The FTSE 100 traded largely flat on Monday as gains in travel, entertainment and financial shares were offset by sharp declines inn the housebuilders.

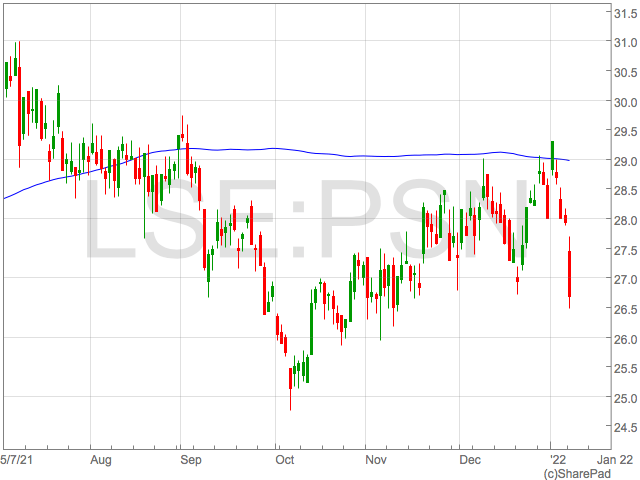

Housebuilding shares such as Persimmon, Barratts and Berkeley Group sank following the announcement by the UK government they were instructing home builders to provide remedies to homeowners impacted by the cladding scandal.

Taking aim at property developers in a letter, Housing Minister Gove said: “For too many of the people living in properties your industry has built in recent years, their home has become a source of misery.”

Persimmon saw the heaviest selling with shares shedding over 4.5% by lunch time in London. Barratts and Berkeley Group 3.6% and 2.5% lower respectively. Taylor Wimpey gave up 2%.

“Despite some tentative positivity in Asian trading, the UK index was not helped by a weak start for the housebuilding sector,” said AJ Bell investment director Russ Mould.

“The UK Government is reportedly looking for property developers to take on a greater share of the costs of repairing dangerous apartment blocks in the wake of the Grenfell tragedy in 2017.”

“Many flat owners have been left with onerous costs for replacing flammable cladding and the latest reports on who will foot the bill should come as no surprise to the sector in that context.”

“The housebuilders have benefited from generous incentives, such as Help to Buy and the mortgage guarantee scheme, in recent years. However, state support is not a one-way street and the sector needs to do its bit to look after its customers.”

The weakness in the housebuilders meant the FTSE 100 traded down by 13 points at 7,471, retreating from the psychological support/resistance at 7,500.

FTSE 100 oil majors BP and Shell provided minor support for the index gaining around 1% despite oil futures slipping. The downside in oil was minor after a strong weeks of gains during the protests in Kazakhstan.

Lloyds shares – along with other UK banks – extended their gains on Monday as investors continued to buy into banks following the surprise interest hike rate by the Bank of England in December.

With inflation expected to hit 6% in the coming months, the prospect of further interest rate increases, and a boost to banking profitability, is very real.