ground to a halt.