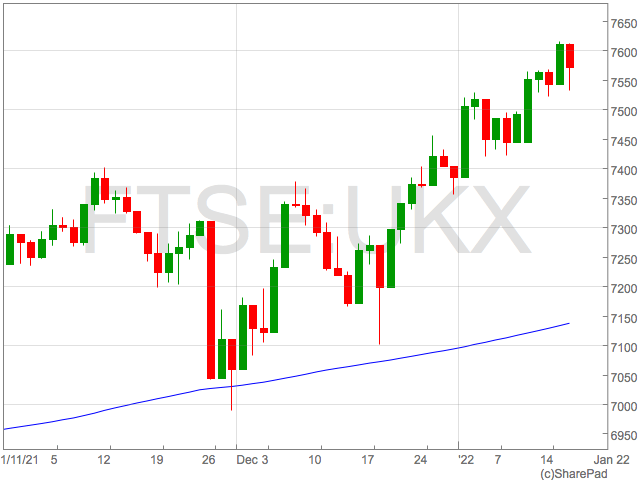

The FTSE 100 rose on Wednesday and bounced back from heavy selling on Tuesday as bargain hunters stepped in despite UK inflation hitting 5.4% – the highest reading in 30 years.

The FTSE 100 had gained 26 points to 7,590 in midday trade on Wednesday bouncing back, but not fully recovering yesterday’s losses.

Soaring inflation is being regularly used in arguments for higher interest rates so it may have been a surprise to see equities rise today after the prospect of higher rates in the US rocked markets yesterday.

“While UK inflation has hit a 30-year high at 5.4%, this is only marginally ahead of expectations, and certainly shouldn’t shock the markets. Indeed, the FTSE 100 and FTSE 250 indices barely budged on the news,” says Russ Mould, investment director at AJ Bell.

“Ongoing weakness among tech-related stocks was offset by strength in housebuilders, retail and oil producers in the FTSE 100. Brent Crude continues to charge ahead with a 0.4% gain to $87.84 per barrel, stoking speculation that it could soon return to $100 per barrel amid supply constraints and robust demand.”

Oil is facing growing pressures of geopolitical risk whilst big consumers such as the US are experiencing growing demand.

Houthi rebels used drones to target UAE oil installations driving concerns about ongoing supply disruptions and the prospect of rising oil prices.

“The damage to the UAE oil facilities in Abu Dhabi is not significant in itself, but it raises the question of even more supply disruptions in the region in 2022,” said Rystad Energy’s senior oil markets analyst Louise Dickson to Reuters.

Having gained yesterday on the news, BP and Shell continued to rise inline with oil prices, providing welcome support for the overall FTSE 100 index.

Burberry jumps

Burberry provided a positive update which was well received by the market and provided reason to send shares 6% higher.

Burberry has been highly dependant on tourism which was evident in earnings. However, the market looks past this to the prospect of increased travel and the resumption of spending in the not too distant future.

“By all accounts, Burberry is in a better position than some had feared. With further news of rising inflation coming out, the brand is also in a better position than some,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

“Luxury customers tend not to be as swayed by economic ups and downs, including when money in the bank is losing its value at a faster rate than normal. That’s something that simply can’t be said of mid-market high street names.”