Natural rutile mined by Sovereign Metals will reduce carbon emissions by 20 to 33 times from the titanium pigment industry.

Sovereign Metals has found through a comprehensive life cycle assessment study (LCA) using the methods from the 2021 initial Kasiya Scoping Study, that the global warming potential is 0.1 tonnes CO2 for the mining of each tonne of natural rutile at its Kasiya Rutile Project in Malawi.

A global warming potential of 0.1 tonnes CO2 to produce one tonne of natural rutile from Kasiya is 20 to 33 times less than compared to the creation of titania slag and synthetic rutile.

The company found that total greenhouse gas emissions are reduced by 95% to 97% in mining natural rutile compared to ‘alternative titanium feedstocks’ created by a carbon-intensive process of upgrading ilmenite through energy usage.

The carbon footprint of paint made from Sovereign Metals’ natural rutile is estimated to be up to 35% lower than that of ilmenite-upgraded substitutes.

By using natural rutile from Kasiya as a titanium feedstock for the chloride pigment process, Scope 1, 2, and 3 greenhouse gas emissions would be greatly reduced.

Using natural rutile found in Kasiya as titanium metal feedstock could hold the key to manufacturing low-carbon products.

The lowest scope 3 emissions analysed by the LCA indicates that using Sovereign’s natural rutile to make titanium dioxide pigment in the EU has the least global warming potential compared to ilmenite-upgraded substitutes.

Sovereign Metals’ Chair of the ESG Committee, Nigel Jones commented, “Since its discovery, the Kasiya rutile project has been designed to help decarbonise the myriad of uses of titanium pigment in industrial and consumer products.”

“This LCA is another step towards providing a solution to an industry targeting material reduction in its global carbon footprint while wholly encompassing values of sustainability.”

Titanium Alternative’s Carbon Footprint

Natural rutile can generate 96% of TiO2 making it the purest form of titanium dioxide.

Other sources of TiO2 are created by titania slag and synthetic rutile.

Titania slag created by smelting ilmenite in electric furnaces in South Africa generates 85% TiO2.

Synthetic rutile produced from ilmenite using the Becher Process in Australia generates 88-95% TiO2.

Natural rutile concentrate from Kasiya has a global warming potential of 0.1 tonnes CO2 per tonne much lower than titania slag production in South Africa with a global warming potential of 2.0 tonnes CO2 per tonne.

Synthetic rutile production using the Becher process in Australia has a global warming potential of 3.3 tonnes of CO2 per tonne.

Julian Stephens, Managing Director, Sovereign Metals said, “the expanded study now highlights the significant reduction in greenhouse gas emissions the titanium pigment industry could achieve by utilising natural rutile produced at Kasiya.”

“This has direct economic benefits to end users in jurisdictions such as the EU, where industry pays for carbon dioxide emissions via the EU’s Emissions Trading System and the proposed Carbon Border Adjustment Mechanism.”

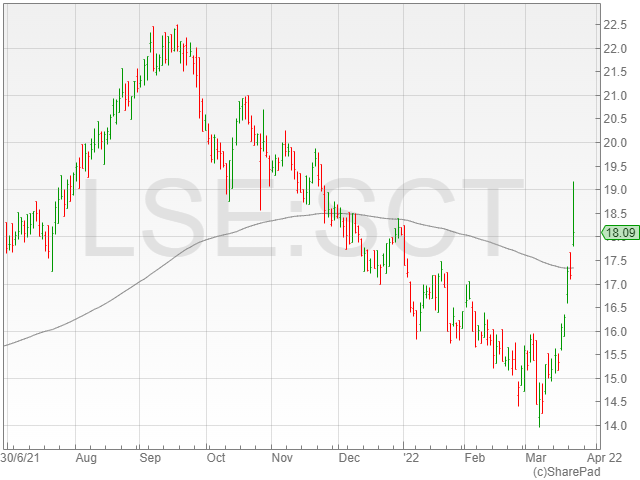

Sovereign Metals shares jumped 4.5% to 29p in early morning trade following the announcement of natural rutile being a greener process to generate titanium.