Windward Ltd has developed AI-based software that enables real-time information about seafaring vessels to be transmitted to their owners. Windward has already spent $25m developing its technology. This is an enormous potential market.

Management argues that Windward is the only company that has complete coverage of security, safety, compliance, environment and ocean freight. Competitors operate in up to three of these segments.

The cash raised will fund further development and additional data sources, as well as helping to boost sales and marketing. The shares opened at 162.5p and ended the d...

FTSE 100 gains as Omicron concerns take a backseat

The FTSE 100 gained on Monday as investors stepped in to take advantage of lower prices delivered by selling late last week.

The confidence to take shares higher stemmed from optimism around the impact of the Omicron and possibilities the strain may be Midler than first thought.

“Monday brought a solid rise for the FTSE 100 despite the continued spread of the Omicron variant as investors reacted positively to suggestions from officials in the US and South Africa that the latest strain of Covid might carry milder symptoms,” says AJ Bell investment director Russ Mould.

“It doesn’t feel like we are out of the woods yet, particularly as, even if this definitely proves to be the case, increased transmissibility could mean a wave of hospitalisations from a lower proportion of people getting really sick.”

“It still feels like we’re in the guesswork stage of working out what the impact of Omicron will be so it would be naïve to rule out further volatility as markets attempt to work out exactly what’s going on.”

Commodity shares were big gainers and added a significant number of points to the FTSE 100 on Monday morning.

Commodity prices rose after China cut their reserve ratio and Saudi Arabia increased their oil prices.

“BP and Shell helped give the FTSE 100 some support as Saudi Arabia lifted its official oil prices as it looked to address the recent slide in crude,” said Mould.

BP and Shell were both up 1.9% at the time of writing.

The commodities space was also helped by the decision in China to cut their reserve ratio for banks.

The reserve requirement ratio (RRR) dictates how much capital banks have to hold in reserve. Lowering the RRR will improve banks’ liquidity in an effort to encourage them to increase lending and boost the economy, in the face of ongoing property concerns.

Outt.com: Tech Solution to the Social Care Staffing Crisis

Sponsored by Outt.com

Outt.com aims to transform the UK social care staffing sector. Having already achieved 105% overfunding, with 290 investors thus far, this innovative team is hitting every target.

With investments starting at just £10.20 and ambitions to reconfigure the fragmented multi-billion pound care recruitment market, the potential is substantial.

The current Crowdcube funding raise closes on 11th December 2021, so there is limited time remaining for investors to get on board.

Outt.com Crowdfunding Investment Opportunities

Launched in late 2020 and initially focused on the Greater London area, outt.com was founder-funded in response to the widespread staffing shortages impacting social care across Britain.

Since then, the partners have developed a rapid registration model and future-proof digital application, embracing remote communications and dynamic responsiveness.

With a management team comprised of accomplished social care professionals, backed by digital expertise and proven through the Beta launch, the technological solution looks to:

- Reduce vacancy fulfilment from weeks to just hours, with in-built compliance functionality.

- Provide full candidate support 24/7, promoting fairer pay and enhanced worker rights – an approach which quickly attracted 700 applicants during testing phases – now at 2,500 registered candidates.

- Meet the extraordinary demand for qualified care professionals, forecast to reach an additional need of 490,000 care workers by 2035.

- Advocate for better employment terms, providing competitive pay rates, lower employer costs and fully compliant PAYE taxation structures.

The early-stage venture has achieved £669,000 in beta revenueto Nov21, a positive balance sheet in the first year-end accounts, and is now eager to push into the broader market.

Backed by an InnovateUK Government grant, the app has gained considerable traction during this period and is a participant in The Growth Accelerator programme.

It expects to generate revenues of £43 million, with forecast pre-taxation profits of £2.5 million over the next few years.

The Social Care Investment Climate

Worth over £50 billion a year, the adult social care industry relies on conventional staffing agencies that overwhelmingly fail to meet an ever-growing demand.

Disparate recruitment strategies, low retention metrics and failure to attract new talent and skill compound the issue, making it extremely difficult for millions of care facilities to offer sufficient capacity to generate viable profits and maintain high standards of care.

Outt.com, designed and tested by a highly experienced team, addresses these entrenched issues, reimagining the agency fee model to offer a streamlined, digital and highly effective alternative.

This approach uses tech-led strategies to offer cost reductions, higher placement competition, and absolute flexibility for employers and candidates.

Steve O’Brien, the co-founder alongside head of legal Ben Oakley, says:

“The social care sector is amidst a huge staffing crisis.Over the last 18 months, our team has developed new tech to provide a real solution.

As a technology-powered, people-based business, we knew that crowdfunding was an excellent chance to offer investment equity to get involved in the company through a regulated platform.”

Investment take-up demonstrates a keen appetite to support the Outt.com mission, building on existing accomplishments to pave the way for faster, fairer and ultimately more efficient social care recruitment.

Invest in Outt.com Through Crowdcube

Interested investors have just a week to take advantage of this exciting crowdfunding opportunity, set to close on 11th December with significant overfunding.

When the raise ends, the business intends to:

- Release the fully tested software to the broad UK social care market, expanding recruitment capacity and accessibility to organisations across the board.

- Invest in sales team growth, enhancing the existing strong social media presence, and reporting in high-visibility publications.

- Launch into the next phase of enterprise growth, hitting a market in severe need of reform.

- On-board employers in major metropolitan regions and key social care hubs, including Birmingham, Manchester and Sheffield.

- Prepare for a submission into the NHS tendering process in 2023 (annual spend £6.2 billion on temporary and contract staffing).

- Invite new applicants, targeted to reach 700 per month as indicated by test campaigns.

When Outt.com hits the market running, it intends to make a sizeable impact and forever change how managers in social care organisations rebalance their depleted workforces.

For further details or to request detailed investment documents, please visit the outt.com Crowdcube investmentpage.

Capital as risk.

Stocks end a choppy week positive after US jobs report

The FTSE 100 carved out minor gains on Friday as the market digested the latest instalment of US jobs data.

The FTSE 100 was up 0.45% in mid afternoon trading on Friday following the release of the Non-Farm Payrolls which heavily missed expectations. However, the FTSE fell into the close but hang on to weekly gains.

Economist estimates of 550,000 jobs added in November proved to be significantly more than the actual reading of 210,000.

November payrolls 210K, Exp. 550K

— zerohedge (@zerohedge) December 3, 2021

There go the Fed’s accelerated tapering plans

The initial market reaction saw UK equities fall, only to be quickly bought into by traders looking forward to what the data means for the Federal Reserve and their pace of tapering.

US equities were choppy as the weak jobs reading cast doubts on the Fed’s recent hints at a faster pace of bond purchase tapering.

The headline figures was a major disappointment in what was otherwise a strong report that saw the unemployment rate fall and prior reports revised higher. US unemployment fell to 4.2% vs expectations of 4.6%.

The market will now await the Fed’s meeting 14th & 15th December and their decision on tapering.

We’ve added 1.1M jobs in the last 3 months and are now 3.9M jobs short of Feb 2020 level. Omicron is the big question mark going forward. pic.twitter.com/nMVe9cHeVW

— Steven Rattner (@SteveRattner) December 3, 2021

However, with the discovery of the Omicron variant, the decision to taper is not a one dimensional assessment of the jobs market, but a careful consideration of economic health with soaring inflation and the unknown impact of Omicron.

Despite the uncertainty, markets remained little changed on Friday with the FTSE 100 holding onto the rebound from last week’s selling.

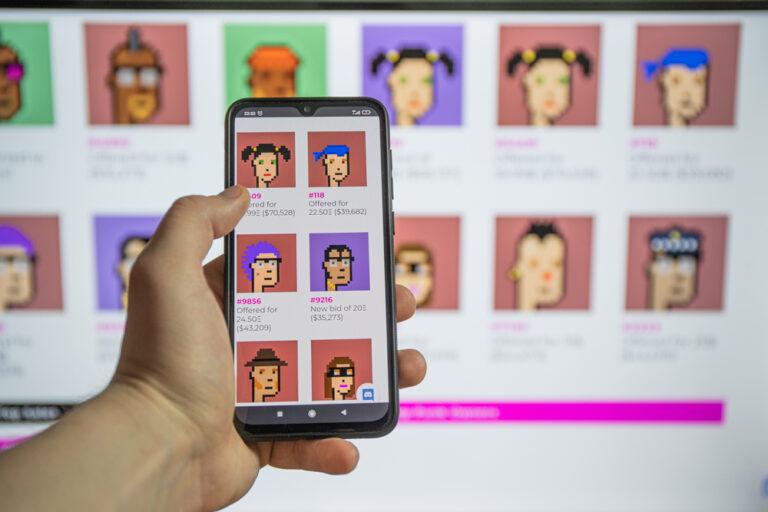

Defiance ETFs launches first ever NFT ETF

Defiance ETFs has launched the first NFT Focused ETF, NFTZ, to provide investors with exposure to the burgeoning NFT marketplace.

NFTs, or non-fungible tokens, have grown on popularity through 2021 with the world’s leading auction houses overseeing multi-million dollar sales of NFTs and company including Visa getting on the action by acquiring the digital art in the form of a ‘Crypto Punk.’

NFT sales hit $2 billion in the first quarter of 2021 and a raft of companies are scrabbling to get in on the action.

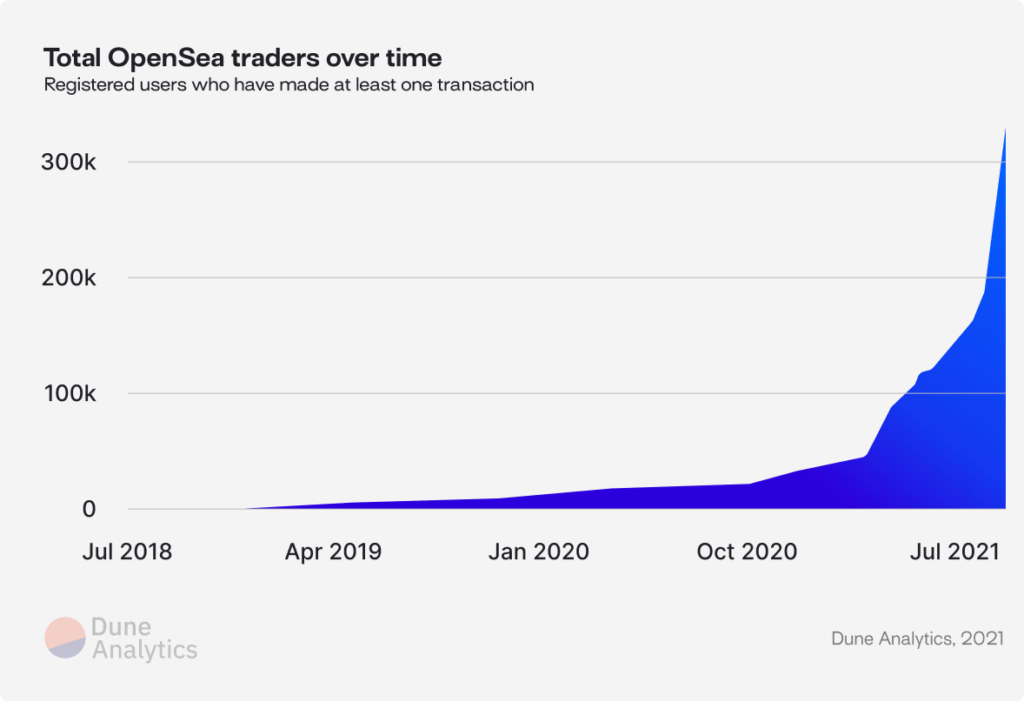

One of the original, and most popular NFT platforms, OpenSea, can illustrate the explosion in NFT activity with the number of their users making at least one transaction.

The latest thematic ETF from Defiance will give investors access to basket of companies at the forefront of the digital economy and NFT innovation. The ETF is passively managed by Defiance ETFs and is comprised of 39 publicly listed companies.

NFTZ Top 20 Holdings

| SILVERGATE CAP CORP |

| PLBY GROUP INC |

| CLOUDFLARE INC |

| NORTHERN DATA AG |

| MARATHON DIGITAL HOLDINGS INC COM |

| BITFARMS LTD/CANADA |

| SBI HOLDINGS INC |

| COINBASE GLOBAL INC |

| HUT 8 MNG CORP NEW COM |

| CLEANSPARK INC |

| RIOT BLOCKCHAIN INC |

| HIVE BLOCKCHAIN TECHNOLOGIES |

| CANAAN INC |

| VOYAGER DIGITAL |

| EBAY INC. |

| ARGO BLOCKCHAIN PL |

| DEFI TECHNOLOGIES INC |

| SQUARE INC |

| FUNKO INC |

| ROBINHOOD MKTS INC |

Crypto trading platform Coinbase is included in the portfolio, as is digital innovation bank Silvergate.

Coinbase floated earlier this year and was seen by many as a watershed moment for the cryptos and the digital economy.

US retail trading platform Robinhood is also in the index with its crypto trading facilities. Investor will also gain exposure to London-listed Argo Blockchain.

Whilst the focus is on NFTs, this ETF will provide substantial exposure to Cryptocurrencies and Blockchain Technology.

NFTZ is listed in New York and has an expense ratio of 0.65%.

The NFTZ ETF adds to Defiance ETFs’ range of thematic ETF that target markets such as Hydrogen, Psychedelics and Biotech.

Beowulf Mining shares soar on Swedish mining hopes

Beowulf Mining shares continues a sharp move to the upside on Friday as investors reacted to comments from the new Swedish Prime Minister about the need for more mines in Sweden.

Beowulf Mining is awaiting the resolution of an application for a concession at the Kallak iron ore resource in Sweden and the positive comments from the new prime minister have raised hopes it may finally be wrapped up.

Beowulf have invested heavily in the Kallak project but have been faced with resistance from local Sami indigenous peoples who claim mining activity will harm their way of life, which includes reindeer herding.

The Kallak project is 30 miles away from a UNESCO World Heritage Site and there have been recommendations revise the mining plan to help protect the site.

Having dragged on for 7 years, Beowulf investors are now hoping Sweden will grant their wishes and enable mining activity to progress.

Beowulf Mining shares rose over 34% in early trade on Friday.

In light of the positive comments from the prime minister, Beowulf CEO Kurt Budge wrote to Sweden’s Minister of Enterprise and Innovation, Karl-Petter Thorwaldsson, urging the Swedish government to consider their application and the economic benefits for the area.

“Fossil-free steel making in Sweden is in the ascendency. Yet when it comes to permitting, there is no visible understanding exhibited by authorities or the Government that steel plants need sustainably produced high quality iron ore, like Kallak’s market-leading 71.5 per cent magnetite iron concentrate, and that competitive sources of supply, alternatives to the state iron ore company LKAB, are positive dynamics for developers and investors,” Beowulf CEO Kurt Budge said in the letter.

“Jokkmokk desperately needs investment and jobs. Kallak will bring billions of SEK in investment and hundreds of jobs to the municipality that will keep people employed and support families for decades.”

“The application you have on your desk is for Kallak North. Yet the Company has continued to invest, explore and assess the potential in the Kallak area, and our licences indicate iron ore mineralisation that could support mining for 30-40 years. More than doubling the current estimated life of Kallak North.”

Nationwide announces new CEO

Nationwide has announced that Debbie Crosbie will be its new chief executive officer.

Crosbie is currently boss at Spain’s Sabadell’s TSB unit but will be joining Nationwide next year, as the group’s first female chief executive.

Kevin Parry, Nationwide’s chair-elect, commented: “The Board is delighted that Debbie has agreed to join Nationwide as Chief Executive. Following a thorough and rigorous selection process, she emerged as the outstanding candidate to lead Nationwide.”

“She brings significant banking experience combined with deep operational and technological knowledge – core skills that are needed to run a modern building society. She is a strong advocate of mutuality and supports Nationwide’s core purpose and the societal role it plays.”

Crosbie said: “Nationwide’s mutual status, combined with its trusted brand and market-leading customer service, make it a purposeful and unique force for good.”