The delayed flotation of Recycling Technologies Group is back on but at a lower valuation than before. Trading on AIM should commence on 5 April.

Recycling Technologies wants to raise up to £30m at a pre-money valuation of £50m. The share price has been set at 110p. The free float should be at least 55%. The books will close on 29 March.

A PrimaryBid offer was launched last November ahead of a proposed flotation before the end of 2021. Recycling Technologies wanted to raise up to £40m and the potential market capitalisation was between £102m and £111m. The indicative share price range was betw...

Small & Mid Cap Roundup: Bridgepoint, Weir Group, Surface Transformations and Mobile Tornado

The FTSE 250 was down 0.7% shortly after midday on Thursday as major constituents such as Carnival and Weir Group hit the index, and UK domestic facing stocks felt the pressure of rising inflation.

FTSE 250 Risers

Private assets growth investor Bridgepoint Group topped of the FTSE 250 risers in early trade with a 12.8% increase to 324.2p per share, following a 29% rise in pre-tax profits in 2021.

However a late morning rally in Polymetal, gaining 30% to 181p, saw the gold miner take over as the FTSE 250 top riser following its exit from the FTSE 100 this week.

Games Workshop Group saw an increase of 6.9% to £76.1 after the confirmation of 70p dividend to be paid in May 2022 as the company distributes excess cash from a solid trading period.

FTSE 250 Fallers

The Weir Group fell 5.3% to 1,782p after its reported revenue of £1.9 billion missing analyst predictions of £2.1 billion for 2021.

XP Power saw a decline of 4.6% to 3,470p following competitor Comet’s $40 million damages claim in US courts against the group.

SDLC Energy Efficient Income Trust took a hit of 3.5% to 116.7p after the company announced plans to raise £75 million for further investments.

AIM Risers

The AIM market was led by Surface Transformations with an increase of 30.9% to 55p following the confirmation of a lucrative £100 million brake discs contract with OEM 8.

The Tungsten Corporation rose 19.1% to 46.1p after the company received an updated, higher takeover bid from software group Kofax.

Uru Metals saw an increase of 19% to 250p. Uru Metals has a large spread of 200p-300p and small trades can cause dramatic price movements.

Bluejay Mining rose 7% to 8.2p following a successful placing to raise £5.38m at 7p.

Shearwater gained 3% after it announced a c.£620,000 contract win with a leading telecoms and media group.

AIM Fallers

The AIM fallers were led by Mobile Tornado Group with a fall of 31.7% to 0.8p per share following an agreed 12 month extension on a loan which is scheduled to expire in September 2023.

PipeHawk fell 20.5% to 29p after a reported interim pre-tax loss of £457,000.

The i-nexus Global company rounded up the AIM market fallers with a decline of 19.5% to 3.9p.

FTSE 100 flat with oil prices at $121

FTSE 100 gained gingerly to 7,461 on Thursday with rising oil prices as investors awaited the outcome from key NATO and G7 meetings.

Commodity prices are surging with wheat and oil rising on the day. Precious metals gold and silver prices are also gaining.

Brent Crude increased 0.2% to $121 a barrel impacting the mining and energy sectors.

“Brent Crude oil at $122 per barrel is going to be a tough one for businesses to stomach as energy costs go through the roof,” says Russ Mould, Investment Director at AJ Bell.

“The cost of running factories, moving trucks and powering computers will put a squeeze on profit margins which means corporate earnings expectations may have to be reduced unless we see a significant reduction in inflationary pressures.”

With the rising price of oil, BP and Shell gained 1.2% and 0.8% on Thursday.

“It isn’t all bad news as a higher oil price is good for BP and Shell on the UK stock market, thereby giving a lift to the FTSE 100 index, up 0.2% to 7,478,” said Mould.

Russian energy supplies are currently being discussed between President Biden and the G7 which is likely to have a further impact on commodity markets.

I’m on my way to Europe to rally the international community in support of Ukraine and ensure Putin pays a severe economic cost for his war of choice. pic.twitter.com/4UJpyitOko

— President Biden (@POTUS) March 23, 2022

FTSE 100 Risers

The possibility of increased sanctions on Russia’s energy exports and rthe ising prices of precious metals are having a positive effect on global miners.

Fresnillo shares strengthened by 2.6% to 744p while Rio Tinto shares gained 1.5%.

M&G shares were trading up 1.7% to 219p as the company started a share buyback programme of £500m.

Similar to M&G, British American Tobacco shares increased 1.3% to 3,233p after the purchase of 485,000 shares at 25p each.

In the banking sector, HSBC was amongst the gainers with a 1.2% increase to 516p.

United Utilities Group shares rose 1.4% to 1,060p with investors seeking defensive shares.

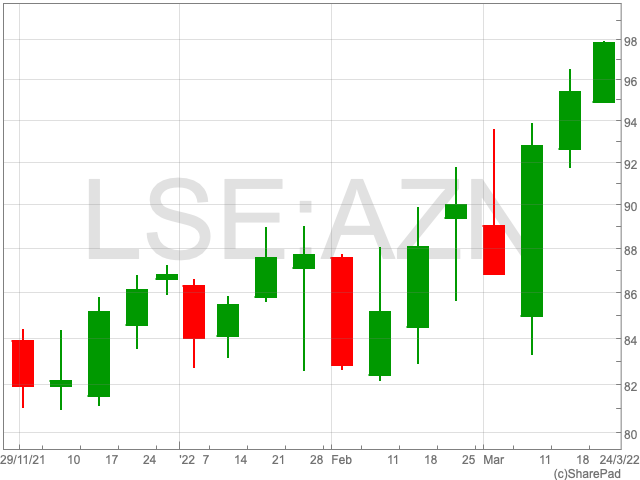

AstraZeneca saw shares gain 0.65% despite unoptimistic results from their CALLA Phase III trial with Imfiniza.

FTSE 100 Fallers

Next saw its shares lose 3.8% to 6,141p as the company reduced its growth outlook for 2022 following the £85m loss expected from the withdrawal of online sales in Russia and Ukraine and rising inflationary pressures impacting consumer spending in the coming months.

Next did however report strong revenue growth of 34% and pre-tax profits increasing 140% to £823m in 2022.

“For a company that has a habit of under-promising and over-delivering, the market has shown disappointment at Next’s downgraded sales guidance for its current financial year,” said Russ Mould.

“Next’s most recent full year period showed a business enjoying significant success. The company put it down to consumers splashing the cash they saved during the various Covid-related lockdowns.

“The key point of disappointment is reduced sales guidance for overseas territories, which is not simply the result of closing its Ukraine and Russian website operations. However, it has lifted guidance for likely sales from UK shops, which is a pleasant surprise given the direction of travel for UK retail – namely so much more business is going online.

“It seems inevitable the coming months may be more challenging given inflationary pressures are intensifying, and household bills are becoming much higher.

IAG was the FTSE 100 top faller as the travel stock continue to feel the pinch from pressures on household spending.

Lloyds Banking Group to axe 60 branches this year

Lloyds Banking Group has announced the closure of a total of 60 more branches across Bank of Scotland, Halifax and Lloyds throughout the UK by the end of 2022.

Lloyds Banking Group has decided to cut back their high street network due to increased dependence on online banking noted by record usage in 2022.

During the pandemic, retail branch visitors had to complete their bank errands online, leading to the downward trajectory of retail banking.

Lloyds saw a 12% and 27% increase in users on their online platform over the last 2 years.

The group reported 18.6 million regular online banking customers and more than 15 million mobile app users across its brands

“Just like many other high street businesses, fewer customers are choosing to visit our branches,” said Vim Maru, Lloyds Banking Group’s group retail director.

“Our branch network is an important way for us to support our customers but we need to adapt to the significant growth in customers choosing to do most of their everyday banking online.”

Since June 2021, the business has cut more than 150 branches from its network, including 24 Lloyds Bank branches, 19 Bank of Scotland branches, and 17 Halifax branches.

Around 124 jobs will be lost through the closure of the 60 branches, according to Unite the Union.

Caren Evans, a national officer with the Unite the Union, said, “Lloyds Banking Group must not be allowed to abandon 60 more local communities where bank branches play an essential role.

“The banking sector needs to answer some serious questions about its corporate social responsibilities and the government cannot stand back and allow the relentless closure of banks to continue until no more local banking services remain.”

Nestle suspends Russian KitKat and Nesquick following intense backlash

Nestle has pulled its popular KitKat and Nesquick brands from Russia following extreme backlash against the FMCG giant for dragging its feet under pressure to boycott the country.

Over 400 companies have withdrawn from Russia in protest of its Ukraine invasion in the last two months, including Starbucks, McDonald’s, Unilever and Heineken.

Nestle halted sales of its non-essential products including San Pellegrino water and Nespresso capsules earlier in March, however, it refused to pull the remainder of its bestsellers from Russia.

The company suspended its investment in the embattled nation a couple of weeks ago but ignored calls to pull out of Russia entirely.

“We have a responsibility toward our more than 7,000 employees in Russia – most of whom are locals,” Nestle said in a statement.

Ukrainian Prime Minister Denys Shmyhal zeroed in on the company and blasted its reluctance to withdraw from Russia in a tweet.

Nestle has pulled most of its major brands from Russia, and will reportedly continue to sell only essential products such as baby food and medical nutrition.

Nestle’s share price was up 0.4% at 199.2 CHF in morning trading on Thursday following the news.

Next sees 140% rise in pre-tax profit due to online sales

Next’s pre-tax profit increased from £342m to £823m in 2022, rising 140% as online sales recovered the gap created by the pandemic in retail sales.

The retailers saw total group revenue grow 34% to £4.8bn in 2022, with significant contributions of £3.1bn from the online segment.

Next’s retail sales saw an increase of 50% from £954m to £1.4bn in 2022.

Total brand full-price sales for the company rose 32.4% to £4.7bn in 2022.

Next saw online sales grow specifically in homeware and kids apparel during lockdown over their first quarter.

The company managed to meet the demand for adult clothing despite stock shortages in the second half, where consumers spent lockdown savings.

Steve Clayton, HL Select fund manager said, “we hold NEXT plc in our UK funds because it is a superbly managed retailer, with the highest online exposure of any High Street operator in the UK and a cash generative business model.”

“The business is performing strongly in unusual circumstances. Demand is holding up well, with the stores trading ahead of expectations, although some of this is a function of pulling business back from the website, post lockdowns.”

Net debt excluding lease debt reduced from £610m to £600m.

Earnings per share rose 138% in 2022 to 530.8p compared to 223.3p in 2021.

Like many big names such as McDonald’s and Starbucks, Next halted their business in Ukraine and Russia generated by their website.

The company has lowered their sales guidance by 2% and profit guidance by 1.2% for the coming year.

Next reportedly expects to mitigate losses from lower margin sales from overseas and costs incurred from increased markdowns through better performance in the UK retail market.

The company predicted a 5% increase in full-price sales, alongside group profits of £850m in 2023.

“Having previously sold well online in Russia, there is an obvious hit that has to be taken, but the business is more than strong enough to cope,” said Clayton.

The group has a business model for the next 15 years for how the company will fare, through which a cash generation of £15bn is what they are capable of.

Steve Clayton highlighted the potential value in the stock by making a comparison to their forecast cash generation and Next’s market cap, currently under £9bn.

“The group has long had a policy of returning all excess cash to shareholders, and today announced a return to pre-pandemic dividend levels, augmented by share buy-backs to absorb surplus cash.”

“If their modelling is anywhere near accurate, then shareholders can look forward to a lot more of that in future,” stated Steve Clayton.

“The market’s reaction, knocking the shares back a couple of per cent in early trading seems a knee-jerk to the reduction in sales forecasts. But all of that relates to the events in Ukraine and cash generation expectations for the current year are actually improved.”

“Longer term, that cash flow modelling suggests that there is in fact much for investors to look forward to.”

Next shares were trading down 3% to 6,198p as a reaction to the company’s lowered growth forecasts.

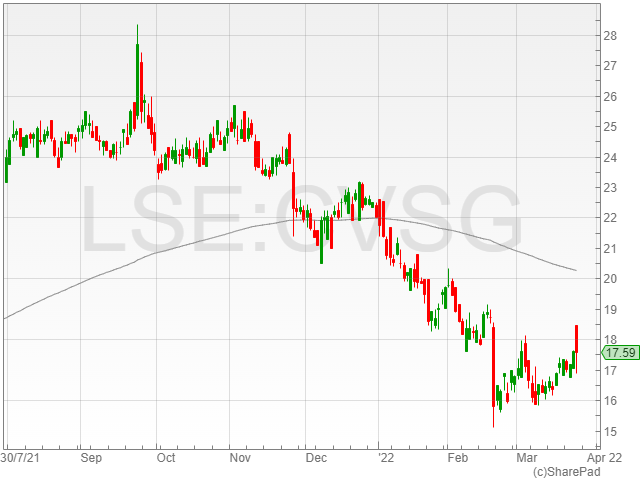

CVS enjoys 11.4% revenue boost on increased membership subscriptions

CVS saw its share price fall 0.9% to 106.2p in early morning trading on Thursday despite the company reporting an 11.4% increase in revenue to £273.7 in its half-year results due to rising vet care membership rates and organic growth.

The veterinary firm reported an adjusted EBITDA of £52 million compared to £45.1 million in 2020.

CVS enjoyed a £36.2 million pre-tax profit against £29.7 million in 2020 as a result of 461,000 new subscribers to its ‘Healthy Pet Club’ affordable preventative healthcare scheme.

The company saw a 9.6% rise in like-for-like sales and predicted a growth of 10% in the first eight months.

The firm paid a final dividend for the year of £4.6 million, which represented a 6.5p per share payout.

CVS confirmed its trading outlook is currently positioned for future growth after increased investment in its facilities, equipment and potential acquisitions pipeline.

“I am pleased to report on another strong set of results which reflect the commitment, dedication and professionalism of our colleagues,” said CVS CEO Richard Fairman.

“Our ongoing strategy of investment in our people, in our practice and other facilities, and in our clinical equipment is generating beneficial returns through organic growth.”

“The positive trading momentum in H1 2022 has continued into the first two months of our second half, and with a strongly cash generative model we remain well placed to continue to invest and acquire to deliver future growth.”

Analysts noted CVS’ strong momentum going forward and the company’s strategy for organic growth in 2022.

“While acquisitions are an important part of the story, with huge scope for further consolidation of the UK’s vet market, a focus on organics is very pleasing,” said Sophie Lund-Yates, Equity Analyst, Hargreaves Lansdown.

“The potential for growth in Europe is another window of opportunity, feeding into the long-term attractions of the business.”

“The UK pet boom seen during the pandemic should act as a long-term growth driver too.”

“As the puppies and kittens welcomed in lockdown age, they will require more trips to the vets.”

“This bolstered source of income isn’t fully reflected in the group’s valuation, which has come down some way from previous highs.”

Playtech hits the jackpot with 25% surge in EBITDA from Americas and Italy

Playtech saw its share price rise 2.3% to 622.5p following a 25% increase in EBITDA to €317.1 million compared to €253.6 million in 2020 on the back of outperformance in the America markets and rising sales in Italian subsidiary Snaitech.

The company reported a revenue increase of 12% to €1.2 billion against €1 billion after B2B growth led by the outperformance in the Americas.

Playtech attributed its especially high 366% surge in post-tax profit of €127.6 million compared to €27.3 million in 2020 to unrealised gain linked to the company’s embedded options in Latin American agreements.

Snaitech accounted for an adjusted EBITDA growth of 38% across 2021, and the subsidiary achieved revenue growth of 45% to €299.9 million throughout the year.

The Italian group topped the rankings across retail and online sports betting in Italy in 2021.

Playtech reported a promising start to the financial year, with the strong performance expected to continue from B2B and B2C businesses across the board.

The company didn’t pay out a dividend for 2021.

Playtech CEO Mor Weizer stated confidence in the company’s future prospects in 2022.

“Our full year results demonstrate the quality of Playtech’s technology and the momentum across the Group,” said Weizer.

“Our strong performance is underpinned by our B2B business, in particular the tremendous growth we have seen in the Americas.”

“We have made real progress in the execution of our US strategy, supported by new licences, new launches and new partnerships, and we continue to go from strength to strength in Latin America, buoyed by new strategic agreements across the region.”

“In B2C, the story is similar, with Snaitech continuing to outperform the market, achieving the position of the number one brand across sports betting and retail in Italy.”

AstraZeneca: CALLA Phase III Trial for Imfinzi fails to achieve statistical significance

AstraZeneca did not achieve statistical significance in its CALLA Phase III study for locally advanced cervical cancer using Imfinzi with chemoradiotherapy.

The advancement of progression-free survival (PFS) for patients with locally advanced cervical cancer through the CALLA Phase III study for Imfinzi (durvalumab) assisted by chemoradiotherapy failed to achieve statistical significance compared to administering chemoradiotherapy alone.

The trial’s safety and tolerability were consistent in both arms, and no new unexpected adverse findings were discovered.

Bradley Monk, MD, Professor at the University of Arizona College of Medicine and principal investigator in the CALLA Phase III trial, said, “while today’s results were not statistically significant, they underscore the need for further evaluation of novel therapeutic options and will inform future strategies to improve treatment for patients with locally advanced cervical cancer.”

Cervical cancer is diagnosed in appoximately 600,000 people each year with 40-50% patients facing locally advanced cervical cancer.

CALLA is a worldwide Phase III trial, in which 770 patients with locally advanced cervical cancer were administered basic chemotherapy with either a 1,500mg fixed dosage of Imfinzi or a placebo every four weeks for up to 24 cycles, or until disease progression.

The trial took place across 120 locations in 15 countries, including the United States, Europe, Latin America, Africa, and Asia.

The primary goal was PFS, with overall survival, safety and tolerability as significant secondary outcomes.

Imfinzi (durvalumab) is a human monoclonal antibody that disrupts the interaction of PD-L1 with the PD-1 and CD80 proteins, preventing the tumour from evading the immune system.

Based on the PACIFIC Phase III trial, Imfinzi is the only immunotherapy approved for the curative-intent treatment of unresectable, Stage III non-small cell lung cancer in patients whose illness has not progressed after chemoradiotherapy.

Imfinzi has shown clinical efficacy in various cancer cases in the last year, including advanced biliary tract cancer (TOPAZ-1), unresectable advanced liver cancer (HIMALAYA), and metastatic NSCLC, including favourable Phase III trials (POSEIDON).

Susan Galbraith, Executive Vice President, Oncology R&D, AstraZeneca, said, “CALLA tested a novel immunotherapy approach in locally advanced cervical cancer, a devastating and complex disease where many patients progress following available treatments.”

“While the results were not what we hoped for, insights from the trial will advance our understanding and application of immunotherapy across our broad clinical development programme, exploring the benefits of Imfinzi in many tumour types.”

AstraZeneca shares gained 0.5% to 9,781 following the announcement of its CALLA Phase III study not achieving statistical significance.