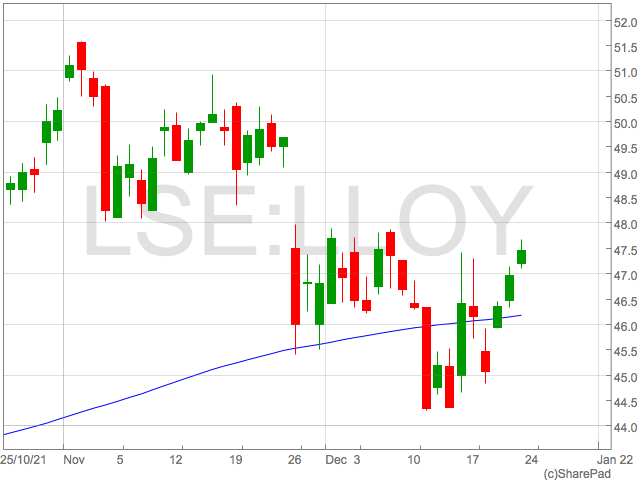

Lloyds share price could be set for a strong 2022 as a number of factors fall into place for the banking group. Having rebounded from the volatility during the pandemic, Lloyds are now in a position to grow revenues and profit, and shareholder distributions.

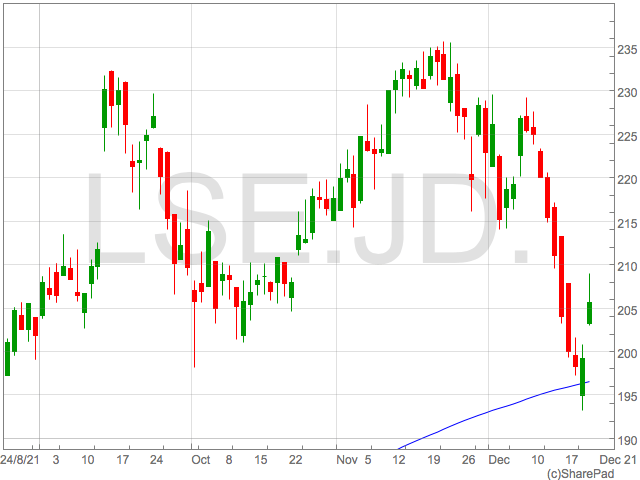

The Lloyds share price is up 28% year-to-date at the time of writing after staging a sustained rally through the first half of 2021.

Despite positivity in Lloyds shares through 2021, the stock faced a period of declines going into the end of the year caused by concerns around monetary policy.

This has left Lloyds shares trading at just 5.8x forecasted forward earnings which suggests their could be further upside, if Lloyds is to meet these forecasts and move up to historical price-to-earnings valuations.

Interest Rates

Lloyds, like all UK banks, are major beneficiaries of higher interest rates. The hopes they could eventually begin to operate in a higher interest rate environment dictated trade in the late 2021 with Lloyds shares rallying into the Bank of England’s November meeting, only to be let down by the ‘unreliable boyfriend’ as the BoE kept rates on hold.

The declines persisted into the next meeting in December with Lloyds shares touching lows below 45p.

The surprises kept coming from the Bank of England in December with the decision to hike the base rate by 0.15% to 0.25%. This sparked a rally in the Lloyds share price as investors piled back into banks on the surprise decision.

It is likely the optimism around higher rates continues into 2022. Inflation will persist and if recent comments around vaccine’s effectiveness against Omicron are confirmed in the real world, the Bank of England will have no reason to not proceed with more rate hikes in 2022.

This will be positive for the Lloyds share price.

Lloyds shares & the UK Economy

Lloyds is both a facilitator and beneficiary of the UK economy. Lloyds’ lending activities and banking services provides individuals and businesses in the UK the means to propel the economy further, whilst benefitting from their increasing activity.

With Lloyds profitability intertwined with the UK economy, the strength of their shares is dependent on UK economic health in 2022.

From an investor’s perspective, one would feel optimistic about how this will play out for the Lloyds share price in 2022.

The UK has a strong jobs market, house prices have shaken off numerous potential hurdles and GDP continues to increase. This will support banking earnings through 2022.

Lloyds dividend

The Lloyds dividend is becoming a major attraction to income investors. Lloyds paid an interim dividend of 0.67p in September 2021. This is after paying its first dividend of 0.57p since the pandemic, earlier in 2021.

One would expect this dividend to increase for the full year, considering Lloyds beat expectation and posted a bumper 88% increase in Underlying Profit for the third quarter.

Should dividends be increased over 2022, this will propel the Lloyds share price higher.