There was a strong recovery in trading at brewer and pubs operator Shepherd Neame (LON: SHEP) when it was able to reopen its pubs earlier this year.

The Aquis Stock Exchange-quoted company won new brewing clients during the pandemic and beer volumes have held up. In fact, volumes in May and June were 8% higher than in the same period in 2019.

Pubs started to reopen outdoors on 12 April, while indoor trading recommenced on 17 May. From that point pubs achieved 97% of 2019 trading levels. Since June, drinks sales have been down on the 2019 level, but food and room revenues were higher.

In the ye...

The startup crowned Web Summit’s winner

The PITCH competition, powered by Siemens, took place at this year’s Web Summit with 650 startups taking part over the three days of the conference based in Lisbon.

The winner of this year’s competition was an environmental startup, Smartex, which is an AI-based solution that reduces defective production of knitted fabrics to close to 0%.

Starting in Lisbon, the company has now expanded to San Francisco and Shenzhen and tackles waste in the fashion industry.

António Rocha, co-founder of Smartex, commented: “Our mission is to provide excellent products with cutting-edge tech to traditional industries and, through continuous innovation, improve the operations of these industries and, most importantly, contribute to a more sustainable and transparent industry.”

“It feels good to get recognition for the work the team at Smartex has been doing. Everyone has been doing

an extraordinary job, with no exceptions, and these kinds of events are good for the team’s morale.”

This year at the Lisbon Web Summit, over 200 Impact startups were present. A core part of these businesses model is the United Nations Sustainable Development Goals.

Watches of Switzerland raises full-year guidance

Watches of Switzerland has posted strong UK performance as revenue increased.

The group has raised full-year revenue guidance from £1.05-£1.10bn to £1.15-£1.20bn. Revenue jumped by 44.6% to £586.2m for the period.

“We are very pleased with our first half performance,” said chief executive, Brian Duffy. “Over the last two years, we have demonstrated the versatility of our multi-channel model with a more than doubling of sales to domestic clients and within this half year, a significant change in brand mix.”

The group is expanding in the US and has purchased five new stores across in Texas, Colorado, Connecticut, and Minnesota.

Persimmon posts strong results

Persimmons announced “healthy” demand over the last quarter thanks to strong sales amid the stamp duty holiday.

Forward sales jumped from £0.95bn in 2019 to £1.15bn, whilst sales of private new homes were up by 16%.

Dean Finch, chief executive, commented on the results: “Persimmon continued to perform well through the period against a backdrop of healthy demand, with private sales reservation rates per site remaining well ahead of 2019, as sales followed a more normal seasonal pattern as expected when compared to 2020.”

“While the industry continues to face challenges in the UK planning system, we are successfully bringing new land into construction and growing our already strong UK wide outlet network.”

In a statement, the housebuilder said it had a positive outlook for the year ahead. It said: “As we approach the quieter trading weeks of December and the Christmas holiday period, we are looking forward to being able to take advantage of the traditionally strong spring selling season in the new year.”

“Goldilocks Territory”

Persimmon have seemingly shook off the negative impact of supply chain issues and now sit in a favourable position going into the end of 2021.

“This is a broadly reassuring statement, but it does not really move the dial one way or the other, compared to what investors were already expecting to hear from Persimmon,”said Steve Clayton, HL Select fund manager.

“The group are in Goldilocks territory, with enough stuff going in their direction, house prices in particular, to offset challenges like wage inflation and materials shortages, to leave Persimmon in a very comfortable financial position.”

“Consumers want to buy, and the group has a £1.15bn forward sales position, well ahead of the level a year ago. Historic quality issues look to be behind the group, which is now getting five star scores for customer satisfaction. Persimmon’s geographic balance, selling in the towns and the shires, but not inner London, has left it largely immune to the cladding issues currently dogging the industry.”

“Even with reduced levels of Government support for homebuyers, reservation rates are running 16% ahead, although this strong sales rate is obliging the group to up the level of land buying.”

“Overall, it’s a positive picture that Persimmon is painting. Cash generation should be strong in these market conditions, which bodes well for dividends. Like all home builders, Persimmon will be hoping that whatever course of action the Bank of England takes with interest rates, it does nothing to knock the housing market off balance. But with no news of any significant changes in Persimmon’s own story, it’s unsurprising to see the stock edging a few pence lower in early trading”.

Making the private, public

By Helen Steers, Partner, Pantheon International PLC

The $5.3 trillion global private equity market has been growing steadily and, according to research by Preqin, is expected to almost double by 2025. With its inherent ability to be nimble, flexible and respond quickly to changing market dynamics, we believe that private equity (“PE”) will emerge strongly from the COVID-19 crisis.

We believe that private equity will continue to benefit from the observed shrinkage of the public markets which has seen the number of public companies reduce by c.2% per year while the number of private equity-backed companies has been increasing by c.6% per year[1]. We believe that this structural trend, along with the increasing recognition of the benefits that PE managers can bring to their investee businesses, is fuelling the future growth of the private equity industry as predicted by Preqin.

Capital in the private equity industry (which covers a range of stages in a company’s life from venture capital and growth equity through to buyouts, and also includes take-private transactions) is managed predominantly in illiquid, difficult to access non-listed fund structures which require sizeable minimum investments and are mainly directed towards large institutional investors such as pension funds and insurance companies. These investors are able to dedicate considerable resources and expertise to handling the complex nature of investing in private equity funds.

While therecan be significant barriers to entry to participating in this exciting and growing asset class for smaller investors, there is an alternative route – investing in a listed private equity company. Through buying just one share in Pantheon International Plc (“PIP”), investors can easily participate in an actively managed, diversified portfolio of high quality, hand-picked private assets which themselves are managed by many of the best private equity managers in the world.

PIP is one of the longest established private equity companies on the London Stock Exchange and is managed by Pantheon – an experienced and prominent global investor in private markets – who does all the hard work of managing PIP’s portfolio on shareholders’ behalf. As at 30 September 2021, PIP had net assets of £2.1bn and had generated average NAV growth of 12.2% per year since it was launched over 34 years ago in 1987. Research carried out by us – and available on PIP’s website[2]– showed that benchmark alternative allocations in private wealth portfolios could have benefited on a risk-adjusted basis from the inclusion of a listed PE company such as PIP.Of course, investors should always consider the risks and the respective advantages or disadvantages of investing in private equity and remember that, as with any investment, past performance does not indicate future results.

PIP invests across the full spectrum of private equity with a particular focus on small to medium sized buyouts and growth: those businesses typically have multiple levers that a PE manager can pull to create value and help those businesses to realise their growth plan, the entry valuations are often more attractive than in other parts of the private equity market, and there are several routes to exit such as selling the business to another private equity manager, to a trade buyer or exiting via an IPO.

The best PE managers focus on long-term value creation through providing hands-on operational and strategic support and they are typically sector experts who bring significant expertise, knowledge, networks and contacts to companies that are often in niche sectors and demonstrate real growth potential. In general, private equity managers are nimble and able to spot long-term trends, enabling them to back future “winners” that become well-known success stories. Recent examples of this in Europe are Spotify and Just Eat – both companies benefited from rounds of venture capital and growth equity, and were in PIP’s portfolio at the time that they went public.

The deep experience of the private equity managers in PIP’s portfolio has also served them well through the COVID-19 crisis. Although our PE managers could not have predicted the trigger for the current crisis, they had been expecting an economic downturn and were prepared to support their portfolio companies with both capital and operational expertise when times became difficult. In addition, prior to the onset of the crisis many of PIP’s underlying managers were investing already in sectors focused on the rapid digitalisation of the economy, process automation and data management, and others had backed segments in the healthcare and consumer services areas that were benefiting from secular trends driven by demographics and lifestyle shifts. All these sectors have shown resilience over the past several months, and have weathered the storm well.

PIP’s portfolio is truly global – it is tilted towards the USA, which has the deepest, most developed PE market, but also offers exposure to private equity investments in Europe, Asia and Emerging Markets. PIP’s direct investment approach into the third party funds and co-investment opportunities that are sourced for it by Pantheon means that it has the flexibility to increase and decrease its weighting to the different investment types according to what it regards as the best fit for PIP’s portfolio, and to vary the rate at which it makes investments.

Increasingly, PE managers are well-positioned to assess risks related to Environment, Social & Governance (“ESG”) effectively and to manage potential ESG issues and opportunities at both the portfolio level and the underlying companies. The interests of the ultimate investors, the PE manager and the business’ management are well aligned and the tight governance in private equity ensures that action can be taken if a portfolio company is not achieving its plan.

As one of the first private equity signatories to the United Nations-backed Principles for Responsible Investment (UNPRI), the world’s leading proponent of responsible investment, in 2007, the core principles of responsible investment are embedded in Pantheon’s due diligence processes when assessing an investment opportunity as well as through the proactive monitoring of the businesses in PIP’s underlying portfolio for the duration of the investment. This continual assessment continues right until the investment is exited. Pantheon is also a leader in promoting diversity and inclusion, and that is also reflected on PIP’s Board of which three directors out of seven are female.

Investors must assess carefully what is suitable for them and their investment objectives and tolerance/appetite for risk, however it is our belief that an investment trust such as PIP, which Pantheon has managed successfully through multiple economic cycles, provides straightforward access to the attractive and growing private equity opportunity, and the potential to achieve healthy returns over the long term.

Important Information

This article and the information contained herein may not be reproduced, amended, or used for any other purpose, without the prior written permission of PIP.

This article is distributed by Pantheon Ventures (UK) LLP (“Pantheon”), PIP’s manager and a firm that is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom, FCA Reference Number 520240.

The information and any views contained in this article are provided for general information only. Nothing in this article constitutes an offer, recommendation, invitation, inducement or solicitation to invest in PIP. Nothing in this article is intended to constitute legal, tax, securities or investment advice. You should seek individual advice from an appropriate independent financial and/or other professional adviser before making any investment or financial decision.Investors should always consider the risks and remember that past performance does not indicate future results. PIP’s share price can go down as well as up, loss of principal invested may occur and the price at which PIP’s shares trade may not reflect its prevailing net asset value per share.

This article is intended only for persons in the UK or in any other jurisdiction to whom such information can be lawfully communicated without any approval being obtained or any other action being taken to permit such communication where approval or other action for such purpose is required. This article is not directed at and is not for use by any other person.

Pantheon has taken reasonable care to ensure that the information contained in this article is accurate at the date of publication. However, no warranty or guarantee (express or implied) is given by Pantheon as to the accuracy of the information in this article, and to the extent permitted by applicable law, Pantheon specifically disclaims any liability for errors, inaccuracies or omissions in this article and for any loss or damage resulting from its use. All rights reserved.

[1]As at March 2021 reflecting YE 2020 data, including North America and Western & Northern Europe. PE-backed company data provided by Pitchbook. Publicly traded data sourced from World Federation of Exchanges database.

[2]PIP’s website: www.piplc.com. “Mind the Allocation Gap” research can be found within Media & Insights/Research.

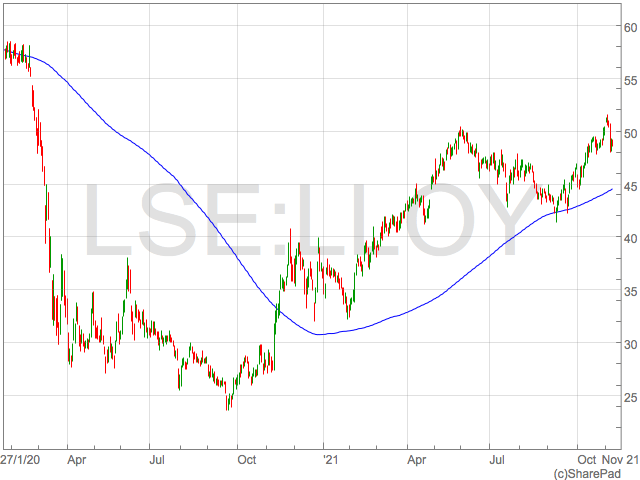

Lloyds share price will suffer after BoE bottles rate hike

The Lloyds share price is set to feel the disappointment of a missed opportunity to raise rates by the Bank of England.

The Bank of England made the surprise decision to vote against hiking rates last week, leading to numerous commentators saying they bottled the chance to hike rates for the first time since the beginning of the pandemic and move against soaring inflation.

Banking shares fell immediately after the announcement as the market begun to factor in the effects of lower rates on the profitability of the UK’s leading lenders.

“There was disappointment for banks which had been holding out for some relief from the record low rates which have eaten into their lending margins,” said Susannah Streeter, Senior Investment and Markets Analyst, Hargreaves Lansdown after the announcement last Thursday.

“Lloyds which earns the majority of its income from traditional lending activities, saw its share price fall by 2%, as did NatWest, while Barclays fell by around 1%,” Streeter summarised the immediate reaction of bankings shares after the decision.

Lloyds Net Interest Margin

Lloyds shares have trended down since the Bank of England’s decision as the prospects of higher earnings driven by increased Net Interest Margin were dashed.

Lloyds recent third quarter update showed improvements in Net Interest Margin compared to a year ago. Lloyds Net Interest Margin was 2.55% in the 3 months to 30 Sep 21, up from 2.42% in the 3 months to 30 Sep 20.

Hargreaves Lansdown equity analyst, Sophie Lund-Yates, was optimistic following Lloyds third quarter release and even highlighted what a rate could do for Lloyds earnings.

“Positive trends are coming through in Lloyds’ net interest margin, which looks at the difference between what the bank charges on loans and pays on deposits. With thoughts that interest rates could budge upwards in the not-too-distant future, the banking giant could be looking forward to a meaningful boost on that front,” said Sophie Lund-Yates soon after the Lloyds Q3 update.

This ‘meaningful boost’ to Net Interest Margin has now been delayed, and with it the associated benefits for Lloyds Banking Group’s profitability.

With shares down since the announcement, it is now likely Lloyds shares remain subdued in the immediate future as we await further hints from the Bank of England on when they will actually hike.

Lloyds share price

We recently discussed how Lloyds shares will struggle to reach pre-pandemic highs and what a disorderly rate hike will do to investor sentiment and equity prices.

However, the irony is now that Lloyds shares are likely to driven by the disappointment of not hiking rates as the market had started to price higher rates in, and became comfortable with the idea of higher rates. Some even saw a hike necessary to fight inflation.

The Lloyds share price is down 5% from the recent closing high of 51.5p recorded in the days running up to the BoE decision. The 51.5p level was the highest closing for Lloyds shares since March 2020.