Planning for the later years in life can be exciting, especially when considering the hobbies you can begin, or the destinations you have on your bucket list that you will finally be able to visit. But one of the most important things to plan ahead for is your financial situation when you retire.

According to the Office for National Statistics UK, the average total expenditure of a retired adult is £10,808, based on factors such as household bills, food and transport (as of 2018). However, the current state pension for 2021/22 is £179.60 per week, which roughly equates to £9,339.20 per year. Therefore, when looking to the future, your State Pension might not be enough to stretch as far as you would like, for the type of lifestyle you want to live.

Financial planning for retirement will help towards building a stable income, and this could involve investing as a way to generate money for those later years. A successful strategy needs to have the right balance between risk and the level of return, so, with that in mind, here are some of the top retirement investment strategies that may help towards building a stable financial future

- Investments considering the factor of time

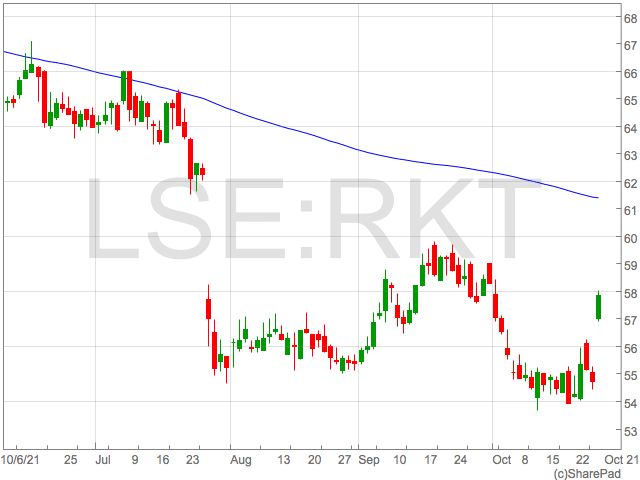

When planning your retirement, your current age and the age you are likely to retire, should be taken into consideration. If you are young, and have plenty of time before you stop working, an effective retirement portfolio should be able to withstand the level of risk that will occur over this time. Therefore, investing in stocks could be a good choice as, although the stock market does experience volatility on a short-term basis, in the long-term, they have historically produced steady returns.

At a younger age, you need to be prepared to have a retirement investment portfolio for more than 10 years, and counteract the rise in inflation rate with your investment choices. However, the older you are when investing for your retirement, the less likely you are to be affected by a rise in the cost of living.

The nearer you are to retirement age, the more you need to think about the income and preservation of your investment. Therefore, you should look at using a higher level of capital in instruments such as bonds. Although they won’t give you as high as return as stocks, they are less volatile over a short period time, and a more stable and instant income. Whichever strategy you implement at any age, corresponding with a financial planning service or advisor will help you to maintain a strategy that suits your needs.

2. Retirement income funds

Managing an investment portfolio can be complicated, so a retirement income fund can be a good option, as the capital is managed for you. The fund is mutually accessible, and the manager of the fund allocates your capital across a diverse portfolio of assets. You can deposit as little or as much money as you like, but the hired service will manage and grow your fund to a suitable value, and in a way that suits your retirement plans.

This is the best option for those who prefer to have someone else place the investments, who most likely have a little more knowledge of the market. This is also better suited to someone who has a few decades left before they retire.

3. Real estate and investment properties

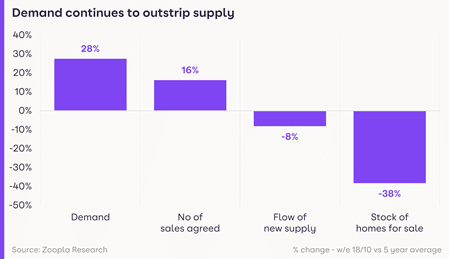

Another popular investment strategy to help towards your retirement income, is to go down the property route. If you have some time before you retire, purchasing a property that you can sell at a later date could provide you with enough returns to put towards your retirement savings.

An alternative for those nearer to retirement age is to consider a rental property, sometimes known as an investment property, which can provide a steady monthly income. Understandably, this does require some experience and knowledge of real estate, and can incur other expenses to maintain the property, which should be taken in consideration when planning your retirement investment strategy.